Can you be held personally liable for debts incurred by your LLC side hustle? Infographic

Can you be held personally liable for debts incurred by your LLC side hustle? Infographic

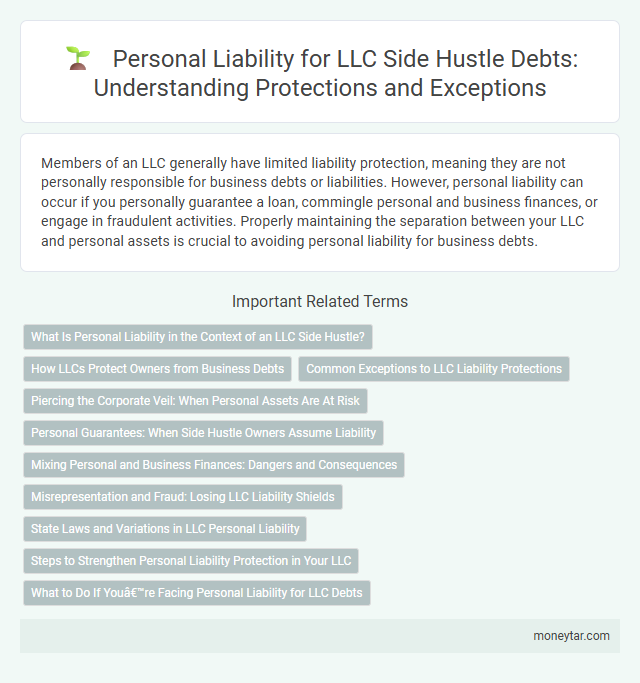

Can you be held personally liable for debts incurred by your LLC side hustle?

Members of an LLC generally have limited liability protection, meaning they are not personally responsible for business debts or liabilities. However, personal liability can occur if you personally guarantee a loan, commingle personal and business finances, or engage in fraudulent activities. Properly maintaining the separation between your LLC and personal assets is crucial to avoiding personal liability for business debts.

What Is Personal Liability in the Context of an LLC Side Hustle?

Personal liability refers to the legal responsibility for debts and obligations incurred by your LLC side hustle. Understanding when you might be personally liable helps protect your personal assets from business-related claims.

- Limited Liability Protection - An LLC generally separates personal assets from business debts, shielding you from personal responsibility.

- Exceptions to Protection - Personal liability can arise if you personally guarantee a loan or engage in fraudulent activities.

- Piercing the Corporate Veil - Courts may hold you personally liable if you fail to maintain proper separation between personal and business finances.

How LLCs Protect Owners from Business Debts

LLCs provide a legal shield that generally protects owners from personal liability for business debts. This protection helps separate your personal assets from the financial obligations of your side hustle.

- Limited Liability Protection - LLCs legally separate personal assets from business liabilities, preventing creditors from targeting personal property.

- Business Debt Responsibility - Debts and financial obligations incurred by the LLC are the responsibility of the company itself, not its individual members.

- Exceptions to Protection - Personal liability can occur if an owner personally guarantees a loan or commits fraud related to the LLC's business activities.

Common Exceptions to LLC Liability Protections

LLC structures generally protect personal assets from business debts and liabilities. However, there are common exceptions where personal liability may apply.

Personal liability can occur if you personally guarantee a loan or debt for the LLC. Courts may pierce the corporate veil in cases of fraud, commingling of assets, or failure to follow LLC formalities. Engaging in illegal activities or negligence can also expose you to personal responsibility for LLC debts.

Piercing the Corporate Veil: When Personal Assets Are At Risk

LLCs generally protect owners from personal liability for business debts, separating personal assets from business obligations. This shield can be compromised through a legal concept known as piercing the corporate veil.

Piercing the corporate veil occurs when courts find that an LLC's formalities were ignored or the entity was used for fraudulent purposes. In such cases, personal assets like savings or property may be at risk to satisfy business debts.

Personal Guarantees: When Side Hustle Owners Assume Liability

| Topic | Detail |

|---|---|

| Personal Liability in LLC Side Hustles | Limited Liability Companies (LLCs) typically protect owners from personal liability for business debts and obligations. |

| Personal Guarantees Definition | A personal guarantee is a contractual promise where the LLC owner agrees to be personally responsible for the debt if the business defaults. |

| When Personal Guarantees Apply | Lenders or creditors often require personal guarantees for small or new LLCs lacking extensive credit history or collateral. |

| Effect on Liability | Signing a personal guarantee removes the liability protection normally granted by the LLC structure, making the owner personally liable for the specified debts. |

| Risks of Personal Guarantees | Owners risk personal assets such as savings, property, and other valuables if the LLC cannot fulfill financial obligations under the guarantee. |

| Avoiding Personal Guarantees | Options include building strong business credit, offering collateral through the LLC's assets, or negotiating loan terms without personal guarantees. |

| Conclusion | LLC owners assume personal liability when signing personal guarantees for side hustle debts, potentially exposing personal assets beyond the business entity. |

Mixing Personal and Business Finances: Dangers and Consequences

Mixing personal and business finances in your LLC side hustle can lead to serious legal risks. Courts may pierce the corporate veil if financial records are not kept separate, making you personally liable for business debts. Properly maintaining distinct accounts is essential to protect your personal assets from business obligations.

Misrepresentation and Fraud: Losing LLC Liability Shields

Misrepresentation and fraud can cause LLC members to lose their personal liability protection. Courts may hold individuals personally liable if they knowingly provide false information or engage in deceptive practices related to the LLC's side hustle debts.

Misuse of the LLC structure to commit fraud eliminates the limited liability shield, exposing personal assets to creditors. Accurate record-keeping and transparent communication are essential to maintaining protection against personal liability.

State Laws and Variations in LLC Personal Liability

Can you be held personally liable for debts incurred by your LLC side hustle? State laws vary considerably in how they treat personal liability within LLCs, often providing a shield to protect members from business debts. However, some states impose exceptions where personal assets may be at risk based on specific circumstances.

Steps to Strengthen Personal Liability Protection in Your LLC

Establish a clear separation between personal and business finances by maintaining a dedicated business bank account for the LLC. Properly document all business activities, including contracts and financial transactions, to reinforce the LLC's legal structure. Regularly update your LLC's operating agreement to reflect current practices and ensure compliance with state requirements.

What to Do If You’re Facing Personal Liability for LLC Debts

Facing personal liability for debts linked to an LLC side hustle can create significant financial challenges. Understanding the steps to protect personal assets is crucial in this scenario.

- Review Operating Agreement - Examine the LLC's operating agreement for any clauses that could affect personal liability protections.

- Consult a Legal Professional - Seek guidance from an attorney specializing in business law to explore options for mitigating personal risk.

- Separate Personal and Business Finances - Ensure complete separation of personal and LLC finances to maintain liability protection.

Taking prompt, informed action can help reduce personal exposure to LLC-related debts.

Related Important Terms

Piercing the Corporate Veil

Piercing the corporate veil occurs when courts hold LLC members personally liable for business debts due to misuse of the LLC structure, such as commingling personal and business funds or failing to follow corporate formalities. This legal doctrine protects creditors by disregarding the LLC's limited liability shield when members engage in fraud or improper conduct.

LLC Member Personal Guarantee

LLC members can be held personally liable for debts if they sign a personal guarantee, which overrides the LLC's limited liability protection. Without a personal guarantee, creditors typically cannot pursue members' personal assets for business debts.

Alter Ego Doctrine

The Alter Ego Doctrine allows creditors to hold LLC owners personally liable when the business is not treated as a separate entity, such as commingling personal and business assets or failing to follow corporate formalities. Courts apply this doctrine to pierce the LLC veil, making owners responsible for debts incurred by their side hustle LLC if the entity is deemed an extension of the individual.

Commingling of Assets

Commingling of personal and LLC assets can lead to personal liability for business debts, as it undermines the legal separation between the owner and the company. Maintaining distinct bank accounts and financial records is crucial to protect personal assets from claims related to LLC obligations.

LLC Operating Agreement Breach

Breaching the LLC Operating Agreement can increase the risk of personal liability for debts incurred by your LLC side hustle if courts find you acted outside the scope of your authorized business activities. Maintaining strict adherence to the Operating Agreement is critical to preserving the limited liability protection typically granted to LLC members.

Fraudulent Conveyance

Fraudulent conveyance occurs when an LLC owner transfers assets to avoid debt obligations, potentially exposing them to personal liability despite the LLC's limited liability protection. Courts can pierce the corporate veil and hold the individual personally responsible if the asset transfers are proven to be made with intent to defraud creditors.

Undercapitalization Risks

Personal liability for debts in an LLC side hustle often arises from undercapitalization, where insufficient initial funding fails to cover business obligations, prompting creditors to pursue owners' personal assets. Proper capitalization ensures the LLC is recognized as a separate legal entity, mitigating risks associated with commingling funds and financial inadequacy.

Successor Liability

Successor liability may hold you personally responsible for your LLC side hustle's debts if you assume its assets or continue its business operations without proper legal separation. Courts often impose successor liability when there is a merger, consolidation, or a mere continuation of the original LLC, undermining the limited liability protection.

Single-Member LLC Exposure

A Single-Member LLC generally limits personal liability, but courts may pierce the corporate veil if personal and business finances are commingled or if fraud occurs, exposing the owner to personal debt responsibility. Properly maintaining separation between personal and LLC assets is essential to protect against personal liability for business debts.

Debt Assumption Agreements

Debt assumption agreements can expose LLC members to personal liability by explicitly assigning responsibility for business debts, potentially overriding the LLC's limited liability protections. Carefully drafting and reviewing these agreements is crucial to prevent unintended personal financial exposure in side hustles operating under an LLC structure.

moneytar.com

moneytar.com