Are there legit ways to get paid for opening credit accounts? Infographic

Are there legit ways to get paid for opening credit accounts? Infographic

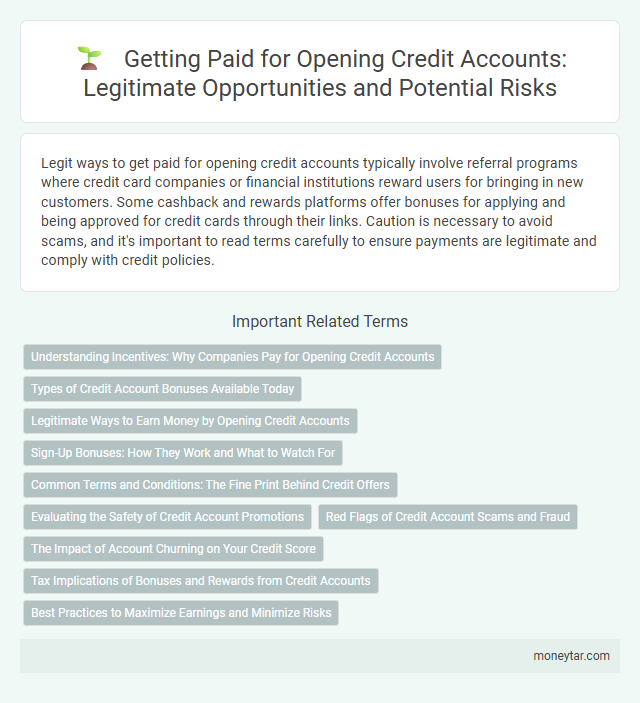

Are there legit ways to get paid for opening credit accounts?

Legit ways to get paid for opening credit accounts typically involve referral programs where credit card companies or financial institutions reward users for bringing in new customers. Some cashback and rewards platforms offer bonuses for applying and being approved for credit cards through their links. Caution is necessary to avoid scams, and it's important to read terms carefully to ensure payments are legitimate and comply with credit policies.

Understanding Incentives: Why Companies Pay for Opening Credit Accounts

Companies often offer financial incentives for opening credit accounts as a strategy to attract new customers and increase market share. These rewards can include cash bonuses, points, or introductory interest rates designed to encourage sign-ups.

Understanding the incentives helps you identify legitimate offers and avoid scams. Credit card issuers benefit from new account fees and ongoing interest payments, making promotions profitable for them. You can take advantage of these offers by responsibly managing your credit and meeting required spending thresholds.

Types of Credit Account Bonuses Available Today

Are there legitimate ways to get paid for opening credit accounts? Many credit card issuers offer sign-up bonuses that reward new applicants with cash back, points, or miles after meeting a minimum spending requirement. You can benefit from these offers by carefully selecting cards that align with your spending habits and financial goals.

Legitimate Ways to Earn Money by Opening Credit Accounts

Legitimate ways to earn money by opening credit accounts revolve around sign-up bonuses and rewards programs offered by credit card companies. These offers often include cash back, points, or miles after meeting specific spending requirements within a set timeframe.

You can maximize these benefits by selecting cards that align with your spending habits and paying off balances in full each month to avoid interest charges. Responsible use of credit accounts not only generates rewards but also helps build a strong credit score over time.

Sign-Up Bonuses: How They Work and What to Watch For

Sign-up bonuses offer a legitimate way to earn rewards by opening new credit accounts, typically involving a set spending requirement within a specific timeframe. These bonuses can include cash back, points, or miles, providing tangible benefits for new cardholders.

It is important to carefully review the terms and conditions, including fees, interest rates, and spending thresholds, to maximize the bonus without incurring unnecessary costs. Avoid opening multiple accounts rapidly to prevent any negative impact on your credit score and to comply with issuer policies.

Common Terms and Conditions: The Fine Print Behind Credit Offers

Many credit offers promise rewards or payments for opening new accounts, but understanding the fine print is crucial. Common terms and conditions often include hidden fees and specific eligibility criteria that affect the benefits you receive.

- Minimum Spending Requirements - You must meet a spending threshold within a set period to qualify for any rewards or payments.

- Introductory Periods - Offers may include limited-time interest rates that change after the initial period, impacting overall costs.

- Credit Score Impact - Opening multiple accounts could lower your credit score, influencing your financial health beyond immediate rewards.

Evaluating the Safety of Credit Account Promotions

Evaluating the safety of credit account promotions is crucial before participating. Understanding the legitimacy of offers can protect your financial health.

- Research the Creditor - Verify the financial institution's reputation through official websites and customer reviews.

- Check for Hidden Fees - Identify any annual fees or interest rates that might negate the promotional benefits.

- Review Terms and Conditions - Scrutinize the fine print to ensure compliance with all requirements to earn rewards.

Careful evaluation ensures that credit account promotions are safe and beneficial without risking your credit score or finances.

Red Flags of Credit Account Scams and Fraud

| Topic | Details |

|---|---|

| Legitimate Opportunities to Get Paid for Opening Credit Accounts | Some credit card companies offer sign-up bonuses or cash rewards for opening new credit accounts and meeting minimum spending requirements. These incentives are legal and regulated by financial institutions aiming to attract new customers. |

| Common Red Flags of Credit Account Scams | Requests for upfront fees before account approval, promises of guaranteed approval regardless of credit history, offers of unusually high commissions for simply opening credit accounts, and requests for sensitive personal information beyond standard application requirements. |

| Fraud Warning Signs | Unsolicited offers claiming easy credit account openings with immediate payouts, pressure tactics to act quickly, lack of official company contact details, and untraceable payment methods such as wire transfers or gift cards indicate potential fraud. |

| Protective Measures | Verify company credentials using the Better Business Bureau, only apply for credit through reputable financial institutions, avoid disclosing social security numbers or banking information outside secure platforms, and review credit reports regularly to detect unauthorized accounts. |

The Impact of Account Churning on Your Credit Score

Opening multiple credit accounts to earn rewards or sign-up bonuses can seem lucrative. However, frequent account openings, known as account churning, can significantly impact your credit score and financial health.

- Credit Inquiries Increase - Each new credit application results in a hard inquiry, which can lower your credit score temporarily.

- Average Account Age Decreases - Opening new accounts frequently reduces the average age of your credit history, negatively affecting your score.

- Credit Utilization Fluctuates - New accounts may alter your overall credit limit and utilization ratio, influencing your creditworthiness.

Tax Implications of Bonuses and Rewards from Credit Accounts

Bonuses and rewards from opening credit accounts are often considered taxable income by the IRS. Credit card sign-up bonuses received in cash or as gift cards must be reported on your tax return. Rewards earned through regular spending, such as cashback or points redeemable for merchandise, typically do not have tax implications but require careful record-keeping for accurate reporting.

Best Practices to Maximize Earnings and Minimize Risks

Opening credit accounts can occasionally offer legitimate opportunities to earn rewards through sign-up bonuses, cashback, or points programs provided by credit card issuers. To maximize earnings, focus on accounts with high-value incentives, ensure timely payments to avoid interest charges, and monitor credit utilization to maintain a healthy credit score. Minimizing risks involves understanding the terms and conditions, avoiding excessive account openings that may harm your credit profile, and regularly reviewing statements for fraudulent activity.

Related Important Terms

Credit Card Churning

Credit card churning involves strategically opening and closing credit card accounts to maximize sign-up bonuses and rewards, which can be a legitimate method to earn money if managed carefully. However, it requires understanding credit issuer rules, maintaining a good credit score, and avoiding negative impacts like increased debt or credit inquiries.

Signup Bonus Stacking

Signup bonus stacking leverages multiple credit card offers simultaneously to maximize rewards by opening several accounts within a short timeframe, enabling users to accumulate substantial points or cash bonuses efficiently. Creditworthy applicants can strategically combine signup bonuses, meeting spending requirements on each card to gain high-value rewards without incurring excessive debt.

Account Opening Incentives

Account opening incentives offer legitimate opportunities to earn rewards, such as cash bonuses, points, or miles, by signing up and meeting minimum spending requirements on new credit accounts. Financial institutions frequently leverage these promotions to attract new customers, making it essential to review terms and conditions carefully to maximize benefits without impacting credit scores negatively.

Referral Bonus Schemes

Referral bonus schemes offer a legitimate way to earn money by opening credit accounts, as many issuers provide financial incentives for customers who successfully refer friends or family members. These bonuses typically come in the form of cash rewards, statement credits, or points, and are subject to specific terms and conditions to qualify.

Manufactured Spending

Legitimate methods to earn rewards from opening credit accounts often involve manufactured spending techniques, where individuals use rewards credit cards for purchases that are effectively cash equivalents, such as buying gift cards and then liquidating them. This strategy requires careful management of credit limits, fees, and spending thresholds to maximize cashback, points, or miles without incurring debt or penalties.

Reward Point Arbitrage

Reward point arbitrage offers a legitimate method to earn money by strategically opening credit accounts that provide lucrative sign-up bonuses and high-value reward points, which can be redeemed for cashback, travel, or gift cards exceeding the initial costs. Maximizing returns involves careful management to avoid fees and maintain credit health while leveraging overlapping promotions across multiple cards.

Fintech Account Onboarding Promotions

Fintech account onboarding promotions offer legitimate opportunities to earn rewards or cash incentives for opening new credit accounts, leveraging partnerships with financial institutions to attract verified users. These promotions typically require completing specific onboarding steps, such as identity verification and initial transactions, ensuring compliance and secure credit activation.

Subprime Credit Bonus Offers

Subprime credit bonus offers provide legit ways to get paid for opening credit accounts by offering cash rewards or statement credits to individuals with lower credit scores when they successfully open and use new credit cards. These incentives often include signup bonuses, cashback on purchases, or credit limit increases, which are designed to help subprime borrowers build credit history while earning financial rewards.

Targeted Credit Product Trials

Targeted credit product trials offer legitimate opportunities to earn rewards by opening credit accounts and meeting specific spending criteria. Financial institutions design these trials to attract new customers, providing cashback, points, or bonuses as incentives for responsible credit use during the promotional period.

Fee-Free Welcome Cashbacks

Fee-free welcome cashback offers from reputable credit card issuers provide legitimate opportunities to earn rewards simply by opening and activating a new credit account without incurring upfront fees. These promotions, often ranging from $100 to $500, incentivize responsible credit behavior while boosting credit scores when managed properly.

moneytar.com

moneytar.com