Are there budgeting methods tailored for people with ADHD? Infographic

Are there budgeting methods tailored for people with ADHD? Infographic

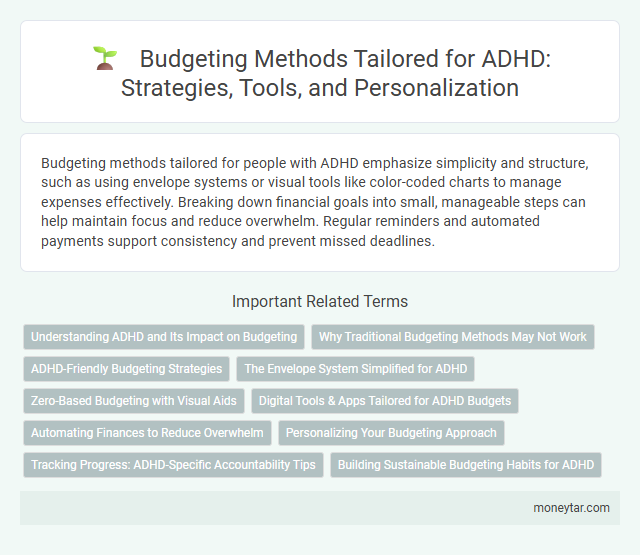

Are there budgeting methods tailored for people with ADHD?

Budgeting methods tailored for people with ADHD emphasize simplicity and structure, such as using envelope systems or visual tools like color-coded charts to manage expenses effectively. Breaking down financial goals into small, manageable steps can help maintain focus and reduce overwhelm. Regular reminders and automated payments support consistency and prevent missed deadlines.

Understanding ADHD and Its Impact on Budgeting

Attention Deficit Hyperactivity Disorder (ADHD) affects executive functioning, making budgeting a unique challenge for those diagnosed. Difficulties with attention, impulsivity, and organization directly impact financial management skills.

People with ADHD often struggle to track expenses consistently, leading to overspending or missed payments. Emotional regulation issues can cause impulsive purchases, derailing budget goals. Tailored budgeting methods that incorporate structure, visual aids, and reminders can improve financial outcomes for individuals with ADHD.

Why Traditional Budgeting Methods May Not Work

Traditional budgeting methods often rely on detailed tracking and strict adherence to fixed plans, which can be challenging for individuals with ADHD due to difficulties with sustained focus and organization. These conventional approaches may lead to feelings of overwhelm and inconsistency, making it harder to maintain financial discipline. Understanding the unique challenges faced by people with ADHD highlights the need for more flexible and adaptive budgeting strategies tailored to their cognitive patterns.

ADHD-Friendly Budgeting Strategies

Budgeting methods tailored for people with ADHD focus on simplicity and structure to accommodate attention challenges. These ADHD-friendly budgeting strategies help improve focus and financial control by reducing overwhelm.

- Use visual aids and color-coding - Visual tools and color-coded categories make tracking expenses clearer and more engaging for people with ADHD.

- Implement automated payments - Automating bills and savings reduces the risk of missed payments and boosts consistency in financial habits.

- Break budgets into smaller, timed segments - Short, focused budgeting sessions prevent fatigue and maintain attention throughout the process.

The Envelope System Simplified for ADHD

The Envelope System Simplified for ADHD adapts traditional cash-based budgeting to suit the unique challenges faced by individuals with attention difficulties. This method uses physical envelopes labeled with specific spending categories to provide a clear, visual budgeting tool that limits impulse spending.

Each envelope holds a predetermined amount of cash for a set time period, helping users avoid overspending by providing tangible spending limits. Regularly refilling and reviewing envelopes encourages consistent financial awareness and helps build routine despite ADHD-related distractions.

Zero-Based Budgeting with Visual Aids

Are there budgeting methods tailored for people with ADHD? Zero-Based Budgeting combined with visual aids can enhance focus and clarity, helping manage finances effectively. This method assigns every dollar a purpose, ensuring You stay organized and intentional with spending.

Digital Tools & Apps Tailored for ADHD Budgets

Digital tools and apps designed specifically for individuals with ADHD offer tailored budgeting features to help manage finances effectively. These platforms incorporate reminders, visual aids, and simplified tracking to accommodate attention challenges.

Apps like Tally and YNAB (You Need A Budget) provide customizable alerts and easy-to-use interfaces that align with ADHD users' needs. Your budgeting experience improves with tools that break down expenses into manageable segments and offer consistent motivational prompts.

Automating Finances to Reduce Overwhelm

Automating finances offers significant relief for individuals with ADHD by minimizing decision fatigue and reducing the risk of missed payments. Tailored budgeting methods that integrate automation can enhance focus and financial consistency.

- Automatic Bill Payments - Set recurring payments to avoid late fees and reduce the mental load of tracking due dates.

- Scheduled Transfers - Automate transfers to savings or investment accounts to ensure consistent financial growth without requiring active management.

- Use of Budgeting Apps - Leverage apps that categorize expenses automatically and send reminders, helping maintain control without manual effort.

Your financial routine becomes simpler and less overwhelming when automation handles routine tasks.

Personalizing Your Budgeting Approach

Budgeting methods can be customized to suit the unique challenges faced by individuals with ADHD. Personalizing Your Budgeting Approach increases the likelihood of maintaining financial control and reducing stress.

- Use Visual Tools - Color-coded charts and graphs help clarify spending patterns and improve focus.

- Set Short-Term Goals - Breaking down larger financial objectives into manageable steps makes budgeting less overwhelming.

- Incorporate Reminders - Automated alerts and scheduled check-ins encourage consistent tracking and prevent missed payments.

Tracking Progress: ADHD-Specific Accountability Tips

| Tracking Progress: ADHD-Specific Accountability Tips |

|---|

| People with ADHD often face challenges in maintaining consistent budgeting habits. Tracking progress with tailored methods improves financial management and accountability. Using visual tools like color-coded charts or digital apps with reminders enhances focus and motivation. Breaking down budgets into smaller, manageable tasks reduces overwhelm and increases follow-through. Regular check-ins, either through automated notifications or support groups, reinforce accountability. Setting clear, realistic goals allows you to celebrate small wins, preventing discouragement. Leveraging ADHD-friendly tools ensures better progress tracking, helping maintain control over your finances. |

Building Sustainable Budgeting Habits for ADHD

Budgeting methods tailored for people with ADHD emphasize simplicity and structure to build sustainable financial habits. Techniques include using visual aids, breaking tasks into smaller steps, and setting reminders to maintain focus and consistency. These strategies help you manage money effectively while accommodating attention challenges.

Related Important Terms

Envelope ADHD Budgeting

The Envelope ADHD Budgeting method breaks expenses into physical or digital envelopes, helping individuals with ADHD visualize and control spending by allocating specific amounts for each category. This tactile and segmented approach reduces impulsiveness and promotes consistent financial management tailored to attention challenges.

ADHD-Friendly Zero-Based Budgeting

ADHD-Friendly Zero-Based Budgeting breaks down each dollar of income to specific expenses or savings categories, minimizing decision fatigue and enhancing focus by providing clear, manageable financial tasks daily. This method incorporates visual aids and frequent check-ins to maintain engagement and adaptability for fluctuating attention spans common in individuals with ADHD.

Task Batching Budget Method

The Task Batching Budget Method, designed to accommodate the inattentiveness typical of ADHD, groups financial tasks into specific time blocks to reduce decision fatigue and improve focus. This structured approach helps individuals with ADHD maintain consistent budgeting habits by minimizing distractions and streamlining expense tracking within manageable sessions.

Visual Reminder Budgeting

Visual Reminder Budgeting is a specialized method designed for individuals with ADHD, utilizing color-coded charts, sticky notes, and visual timers to enhance focus and track spending habits effectively. This approach leverages visual cues to reduce cognitive overload and improve money management through immediate, easily interpretable reminders.

Gamified Budget Tracker

Gamified budget trackers designed for people with ADHD use interactive elements and rewards to maintain engagement and improve financial discipline. These tools break down complex budgeting tasks into manageable, game-like challenges, enhancing focus and motivation for consistent expense tracking.

Automated ADHD Bill Allocation

Automated ADHD bill allocation systems streamline financial management by categorizing expenses and scheduling payments, reducing the cognitive load for individuals with ADHD. These tools use algorithms to prioritize bills based on due dates and amounts, ensuring timely payments while minimizing forgetfulness and stress.

Hyperfocus Budget Sprint

The Hyperfocus Budget Sprint method harnesses the intense concentration periods common in ADHD to accomplish budgeting tasks quickly and effectively. This technique breaks down budgeting into short, timed sprints that leverage hyperfocus, improving financial management and task completion for individuals with ADHD.

Color-Coded Money Mapping

Color-Coded Money Mapping helps people with ADHD visually organize expenses by assigning specific colors to different budget categories, enhancing focus and reducing overwhelm. This method leverages visual cues to simplify financial management and improve adherence to spending plans.

Digital ADHD Budget Jars

Digital ADHD Budget Jars offer a tailored budgeting method designed for individuals with ADHD, using visual and interactive interfaces to simplify expense tracking and promote consistent saving habits. These tools leverage customizable alerts and categorized digital envelopes to enhance focus and reduce overwhelm in managing personal finances.

Micro-Task Budget Planning

Micro-Task Budget Planning is an effective budgeting method tailored for people with ADHD, breaking financial goals and tasks into small, manageable steps to reduce overwhelm and improve focus. This approach uses segmented tasks like daily expense tracking and incremental saving goals, leveraging time-bound actions to enhance consistency and financial control.

moneytar.com

moneytar.com