Are currency conversion kiosks a viable small business? Infographic

Are currency conversion kiosks a viable small business? Infographic

Are currency conversion kiosks a viable small business?

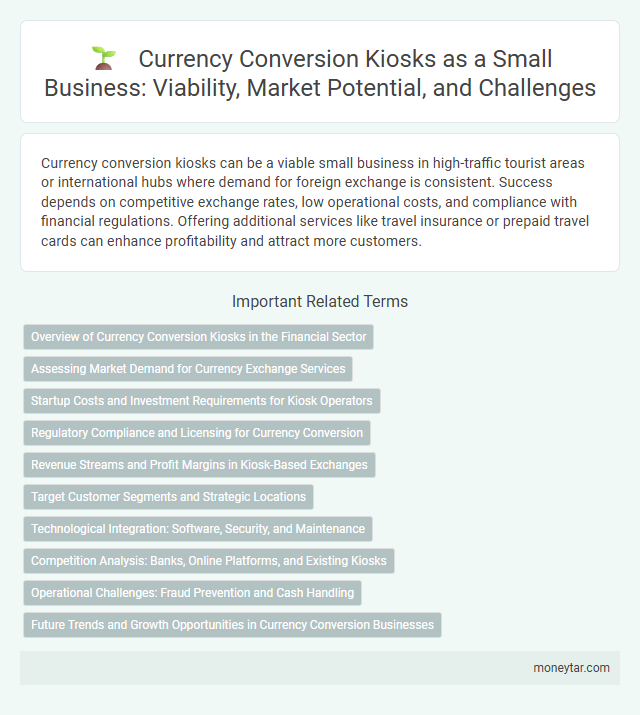

Currency conversion kiosks can be a viable small business in high-traffic tourist areas or international hubs where demand for foreign exchange is consistent. Success depends on competitive exchange rates, low operational costs, and compliance with financial regulations. Offering additional services like travel insurance or prepaid travel cards can enhance profitability and attract more customers.

Overview of Currency Conversion Kiosks in the Financial Sector

Currency conversion kiosks play a significant role within the financial sector by providing accessible foreign exchange services. These kiosks cater to travelers, businesses, and individuals needing quick, on-the-spot currency exchanges.

- Market Presence - Currency conversion kiosks are commonly found in airports, shopping centers, and tourist hotspots, facilitating convenient access to multiple currencies.

- Technology Integration - Modern kiosks utilize real-time exchange rate data and secure transaction systems to enhance accuracy and trustworthiness.

- Business Viability - Low startup costs combined with steady customer demand make these kiosks an attractive option for small business ventures.

You can capitalize on the growing need for hassle-free currency exchange by exploring this niche within the financial services industry.

Assessing Market Demand for Currency Exchange Services

Currency conversion kiosks cater to travelers and expatriates needing quick access to foreign cash. Market demand is influenced by tourist volume, local business activity, and currency volatility. Strategic placement in airports, travel hubs, and busy commercial areas enhances profitability and customer reach.

Startup Costs and Investment Requirements for Kiosk Operators

Currency conversion kiosks can offer a profitable small business opportunity with moderate startup costs. Understanding the initial investment and ongoing expenses is crucial for your success as a kiosk operator.

- Initial Equipment and Setup Costs - Purchasing secure currency counters, software, and kiosk booth installation typically ranges from $5,000 to $20,000.

- Licensing and Compliance Fees - Obtaining necessary money transmitter licenses and meeting regulatory requirements can cost several thousand dollars depending on the location.

- Working Capital Requirements - Maintaining sufficient cash reserves for foreign currency exchange and operational expenses is essential, often requiring $10,000 or more upfront.

Regulatory Compliance and Licensing for Currency Conversion

Currency conversion kiosks must adhere to strict regulatory compliance and licensing requirements to operate legally. Business owners need to obtain money transmitter licenses and comply with anti-money laundering (AML) laws, including Know Your Customer (KYC) protocols. Failure to meet these standards can result in hefty fines and suspension of business operations.

Revenue Streams and Profit Margins in Kiosk-Based Exchanges

Currency conversion kiosks generate revenue primarily through transaction fees and exchange rate markups. These revenue streams depend heavily on high customer traffic and competitive rates to attract users.

Profit margins in kiosk-based exchanges vary but generally range from 2% to 10% per transaction, influenced by operational costs such as rent and staffing. Peak locations like airports or tourist hubs enhance profitability due to increased transaction volume. Efficient management of currency inventory and minimizing exchange rate risk are critical to maintaining healthy profits.

Target Customer Segments and Strategic Locations

| Target Customer Segments |

|

|---|---|

| Strategic Locations |

|

Technological Integration: Software, Security, and Maintenance

Currency conversion kiosks rely heavily on advanced software to provide real-time exchange rates and seamless transaction processing. Integration with global financial networks ensures accuracy and efficiency, attracting a steady stream of customers.

Robust security measures protect sensitive customer data and prevent fraud, utilizing encryption and multi-factor authentication. Regular software updates and maintenance are essential to keep kiosks operational and compliant with evolving regulations.

Competition Analysis: Banks, Online Platforms, and Existing Kiosks

Currency conversion kiosks face significant competition from established banks that offer reliable and secure exchange services with established customer trust. Banks often provide favorable rates and integrated financial services, making it challenging for kiosks to attract a loyal customer base.

Online platforms and currency exchange apps present a convenient alternative by offering competitive rates and the ability to convert currencies digitally without physical visits. Existing kiosks benefit from physical presence in high-traffic areas but must differentiate through superior customer service and accessibility to remain competitive.

Operational Challenges: Fraud Prevention and Cash Handling

Currency conversion kiosks face significant operational challenges that affect profitability and security. Effective management of fraud prevention and cash handling is critical to sustaining your business.

- Fraud Detection Systems - Implementing advanced software to identify counterfeit bills and suspicious transactions reduces financial losses.

- Cash Management Processes - Regular auditing and secure cash storage procedures minimize the risk of theft and errors during currency exchange.

- Compliance and Reporting - Adhering to regulatory requirements for anti-money laundering ensures legal operation and prevents fines.

Future Trends and Growth Opportunities in Currency Conversion Businesses

Are currency conversion kiosks a viable small business in the evolving financial landscape? The increasing globalization and travel demand drive steady growth in currency exchange services. Advancements in digital technology and contactless payments present new opportunities for kiosks to integrate innovative solutions.

What future trends are shaping the currency conversion business? The rise of cryptocurrencies and blockchain technology influences currency exchange operations, pushing kiosks to adopt more secure and transparent processes. Mobile apps and AI-powered rates forecasting enhance customer experience and operational efficiency.

How can small businesses capitalize on growth opportunities in currency conversion? Expanding services to include multi-currency ATM access and personalized forex advice attracts a wider customer base. Strategic partnerships with travel agencies and hotels create steady traffic and increased transaction volumes for kiosks.

Related Important Terms

Automated Currency Exchange (ACE)

Automated Currency Exchange (ACE) kiosks offer a scalable small business model by providing 24/7 currency conversion services with minimal staffing and operational costs, appealing especially in high-traffic locations such as airports and shopping centers. The integration of real-time exchange rates and secure transaction technology enhances customer trust and profitability, positioning ACE kiosks as a competitive alternative to traditional currency exchange counters.

Dynamic Currency Conversion (DCC)

Dynamic Currency Conversion (DCC) kiosks offer a convenient way for travelers to convert currency at points of sale, generating revenue through transaction fees but often facing criticism for higher costs compared to traditional methods. Small businesses incorporating DCC can benefit from increased customer convenience and enhanced profit margins, though careful consideration of exchange rates and compliance with financial regulations is essential for viability.

Fintech Currency Kiosks

Fintech currency conversion kiosks leverage advanced technology to provide fast, secure, and real-time exchange rates, enhancing convenience for travelers and small businesses. These kiosks reduce operational costs and increase transaction efficiency, making them a viable and scalable option in the growing foreign exchange market.

Crypto-to-Fiat Kiosks

Crypto-to-fiat kiosks are emerging as viable small business opportunities by providing instant conversion services between cryptocurrencies and traditional currencies, catering to growing demand in both urban and tourist-heavy areas. These kiosks leverage blockchain technology to ensure secure, transparent transactions while offering convenient access for users seeking liquidity in digital assets.

Micro-FX Entrepreneurs

Currency conversion kiosks offer Micro-FX entrepreneurs a scalable opportunity to capitalize on the growing demand for foreign exchange services in high-traffic locations, leveraging low operational costs and flexible hours. Strategic placement near airports, tourist hubs, and business districts maximizes transaction volume while minimizing overhead, making it a viable small business with steady cash flow potential.

Kiosk-as-a-Service (KaaS)

Currency conversion kiosks operating via Kiosk-as-a-Service (KaaS) provide entrepreneurs a scalable entry into the foreign exchange market, leveraging cloud-based management and real-time transaction monitoring to reduce overhead and improve compliance. This model enables rapid deployment and ongoing software updates, ensuring enhanced security and optimized currency exchange rates, which are critical for profitability in small-scale currency services.

Multicurrency Dispensing Units

Multicurrency Dispensing Units (MCDUs) offer a viable small business opportunity by enabling convenient, on-demand foreign currency access, reducing the need for physical cash handling and streamlining currency exchange operations. These kiosks support multiple currencies, attract international travelers, and generate revenue through transaction fees and exchange rate margins.

Airport Forex Pop-ups

Airport forex pop-ups serve as practical currency conversion kiosks by capitalizing on high traveler traffic and immediate demand for foreign exchange services. Their strategic airport locations and low overhead costs enhance profitability potential for small businesses specializing in quick, convenient currency exchange solutions.

Compliance-First Kiosk Solutions

Currency conversion kiosks can be a viable small business when equipped with compliance-first kiosk solutions that ensure adherence to anti-money laundering (AML) regulations, know your customer (KYC) policies, and local financial laws. Implementing advanced software for real-time transaction monitoring, identity verification, and secure data handling enhances regulatory compliance and reduces operational risks.

Digital Onboarding for Currency Exchange

Digital onboarding in currency conversion kiosks enhances customer experience by enabling quick identity verification and seamless account setup, reducing wait times and operational costs. Incorporating secure biometric authentication and AI-powered compliance checks makes these kiosks a scalable and compliant solution for small businesses in the currency exchange market.

moneytar.com

moneytar.com