What small daily expenses sabotage personal budgets? Infographic

What small daily expenses sabotage personal budgets? Infographic

What small daily expenses sabotage personal budgets?

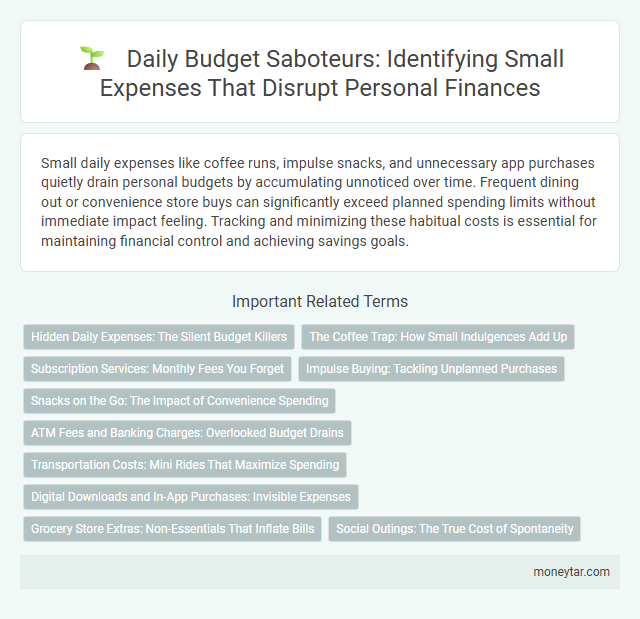

Small daily expenses like coffee runs, impulse snacks, and unnecessary app purchases quietly drain personal budgets by accumulating unnoticed over time. Frequent dining out or convenience store buys can significantly exceed planned spending limits without immediate impact feeling. Tracking and minimizing these habitual costs is essential for maintaining financial control and achieving savings goals.

Hidden Daily Expenses: The Silent Budget Killers

Hidden daily expenses, such as overpriced coffee, subscription services, and impulse snacks, quietly drain your personal budget. These small charges often go unnoticed but accumulate significantly over time.

Tracking these silent budget killers helps reveal patterns of unnecessary spending. Identifying and managing these costs can improve financial stability and increase savings.

The Coffee Trap: How Small Indulgences Add Up

Small daily expenses, such as the cost of a daily coffee, silently sabotage personal budgets by accumulating into significant amounts over time. The coffee trap involves purchasing expensive beverages outside the home, often without realizing the true monthly or yearly financial impact. Recognizing and controlling these small indulgences can lead to substantial savings and better overall budget management.

Subscription Services: Monthly Fees You Forget

Small, recurring costs often drain financial resources unnoticed. Subscription services with monthly fees frequently slip under the radar, affecting budget health.

- Untracked Streaming Services - Multiple platforms with overlapping content lead to redundant monthly charges.

- Forgotten Trial Subscriptions - Automatic payments begin after free trials, creating unexpected expenses.

- Inactive App Subscriptions - Subscriptions billed despite infrequent or no usage contribute to budget leakage.

Impulse Buying: Tackling Unplanned Purchases

Impulse buying significantly undermines personal budgets by introducing unplanned expenses that accumulate rapidly. Small daily purchases on snacks, coffee, or convenience items may seem insignificant but can derail financial goals over time.

Impulse buying often occurs due to emotional triggers or convenient access to tempting products. These unplanned purchases disrupt careful budgeting and reduce available funds for essential expenses or savings. You can manage impulse buying by creating a strict shopping list and setting spending limits to avoid unnecessary financial strain.

Snacks on the Go: The Impact of Convenience Spending

Small daily expenses can quietly erode your personal budget, especially convenience purchases like snacks on the go. These seemingly minor costs accumulate, affecting your overall financial health.

- High Frequency - Regularly buying snacks while out leads to repeated spending that adds up quickly.

- Premium Pricing - Convenience stores and vending machines charge higher prices compared to grocery stores.

- Unplanned Purchases - Impulse snack buys often disrupt planned budgets and reduce savings potential.

Monitoring and controlling convenience snack spending can significantly improve your budget management and financial goals.

ATM Fees and Banking Charges: Overlooked Budget Drains

Small daily expenses often hidden in plain sight can significantly undermine personal budgets. ATM fees and banking charges represent common yet overlooked budget drains that accumulate over time.

- Frequent ATM Withdrawals - Regular use of out-of-network ATMs leads to multiple fees that erode financial resources unnoticed.

- Monthly Account Maintenance Fees - Many banking institutions impose standard charges that reduce available monthly funds without explicit consumer awareness.

- Transaction and Overdraft Fees - Small charges on routine transactions or overdrafts add up quickly, causing unexpected budget shortfalls.

Transportation Costs: Mini Rides That Maximize Spending

| Category | Small Daily Expense | Impact on Personal Budget | Example |

|---|---|---|---|

| Transportation Costs | Mini Rides | Accumulate into significant, unplanned spending that erodes budget limits | Taking multiple short taxi or rideshare trips instead of using a monthly transit pass or walking |

| Transportation Costs | Frequent Ride Sharing | Small fees per ride multiply, increasing overall transportation expenses beyond expectations | Daily use of ride-hailing apps for short distances to save minimal time |

| Transportation Costs | Repeated Parking Fees | Small daily parking charges add up, creating a hidden expense often overlooked in budgets | Paying for parking each time instead of using free parking options or parking passes |

| Transportation Costs | Impulse Vehicle Use | Unnecessary short trips increase fuel and maintenance costs, straining personal finances | Driving for errands that could be combined or done on foot to reduce cost |

Digital Downloads and In-App Purchases: Invisible Expenses

Small daily expenses such as digital downloads and in-app purchases quietly erode personal budgets. These seemingly minor transactions accumulate rapidly, creating invisible financial leaks.

Subscription fees for apps, bonus content, and game upgrades often go unnoticed but drain funds consistently. Tracking these digital expenses is essential for maintaining effective budget control.

Grocery Store Extras: Non-Essentials That Inflate Bills

Small daily expenses like grocery store extras can quietly sabotage personal budgets. Items such as snacks, sugary drinks, and impulse buys inflate bills beyond the essentials needed for meals. These non-essential purchases add up, making it difficult to stick to a planned budget over time.

Social Outings: The True Cost of Spontaneity

How do spontaneous social outings quietly drain your personal budget? Small, unplanned expenses like grabbing coffee with friends or last-minute event tickets add up quickly over time. These seemingly minor costs disrupt savings goals and create unexpected financial strain.

Related Important Terms

Latte Factor

Small daily expenses such as gourmet coffee or frequent latte purchases, known as the Latte Factor, disproportionately sabotage personal budgets by accumulating unnoticed costs that erode savings potential. Tracking and reducing these habitual small spendings can significantly enhance financial discipline and contribute to long-term wealth building.

Subscriptions Creep

Subscriptions creep silently drains personal budgets as multiple low-cost recurring payments, such as streaming services, app memberships, and digital tools, accumulate unnoticed over time. These small daily expenses erode financial goals by diverting funds from essential categories, making it crucial to regularly audit and cancel unused subscriptions.

Micro-Transactions

Micro-transactions such as daily coffee purchases, snack runs, and app-based in-game buys quietly drain personal budgets by accumulating untracked expenses. These small, frequent charges often go unnoticed but collectively reduce savings and hinder financial goals.

Digital Drip Spending

Small daily expenses like frequent app subscriptions, in-app purchases, and unnoticed automatic renewals exemplify digital drip spending that silently sabotages personal budgets. These microtransactions accumulate over time, diverting funds from essential financial goals and destabilizing overall budget plans.

In-App Purchases

In-app purchases often undermine personal budgets by encouraging frequent, small transactions that accumulate unnoticed over time, significantly inflating monthly spending. These microtransactions, especially in gaming and subscription apps, bypass conscious spending limits and disrupt careful financial planning.

On-Demand Gigs (small splurges on services)

Small daily expenses on on-demand gigs, such as quick food deliveries, ride-sharing, or short-term freelance services, can silently erode personal budgets by accumulating unnoticed costs. Regular splurges on convenience-based apps drain financial resources and disrupt long-term savings goals despite their seemingly minor individual prices.

Tap-and-Go Temptations

Tap-and-go temptations, such as frequent coffee purchases and quick snack runs, covertly drain personal budgets by accumulating unnoticed daily. These small, impulsive expenses bypass careful budgeting, making it harder to track spending and save effectively.

Convenience Fees

Convenience fees, often charged for online bill payments or quick transactions, silently erode personal budgets by accumulating unnoticed over time. These small daily expenses, typically ranging from $1 to $5 per transaction, can significantly impact monthly savings if not tracked and minimized.

Rounding-Up Purchases

Rounding-up purchases, such as paying $4.75 and being charged $5.00, subtly erode personal budgets by accumulating unnoticed extra costs. These seemingly minor daily expenses can lead to significant budget deviations over time, undermining financial goals.

Snackflation

Snackflation, the rising cost and frequency of small snack purchases, significantly undermines personal budgets by accumulating unnoticed daily expenses. Consistently spending on overpriced snacks and convenience foods leads to substantial monthly financial leakage, eroding savings and disrupting carefully planned budgets.

moneytar.com

moneytar.com