What overlooked expenses blow up most people’s budgets? Infographic

What overlooked expenses blow up most people’s budgets? Infographic

What overlooked expenses blow up most people’s budgets?

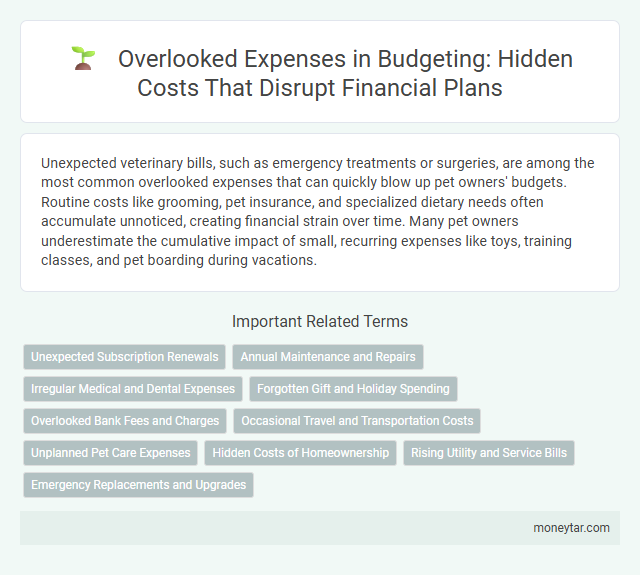

Unexpected veterinary bills, such as emergency treatments or surgeries, are among the most common overlooked expenses that can quickly blow up pet owners' budgets. Routine costs like grooming, pet insurance, and specialized dietary needs often accumulate unnoticed, creating financial strain over time. Many pet owners underestimate the cumulative impact of small, recurring expenses like toys, training classes, and pet boarding during vacations.

Unexpected Subscription Renewals

Unexpected subscription renewals silently drain budgets each month, often unnoticed until they pile up. Many people overlook these automatic payments, leading to significant overspending over time.

- Hidden Fees - Subscriptions may include hidden fees or price increases that catch users off guard.

- Forgotten Services - Users frequently forget about dormant subscriptions still charging their accounts.

- Multiple Subscriptions - Managing several subscriptions simultaneously makes tracking expenses challenging.

Annual Maintenance and Repairs

Annual maintenance and repairs often catch homeowners off guard, leading to significant budget overruns. Common overlooked expenses include HVAC servicing, roof inspections, and plumbing repairs that accumulate throughout the year. Planning for these routine costs can prevent unexpected financial strain and keep your budget on track.

Irregular Medical and Dental Expenses

Irregular medical and dental expenses often catch people off guard, causing significant budget strain. These costs can include emergency visits, unexpected treatments, and specialist consultations that are not part of routine care.

Many fail to account for periodic dental cleanings, orthodontic work, or prescription medications that fluctuate monthly. Planning for these irregular expenses helps prevent sudden financial burdens and keeps budgets more accurate.

Forgotten Gift and Holiday Spending

Many people underestimate the impact of forgotten gifts and holiday spending on their budgets. These overlooked expenses can accumulate quickly, leading to unexpected financial strain.

Gift expenses often arise during birthdays, anniversaries, and special occasions that are easily forgotten throughout the year. Holiday spending, including decorations, travel, and festive meals, adds substantial costs that are frequently unplanned. Ignoring these expenses can cause significant budget blowouts and stress during peak spending seasons.

Overlooked Bank Fees and Charges

Overlooked bank fees and charges can silently drain a significant portion of personal budgets. Many individuals fail to account for monthly maintenance fees, overdraft charges, and ATM surcharges when planning their finances.

These hidden expenses accumulate quickly, leading to unexpected budget shortfalls. Monitoring bank statements regularly helps identify and reduce unnecessary fees, preserving more money for essential expenses.

Occasional Travel and Transportation Costs

What overlooked expenses blow up most people's budgets related to occasional travel and transportation costs? Many fail to account for infrequent trips, like weekend getaways or business travel, which can include hidden fees such as parking, tolls, and airfare surcharges. These small but recurring expenses can accumulate quickly and disrupt your financial planning.

Unplanned Pet Care Expenses

| Overlooked Expense | Impact on Budget | Details |

|---|---|---|

| Unplanned Pet Care Expenses | High | Unexpected veterinary bills, emergency surgeries, and sudden medication costs can rapidly increase monthly spending. Routine vaccinations and flea treatments often get planned, but emergencies like accidents or illness are difficult to anticipate. These unplanned expenses frequently cause significant strain on budgets and disrupt financial goals. Preparing an emergency fund specifically for pet care can help mitigate these unexpected costs. |

Hidden Costs of Homeownership

Hidden costs of homeownership often catch many off guard, significantly blowing up their budgets. Expenses like property taxes, maintenance repairs, and homeowners insurance add up quickly and tend to be underestimated. Unexpected costs such as appliance replacements and yard upkeep create financial strain that few plan for in advance.

Rising Utility and Service Bills

Rising utility and service bills often catch budget planners off guard, significantly inflating monthly expenses. Many fail to account for the steady increase in costs associated with essential services.

- Electricity Costs Escalation - Utility companies frequently raise rates due to infrastructure upgrades and increased energy demand, leading to higher monthly electricity bills.

- Water and Sewage Fees - Hidden surcharges and rising water treatment costs contribute to sharp increases in water bills over time.

- Internet and Cable Service Increases - Service providers commonly implement annual price hikes or add fees for upgraded packages, unexpectedly boosting household budgets.

Emergency Replacements and Upgrades

Emergency replacements and upgrades often catch people off guard, leading to significant budget overruns. These unexpected costs can disrupt financial plans and create stress when funds are limited.

- Appliance Failures - Sudden breakdowns of essential home appliances require immediate replacement, causing unplanned expenses.

- Technology Upgrades - Necessary updates to outdated devices can become costly when software or hardware support ends unexpectedly.

- Vehicle Repairs and Parts - Unexpected mechanical failures or required upgrades to maintain safety standards can strain monthly budgets.

Planning for emergency replacements and upgrades with a dedicated fund helps prevent budget blowouts and maintains financial stability.

Related Important Terms

Subscription Creep

Subscription creep, the accumulation of multiple unnoticed recurring charges from streaming services, apps, and memberships, often inflates monthly expenses beyond initial expectations. These small, automatic payments can silently erode financial stability, making it essential to regularly audit and cancel unused or redundant subscriptions.

Lifestyle Inflation

Lifestyle inflation, characterized by increasing spending as income rises, is the most overlooked expense that blows up most people's budgets, leading to unmanageable debt and insufficient savings. This subtle rise in discretionary spending on dining out, entertainment, and luxury items gradually erodes financial stability despite nominal income growth.

Microtransactions

Microtransactions, small in-app purchases often overlooked during budgeting, significantly inflate expenses by accumulating unnoticed charges over time. These frequent, low-cost payments for digital goods or upgrades can silently erode financial plans, leading to budget overruns without clear awareness.

Shadow Expenses

Shadow expenses such as subscription services, automatic renewals, and small but frequent impulse purchases often silently erode budgets, leading to unexpected financial strain. These hidden costs accumulate over time, making it essential to regularly audit bank statements and cancel unused or unnecessary subscriptions to maintain effective budgeting.

Phantom Charges

Phantom charges, such as hidden subscription fees and automatic renewals, silently drain budgets by recurring monthly without clear notification. These unnoticed expenses often accumulate, leading to significant overspending and financial strain for individuals.

Sneaky Service Fees

Sneaky service fees, such as hidden bank charges, subscription add-ons, and convenience fees, silently deplete budgets by adding unexpected costs that many overlook. These small, repetitive fees accumulate significantly over time, turning manageable budgets into financial strain without clear visibility.

Convenience Premiums

Convenience premiums such as subscription services, delivery fees, and impulse purchases from nearby stores silently inflate monthly expenses, often unnoticed in typical budgeting. These small, frequent charges accumulate significantly, undermining financial goals and leading to budget overruns.

Auto-Renewal Traps

Auto-renewal traps often catch consumers off guard, leading to repeated charges for subscriptions or services they no longer use, significantly inflating monthly expenses. These hidden fees can silently drain budgets if not regularly reviewed, highlighting the necessity of monitoring and canceling unnecessary auto-renewals to maintain financial control.

Upgrade Temptation Costs

Upgrade temptation costs, such as frequently replacing gadgets or vehicles with newer models, often cause significant budget overruns due to underestimated depreciation and high upgrade premiums. Consumers typically overlook these expenses, leading to unexpected financial strain and delayed savings goals.

Maintenance Gap

Maintenance gaps, such as deferred car repairs or home upkeep, often cause unexpected financial strain that disrupts budgets significantly. Ignoring routine maintenance leads to costly emergency fixes, inflating expenses beyond planned amounts and creating budget shortfalls.

moneytar.com

moneytar.com