Is it legal to create and sell your own local currency or scrip? Infographic

Is it legal to create and sell your own local currency or scrip? Infographic

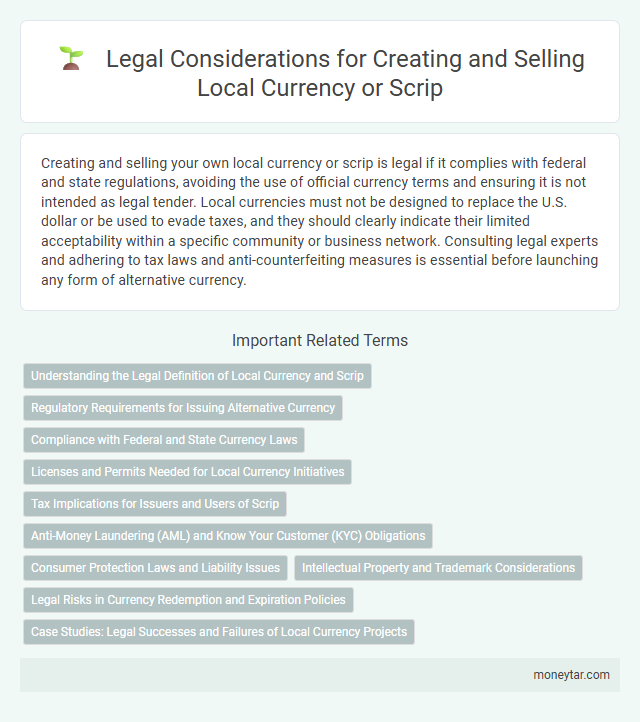

Is it legal to create and sell your own local currency or scrip?

Creating and selling your own local currency or scrip is legal if it complies with federal and state regulations, avoiding the use of official currency terms and ensuring it is not intended as legal tender. Local currencies must not be designed to replace the U.S. dollar or be used to evade taxes, and they should clearly indicate their limited acceptability within a specific community or business network. Consulting legal experts and adhering to tax laws and anti-counterfeiting measures is essential before launching any form of alternative currency.

Understanding the Legal Definition of Local Currency and Scrip

Creating and selling your own local currency or scrip involves understanding the legal boundaries defined by government authorities. Local currencies typically function as alternative forms of exchange within specific communities but must comply with national laws.

The legal definition of local currency distinguishes it from official national currency issued by a central bank. Scrip often refers to substitute money issued by private entities, usually redeemable for goods or services within a limited scope. You must ensure your local currency or scrip does not infringe on regulations related to counterfeiting, monetary policy, or tax obligations.

Regulatory Requirements for Issuing Alternative Currency

Creating and selling your own local currency or scrip involves navigating complex legal frameworks. Compliance with regulatory requirements is essential to avoid legal issues and ensure legitimacy.

- Compliance with National Laws - Issuers must adhere to federal and state regulations governing currency and financial transactions.

- Registration and Licensing - Many jurisdictions require registration or licensing before issuing alternative currencies to maintain transparency.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Policies - Implementing AML and KYC procedures helps prevent fraud and money laundering related to alternative currencies.

Compliance with Federal and State Currency Laws

| Aspect | Details |

|---|---|

| Legal Framework | Creating and selling your own local currency or scrip must comply with federal laws, including the U.S. Code Title 18, Section 486, which prohibits forging or issuing currency intended to be used as legal tender. State laws vary widely and may impose additional restrictions or reporting requirements. |

| Federal Compliance | You must ensure that your local currency does not resemble official U.S. currency to avoid counterfeiting violations. The alternative currency should not be intended as legal tender but rather as a barter or promotional tool. The Federal Reserve and the U.S. Secret Service monitor such activities. |

| State Regulations | State laws differ; some states require licensing or registration for issuing scrip. Verification with local financial and regulatory authorities is essential to avoid legal penalties or criminal charges. Disclosure of terms and usage limitations protects both issuers and recipients. |

| Taxation | Income generated from issuing or selling local currency may be subject to federal and state taxation. The Internal Revenue Service treats certain exchanged scrip as taxable income or barter transactions, requiring proper reporting. |

| Recommendations | Consult legal professionals specializing in currency and financial regulation before launching your local currency. Full transparency and compliance with all applicable laws prevent unintentional violations and support sustainable local economic initiatives. |

Licenses and Permits Needed for Local Currency Initiatives

Creating and selling your own local currency or scrip requires careful consideration of legal regulations and compliance with federal and state laws. Licenses and permits may be necessary, depending on your jurisdiction, including money transmitter licenses or approvals from financial regulatory authorities. Consulting legal experts ensures that your local currency initiative operates within legal boundaries and avoids potential penalties.

Tax Implications for Issuers and Users of Scrip

Creating and selling your own local currency or scrip involves specific tax obligations for both issuers and users. The IRS treats scrip as taxable income when issued or exchanged, requiring proper reporting to avoid legal issues. You must maintain accurate records of transactions to comply with tax regulations and ensure transparent reporting for tax purposes.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Obligations

Creating and selling your own local currency or scrip may be legal in specific jurisdictions but is subject to strict regulations. Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) obligations is crucial to prevent illicit activities and ensure transparency.

Regulatory bodies require detailed record-keeping and verification of user identities to detect suspicious transactions. Failure to adhere to these AML and KYC standards can lead to significant legal penalties and financial sanctions.

Consumer Protection Laws and Liability Issues

Creating and selling your own local currency or scrip involves strict regulation under Consumer Protection Laws designed to prevent fraud and ensure transparency. Your currency must clearly disclose its terms of use, value, and redemption policies to protect consumers from misleading practices.

Liability issues arise if the local currency fails to maintain its promised value or if there are disputes over acceptance. Legal risks include fines and civil claims if consumers suffer losses due to inadequate disclosure or deceptive marketing.

Intellectual Property and Trademark Considerations

Creating and selling your own local currency or scrip involves important intellectual property and trademark considerations that influence legality and protection. Understanding these factors helps ensure compliance and safeguards your unique currency design and branding.

- Intellectual Property Rights - Protecting your currency design through copyrights or patents prevents unauthorized reproduction and misuse.

- Trademark Registration - Registering your local currency's name or logo as trademarks establishes exclusive rights and enhances market recognition.

- Legal Restrictions - Compliance with laws governing currency imitation is crucial to avoid infringement on national currency trademarks and counterfeiting statutes.

Legal Risks in Currency Redemption and Expiration Policies

Is it legal to create and sell your own local currency or scrip? Creating local currency or scrip is generally permitted under specific legal frameworks, but strict regulations apply. Businesses must carefully design redemption and expiration policies to avoid legal complications and consumer protection issues.

What legal risks exist in currency redemption policies? Redemption policies that are unclear or excessively restrictive can lead to allegations of fraud or unfair business practices. Ensuring transparent and fair terms protects issuers from lawsuits and regulatory penalties.

Can expiration policies on local currencies cause legal problems? Expiration dates on local currency or scrip must comply with consumer protection laws to be enforceable. Arbitrary or hidden expiration terms increase the risk of regulatory scrutiny and potential financial liabilities.

Case Studies: Legal Successes and Failures of Local Currency Projects

Creating and selling your own local currency involves navigating complex legal frameworks that vary by country. Examining case studies reveals a mix of successful and failed projects based on compliance with financial regulations.

- Ithaca Hours - A local currency launched in Ithaca, New York, successfully operated for decades by adhering to tax and banking laws.

- Bristol Pound - This UK initiative thrived initially but faced regulatory challenges related to anti-money laundering rules, leading to its closure.

- LETS Systems - Community-led trading schemes like LETS often avoided legal issues by not producing physical currency, but limitations on scale restricted their impact.

You must thoroughly research and comply with local laws before launching a local currency to avoid legal pitfalls.

Related Important Terms

Complementary Currency Legality

Creating and selling your own local currency or scrip is generally legal when it operates as a complementary currency within a specific community and does not attempt to imitate official legal tender. Compliance with local laws, avoiding counterfeit practices, and ensuring transparency in its use are essential to maintain legality under regulations governing currency issuance and anti-fraud statutes.

Community Scrip Regulation

Creating and selling your own local currency or community scrip is subject to specific legal regulations that vary by jurisdiction, often requiring compliance with laws governing money transmission, taxation, and anti-fraud measures. Many regions permit community scrip usage within localized networks for goods and services but prohibit issuance resembling official legal tender to prevent counterfeiting and financial crimes.

Alternative Currency Compliance

Creating and selling your own local currency or scrip is legal if it complies with federal and state regulations, including avoiding counterfeit currency laws and ensuring it does not resemble official legal tender. Alternative currencies must adhere to guidelines from agencies like the U.S. Treasury and IRS, including clear disclaimers and proper tax reporting to maintain compliance.

Local Exchange Trading Systems (LETS) Law

Creating and selling local currencies or scrip within Local Exchange Trading Systems (LETS) is generally legal when these currencies operate as a non-profit bartering system without functioning as legal tender or replacing national currency. Compliance with national regulations, including anti-money laundering laws and restrictions against issuing unauthorized currency, is essential to avoid legal issues.

Time-Based Currency Statutes

Time-based currency statutes permit the creation and exchange of local currencies or scrip backed by hours of service rather than fiat money, often under specific legal frameworks to promote community trade and bartering. Compliance with federal and state laws, including anti-fraud and tax regulations, is essential to legally operate a time-based currency system.

Mutual Credit System Legality

Creating and selling your own local currency or scrip is generally legal when structured as a Mutual Credit System, which operates as a closed-loop exchange medium without issuing legal tender or relying on government-backed currency. Compliance with local laws regarding financial regulation, anti-money laundering, and taxation is essential to ensure the Mutual Credit System remains lawful and recognized by authorities.

Scrip Anti-Counterfeiting Requirements

Creating and selling your own local currency or scrip is legal in many jurisdictions only if it complies with specific anti-counterfeiting requirements, including the incorporation of security features such as watermarks, holograms, and unique serial numbers. These measures protect against fraud and ensure that the scrip cannot be easily replicated, helping it maintain trust and usability within the local economy.

Digital Local Currency Licensing

Creating and selling your own digital local currency or scrip requires obtaining appropriate licensing from financial regulatory authorities to ensure compliance with anti-money laundering and securities laws. Failure to secure digital local currency licensing can result in legal penalties, including fines and criminal charges, depending on jurisdiction-specific regulations.

Tokenized Community Credit Legalities

Creating and selling tokenized community credits or local currencies involves navigating complex legal frameworks, as these tokens often intersect with financial regulations concerning money transmission and securities laws. Compliance with federal and state laws, including registration requirements and anti-money laundering provisions, is essential to legally operate such tokenized local currency systems.

Central Bank Opinion on Local Currencies

Central banks typically discourage or regulate the creation and sale of local currencies or scrip due to potential risks to monetary stability and legal tender laws. Many countries require such currencies to not resemble official money and to avoid competing with the national currency to ensure compliance with central bank regulations.

moneytar.com

moneytar.com