Is investing in trailer parks more lucrative than multifamily properties? Infographic

Is investing in trailer parks more lucrative than multifamily properties? Infographic

Is investing in trailer parks more lucrative than multifamily properties?

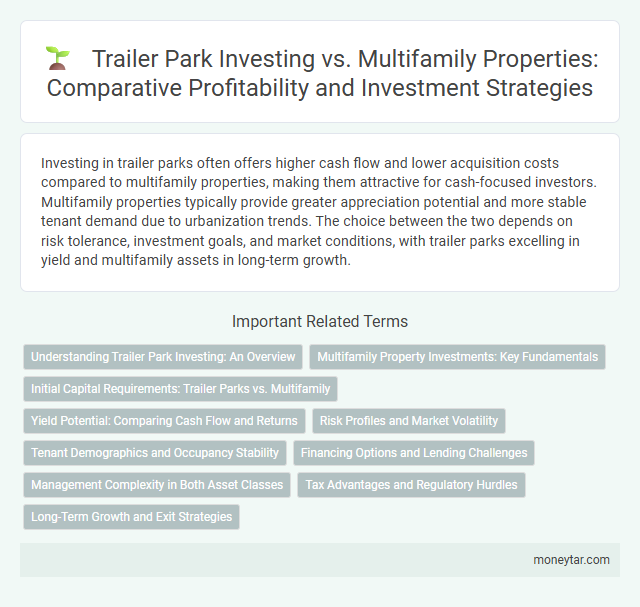

Investing in trailer parks often offers higher cash flow and lower acquisition costs compared to multifamily properties, making them attractive for cash-focused investors. Multifamily properties typically provide greater appreciation potential and more stable tenant demand due to urbanization trends. The choice between the two depends on risk tolerance, investment goals, and market conditions, with trailer parks excelling in yield and multifamily assets in long-term growth.

Understanding Trailer Park Investing: An Overview

Investing in trailer parks presents unique advantages compared to multifamily properties, often offering higher cash flow and lower entry costs. Understanding the fundamentals of trailer park investments helps you make informed decisions about portfolio diversification and risk management.

- Lower Operating Costs - Trailer parks typically incur fewer maintenance expenses because tenants own their homes, reducing landlord responsibilities.

- Steady Demand - Affordable housing shortages contribute to consistent occupancy rates in trailer parks, ensuring stable revenue.

- Higher Cash Flow Potential - Monthly lot rent from trailer parks can generate higher yields than traditional multifamily rents due to lower acquisition costs and operating expenses.

Multifamily Property Investments: Key Fundamentals

Multifamily property investments offer steady cash flow and strong appreciation potential compared to trailer parks. Understanding key fundamentals is essential for evaluating profitability in multifamily real estate.

- Location Importance - Proximity to urban centers and employment hubs drives tenant demand and rental income stability.

- Occupancy Rates - High occupancy rates correlate with reliable revenue streams and lower risk of vacancy losses.

- Property Management - Effective management reduces maintenance costs and improves tenant retention, enhancing overall investment returns.

Investors should weigh these fundamentals carefully to determine if multifamily properties align better with their financial goals than trailer park investments.

Initial Capital Requirements: Trailer Parks vs. Multifamily

Initial capital requirements for investing in trailer parks tend to be significantly lower compared to multifamily properties. Trailer parks often involve purchasing land and mobile homes, which reduces upfront costs.

Multifamily properties usually demand higher down payments and financing due to the cost of construction and location. Investors may face stricter loan qualifications and longer timelines before rental income stabilizes in multifamily investments. Trailer parks offer an affordable entry point, attracting investors with limited initial capital.

Yield Potential: Comparing Cash Flow and Returns

Investing in trailer parks often yields higher cash flow compared to multifamily properties due to lower operational costs and higher rent-to-value ratios. Your return potential varies depending on location, management efficiency, and market demand.

- Trailer Parks Generate Stronger Cash Flow - Lower overhead and minimal maintenance expenses typically result in higher monthly income from trailer parks.

- Multifamily Properties Offer Stable Appreciation - These investments tend to have consistent rental demand, contributing to steady long-term returns.

- Yield Potential Depends on Market Dynamics - Both asset types respond differently to economic shifts, affecting cash flow and overall profitability.

Risk Profiles and Market Volatility

Investing in trailer parks typically carries lower risk profiles compared to multifamily properties due to stable demand and lower tenant turnover. Market volatility impacts multifamily properties more significantly as they are sensitive to economic cycles and rental market fluctuations. Trailer parks benefit from consistent cash flow and less susceptibility to market downturns, making them a potentially more lucrative investment in uncertain markets.

Tenant Demographics and Occupancy Stability

| Aspect | Trailer Parks | Multifamily Properties |

|---|---|---|

| Tenant Demographics | Predominantly lower-income residents, often seeking affordable and stable housing options. Tenants typically include families, retirees, and individuals valuing cost-efficiency. | Wide range of demographics, including young professionals, families, and higher-income renters. Diversity in tenant profiles leads to varied rental demand patterns. |

| Occupancy Stability | High occupancy rates due to affordable rent and limited alternative options. Tenants tend to stay longer, creating lower turnover and consistent cash flow. | Variable occupancy rates influenced by market trends and economic cycles. Potential for higher turnover requiring more active management to maintain full occupancy. |

Your investment strategy should weigh the stability offered by trailer parks against the demographic diversity and potential growth in multifamily properties.

Financing Options and Lending Challenges

Investing in trailer parks often requires unique financing options compared to multifamily properties. Traditional loans may be harder to secure due to the perceived risks associated with mobile home parks.

Multifamily properties typically qualify for conventional mortgages, offering lower interest rates and longer terms. Lenders view multifamily buildings as more stable investments, resulting in smoother approval processes.

Management Complexity in Both Asset Classes

Investing in trailer parks typically involves lower management complexity compared to multifamily properties due to fewer tenant interactions and simpler maintenance. Multifamily properties require comprehensive property management, including handling multiple leases, tenant turnover, and amenities upkeep. Investors seeking less hands-on involvement often prefer trailer parks for their streamlined operational demands.

Tax Advantages and Regulatory Hurdles

Investing in trailer parks offers significant tax advantages, including accelerated depreciation and lower property taxes compared to multifamily properties. These benefits can enhance cash flow and improve overall investment returns.

Regulatory hurdles for trailer parks are generally less stringent, with fewer zoning restrictions and lower compliance costs than multifamily developments. Investors may find trailer parks easier to manage from a regulatory standpoint, reducing delays and legal expenses.

Long-Term Growth and Exit Strategies

Is investing in trailer parks more lucrative than multifamily properties for long-term growth? Trailer parks often offer lower entry costs and consistent cash flow, making them attractive for steady appreciation. Multifamily properties typically provide higher valuation multiples and greater scalability over time.

How do exit strategies differ between trailer parks and multifamily properties? Trailer parks can be sold as entire communities or subdivided, offering flexibility in exit planning. Multifamily properties usually rely on refinancing or selling as a whole package to maximize investor returns.

Related Important Terms

Trailer Park Syndication

Trailer park syndication offers investors higher cash-on-cash returns and lower volatility compared to multifamily properties, driven by lower acquisition costs and stable tenant demand. The growing acceptance of affordable housing solutions enhances trailer park syndication profitability, making it a compelling alternative within real estate investment portfolios.

Cap Rate Compression

Cap rate compression in trailer parks often results in higher relative returns compared to multifamily properties due to limited supply and increasing demand for affordable housing; investors benefit from stable cash flows and lower turnover rates. Multifamily properties face greater competition and development risks, which can suppress cap rates and reduce yield potential over time.

Pad Rent Arbitrage

Investing in trailer parks can offer higher cash flow through lower maintenance costs and stable tenant turnover compared to multifamily properties, enhancing returns via Pad Rent Arbitrage by leasing pads to individual trailer owners at premium rates. Multifamily properties typically require significant capital expenditures and face variable vacancy risks, whereas trailer parks benefit from consistent income streams and less operational complexity.

Value-Add Mobile Home Park

Investing in value-add mobile home parks often yields higher returns than multifamily properties due to lower acquisition costs, stable cash flow, and significant upside potential through operational improvements and rent increases. Value-add strategies such as infrastructure upgrades, enhanced amenities, and improved management drive increased occupancy rates and property valuations, making mobile home parks a compelling alternative in real estate portfolios.

Resident-Owned Communities (ROC)

Investing in Resident-Owned Communities (ROC) trailer parks often yields higher profit margins and lower tenant turnover compared to multifamily properties due to strong community engagement and resident-driven management. ROC models enhance stability and long-term value by empowering residents, resulting in consistent cash flow and reduced operational costs unlike traditional multifamily property investments.

Turnkey Mobile Park Investing

Turnkey mobile park investing offers higher cash flow and lower management costs compared to multifamily properties, driven by stable tenant demand and reduced maintenance expenses. Investors benefit from scalable income streams and community-style amenities, making trailer parks a more lucrative and resilient asset class in the real estate market.

Rural Land Leasing Models

Investing in trailer parks often yields higher cash flow compared to multifamily properties due to lower maintenance costs and consistent rental income from long-term tenants. Rural land leasing models enhance profitability by leveraging affordable land prices and flexible lease terms, attracting stable tenant bases and reducing capital expenses.

Opportunity Zone Trailer Parks

Investing in Opportunity Zone trailer parks offers significant tax incentives and higher cash flow potential compared to traditional multifamily properties, driven by lower acquisition costs and steady demand for affordable housing. These advantages position trailer parks as a lucrative alternative, especially within designated Opportunity Zones where capital gains tax deferral and exclusion amplify overall returns.

Institutional Mobile Home Expansion

Institutional mobile home expansion offers higher cash flow and lower vacancy risks compared to multifamily properties due to stable tenant demand and minimal turnover rates. Trailer parks also benefit from lower maintenance costs and regulatory barriers, enhancing their overall investment returns relative to traditional multifamily assets.

Pad-to-Unit Ratio

Investing in trailer parks often yields a higher return due to a favorable Pad-to-Unit Ratio, where multiple mobile home pads generate consistent rental income with lower maintenance costs compared to the numerous individual units in multifamily properties. This efficiency in space utilization and reduced operational expenses enhances cash flow, making trailer parks potentially more lucrative than traditional multifamily investments.

moneytar.com

moneytar.com