Is it profitable to create a digital budget planner for those in debt? Infographic

Is it profitable to create a digital budget planner for those in debt? Infographic

Is it profitable to create a digital budget planner for those in debt?

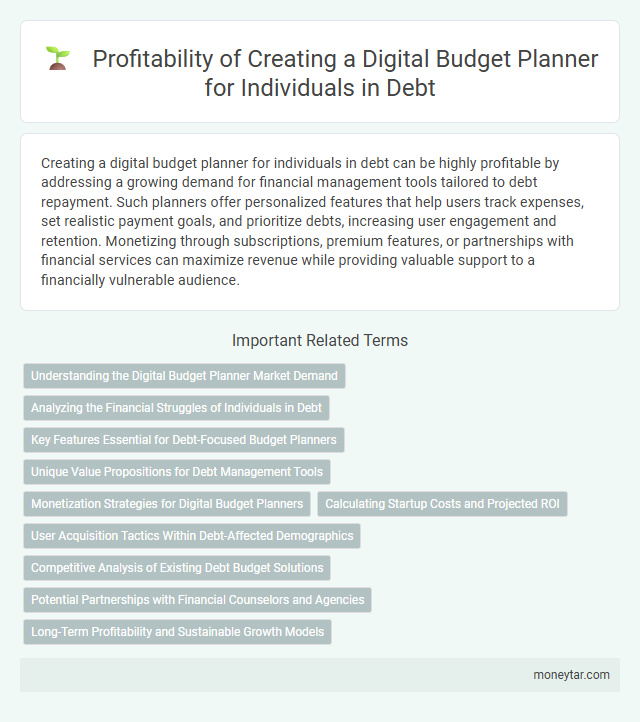

Creating a digital budget planner for individuals in debt can be highly profitable by addressing a growing demand for financial management tools tailored to debt repayment. Such planners offer personalized features that help users track expenses, set realistic payment goals, and prioritize debts, increasing user engagement and retention. Monetizing through subscriptions, premium features, or partnerships with financial services can maximize revenue while providing valuable support to a financially vulnerable audience.

Understanding the Digital Budget Planner Market Demand

The digital budget planner market for individuals in debt shows strong growth potential due to increasing financial awareness. Many users seek effective tools for managing debt repayment and tracking expenses efficiently.

Understanding user needs is crucial for developing a profitable digital budget planner tailored to debt management. Your product must offer clear value by simplifying complex financial situations and promoting sustained budgeting habits.

Analyzing the Financial Struggles of Individuals in Debt

Creating a digital budget planner specifically for individuals in debt offers valuable insights into their unique financial challenges. Understanding these struggles helps tailor solutions that improve money management and debt repayment strategies.

- High Debt-to-Income Ratios - Many individuals in debt face difficulty meeting monthly expenses because their debt payments consume a large portion of their income.

- Lack of Financial Literacy - A significant number of people in debt struggle to create effective budgets due to limited knowledge of financial planning tools and concepts.

- Irregular Income Patterns - Income instability complicates budgeting efforts, making it harder for individuals to allocate funds consistently toward debt reduction.

Key Features Essential for Debt-Focused Budget Planners

Creating a digital budget planner specifically for individuals in debt offers promising profitability due to the growing demand for tailored financial tools. Key features essential for debt-focused budget planners include automated debt tracking, personalized payoff strategies, and real-time progress visualization. Your users benefit greatly from integrated alerts and repayment reminders that help maintain accountability and motivate consistent debt reduction.

Unique Value Propositions for Debt Management Tools

Creating a digital budget planner specifically for individuals in debt offers unique opportunities for targeted financial recovery. Such tools provide customized insights and actionable strategies to help users regain control over their finances.

- Personalized Debt Tracking - Enables users to monitor multiple debts with tailored payment schedules and interest calculations.

- Goal-Oriented Financial Planning - Guides you through setting and achieving realistic debt payoff milestones, enhancing motivation and accountability.

- Automated Expense Analysis - Identifies spending patterns that contribute to debt accumulation and suggests optimized budgeting adjustments.

Monetization Strategies for Digital Budget Planners

Creating a digital budget planner tailored for individuals in debt presents a lucrative opportunity by addressing a widespread financial challenge. Effective monetization strategies include subscription models offering premium features, affiliate marketing partnerships with debt relief services, and in-app purchases for personalized budgeting tools. Leveraging user data to provide targeted financial advice and partnering with financial institutions can further enhance revenue streams.

Calculating Startup Costs and Projected ROI

Creating a digital budget planner for individuals in debt involves initial expenses such as software development, design, and marketing. Calculating these startup costs is crucial to ensure the financial feasibility of the project.

Projected ROI depends on factors like subscription pricing, user acquisition rates, and retention strategies. Accurate ROI estimation helps in determining profitability and attracting potential investors.

User Acquisition Tactics Within Debt-Affected Demographics

| Aspect | Details |

|---|---|

| Profitability of Digital Budget Planner for Debt | Creating a digital budget planner tailored for users in debt is highly profitable due to strong demand for financial management tools that aid debt reduction and budgeting discipline. Personalization and debt-focused features increase user retention and willingness to pay for premium plans. |

| Target Demographics | Individuals with credit card debt, student loans, medical debt, and payday loan burdens. Key segments include millennials, young professionals, and middle-income households seeking structured debt repayment plans. |

| User Acquisition Channels | Social media ads targeting financial literacy groups, partnerships with debt counseling services, SEO optimized content for debt-related queries, and collaborations with personal finance influencers. Email marketing with tailored tips also converts engaged users. |

| Content Marketing Strategy | Publish blog posts focusing on debt management tips, budgeting templates, case studies showing successful debt payoff, and interactive tools like debt calculators. Emphasize keywords such as "debt reduction," "budget planner," and "payoff strategies." |

| Incentives and Engagement | Offer free trials, debt progress tracking badges, and community forums for peer support. Gamification elements motivate users to maintain budgeting consistency and share achievements. |

| Monetization Models | Subscription-based access to advanced features, premium customer support for debt counseling integration, and affiliate links to financial services like loan consolidation and credit counseling platforms. |

Competitive Analysis of Existing Debt Budget Solutions

The market for digital budget planners targeting individuals in debt is growing rapidly, driven by increasing financial awareness and demand for debt management tools. Established solutions often include features like expense tracking, debt payoff calculators, and personalized budgeting advice.

Competitive analysis reveals that many existing apps focus on generic budgeting rather than specialized debt strategies, creating an opportunity to offer unique features such as tailored debt repayment plans or integration with credit counseling services. User experience varies widely, with some solutions lacking intuitive interfaces or comprehensive support. Your digital budget planner can stand out by combining advanced analytics with user-friendly design to effectively guide users through debt reduction.

Potential Partnerships with Financial Counselors and Agencies

Creating a digital budget planner for individuals in debt offers significant opportunities for collaboration with financial counselors and agencies. Partnering with these experts can enhance credibility and widen reach within target audiences struggling with debt.

- Access to Expert Insights - Financial counselors provide valuable knowledge that can improve the planner's features and user experience tailored to debt management.

- Expanded User Base - Agencies working with debtors offer a direct channel to potential users actively seeking financial assistance tools.

- Credibility and Trust - Endorsements from established financial organizations increase user confidence and promote adoption of the digital planner.

Your collaboration with financial counselors and agencies can maximize the planner's impact and profitability in the debt management market.

Long-Term Profitability and Sustainable Growth Models

Is it profitable to create a digital budget planner for those in debt? Developing a digital budget planner tailored to individuals struggling with debt can tap into a significant market with ongoing demand. Long-term profitability is achievable by focusing on sustainable growth models such as subscription services and personalized financial advice features.

Related Important Terms

Debt Snowball Automation

Creating a digital budget planner with integrated Debt Snowball Automation can significantly enhance debt repayment efficiency by prioritizing high-interest debts and accelerating payoff timelines. This tool offers users a structured, automated approach to managing multiple debts, increasing the likelihood of sustained financial discipline and long-term savings.

Micro-Budgeting Algorithms

Micro-budgeting algorithms enhance digital budget planners by analyzing granular spending patterns and prioritizing debt repayment strategies, increasing user profitability through optimized cash flow management. Incorporating real-time data and predictive analytics, these algorithms reduce financial stress and accelerate debt reduction, making digital planners highly effective for individuals in debt.

Real-Time Debt Tracker

A digital budget planner with a Real-Time Debt Tracker enhances profitability by providing users instant updates on their debt balances and payment progress, increasing engagement and retention. Integrating features like automated alerts and personalized repayment recommendations drives financial discipline, leading to higher subscription rates and potential monetization through premium services.

Digital Debt Avalanche Planner

Creating a Digital Debt Avalanche Planner offers a profitable opportunity by providing users with an algorithm-based tool to prioritize high-interest debts, accelerating repayment and reducing overall interest costs. Integrating personalized payment schedules and progress tracking enhances user engagement, making the planner a valuable resource for effective debt management and financial recovery.

Gamified Repayment Incentives

Creating a digital budget planner incorporating gamified repayment incentives can significantly enhance user engagement and motivation for those in debt, leading to more consistent payment behaviors and faster debt reduction. By integrating reward systems, progress tracking, and interactive challenges, the planner leverages behavioral economics to improve financial discipline and long-term debt management outcomes.

AI-Powered Expense Categorization

AI-powered expense categorization enhances digital budget planners by automatically sorting transactions into relevant categories, helping users in debt gain precise insights into their spending patterns and identify areas for cost-cutting. This advanced feature increases profitability by attracting tech-savvy debtors seeking efficient, personalized financial management tools that simplify debt reduction strategies.

Subscription-Based Budget Tools

Subscription-based budget tools offer continuous updates and personalized financial insights, making them highly profitable for users managing debt. Recurring revenue from monthly or annual subscriptions ensures consistent cash flow while providing valuable features like debt payoff tracking and expense categorization.

Community Debt Paydown Challenges

Creating a digital budget planner tailored for individuals participating in Community Debt Paydown Challenges can drive profitability by addressing a growing demand for collaborative financial tools that track shared goals and progress. Integrating features like personalized payment schedules, progress visualization, and peer support mechanisms enhances user engagement and retention, increasing monetization opportunities through subscriptions and premium services.

Personalized Debt Analytics Dashboard

Creating a digital budget planner with a Personalized Debt Analytics Dashboard enhances user engagement by providing tailored insights into debt repayment strategies, interest cost projections, and cash flow management. This targeted approach increases customer retention and monetization potential through subscription models and premium features designed for individuals managing diverse debt portfolios.

Financial Wellness Gamification

Creating a digital budget planner that incorporates financial wellness gamification can significantly enhance engagement and motivation for individuals in debt by transforming complex debt management into interactive, rewarding experiences. Features such as progress tracking, personalized challenges, and achievement badges effectively promote consistent budgeting habits and accelerate debt repayment.

moneytar.com

moneytar.com