What’s the liability of managing others’ money as a paid budgeting coach? Infographic

What’s the liability of managing others’ money as a paid budgeting coach? Infographic

What’s the liability of managing others’ money as a paid budgeting coach?

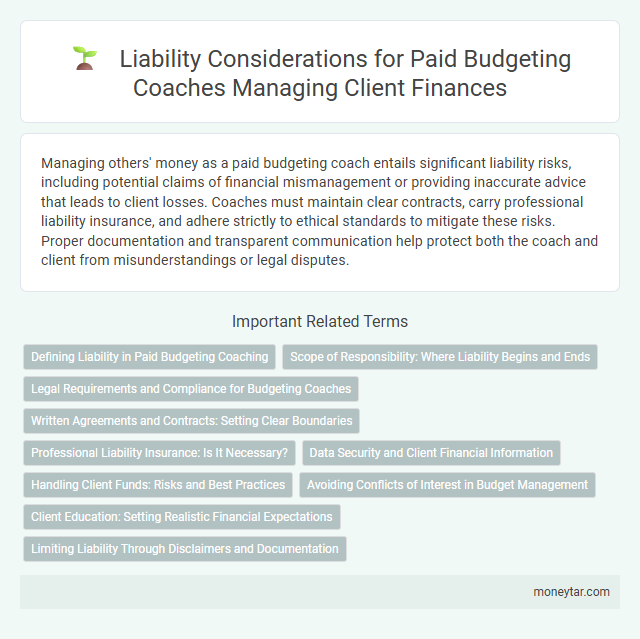

Managing others' money as a paid budgeting coach entails significant liability risks, including potential claims of financial mismanagement or providing inaccurate advice that leads to client losses. Coaches must maintain clear contracts, carry professional liability insurance, and adhere strictly to ethical standards to mitigate these risks. Proper documentation and transparent communication help protect both the coach and client from misunderstandings or legal disputes.

Defining Liability in Paid Budgeting Coaching

Liability in paid budgeting coaching refers to the legal and ethical responsibilities a coach holds when managing clients' finances. Understanding these liabilities is crucial to protect both the coach and the client from potential financial harm.

- Fiduciary Duty - A paid budgeting coach must act in the best interest of the client, ensuring transparency and honesty in all financial advice provided.

- Legal Accountability - Coaches can be held legally responsible for negligence or misinformation that causes financial loss to clients.

- Contractual Obligations - Clear agreements outlining the scope of services and limits of liability protect both parties during the coaching relationship.

Scope of Responsibility: Where Liability Begins and Ends

Managing others' money as a paid budgeting coach involves clearly defined liability boundaries based on the scope of services offered. Understanding where responsibility begins and ends is essential to mitigate legal and financial risks.

- Fiduciary Responsibility - Coaches must exercise due diligence and act in clients' best financial interests when advising or managing budgets.

- Limited Authority - Liability typically excludes outcomes from clients' independent financial decisions made outside the coach's guidance.

- Contractual Scope - Liability is confined to the terms outlined in the coaching agreement, specifying duties, limits, and disclaimers.

Legal Requirements and Compliance for Budgeting Coaches

Managing others' money as a paid budgeting coach involves strict adherence to legal requirements and compliance standards. Budgeting coaches must ensure transparency, maintain accurate financial records, and follow state and federal regulations governing financial advisory services.

Coaches are liable for any mismanagement or negligence that leads to client financial loss or breach of trust. Compliance with data protection laws and clear contractual agreements help mitigate risks and establish professional accountability.

Written Agreements and Contracts: Setting Clear Boundaries

Managing others' money as a paid budgeting coach involves significant legal responsibilities. Clear written agreements and contracts help define the scope of services and protect both parties.

Written agreements establish boundaries regarding financial decision-making authority and liability limits. These contracts clarify expectations, reducing the risk of disputes or claims of mismanagement.

Professional Liability Insurance: Is It Necessary?

Managing others' money as a paid budgeting coach involves significant responsibility and potential legal risks. Professional liability insurance protects against claims of negligence or errors during financial advising services.

- Professional Liability Insurance Covers Financial Errors - This insurance protects you from lawsuits related to mistakes or omissions in budgeting advice.

- It Shields Your Business Assets - Legal claims can lead to costly settlements or damages that may threaten your financial stability.

- Not Legally Required but Highly Recommended - While not mandatory, obtaining coverage is crucial to mitigate exposure to liability risks in money management.

Protecting your career and clients through professional liability insurance is a prudent step for anyone managing others' finances.

Data Security and Client Financial Information

Managing others' money as a paid budgeting coach carries significant liability, especially concerning data security. Protecting client financial information is crucial to maintain trust and comply with legal standards.

You are responsible for implementing robust security measures to safeguard sensitive data from unauthorized access or breaches. Failure to protect client information can lead to financial loss, legal penalties, and reputational damage. Ensuring encrypted communication and secure storage solutions helps minimize these risks and upholds your professional integrity.

Handling Client Funds: Risks and Best Practices

What are the key liabilities involved in managing clients' money as a paid budgeting coach? Handling client funds carries significant risks including potential legal disputes and loss of trust. Establishing clear agreements and transparent financial practices helps mitigate these liabilities effectively.

Avoiding Conflicts of Interest in Budget Management

Managing others' money as a paid budgeting coach involves significant liability, especially when conflicts of interest arise. Coaches must maintain transparency and professional boundaries to avoid compromising their impartiality and trustworthiness. Clear agreements and strict adherence to ethical guidelines help minimize risks associated with conflicts of interest in budget management.

Client Education: Setting Realistic Financial Expectations

| Liability of Managing Others' Money as a Paid Budgeting Coach | |

|---|---|

| Aspect | Details on Client Education: Setting Realistic Financial Expectations |

| Role of the Budgeting Coach | Provide guidance without guaranteeing financial outcomes or investment returns to clients. |

| Client Education | Explain the limitations of coaching services, emphasizing that results depend on clients' personal financial behaviors and market conditions. |

| Setting Expectations | Establish clear, realistic goals during initial consultations to avoid misunderstandings about potential financial improvements. |

| Liability Risk | Mitigate through transparent communication and documented agreements outlining the scope of services and responsibilities. |

| Legal Considerations | Comply with relevant financial advice regulations to prevent unauthorized advisory activities and ensure proper disclaimers are in place. |

| Best Practices | Use written contracts specifying that coaching is educational, not fiduciary; encourage clients to seek licensed financial advisors for investment decisions. |

Limiting Liability Through Disclaimers and Documentation

Managing others' money as a paid budgeting coach carries significant liability risks if financial advice leads to losses. Limiting liability through clear disclaimers that outline the scope of your services protects you from potential legal claims. Thorough documentation of client communications and agreements further safeguards your professional responsibilities and clarifies expectations.

Related Important Terms

Fiduciary Duty Risk

Managing others' money as a paid budgeting coach entails significant fiduciary duty risk, requiring strict adherence to ethical standards and transparent financial practices to avoid breaches that could result in legal liabilities. Failure to uphold this fiduciary responsibility may lead to claims of negligence, mismanagement, or fraud, exposing the coach to potential lawsuits and financial penalties.

Budget Mismanagement Liability

Managing others' money as a paid budgeting coach carries significant liability for budget mismanagement, including legal consequences if clients experience financial loss due to negligence or improper advice. Coaches must adhere to clear agreements and maintain transparent records to minimize risks associated with fiduciary duties and client trust.

Unauthorized Transaction Exposure

Managing others' money as a paid budgeting coach carries significant liability for unauthorized transaction exposure, as clients may hold the coach accountable for any unapproved withdrawals or payments made without explicit consent. Coaches must implement strict controls and maintain transparent transaction records to mitigate risks and ensure compliance with financial regulations governing fiduciary responsibility.

Embezzlement Accusation Safeguards

Paid budgeting coaches managing clients' money face significant liability risks, including potential embezzlement accusations if funds are mishandled or misappropriated. Implementing safeguards such as transparent bookkeeping, documented client agreements, regular audits, and using segregated accounts minimizes these risks and protects both the coach and clients from legal repercussions.

Financial Coaching Errors and Omissions (E&O)

Managing others' money as a paid budgeting coach carries liability risks primarily related to Financial Coaching Errors and Omissions (E&O), which protect against claims arising from negligence, mistakes, or failure to deliver promised services. E&O insurance is essential for budgeting coaches to mitigate financial losses and legal costs resulting from alleged errors in financial advice or coaching guidance.

Client Fund Commingling Violation

Managing others' money as a paid budgeting coach entails strict adherence to legal frameworks to avoid client fund commingling violations, which occur when personal and client funds are mixed. Such violations can result in severe civil and criminal liabilities, including fiduciary breaches, loss of licensure, and potential restitution claims by clients.

Digital Wallet Custody Liability

Managing others' money as a paid budgeting coach entails significant digital wallet custody liability, requiring strict adherence to cybersecurity protocols and regulatory compliance to prevent unauthorized access, fraud, or data breaches. Failure to secure clients' digital wallets can result in legal consequences and financial restitution obligations under laws such as the Electronic Fund Transfer Act (EFTA) and relevant state fiduciary duty regulations.

Remote Payment Instruction Risk

Managing others' money as a paid budgeting coach involves significant liability related to Remote Payment Instruction (RPI) risk, where unauthorized or fraudulent electronic fund transfers can result in financial loss and legal consequences. Implementing robust verification protocols and maintaining clear client agreements are critical to minimizing exposure to RPI-related claims and ensuring compliance with financial regulations.

Data Breach Financial Responsibility

Managing others' money as a paid budgeting coach entails strict legal liability for data breach financial responsibility, including potential costs from identity theft, regulatory fines, and client compensation due to mishandling sensitive financial information. Compliance with data protection regulations such as GDPR or CCPA is critical to mitigating exposure to lawsuits and financial penalties stemming from unauthorized access or loss of client financial data.

AI-Driven Advice Misrepresentation

Paid budgeting coaches face significant liability risks if AI-driven advice tools misrepresent financial outcomes or provide inaccurate guidance, potentially leading to client losses or legal claims. Ensuring transparent communication about AI limitations and maintaining human oversight are critical to mitigating liability in managing others' money.

moneytar.com

moneytar.com