How do I budget for annual expenses on a monthly basis? Infographic

How do I budget for annual expenses on a monthly basis? Infographic

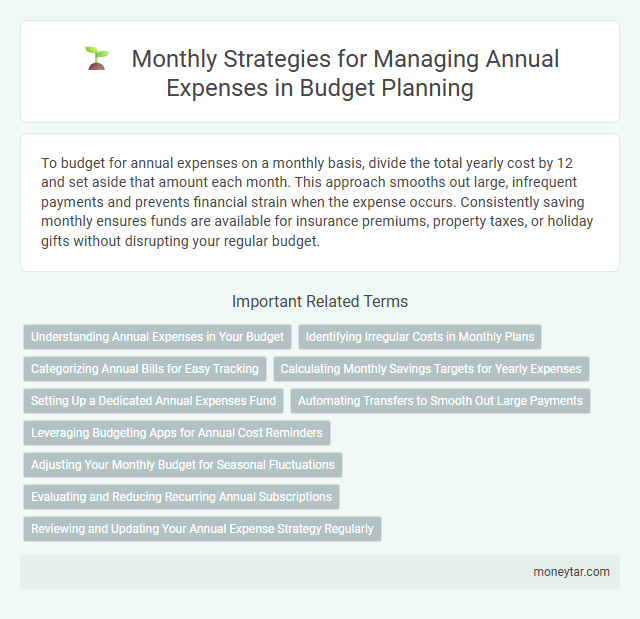

How do I budget for annual expenses on a monthly basis?

To budget for annual expenses on a monthly basis, divide the total yearly cost by 12 and set aside that amount each month. This approach smooths out large, infrequent payments and prevents financial strain when the expense occurs. Consistently saving monthly ensures funds are available for insurance premiums, property taxes, or holiday gifts without disrupting your regular budget.

Understanding Annual Expenses in Your Budget

Annual expenses often include costs like insurance premiums, property taxes, and holiday gifts that occur once a year but require financial planning. Understanding these expenses is essential for accurate budgeting and avoiding surprises.

Break down your total annual expenses by dividing them by 12 to find the monthly amount to save. This approach spreads out large payments evenly, helping maintain steady cash flow throughout the year.

Identifying Irregular Costs in Monthly Plans

Budgeting for annual expenses on a monthly basis requires careful identification of irregular costs within your monthly plan. Recognizing these expenses helps distribute funds evenly and avoid financial strain.

- List Annual Expenses - Compile all yearly costs such as insurance, subscriptions, and maintenance fees to understand where your money goes.

- Calculate Monthly Allocations - Divide each annual expense by 12 to determine the monthly amount to set aside.

- Track and Adjust - Monitor your spending regularly and adjust monthly savings to cover any changes in irregular costs.

Incorporating irregular costs into your monthly budget ensures smooth financial management and preparedness for unexpected large payments.

Categorizing Annual Bills for Easy Tracking

How do you budget for annual expenses on a monthly basis? Categorizing annual bills into specific groups such as insurance, taxes, and subscriptions helps in spreading out payments evenly over the year. This method simplifies tracking and ensures consistent savings for each expense category.

Calculating Monthly Savings Targets for Yearly Expenses

To budget for annual expenses on a monthly basis, start by listing all expected yearly costs such as insurance premiums, memberships, and holiday spending. Divide the total annual amount by 12 to determine the monthly savings target needed for each expense.

Track these monthly targets alongside regular monthly bills to ensure sufficient funds are set aside over time. By consistently saving this calculated amount each month, large yearly expenses become manageable without financial strain.

Setting Up a Dedicated Annual Expenses Fund

| Step | Description |

|---|---|

| Identify Annual Expenses | List all yearly costs such as insurance premiums, property taxes, holiday gifts, and memberships to determine total annual outlay. |

| Calculate Monthly Contribution | Divide the total annual expenses by 12 to find the monthly amount needed to save consistently. |

| Create Dedicated Savings Fund | Open a separate savings account or sub-account specifically for annual expenses to keep these funds distinct from everyday spending money. |

| Automate Monthly Transfers | Set up automatic monthly transfers to the dedicated annual expenses fund to ensure discipline and avoid missing contributions. |

| Monitor and Adjust | Review the list yearly to update amounts and adjust monthly contributions accordingly for any changes in annual expenses. |

Automating Transfers to Smooth Out Large Payments

Automating transfers from your checking account to a dedicated savings account helps manage large annual expenses by spreading the cost evenly each month. This method ensures that funds accumulate steadily, avoiding financial strain when big payments like insurance or property taxes are due. Setting up automatic monthly transfers aligns your budget with upcoming expenses, providing a seamless way to stay on track financially.

Leveraging Budgeting Apps for Annual Cost Reminders

Budgeting for annual expenses on a monthly basis ensures that large payments do not disrupt your financial stability. Leveraging budgeting apps for annual cost reminders helps you stay organized and prepared throughout the year.

- Automated Reminders - Budgeting apps can send notifications before an annual expense is due, preventing missed payments.

- Expense Tracking - These apps categorize and monitor annual costs, making monthly budgeting more accurate and manageable.

- Savings Goals Integration - Budgeting tools allow you to set aside monthly amounts specifically for upcoming annual expenses, smoothing cash flow.

Adjusting Your Monthly Budget for Seasonal Fluctuations

To budget for annual expenses on a monthly basis, identify predictable seasonal fluctuations in your spending patterns. Divide larger yearly costs, such as insurance premiums or holiday gifts, into manageable monthly amounts and adjust your budget during months with lower expenses. This approach helps maintain consistent savings and prevents financial strain during peak spending periods.

Evaluating and Reducing Recurring Annual Subscriptions

Break down your annual expenses by listing all recurring subscriptions and dividing their total cost by 12 to determine the monthly amount. This approach helps you allocate a consistent budget each month without surprises.

Evaluate each subscription to assess its value and necessity, identifying services you no longer use or can replace with cheaper alternatives. Canceling or downgrading unnecessary subscriptions reduces overall spending and frees up funds for other priorities. Regularly reviewing these expenses ensures your budget stays aligned with your financial goals throughout the year.

Reviewing and Updating Your Annual Expense Strategy Regularly

Budgeting for annual expenses on a monthly basis requires consistent review and strategic updates to ensure accuracy. Regularly updating your expense plan helps accommodate changes in costs and financial goals effectively.

- Track Past Annual Expenses - Analyze last year's spending to identify predictable annual costs and establish a baseline for your budget.

- Adjust Monthly Allocations - Modify your monthly savings amounts to reflect any changes in expense amounts or new anticipated costs discovered during reviews.

- Schedule Regular Budget Reviews - Set quarterly or semi-annual check-ins to evaluate expense trends and update your budgeting strategy accordingly.

Related Important Terms

Sinking Funds

Creating sinking funds involves dividing anticipated annual expenses by 12 to allocate a fixed monthly amount, ensuring consistent savings throughout the year. This method prevents budget shortfalls by spreading large costs like insurance premiums or property taxes evenly across all months.

Annualization Method

Divide the total annual expenses by 12 to determine the consistent monthly amount needed, ensuring funds are allocated evenly throughout the year. This annualization method smooths out irregular costs, enabling better cash flow management and preventing financial strain during high-expense months.

Expense Smoothing

Divide your total annual expenses by 12 to allocate a consistent monthly amount, ensuring steady cash flow and avoiding large financial burdens. Implement expense smoothing by setting aside funds each month into a dedicated account for predictable annual costs like insurance, taxes, and subscriptions.

Subscription Envelope System

The Subscription Envelope System involves allocating a specific portion of your monthly income to a dedicated "subscription" budget envelope, ensuring annual expenses like software, streaming services, or memberships are covered without needing a lump sum once a year. By dividing the total annual cost by 12 and consistently funding this envelope each month, you avoid financial strain and maintain better control over recurring yearly payments.

Rolling Allocation

Rolling allocation spreads annual expenses evenly across each month by dividing total yearly costs by twelve, ensuring consistent monthly savings. This method simplifies cash flow management and prevents financial strain during months with large one-time payments.

Micro-saving Buckets

Create micro-saving buckets by dividing your total annual expenses into specific categories and allocating a fixed monthly amount to each. This targeted approach ensures consistent savings throughout the year, making large annual payments manageable and preventing financial strain.

Time-shifted Budgeting

Time-shifted budgeting divides annual expenses by the months leading up to their due date, allowing you to set aside smaller, manageable amounts each month instead of one lump sum payment. This approach improves cash flow management and reduces financial stress by aligning monthly savings with the timing of large annual costs.

Expense Forecast Mapping

Expense forecast mapping involves breaking down anticipated annual costs into precise monthly allocations, ensuring consistent tracking and avoiding budget shortfalls. By categorizing expenses and analyzing historical spending data, you can create a detailed roadmap that aligns monthly savings goals with upcoming annual payments, enhancing financial stability and cash flow management.

Revolving Category Funds

Allocate a fixed portion of your monthly income to a revolving category fund specifically for annual expenses, ensuring consistent savings throughout the year. This approach smooths out large payments by building reserves monthly, preventing financial strain when annual bills, such as insurance premiums or property taxes, come due.

Calendarized Cash Flow Planning

Calendarized cash flow planning divides annual expenses into monthly allocations by mapping out due dates and expected payment amounts throughout the year, ensuring consistent monthly saving targets. This approach helps maintain smooth financial management by aligning cash inflows with scheduled outflows, preventing budget shortfalls during high-expense months.

moneytar.com

moneytar.com