Is it possible to negotiate medical debt yourself? Infographic

Is it possible to negotiate medical debt yourself? Infographic

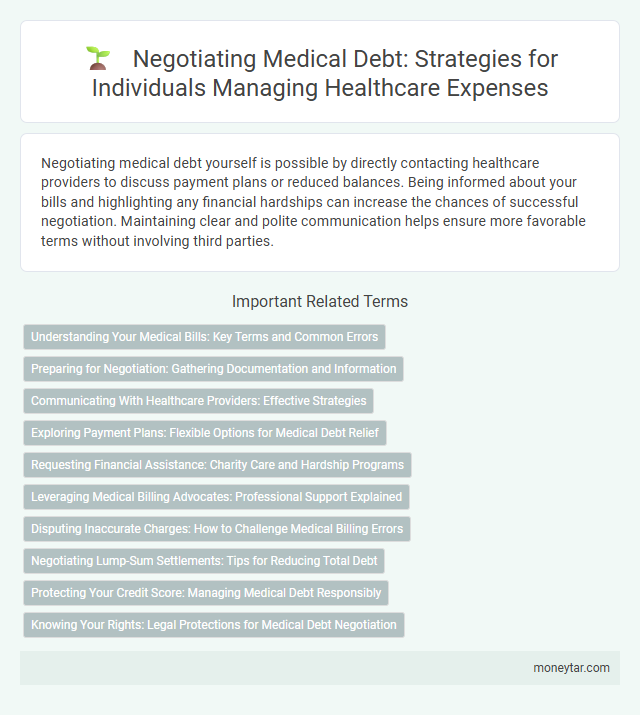

Is it possible to negotiate medical debt yourself?

Negotiating medical debt yourself is possible by directly contacting healthcare providers to discuss payment plans or reduced balances. Being informed about your bills and highlighting any financial hardships can increase the chances of successful negotiation. Maintaining clear and polite communication helps ensure more favorable terms without involving third parties.

Understanding Your Medical Bills: Key Terms and Common Errors

Understanding your medical bills is essential when negotiating medical debt yourself. Recognizing key terms and common errors can help you lower the amount owed.

- Explanation of Key Terms - Medical bills include terms like deductible, copayment, coinsurance, and out-of-pocket maximum that affect your total charges.

- Identifying Billing Errors - Common errors include duplicate charges, incorrect patient information, and services not rendered, which you can dispute to reduce debt.

- Requesting an Itemized Bill - Asking for a detailed bill helps you review each charge carefully and spot discrepancies before negotiating.

Being informed about your medical bills increases your chances of successfully negotiating medical debt on your own.

Preparing for Negotiation: Gathering Documentation and Information

| Aspect | Details |

|---|---|

| Feasibility of Negotiation | Negotiating medical debt independently is possible and often encouraged to reduce the owed amount. |

| Preparation Importance | Effective negotiation depends on thorough preparation and accurate documentation gathering. |

| Essential Documents | Medical bills, insurance statements, payment records, and any prior correspondence with healthcare providers. |

| Information to Collect | Details of treatments received, dates, provider contact information, and explanations of charges. |

| Your Role | You should organize these documents carefully to present a clear and factual case during negotiation discussions. |

Communicating With Healthcare Providers: Effective Strategies

Negotiating medical debt yourself is possible by directly communicating with healthcare providers. Clear and respectful dialogue opens opportunities for payment plans or reduced balances.

Start by reviewing your medical bills carefully to identify any errors or unnecessary charges. Contact the billing department and explain your financial situation honestly. Request detailed information about payment options, discounts, or financial assistance programs.

Exploring Payment Plans: Flexible Options for Medical Debt Relief

Negotiating medical debt yourself is possible and often leads to more manageable payment solutions. Many healthcare providers offer flexible payment plans tailored to individual financial situations. Exploring these options can significantly reduce financial stress and prevent long-term credit damage.

Requesting Financial Assistance: Charity Care and Hardship Programs

It is possible to negotiate medical debt yourself by requesting financial assistance through charity care and hardship programs offered by many healthcare providers. These programs help reduce or eliminate medical bills based on your financial situation.

- Charity Care Eligibility - Many hospitals provide charity care to patients who demonstrate low income and lack adequate insurance coverage.

- Hardship Programs - Hardship programs offer payment reductions or forgiveness for those experiencing significant financial difficulties due to medical expenses.

- Application Process - Patients must typically submit financial documents and a hardship application to qualify for assistance under these programs.

Leveraging Medical Billing Advocates: Professional Support Explained

Is it possible to negotiate medical debt yourself? Yes, individuals can attempt to negotiate medical bills independently by contacting healthcare providers directly. However, leveraging medical billing advocates offers professional expertise that improves the chances of reducing or managing medical debt effectively.

Disputing Inaccurate Charges: How to Challenge Medical Billing Errors

Disputing inaccurate charges on medical bills is a critical step in negotiating medical debt yourself. Careful review of each itemized charge helps identify errors such as duplicate fees or services not rendered.

Contact the healthcare provider's billing department directly to request clarification and corrections. Maintaining detailed records of all communications strengthens your case when challenging billing errors.

Negotiating Lump-Sum Settlements: Tips for Reducing Total Debt

Negotiating lump-sum settlements for medical debt allows you to potentially reduce the total amount owed by offering a one-time payment. Medical providers or collection agencies may accept a lower amount to close the account quickly and avoid prolonged collection efforts.

Start by reviewing your medical bills for errors and gather all relevant documents before contacting the creditor. Clearly communicate your financial hardship and propose a reasonable lump-sum payment, emphasizing your intention to resolve the debt promptly.

Protecting Your Credit Score: Managing Medical Debt Responsibly

Negotiating medical debt yourself is possible and can help protect your credit score by preventing missed payments or defaults. Taking proactive steps to communicate directly with healthcare providers or debt collectors often results in manageable payment plans or reduced balances. Managing medical debt responsibly ensures that your credit history remains intact while addressing your financial obligations.

Knowing Your Rights: Legal Protections for Medical Debt Negotiation

It is possible to negotiate medical debt yourself by understanding your rights and the legal protections available during the negotiation process. Knowing these protections empowers you to manage your medical debt more effectively and avoid unfair practices.

- Fair Debt Collection Practices Act (FDCPA) - This federal law prohibits debt collectors from using abusive or deceptive tactics when pursuing medical debt.

- State-specific Consumer Protection Laws - Many states have additional regulations that limit how medical debts can be collected or negotiated, offering you extra safeguards.

- Right to Request Validation - You have the legal right to ask for verification of your medical debt, ensuring the debt is accurate and belongs to you before negotiating.

Related Important Terms

Medical Debt Settlement

Negotiating medical debt yourself involves contacting healthcare providers or medical billing companies directly to request reduced balances, payment plans, or debt forgiveness based on financial hardship. Effective medical debt settlement requires persistence, thorough documentation of financial status, and understanding of your rights under the Fair Debt Collection Practices Act.

Self-Negotiation Discount

Negotiating medical debt yourself is possible by directly contacting healthcare providers or debt collectors to request a self-negotiation discount, which can reduce the total amount owed without involving third parties. Many providers offer financial hardship discounts or payment plans when patients proactively communicate their financial situation, making self-negotiation an effective strategy to lower medical debt.

Charge Master Rate Reduction

Negotiating medical debt yourself often involves requesting a Charge Master Rate Reduction, which is the hospital's official list price for procedures and services. By directly contacting the billing department and comparing your charges to the institution's standard rates, you may secure a lower balance without third-party assistance.

Out-of-Network Bill Negotiation

Negotiating out-of-network medical bills yourself involves directly contacting the provider's billing department to request a reduction or payment plan based on financial hardship or insurance limitations. Leveraging detailed explanation of benefits (EOB) and comparable in-network rates can strengthen your position during negotiation.

Financial Assistance Waiver

Negotiating medical debt yourself often involves applying for a Financial Assistance Waiver, which many hospitals offer to reduce or eliminate bills based on income eligibility and financial hardship. Understanding the specific criteria and providing thorough documentation can improve your chances of successfully securing this waiver and lowering your overall medical expenses.

Medical Hardship Program

Negotiating medical debt yourself is possible by enrolling in a Medical Hardship Program, which some hospitals and providers offer to reduce or forgive balances based on financial need. These programs often require documentation of income and expenses to qualify, enabling patients to lower their debt without third-party assistance.

Prompt Payment Discount

Negotiating medical debt yourself is possible by directly contacting the healthcare provider and requesting a prompt payment discount, which offers a reduced balance for immediate settlement. Many providers prefer quick payments and may agree to lower the total owed if you pay the discounted amount upfront.

Billing Advocate Tools

Negotiating medical debt yourself is possible by utilizing billing advocate tools that help identify billing errors, request discounts, and create manageable payment plans directly with healthcare providers. These tools empower patients to reduce their outstanding balances and avoid unnecessary collections by providing clear guidance and resources for self-advocacy.

Surprise Billing Dispute

Negotiating medical debt yourself is possible, especially with surprise billing disputes where unexpected charges arise from out-of-network providers. Patients can directly contact healthcare providers or billing departments to dispute the charges, request itemized bills, and negotiate reduced payments based on financial hardship or insurance coverage gaps.

Good Faith Estimate Appeal

Negotiating medical debt yourself is possible by using a Good Faith Estimate Appeal, which allows patients to dispute and reduce unexpected medical charges through a formal request to providers. This process leverages federal regulations requiring transparent pricing, helping individuals lower their out-of-pocket expenses without involving third-party negotiators.

moneytar.com

moneytar.com