Is building a YouTube channel about living with debt profitable? Infographic

Is building a YouTube channel about living with debt profitable? Infographic

Is building a YouTube channel about living with debt profitable?

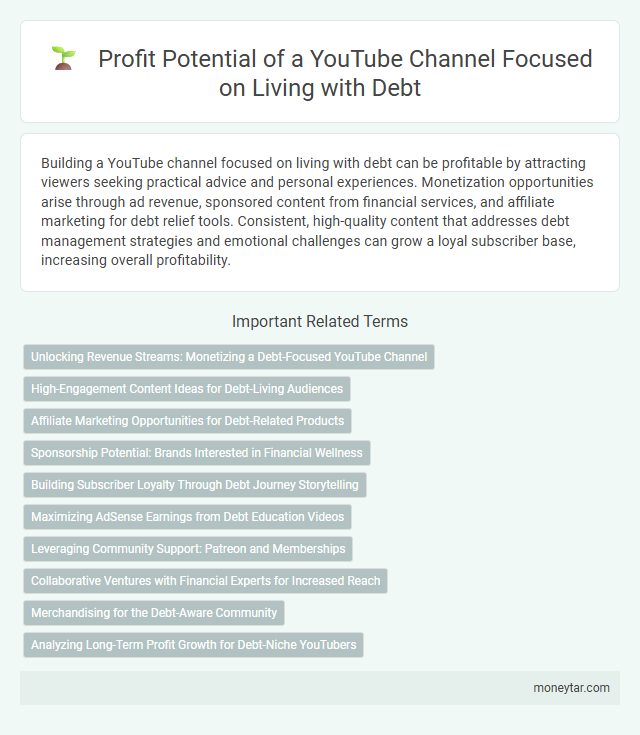

Building a YouTube channel focused on living with debt can be profitable by attracting viewers seeking practical advice and personal experiences. Monetization opportunities arise through ad revenue, sponsored content from financial services, and affiliate marketing for debt relief tools. Consistent, high-quality content that addresses debt management strategies and emotional challenges can grow a loyal subscriber base, increasing overall profitability.

Unlocking Revenue Streams: Monetizing a Debt-Focused YouTube Channel

| Aspect | Details |

|---|---|

| Channel Niche | Living with debt, debt management, financial advice, personal finance tips |

| Target Audience | Individuals struggling with debt, financial literacy seekers, millennials, student loan borrowers, credit card users |

| Monetization Methods |

|

| Content Strategy |

|

| Revenue Potential |

|

| Challenges |

|

| Key Success Factors |

|

High-Engagement Content Ideas for Debt-Living Audiences

Creating a YouTube channel centered on living with debt can attract a dedicated audience seeking relatable and practical advice. High-engagement content focuses on authentic storytelling and actionable debt management tips.

Videos that document personal debt journeys, success stories, and budgeting hacks encourage viewer interaction and loyalty. Integrating expert interviews and myth-busting sessions about debt can further boost channel credibility and engagement.

Affiliate Marketing Opportunities for Debt-Related Products

Building a YouTube channel about living with debt can be profitable by targeting niche audiences seeking financial advice. Debt-related affiliate marketing offers opportunities through products like debt consolidation services, budgeting tools, and credit counseling platforms.

Promoting reputable debt relief programs and personal finance apps provides a steady revenue stream. Many companies offer affiliate commissions for referrals that lead to service sign-ups or product purchases. Optimizing your content for terms like "debt management tools" and "credit repair services" attracts viewers looking for actionable solutions.

Sponsorship Potential: Brands Interested in Financial Wellness

Is building a YouTube channel about living with debt profitable through sponsorship potential? Brands focused on financial wellness increasingly seek authentic creators who share real experiences with debt management. Your channel can attract partnerships from companies offering budgeting tools, debt consolidation services, and financial education platforms.

Building Subscriber Loyalty Through Debt Journey Storytelling

Building a YouTube channel centered on living with debt can be profitable by creating strong subscriber loyalty through authentic debt journey storytelling. Sharing real experiences fosters trust and engagement, turning viewers into dedicated followers.

- Authentic Storytelling - Revealing personal debt challenges and progress resonates deeply with viewers seeking relatable content.

- Engagement Through Transparency - Open discussions about debt strategies encourage community interaction and viewer retention.

- Consistent Content Delivery - Regular updates on the debt journey maintain subscriber interest and promote channel growth.

Maximizing AdSense Earnings from Debt Education Videos

Creating a YouTube channel focused on living with debt can be profitable by targeting a niche audience seeking financial education. Leveraging AdSense earnings from debt-related videos maximizes revenue potential through relevant content and targeted keywords.

- High CPM Rates - Debt education videos often attract advertisers from finance and loan industries, resulting in higher cost-per-thousand impressions (CPM).

- Engaged Audience - Viewers searching for debt solutions tend to watch longer and engage more, boosting channel metrics and ad revenue.

- Keyword Optimization - Using debt-specific keywords improves search visibility, increasing organic traffic and AdSense earnings.

You can enhance monetization by regularly posting quality content that addresses common debt challenges and solutions.

Leveraging Community Support: Patreon and Memberships

Building a YouTube channel focused on living with debt can be profitable by leveraging community support through Patreon and memberships. These platforms provide steady income streams while fostering a dedicated audience invested in your content.

- Stable Revenue Generation - Patreon and membership subscriptions create recurring income from viewers who value debt-related content.

- Enhanced Audience Engagement - Exclusive content and perks encourage members to stay connected and participate actively in your community.

- Strengthened Trust and Loyalty - Support via memberships builds a closer relationship between you and your audience, increasing long-term channel sustainability.

Collaborative Ventures with Financial Experts for Increased Reach

Collaborating with financial experts can significantly enhance the credibility and reach of a YouTube channel focused on living with debt. These partnerships provide authoritative content that attracts a larger, more engaged audience.

Joint ventures often lead to cross-promotion opportunities, expanding the channel's visibility across various platforms. Engaging experts in debt management, credit counseling, and personal finance adds valuable insights that boost viewer trust and channel profitability.

Merchandising for the Debt-Aware Community

Building a YouTube channel about living with debt can be profitable by targeting the debt-aware community through merchandising. Selling themed apparel, planner kits, and motivational accessories resonates with viewers seeking financial encouragement and practical tools. Your unique merchandise fosters brand loyalty while generating additional revenue streams beyond ad income.

Analyzing Long-Term Profit Growth for Debt-Niche YouTubers

Building a YouTube channel focused on living with debt offers significant long-term profit growth potential due to the high demand for financial advice and debt management strategies. Channels that consistently provide valuable, relatable content can attract a dedicated audience, resulting in increased ad revenue, sponsorships, and affiliate marketing opportunities. Over time, debt-niche YouTubers benefit from steady viewership growth as financial awareness and debt-related challenges continue to rise globally.

Related Important Terms

Debtfluen-Creators

Debtfluen-Creators leverage specialized content on managing personal debt and financial recovery, attracting a niche audience seeking practical debt solutions. Monetization strategies include affiliate marketing for debt consolidation services, sponsored content, and AdSense revenue, making building a YouTube channel about living with debt a potentially profitable venture.

Finance Niche Monetization

Building a YouTube channel focused on living with debt can be highly profitable within the finance niche by targeting a specific audience seeking debt relief strategies, budgeting tips, and financial advice. Monetization opportunities include ad revenue, affiliate marketing for debt consolidation services, sponsored content from financial institutions, and selling digital products like budgeting courses or eBooks.

Debt Storytelling Revenue

Building a YouTube channel focused on living with debt can generate significant revenue through debt storytelling by attracting viewers seeking relatable financial experiences, leading to higher ad revenue and sponsorship opportunities. Channels that authentically share personal debt journeys often see increased engagement, which boosts monetization potential via affiliate marketing, brand partnerships, and crowd-funding platforms.

AdSense Debt Niche CPM

Building a YouTube channel focused on living with debt can be highly profitable due to the high CPM rates in the finance and debt niche, where advertisers target audiences seeking debt management and financial advice. Channels that effectively leverage AdSense revenue with targeted content on credit repair, debt consolidation, and budgeting strategies often experience increased monetization through higher viewer engagement and advertiser demand.

Credit Rebuilder Vlogging

Building a YouTube channel centered on Credit Rebuilder Vlogging proves profitable by attracting a niche audience seeking practical debt recovery strategies and credit repair tips. Monetization opportunities arise through affiliate marketing with credit counseling services, sponsored content, and partnerships with financial institutions focused on debt management solutions.

Authentic Debt Transparency Content

Creating a YouTube channel centered on authentic debt transparency content attracts a niche audience seeking genuine advice on managing and overcoming debt, which can lead to steady monetization through sponsorships, affiliate marketing, and ad revenue. Consistent, relatable storytelling about personal debt experiences builds trust and engagement, enhancing credibility and opening opportunities for brand partnerships in the financial education sector.

Debt-free Journey Engagement Rate

Building a YouTube channel focused on living with debt can be highly profitable due to the growing audience seeking Debt-free Journey Engagement Rate insights. Content that emphasizes practical debt reduction strategies and personal success stories attracts higher viewer interaction and loyal subscribers, boosting monetization opportunities through ads, sponsorships, and affiliate marketing.

Sponsorships for Debt Support Tools

Sponsorships for debt support tools offer a lucrative revenue stream for YouTube channels focused on living with debt by connecting creators with financial service providers seeking targeted, engaged audiences. Brands specializing in debt management apps, budgeting software, and credit counseling services often invest in sponsored content to increase visibility and trust among viewers actively seeking debt relief solutions.

YouTube Shorts Debt Hacks

Building a YouTube channel focused on living with debt, especially through YouTube Shorts featuring quick Debt Hacks, can be highly profitable due to the high demand for financial advice and the platform's algorithm favoring short, engaging content. Monetization opportunities increase with consistent views and subscriber growth, attracting advertisers in the personal finance niche and enabling sponsorships from debt relief services.

Peer-to-Peer Debt Inspiration Network

Building a YouTube channel centered on living with debt can be profitable by leveraging the Peer-to-Peer Debt Inspiration Network, which fosters community engagement and support through shared experiences and practical advice. This network enhances viewer retention and monetization potential by creating authentic connections and promoting debt management solutions tailored to real-life challenges.

moneytar.com

moneytar.com