Are payments for user-testing websites or software taxed? Infographic

Are payments for user-testing websites or software taxed? Infographic

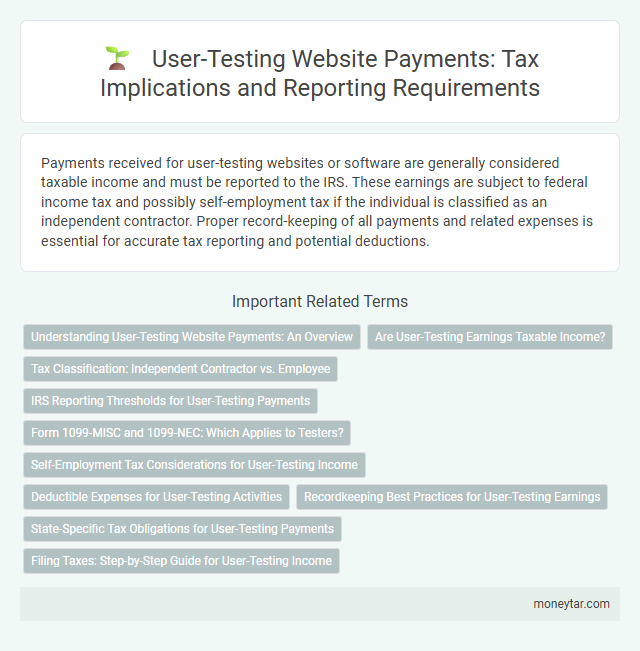

Are payments for user-testing websites or software taxed?

Payments received for user-testing websites or software are generally considered taxable income and must be reported to the IRS. These earnings are subject to federal income tax and possibly self-employment tax if the individual is classified as an independent contractor. Proper record-keeping of all payments and related expenses is essential for accurate tax reporting and potential deductions.

Understanding User-Testing Website Payments: An Overview

| Aspect | Details |

|---|---|

| Nature of Payment | Payments received for user-testing websites or software are typically classified as income from services provided. |

| Taxable Income | Such payments are considered taxable and must be reported on your income tax return. |

| Self-Employment Implications | If you receive payments frequently or as part of a business activity, the income may be treated as self-employment income, subject to additional taxes like self-employment tax. |

| Record Keeping | Maintaining accurate records of payments and related expenses can help in properly reporting and potentially deducting expenses connected to user-testing services. |

| Payment Thresholds | Payments exceeding certain thresholds might require issuers to provide tax forms such as 1099-MISC or 1099-NEC in the United States, making reporting mandatory. |

| International Considerations | Tax treatment varies by jurisdiction. If payments come from foreign companies, you may need to consider local tax laws and treaties. |

| Professional Advice Recommended | Consulting a tax professional or accountant ensures correct classification and reporting based on specific circumstances surrounding user-testing payments. |

Are User-Testing Earnings Taxable Income?

Payments for user-testing websites or software are generally considered taxable income by tax authorities. Earnings from these activities must be reported on your tax return as self-employment or miscellaneous income.

Income from user-testing platforms, such as UserTesting or TryMyUI, is subject to federal and state income taxes. Keep accurate records of payments received to ensure proper tax compliance and avoid potential penalties.

Tax Classification: Independent Contractor vs. Employee

Payments for user-testing websites or software are generally considered taxable income. The tax treatment depends on whether you are classified as an independent contractor or an employee.

If you are an independent contractor, income from testing is reported on Form 1099-NEC and you are responsible for self-employment taxes. Employees receive wages reported on Form W-2, with taxes withheld by the employer.

IRS Reporting Thresholds for User-Testing Payments

Payments received for user-testing websites or software are considered taxable income by the IRS. If your total earnings from user-testing exceed $600 in a calendar year, the company must issue a Form 1099-NEC to report these payments. Ensure you track your income to comply with IRS reporting thresholds and accurately report your earnings on your tax return.

Form 1099-MISC and 1099-NEC: Which Applies to Testers?

Payments received for user-testing websites or software are generally subject to taxation and must be reported by the payer. The proper form for reporting depends on the nature of the payment and the relationship with the tester.

- Form 1099-NEC applies - Typically used to report non-employee compensation paid to independent testers for services rendered.

- Form 1099-MISC applies - Used if the payment is for royalties, rent, or other income types not classified as non-employee compensation.

- Threshold for reporting - Payments of $600 or more to a tester generally require issuing either Form 1099-NEC or 1099-MISC, depending on the payment type.

Testers should keep detailed records and consult tax guidelines to ensure accurate reporting and compliance.

Self-Employment Tax Considerations for User-Testing Income

Are payments for user-testing websites or software subject to self-employment tax? Income earned from user-testing websites or software is generally considered self-employment income by the IRS. Individuals must report this income on Schedule C and pay self-employment taxes if their net earnings exceed $400 annually.

Deductible Expenses for User-Testing Activities

Payments received for user-testing websites or software are considered taxable income and must be reported accordingly. Expenses directly related to user-testing activities, such as software subscriptions, testing devices, and internet costs, are often deductible. Proper documentation of these expenses helps reduce taxable income and ensures compliance with tax regulations.

Recordkeeping Best Practices for User-Testing Earnings

Payments received from user-testing websites or software are generally considered taxable income by tax authorities. Proper recordkeeping is essential to accurately report and manage these earnings for tax purposes.

- Keep Detailed Payment Records - Maintain copies of all payment receipts, transaction confirmations, and earnings reports from user-testing platforms.

- Track Dates and Amounts - Record the date each payment was received and the exact amount to ensure accurate income reporting.

- Separate Testing Income - Organize your user-testing earnings separately from other income sources to simplify tax filing and deductions.

State-Specific Tax Obligations for User-Testing Payments

Payments for user-testing websites or software are subject to state-specific tax regulations that vary widely across the United States. Understanding the tax obligations in the applicable state is crucial for compliance and accurate reporting of income from such activities.

- California requires income reporting - Payments received for user-testing are considered taxable income and must be reported on state tax returns.

- New York treats user-testing payments as self-employment income - Individuals must account for self-employment tax and may owe additional state taxes on these earnings.

- Texas does not impose state income tax - User-testing payments are not subject to state income tax, but federal tax obligations still apply.

Filing Taxes: Step-by-Step Guide for User-Testing Income

Income earned from user-testing websites or software is generally subject to taxation and must be reported to the IRS. Proper documentation of all payments received is essential for accurate tax filing.

Start by gathering all 1099 forms or records of payments from user-testing platforms. Report this income as part of your gross earnings on your tax return. Keep detailed records of expenses related to user-testing to maximize potential deductions.

Related Important Terms

Crowdtesting Income Classification

Payments received from crowdtesting websites or software user-testing services are generally classified as taxable income under freelance or self-employment earnings. Such income must be reported to tax authorities and may be subject to income tax, self-employment tax, and applicable local tax regulations depending on jurisdiction.

Gig-Economy Taxation

Payments for user-testing websites or software are generally considered taxable income under gig-economy taxation rules and must be reported on tax returns as self-employment income. The IRS requires individuals to report earnings from platforms like UserTesting.com, and these payments are subject to income tax and self-employment tax obligations.

Microtask Earnings Reporting

Payments received from user-testing websites or software as microtask earnings are typically considered taxable income and must be reported on your tax return. The IRS requires individuals to report all earnings from platforms like UserTesting, with payment amounts often documented via Form 1099-NEC or similar tax documents for income verification.

Digital Labor Tax Obligations

Payments for user-testing websites or software are subject to digital labor tax obligations and must be reported as taxable income under most jurisdictions' digital services tax guidelines. Companies and independent testers alike need to comply with withholding requirements, local VAT, and income tax regulations to avoid penalties.

User-Testing Payments 1099-K

Payments for user-testing websites or software are generally considered taxable income and must be reported on tax forms, typically leading to the issuance of a Form 1099-K if payments exceed $600 through third-party networks starting tax year 2023. The IRS requires users to report this income, and failure to do so can result in penalties, making accurate record-keeping and understanding of the 1099-K reporting thresholds essential for compliance.

Platform-Worker Withholding

Payments made to platform workers for user-testing websites or software are subject to withholding tax as mandated by tax authorities to ensure compliance and accurate income reporting. Platforms acting as intermediaries are typically responsible for deducting and remitting withholding taxes based on the worker's earnings and applicable local tax regulations.

Self-Employed Beta Tester Tax

Payments received by self-employed beta testers for user-testing websites or software are considered taxable income and must be reported on Schedule C of the IRS Form 1040. These earnings are subject to both income tax and self-employment tax, requiring the maintenance of accurate records to claim allowable business expenses and maximize deductions.

Remote Usability Incentives Taxable

Payments received as remote usability incentives for user-testing websites or software are generally considered taxable income by the IRS and must be reported on tax returns. These payments fall under self-employment income if received independently and are subject to both income tax and self-employment tax obligations.

Freelance QA Tester Tax Filing

Payments received by freelance QA testers for user-testing websites or software are considered taxable income and must be reported on tax returns. Freelancers should track all payments and related expenses carefully to ensure accurate tax filing and compliance with IRS regulations.

Online Micro-Employment Tax Compliance

Payments received for user-testing websites or software are generally considered taxable income and must be reported in compliance with online micro-employment tax regulations. Platforms facilitating these tasks often issue Form 1099-NEC for earnings exceeding $600, requiring recipients to accurately report and pay applicable self-employment taxes.

moneytar.com

moneytar.com