How do students budget on a part-time income without taking out loans? Infographic

How do students budget on a part-time income without taking out loans? Infographic

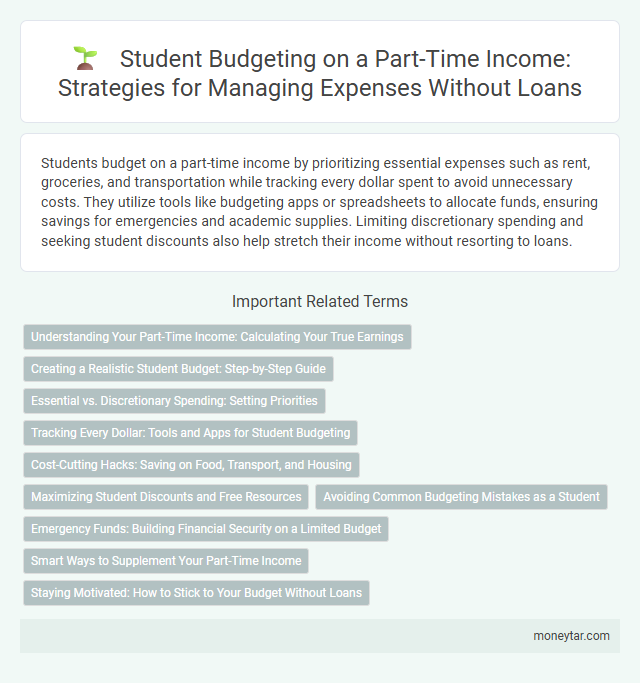

How do students budget on a part-time income without taking out loans?

Students budget on a part-time income by prioritizing essential expenses such as rent, groceries, and transportation while tracking every dollar spent to avoid unnecessary costs. They utilize tools like budgeting apps or spreadsheets to allocate funds, ensuring savings for emergencies and academic supplies. Limiting discretionary spending and seeking student discounts also help stretch their income without resorting to loans.

Understanding Your Part-Time Income: Calculating Your True Earnings

Understanding your part-time income starts with calculating your true earnings by considering hourly wages, hours worked, and any taxes or deductions. Tracking actual take-home pay helps create a realistic budget that aligns with your financial goals. This approach prevents overspending and ensures students live within their means without relying on loans.

Creating a Realistic Student Budget: Step-by-Step Guide

```htmlHow can students create a realistic budget with a part-time income without relying on loans? Understanding income and prioritizing essential expenses are key to managing finances effectively. Tracking spending habits helps adjust the budget to maintain balance and avoid debt.

What are the first steps in building a student budget on limited income? Listing all sources of income and fixed monthly costs provides a clear financial picture. This foundation supports setting achievable spending limits aligned with financial goals.

How do students categorize their expenses for better budget control? Dividing expenses into essentials, savings, and discretionary spending highlights areas to cut back. Focusing on essentials ensures coverage of necessities while controlling non-essential costs.

Why is tracking daily expenses important in a student budget? Monitoring each expense increases awareness of spending patterns and prevents overspending. Using apps or journals assists in maintaining accurate records and staying within budget limits.

How can students adjust their budget when income fluctuates? Reviewing and modifying spending categories monthly accommodates changes in earnings. Prioritizing essential expenses and reducing discretionary spending maintains financial stability.

```Essential vs. Discretionary Spending: Setting Priorities

Balancing essential and discretionary spending is crucial for students managing part-time income without loans. Clear priority setting helps maintain financial stability and avoid debt.

- Identify Essential Expenses - Essential expenses include rent, groceries, utilities, and transportation, which must be covered first to ensure basic living needs.

- Limit Discretionary Spending - Non-essential items such as entertainment, dining out, and subscriptions should be minimized to keep the budget manageable.

- Set Clear Financial Priorities - Prioritizing needs over wants allows for better control over spending and helps allocate funds efficiently.

Tracking Every Dollar: Tools and Apps for Student Budgeting

Students managing part-time income often rely on budgeting apps like Mint, YNAB (You Need A Budget), and PocketGuard to track every dollar effectively. These tools categorize expenses automatically, providing real-time insights on spending habits and helping students avoid overspending. By monitoring income and expenses closely, students can maintain financial discipline without resorting to loans.

Cost-Cutting Hacks: Saving on Food, Transport, and Housing

Managing a part-time income effectively requires strategic budgeting, especially when loans are not an option. Focusing on essential expenses such as food, transport, and housing can significantly increase savings for students.

- Meal Prep and Bulk Buying - Preparing meals in advance and purchasing groceries in bulk reduces daily food costs and minimizes impulse spending.

- Use Public Transport or Biking - Utilizing affordable transit options or cycling cuts down on fuel and parking expenses substantially.

- Opt for Shared Housing - Renting a room in a shared apartment lowers monthly rent and utility bills compared to living alone.

Maximizing Student Discounts and Free Resources

Students budgeting on a part-time income can significantly stretch their finances by maximizing student discounts. Many retailers, software providers, and transportation services offer exclusive deals that reduce everyday costs.

Utilizing free resources such as campus libraries, online educational platforms, and community events can further minimize expenses. These strategies help students avoid loans while managing their budgets effectively.

Avoiding Common Budgeting Mistakes as a Student

| Common Budgeting Mistakes | Strategies to Avoid Mistakes |

|---|---|

| Overestimating Income | Track all part-time earnings carefully; base the budget on actual income, not projected amounts. |

| Ignoring Essential Expenses | Prioritize fixed costs such as rent, utilities, and groceries before allocating money to discretionary spending. |

| Lack of Expense Tracking | Maintain daily spending records using budgeting apps or a notebook to identify spending patterns. |

| Impulse Spending | Create a list of monthly needs versus wants; limit impulse purchases by setting spending limits. |

| Not Saving for Emergencies | Allocate a small portion of income into a separate savings fund to cover unexpected costs. |

| Failing to Adjust Budget | Regularly review and revise the budget based on changes in income or expenses. |

| Overreliance on Credit or Loans | Use only part-time income for monthly expenses; avoid borrowing by managing expenses within means. |

Emergency Funds: Building Financial Security on a Limited Budget

Emergency funds are essential for students managing part-time income without relying on loans. Building financial security on a limited budget requires disciplined saving and smart money management.

- Start Small - Set aside a fixed, manageable amount from each paycheck to avoid financial strain.

- Prioritize Necessities - Focus on saving for unexpected expenses before spending on non-essentials.

- Use Separate Accounts - Keep emergency savings distinct to prevent accidental spending.

Establishing an emergency fund creates a safety net that supports financial stability during unforeseen challenges.

Smart Ways to Supplement Your Part-Time Income

Managing your finances on a part-time income requires strategic planning and smart budgeting. Identifying ways to supplement your earnings can reduce the need for loans and offer financial stability.

Explore freelance opportunities related to your skills, such as writing, graphic design, or tutoring, to boost your income. Selling unused items online or participating in gig economy jobs like delivery services can provide additional funds. Setting clear spending limits and tracking expenses helps maximize the value of every dollar earned.

Staying Motivated: How to Stick to Your Budget Without Loans

Students balancing part-time income with academic expenses often face the challenge of managing funds without relying on loans. Staying motivated to stick to a budget requires setting clear financial goals and tracking every expense diligently.

Visualizing progress through budgeting apps or simple spreadsheets helps maintain discipline and avoid unnecessary spending. Consistent reminders of the long-term benefits of debt-free education reinforce commitment to spending within means and saving diligently.

Related Important Terms

Zero-Based Budgeting for Students

Students utilizing zero-based budgeting allocate every dollar of their part-time income to specific expenses, savings, and financial goals, ensuring no money is left unassigned to prevent overspending. This method emphasizes precise tracking and planning, enabling students to manage limited funds effectively without relying on loans.

Micro-Savings Rounds

Students maximize their part-time income by implementing micro-savings rounds, setting aside small amounts from each paycheck or daily expenses to build a financial buffer without loans. This strategy leverages consistent, incremental savings that accumulate over time, enabling effective budgeting and financial stability during studies.

Envelope Digitization

Students maximize part-time income management by employing envelope digitization, which allocates funds into virtual categories for precise spending control. This method enhances budgeting accuracy, reduces overspending, and promotes financial discipline without relying on loans.

Frugal Meal-Prepping

Students maximize their limited part-time income by adopting frugal meal-prepping strategies, purchasing bulk ingredients and planning meals ahead to reduce food waste and dining expenses. This approach allows them to maintain a balanced diet while effectively controlling their monthly food budget without relying on loans.

Share-Economy Splitting

Students maximize their limited part-time income by leveraging share-economy splitting platforms to reduce living and commuting expenses, such as sharing rides, accommodation, and utilities with peers. This approach enables them to allocate funds more efficiently toward necessities without resorting to loans, ensuring better financial stability during their studies.

Must-Have-Only Shopping

Students budgeting on a part-time income prioritize must-have-only shopping by focusing exclusively on essential expenses such as rent, groceries, and transportation, eliminating non-essential purchases to stretch limited funds effectively. Using budgeting apps or spreadsheets to track and categorize essentials helps maintain discipline and avoid impulse buying, ensuring loan-free financial management.

Tiny Subscription Auditing

Students maximize financial control by using Tiny Subscription Auditing to identify and eliminate unnecessary recurring expenses from their limited part-time income. This targeted approach enhances budget efficiency, allowing more funds to be allocated toward essential needs without resorting to loans.

Cash-Stuffing TikTok Challenge

Students budget on a part-time income without taking out loans by using the Cash-Stuffing TikTok Challenge method, which involves allocating physical cash into labeled envelopes for specific expenses, enhancing spending awareness and control. This visual and tangible budgeting technique helps students avoid overspending and prioritize essential costs like tuition, food, and transport.

Side-Gig Sinking Funds

Students managing part-time incomes optimize cash flow by creating side-gig sinking funds, allocating a fixed percentage of irregular earnings into separate accounts dedicated to future expenses like textbooks or emergency costs. This proactive budgeting technique helps avoid loan dependency by ensuring essential payments are covered without financial strain.

Secondhand First Strategy

Students often adopt the Secondhand First Strategy by purchasing used textbooks, clothing, and electronics to stretch their limited part-time income effectively. This approach reduces expenses significantly, allowing them to allocate funds toward essentials like tuition, housing, and food without resorting to loans.

moneytar.com

moneytar.com