Are there budgeting methods specifically for single parents? Infographic

Are there budgeting methods specifically for single parents? Infographic

Are there budgeting methods specifically for single parents?

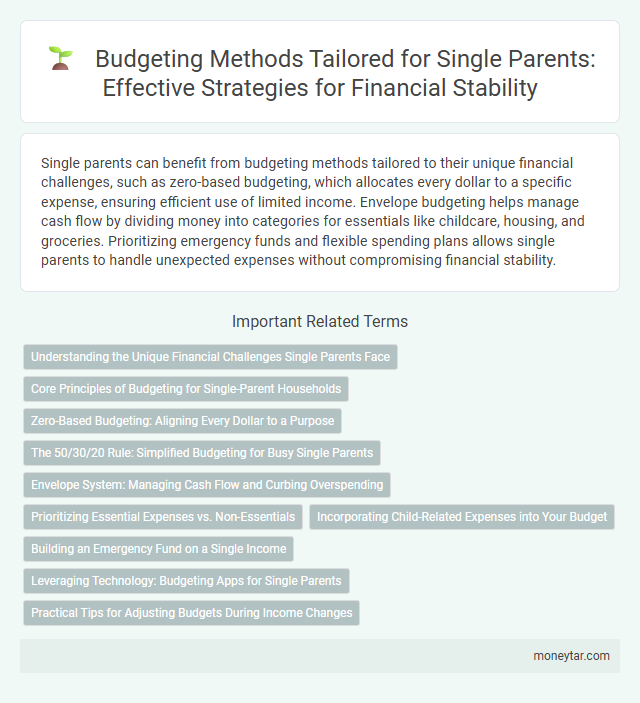

Single parents can benefit from budgeting methods tailored to their unique financial challenges, such as zero-based budgeting, which allocates every dollar to a specific expense, ensuring efficient use of limited income. Envelope budgeting helps manage cash flow by dividing money into categories for essentials like childcare, housing, and groceries. Prioritizing emergency funds and flexible spending plans allows single parents to handle unexpected expenses without compromising financial stability.

Understanding the Unique Financial Challenges Single Parents Face

Single parents encounter distinct financial challenges that demand tailored budgeting methods. Understanding these obstacles helps in creating effective and sustainable financial plans.

- Reduced Income Streams - Single parents often manage finances on a sole income, requiring careful allocation to cover all essential expenses.

- Childcare and Education Costs - Budgeting must account for significant expenses related to childcare, schooling, and extracurricular activities.

- Emergency Fund Importance - Prioritizing an emergency savings fund is critical to address unexpected costs without compromising financial stability.

Core Principles of Budgeting for Single-Parent Households

Budgeting methods tailored for single-parent households address unique financial challenges and responsibilities. Core principles focus on stability, prioritization, and realistic goal setting to ensure financial well-being.

- Prioritize Essential Expenses - Allocate funds first to housing, utilities, food, and childcare to maintain household stability.

- Create an Emergency Fund - Savings serve as a financial buffer against unexpected expenses, providing peace of mind.

- Track Income and Expenses Consistently - Monitoring spending habits helps identify areas for adjustment and improves financial control.

Your budgeting approach should be flexible enough to adapt to changing circumstances and financial needs.

Zero-Based Budgeting: Aligning Every Dollar to a Purpose

Zero-Based Budgeting is an effective method for single parents, ensuring every dollar is assigned a specific purpose. This approach helps maximize limited income by prioritizing essential expenses, such as childcare, housing, and education. Aligning spending with precise financial goals promotes greater control and reduces unnecessary expenses in single-parent households.

The 50/30/20 Rule: Simplified Budgeting for Busy Single Parents

| Budgeting Method | Description | Benefits for Single Parents |

|---|---|---|

| The 50/30/20 Rule | A straightforward budgeting approach dividing income into three categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment. | Simplified financial management helps busy single parents prioritize essential expenses, allocate funds for personal and family enjoyment, and build savings without complex calculations. Encourages financial discipline while accommodating unpredictable income or expenses. |

Envelope System: Managing Cash Flow and Curbing Overspending

The Envelope System is an effective budgeting method tailored for single parents who need to manage limited income carefully. This approach allocates cash into labeled envelopes for specific expenses, helping to control spending and ensure bills are covered.

Single parents often face fluctuating expenses, making the Envelope System ideal for tracking and prioritizing necessities such as rent, groceries, and childcare. By using physical cash divided into envelopes, overspending is reduced since money is only available for each category's budget. This tangible method promotes disciplined spending habits and financial stability.

Prioritizing Essential Expenses vs. Non-Essentials

Single parents benefit from budgeting methods that emphasize prioritizing essential expenses over non-essentials. Focusing on needs first helps ensure financial stability for both the parent and child.

- Essentials First Budgeting - Prioritize housing, utilities, food, and childcare expenses before allocating funds to non-essential items.

- Zero-Based Budgeting - Assign every dollar a specific purpose, ensuring essentials are fully funded before considering discretionary spending.

- Envelope System - Use cash envelopes for key categories to limit spending on non-essential items and maintain focus on necessary expenses.

Incorporating Child-Related Expenses into Your Budget

Single parents can benefit from budgeting methods tailored to manage child-related expenses effectively. Incorporating costs such as childcare, education, and healthcare into a monthly budget ensures financial stability. Prioritizing these expenses helps maintain a balanced budget while addressing the unique needs of raising a child alone.

Building an Emergency Fund on a Single Income

Are there budgeting methods specifically designed for single parents to build an emergency fund on a single income? Single parents often face unique financial challenges that require focused strategies to save effectively. Prioritizing essential expenses and setting aside a fixed monthly amount can help build a reliable emergency fund despite limited resources.

Leveraging Technology: Budgeting Apps for Single Parents

Single parents can greatly benefit from budgeting apps designed to simplify financial management and track expenses in real-time. These apps offer features like automated bill reminders, expense categorization, and customizable savings goals tailored to single-parent households.

Popular budgeting apps such as Mint, YNAB (You Need A Budget), and EveryDollar provide user-friendly interfaces and tools that help single parents maximize every dollar. Leveraging technology reduces stress and improves financial discipline by providing clear insights into income and spending patterns.

Practical Tips for Adjusting Budgets During Income Changes

Single parents often face unique financial challenges that require flexible budgeting methods designed to accommodate fluctuating income and expenses. Prioritizing essential costs such as housing, utilities, and childcare ensures financial stability during income changes.

Regularly reviewing and adjusting your budget helps manage unexpected expenses and income shifts effectively. Tracking variable spending categories and creating an emergency fund provide practical support for maintaining balance in single-parent households.

Related Important Terms

Solo Parent Zero-Based Budgeting

Solo Parent Zero-Based Budgeting allocates every dollar of income to specific expenses, savings, and debt payments, ensuring no money is left unassigned, which is crucial for single parents managing limited resources. This method helps solo parents prioritize essential costs like childcare, housing, and emergency funds while maintaining financial discipline and preventing overspending.

Envelope Method for Single Guardians

The Envelope Method offers a practical budgeting strategy for single parents by dividing income into designated cash envelopes for essential expenses like childcare, groceries, and transportation, ensuring controlled spending and financial discipline. This hands-on approach helps single guardians prioritize critical needs, manage irregular income, and avoid debt by adhering strictly to allotted amounts within each spending category.

Child-Centric Sinking Funds

Child-centric sinking funds allow single parents to allocate money specifically for upcoming child-related expenses such as education, healthcare, and extracurricular activities, ensuring financial preparedness and reducing stress. This budgeting method segments funds into dedicated accounts, promoting disciplined saving tailored to each child's unique needs and future costs.

One-Income Flex Budget

The One-Income Flex Budget method is tailored for single parents managing household expenses on a sole income, emphasizing flexible allocation to essential categories like housing, childcare, and emergency savings. This approach prioritizes adaptability to unexpected costs while maintaining financial stability and reducing debt risks.

Hybrid Digital Cash Stuffing (Single Parent Edition)

Hybrid Digital Cash Stuffing (Single Parent Edition) combines traditional cash envelope techniques with digital budgeting tools tailored to the unique financial challenges faced by single parents. This method enables precise expense tracking, prioritizes essential categories like childcare and education, and fosters savings through customizable, user-friendly applications designed specifically for single-parent households.

No-Overlap Co-Parenting Budgets

No-Overlap Co-Parenting Budgets optimize financial planning for single parents by strictly separating child-related expenses incurred independently during non-custodial periods. This method reduces confusion and conflict by ensuring each parent covers costs only for their specific timeframe, enhancing transparency and fairness in single-parent budgeting.

Essential-Only Budget Blueprint

The Essential-Only Budget Blueprint is tailored for single parents by prioritizing necessary expenses like housing, utilities, childcare, and groceries while minimizing discretionary spending to ensure financial stability. This method emphasizes creating a streamlined budget that allocates funds primarily to essentials, reducing stress and maximizing available resources for single-parent households.

Paycheck Priority Planning (for Single Breadwinners)

Paycheck Priority Planning for single parents focuses on allocating income directly from each paycheck to essential expenses such as housing, utilities, childcare, and groceries, ensuring financial stability without relying on a lump sum budget. This method helps single breadwinners meet critical needs first, reduce debt, and build savings by organizing monthly expenses according to paycheck arrival dates.

Rescue Fund Rollover

Single parents can benefit from the Rescue Fund Rollover budgeting method, which involves reallocating unused emergency funds from one month to the next to build a more robust financial cushion. This strategy helps single parents manage unexpected expenses without disrupting essential budget categories, ensuring greater financial stability and peace of mind.

Automated “Me Time” Micro-Savings

Automated "Me Time" micro-savings methods help single parents efficiently allocate small, consistent amounts toward personal expenses without disrupting essential budget categories. By integrating app-based tools that round up purchases or schedule periodic transfers, these methods ensure intentional self-care funding within tight financial constraints.

moneytar.com

moneytar.com