Is starting a YouTube channel about credit myths lucrative? Infographic

Is starting a YouTube channel about credit myths lucrative? Infographic

Is starting a YouTube channel about credit myths lucrative?

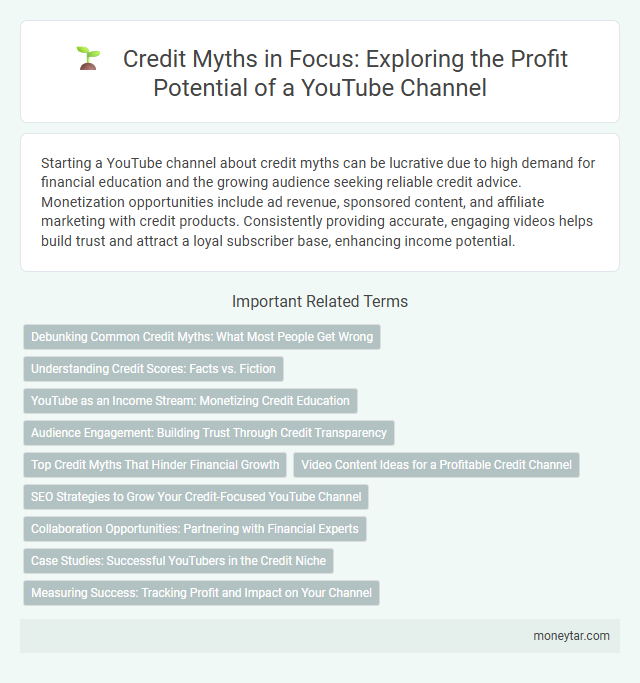

Starting a YouTube channel about credit myths can be lucrative due to high demand for financial education and the growing audience seeking reliable credit advice. Monetization opportunities include ad revenue, sponsored content, and affiliate marketing with credit products. Consistently providing accurate, engaging videos helps build trust and attract a loyal subscriber base, enhancing income potential.

Debunking Common Credit Myths: What Most People Get Wrong

Is starting a YouTube channel about credit myths lucrative? Many people misunderstand credit concepts, creating a high demand for accurate information. Debunking common credit myths attracts viewers eager to learn what most people get wrong.

Understanding Credit Scores: Facts vs. Fiction

Starting a YouTube channel about credit myths can be lucrative by educating viewers on common misconceptions. Understanding credit scores is crucial for building financial literacy and trust with your audience.

- Credit Scores Reflect Payment History - Your payment history accounts for 35% of your credit score, making timely payments critical.

- Checking Your Own Credit Doesn't Hurt Your Score - Soft inquiries like personal credit checks do not impact credit scores.

- Credit Utilization Impacts Score Significantly - Keeping credit utilization below 30% helps maintain a healthier credit profile.

Debunking credit myths with accurate information can attract a dedicated audience and monetize effectively.

YouTube as an Income Stream: Monetizing Credit Education

Starting a YouTube channel focused on credit myths can be a lucrative venture by tapping into a niche with high viewer interest and demand for financial education. Monetizing credit education through video content allows creators to generate income from ad revenue, sponsorships, and affiliate marketing partnerships related to credit products.

- High Demand for Credit Knowledge - Many individuals seek to understand credit scores, reports, and myths, providing consistent content opportunities.

- Ad Revenue Potential - YouTube's monetization program rewards channels with quality content and steady viewership, increasing earnings as the channel grows.

- Diverse Income Streams - Sponsored videos and affiliate links to credit cards or financial services diversify revenue beyond ads.

Audience Engagement: Building Trust Through Credit Transparency

Starting a YouTube channel about credit myths can be lucrative by addressing common misconceptions and providing clear, accurate information. Audience engagement thrives when creators build trust through credit transparency, sharing real-life examples and actionable tips. This approach encourages viewers to return and recommend the channel, boosting subscriber growth and monetization opportunities.

Top Credit Myths That Hinder Financial Growth

| Topic | Starting a YouTube Channel About Credit Myths |

|---|---|

| Focus | Top Credit Myths That Hinder Financial Growth |

| Monetization Potential | High, given the increasing interest in personal finance and credit management content |

| Common Credit Myths to Address |

|

| Why These Myths Hinder Financial Growth | Misconceptions cause poor credit decisions, limit borrowing power, increase interest costs, and delay wealth-building opportunities |

| Audience | Millennials, Gen Z, individuals seeking debt management advice, first-time credit users |

| Content Strategies | Explainer videos, myth-busting series, expert interviews, practical credit tips, case studies on credit improvement |

| SEO Keywords | Credit myths debunked, credit score mistakes, improve credit fast, personal finance tips credit, credit management strategies |

Video Content Ideas for a Profitable Credit Channel

Starting a YouTube channel focused on credit myths can attract a large audience seeking reliable financial advice. Content that debunks common credit misconceptions increases viewer trust and engagement.

Video ideas include explaining credit scores, credit report errors, and how credit cards impact credit health. Tutorials on improving credit, managing debt, and leveraging credit for financial growth drive channel profitability.

SEO Strategies to Grow Your Credit-Focused YouTube Channel

Starting a YouTube channel about credit myths can be lucrative by targeting a niche audience interested in financial literacy and credit management. Effective SEO strategies include using keyword-rich titles, descriptions, and tags focused on credit-related queries to boost visibility. Consistent content creation paired with engaging thumbnails and interactive community features helps grow and retain subscribers interested in credit education.

Collaboration Opportunities: Partnering with Financial Experts

Starting a YouTube channel about credit myths can be lucrative when leveraging collaboration opportunities with financial experts. Partnering with credible professionals boosts channel authority and attracts a targeted audience seeking trustworthy credit information.

- Amplifies Credibility - Collaborations with certified financial advisors enhance content trustworthiness and viewer confidence.

- Expands Audience Reach - Joint videos and guest appearances tap into the experts' follower base, increasing subscriber growth.

- Generates Diverse Content - Expert insights provide fresh perspectives, enriching the channel with varied and valuable credit knowledge.

Case Studies: Successful YouTubers in the Credit Niche

Starting a YouTube channel about credit myths can be lucrative, especially when leveraging proven strategies from successful creators. Case studies of top YouTubers in the credit niche reveal consistent audience engagement and monetization through ad revenue, sponsorships, and affiliate marketing.

Channels like CreditShifu and The Credit Bros have grown their subscriber base by debunking common credit misconceptions and providing actionable advice. Their success highlights the demand for clear, trustworthy credit information, making the niche profitable with targeted content.

Measuring Success: Tracking Profit and Impact on Your Channel

Starting a YouTube channel about credit myths can be lucrative when success is measured by both profit and audience impact. Clear tracking of revenue streams and viewer engagement helps optimize content strategy.

Monitoring metrics such as ad revenue, sponsorship deals, and affiliate marketing earnings provides a comprehensive view of channel profitability. Tracking viewer retention, comments, and subscriber growth gauges the educational impact on the audience. Effective use of analytics tools allows creators to refine content, boosting both financial returns and channel influence.

Related Important Terms

Credit Mythbusting Niche

The credit mythbusting niche on YouTube offers lucrative opportunities by addressing widespread misconceptions about credit scores, debt management, and credit repair, attracting a dedicated audience seeking trustworthy financial advice. Channels that deliver clear, actionable insights on credit myths can generate substantial ad revenue, sponsorships, and affiliate partnerships within personal finance sectors.

FICO Algorithm Expose

Exposing the FICO algorithm on a YouTube channel offers lucrative potential by demystifying credit scoring processes and attracting viewers seeking insider knowledge on credit myths. Detailed analysis of FICO's impact on credit decisions builds authority, driving ad revenue and sponsorships in the personal finance niche.

Credit Score Gaming Trends

Starting a YouTube channel about credit myths can be lucrative by tapping into the growing interest in credit score gaming trends, which attract viewers seeking strategies to improve or optimize their credit ratings. Videos explaining credit utilization tactics, myth-busting on credit reporting, and the impact of new AI-driven credit scoring models generate high engagement and advertiser interest.

Finfluencer Monetization

Launching a YouTube channel centered on credit myths offers lucrative potential through Finfluencer monetization, leveraging affiliate marketing partnerships with credit card companies, financial institutions, and credit monitoring services to earn commissions and sponsorships. Consistent content demystifying credit scoring, debt management, and credit repair attracts a targeted audience, enhancing viewer engagement and maximizing ad revenue and brand collaborations.

Micro-Niche Credit Channels

Micro-niche credit channels debunking credit myths attract targeted audiences highly interested in financial literacy, driving monetization through affiliate marketing, sponsored content, and premium credit tools. Leveraging SEO-optimized content on credit score improvement and myth-busting can generate consistent revenue streams while building authority in the credit education space.

TikTok Credit Scams

Starting a YouTube channel that debunks credit myths and exposes TikTok credit scams can be highly lucrative due to the growing audience seeking trustworthy financial advice and scam awareness. Leveraging trending TikTok credit scams as content boosts engagement, attracts sponsorships, and monetizes through ads and affiliate marketing targeting credit repair and financial services.

Viral Credit Repair Shorts

Creating a YouTube channel centered on viral credit repair shorts can be highly lucrative by tapping into the growing audience seeking quick, actionable insights on credit myths and financial literacy. Leveraging trending topics related to credit scores, debt management, and credit repair strategies increases viewer engagement and monetization potential through ads, sponsorships, and affiliate marketing.

Credit Data Deepfake

Starting a YouTube channel about credit myths can be lucrative by leveraging the growing interest in credit education and the impact of credit data deepfakes on financial decisions. Addressing the risks of deepfake credit data enhances viewer trust and attracts a niche audience seeking accurate, cutting-edge credit insights.

Subscriber-to-Consultant Funnel

Starting a YouTube channel debunking credit myths can be lucrative when leveraging a subscriber-to-consultant funnel, as engaging content attracts subscribers who can be converted into credit consultation clients. Optimizing this funnel boosts revenue by targeting audiences seeking expert advice on credit scores, debt management, and loan approval strategies.

YouTube CPM for Credit Content

YouTube CPM rates for credit-related content typically range from $12 to $25, reflecting high advertiser demand in the personal finance niche. Monetizing a channel focused on debunking credit myths can attract a well-targeted audience, increasing revenue potential through affiliate marketing and sponsored credit products.

moneytar.com

moneytar.com