Are you taxed on money earned for filling out online surveys? Infographic

Are you taxed on money earned for filling out online surveys? Infographic

Are you taxed on money earned for filling out online surveys?

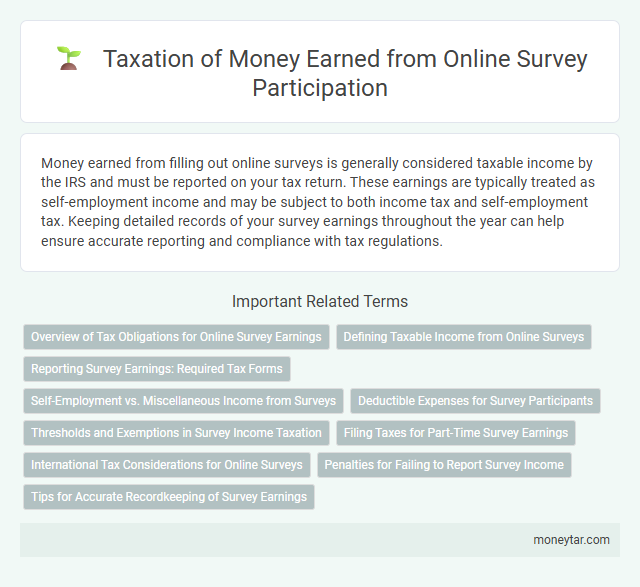

Money earned from filling out online surveys is generally considered taxable income by the IRS and must be reported on your tax return. These earnings are typically treated as self-employment income and may be subject to both income tax and self-employment tax. Keeping detailed records of your survey earnings throughout the year can help ensure accurate reporting and compliance with tax regulations.

Overview of Tax Obligations for Online Survey Earnings

Earnings from filling out online surveys are considered taxable income by tax authorities. You must report this income when filing your tax return to comply with tax regulations.

- Taxable Income Classification - Money earned from online surveys is generally classified as miscellaneous income or self-employment income.

- Reporting Requirements - Survey earnings must be included on your tax return, regardless of the amount earned.

- Record Keeping - Keeping accurate records of all survey payments and related expenses is essential for proper tax reporting.

Defining Taxable Income from Online Surveys

| Topic | Defining Taxable Income from Online Surveys |

|---|---|

| What is Taxable Income? | Taxable income includes all earnings subject to federal and state income tax, encompassing wages, freelance earnings, and money earned from online surveys. |

| Are Earnings from Online Surveys Taxable? | Yes, income from completing online surveys is considered taxable. The IRS classifies it as miscellaneous income and it must be reported. |

| Reporting Requirements | Survey income must be reported on your tax return, often on Schedule 1 (Form 1040) as other income. Platforms may issue Form 1099-MISC if payments exceed $600. |

| Thresholds for Tax Forms | You must report all income regardless of amount. However, surveys platforms typically send Form 1099-MISC only if total earnings are $600 or more annually. |

| Record-Keeping Tips | Maintain detailed logs of earnings and payments received from online survey platforms to ensure accurate reporting during tax season. |

| Tax Deductions | Expenses related to online survey work, such as internet costs or computers, may be deductible if properly documented as business expenses. |

Reporting Survey Earnings: Required Tax Forms

Are you required to report earnings from filling out online surveys? Income earned from online surveys is generally considered taxable and must be reported on your tax return. You may receive a 1099-MISC form from the survey company if your earnings exceed $600 in a tax year.

Self-Employment vs. Miscellaneous Income from Surveys

Income earned from filling out online surveys is generally taxable and must be reported to the IRS. The classification of this income depends on whether it is considered self-employment income or miscellaneous income.

If the survey work is regular and conducted as a business, the income is typically treated as self-employment income, requiring you to file Schedule C and pay self-employment taxes. If the income is occasional and not part of a business, it may be reported as miscellaneous income on Form 1099-MISC or Form 1040. Proper classification affects tax obligations, deductions, and record-keeping requirements.

Deductible Expenses for Survey Participants

Income earned from filling out online surveys is generally considered taxable and must be reported to tax authorities. Survey participants can reduce their taxable income by claiming deductible expenses directly related to their survey activities, such as internet costs and computer equipment. Keeping detailed records of these expenses helps ensure accurate tax reporting and potential tax savings.

Thresholds and Exemptions in Survey Income Taxation

Income earned from filling out online surveys is subject to taxation based on specific thresholds and exemptions. Understanding these limits ensures proper reporting and compliance with tax regulations.

- Income Thresholds - Income below a certain amount, often set by tax authorities, may not require filing or tax payment.

- Exemptions for Small Earnings - Some jurisdictions exempt low survey earnings from taxation to reduce administrative burdens for minor income.

- Reporting Requirements - Income exceeding thresholds must be reported and may be taxed according to applicable rates and brackets.

Your survey earnings should be tracked carefully to determine if they surpass tax thresholds or qualify for exemptions.

Filing Taxes for Part-Time Survey Earnings

Earnings from filling out online surveys are considered taxable income by the IRS. You must report this income on your tax return, regardless of the amount earned.

When filing taxes for part-time survey earnings, include the income under "Other Income" on Form 1040. Keep detailed records and receipts to support your reported earnings and avoid potential issues during an audit.

International Tax Considerations for Online Surveys

Earnings from online surveys are generally considered taxable income by most countries and must be reported according to local tax laws. International tax considerations arise when participation occurs across borders, requiring awareness of tax treaties and reporting obligations.

- Taxability of Online Survey Income - Income earned from completing online surveys is typically classified as miscellaneous income or self-employment income and is subject to regular income tax regulations.

- Cross-Border Tax Reporting - Income received from foreign survey platforms may require declaration in both the country of residence and the country where the platform operates, depending on tax treaties and foreign income reporting rules.

- Compliance with International Tax Treaties - Bilateral tax agreements can impact withholding taxes or exemptions, making it essential to understand treaty provisions related to digital income.

Penalties for Failing to Report Survey Income

Income earned from filling out online surveys is subject to taxation and must be reported on your tax return. Failure to report this survey income can lead to penalties, including fines and interest charges imposed by the IRS. Penalties increase with the amount of unreported income and the duration of non-compliance, emphasizing the importance of accurate reporting.

Tips for Accurate Recordkeeping of Survey Earnings

Keeping detailed records of your online survey earnings is crucial for accurate tax reporting. Maintain a separate spreadsheet or digital file to log the date, survey platform, amount earned, and payment method for each completed survey.

Save all payment confirmations and related emails to support your reported income during tax filing. Organizing your records consistently helps avoid errors and ensures compliance with tax regulations on survey income.

Related Important Terms

Microtask Taxation

Income earned from filling out online surveys is generally categorized as microtask earnings and must be reported as taxable income to the IRS, regardless of the amount. Failure to declare this income can result in penalties, as the IRS treats these payments as self-employment income subject to both income tax and self-employment tax.

Gig Economy Income Reporting

Income earned from filling out online surveys is considered taxable gig economy income and must be reported to the IRS. Platforms may issue a 1099-NEC form if payments exceed $600, requiring individuals to include this income on their tax returns to avoid penalties.

Survey Earnings Threshold

Income earned from filling out online surveys is generally taxable once it exceeds the IRS reporting threshold of $600 per year, requiring you to report it as miscellaneous income on your tax return. Failure to report survey earnings above this amount can result in penalties or audits, emphasizing the importance of tracking income accurately.

1099-K for Survey Platforms

Income earned from filling out online surveys is generally taxable and must be reported to the IRS, especially if payments exceed $600, triggering platforms to issue a Form 1099-K. This form reports gross payment card and third-party network transactions, ensuring survey participants report their income accurately for federal tax purposes.

Online Incentive Compensation Tax

Income earned from filling out online surveys is considered taxable under the IRS guidelines for online incentive compensation and must be reported as miscellaneous income on your tax return. Failure to report this income can result in penalties, as payments from survey platforms are typically issued via Form 1099-MISC or similar documentation.

Crowdsourced Earnings Declaration

Earnings from filling out online surveys are considered taxable income under Crowdsourced Earnings Declaration guidelines and must be reported on your tax return. Failure to declare this income can result in penalties or audits, as tax authorities treat survey payments as self-employment or miscellaneous income.

Third-Party Platform Withholding

Income earned from filling out online surveys through third-party platforms may be subject to withholding taxes if the platform reports payments using Form 1099-K or 1099-MISC, depending on the total amount earned. Taxpayers must accurately report this income on their tax returns, as third-party platforms may withhold a percentage of earnings for federal and state taxes based on their withholding policies.

Digital Side Hustle Tax Compliance

Income earned from filling out online surveys is considered taxable by the IRS and must be reported on your tax return, often classified as self-employment income. Maintaining accurate records of payments received and related expenses ensures compliance with digital side hustle tax regulations and helps optimize deductions.

Minimal Income Taxable Events

Income earned from filling out online surveys is generally considered taxable and must be reported to tax authorities if it exceeds minimal income thresholds. Small amounts earned may fall below taxable income levels, but consistent or substantial payments from surveys could trigger taxable income events requiring proper declaration.

Blockchain Survey Payout Tax

Income earned from completing Blockchain Survey Payouts is considered taxable and must be reported to tax authorities as ordinary income. Cryptocurrency payments received from these surveys are subject to IRS regulations, requiring accurate valuation in USD at the time of receipt for proper tax reporting.

moneytar.com

moneytar.com