Can hobby income from homemade soap sales be considered taxable? Infographic

Can hobby income from homemade soap sales be considered taxable? Infographic

Can hobby income from homemade soap sales be considered taxable?

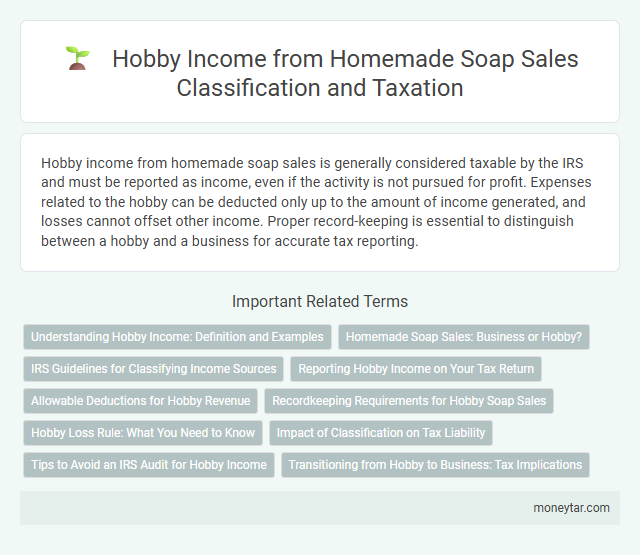

Hobby income from homemade soap sales is generally considered taxable by the IRS and must be reported as income, even if the activity is not pursued for profit. Expenses related to the hobby can be deducted only up to the amount of income generated, and losses cannot offset other income. Proper record-keeping is essential to distinguish between a hobby and a business for accurate tax reporting.

Understanding Hobby Income: Definition and Examples

Hobby income refers to earnings generated from activities not engaged in for profit, such as selling homemade soap occasionally. Understanding whether this income is taxable depends on how the activity is classified by tax authorities.

- Definition of Hobby Income - Income earned from personal activities done primarily for pleasure, not as a business.

- Examples of Hobby Income - Selling homemade soap, crafts, or occasional freelance work without intent to make a profit.

- Tax Implications - You must report hobby income, but related expenses may have limitations unlike business deductions.

Homemade Soap Sales: Business or Hobby?

Homemade soap sales can be classified as either a hobby or a business depending on the intent and frequency of sales. If the activity is conducted with the aim of making a profit and shows regularity, it is likely to be treated as a business for tax purposes. Hobby income, including occasional homemade soap sales, must still be reported, but deductions may be limited compared to business expenses.

IRS Guidelines for Classifying Income Sources

Hobby income from homemade soap sales can be considered taxable according to IRS guidelines. The IRS distinguishes between hobby income and business income based on factors such as profit motive and regularity of activities.

Your homemade soap sales income must be reported if the activity generates any amount of money, even if it is a hobby rather than a business. The IRS uses specific criteria to determine if your income is taxable, including whether you operate with the intent to make a profit, maintain accurate records, and promote your products. Understanding these guidelines helps ensure compliance with federal tax laws.

Reporting Hobby Income on Your Tax Return

Income earned from selling homemade soap as a hobby must be reported on your tax return. Hobby income is taxable even if the activity is not pursued as a business.

- Report All Income - Include all income from hobby sales on your tax return as miscellaneous income.

- No Business Deductions - Expenses related to hobby activities cannot be deducted as business expenses.

- Form 1040 Requirements - Use Schedule 1 (Form 1040) to report hobby income accurately.

Allowable Deductions for Hobby Revenue

| Hobby Income Taxability | Income earned from selling homemade soaps is considered hobby income. The IRS taxes hobby income but distinguishes it from business income. |

|---|---|

| Allowable Deductions | Deductions related to hobby revenue are limited. You can only deduct expenses up to the amount of income generated from soap sales. These include costs of materials, supplies, and other direct costs. |

| Non-Deductible Expenses | Expenses exceeding the hobby income are not deductible. Personal expenses or losses from the hobby cannot be used to offset other income sources. |

| Record Keeping | Maintaining detailed records of income and related expenses improves accuracy in reporting hobby income. Receipts and invoices for soap ingredients and packaging are essential. |

| Filing Requirements | Report hobby income on Form 1040, Schedule 1. Deduct allowable expenses under hobby loss rules without claiming a business loss. |

Recordkeeping Requirements for Hobby Soap Sales

Is income from homemade soap sales considered taxable for hobby purposes? Hobby income is generally taxable and must be reported on your tax return. Maintaining accurate records of all income and related expenses is essential for proper tax compliance.

Hobby Loss Rule: What You Need to Know

Income generated from homemade soap sales is subject to specific tax rules that distinguish hobbies from businesses. Understanding the Hobby Loss Rule is essential for determining if this income must be reported on your tax return.

- Hobby Loss Rule overview - The IRS uses this rule to decide if activities are profit-motivated businesses or non-deductible hobbies.

- Profit motive criteria - Consistent profitability in soap sales over multiple years indicates a business rather than a hobby.

- Tax implications - Income from hobbies must be reported, but related expenses are limited and often non-deductible.

Consulting IRS guidelines or a tax professional helps clarify whether homemade soap sales income is taxable under the Hobby Loss Rule.

Impact of Classification on Tax Liability

Hobby income from homemade soap sales is generally considered taxable by the IRS, but its classification significantly impacts the tax liability. If the activity is classified as a hobby rather than a business, expenses may only be deductible up to the amount of income generated.

When classified as a business, soap sales income is subject to self-employment tax, and all related expenses can be deducted. Proper classification ensures accurate reporting, affecting how much tax the seller ultimately owes.

Tips to Avoid an IRS Audit for Hobby Income

Income from homemade soap sales is considered hobby income by the IRS if the activity is not conducted with a genuine profit motive. Hobby income must be reported on your tax return, but deductions are limited compared to a business.

Keep detailed records of all income and expenses related to your soap-making hobby to clearly demonstrate the nature and scale of your activities. Avoid auditing red flags by maintaining consistent reporting and showing genuine efforts to improve profitability.

Transitioning from Hobby to Business: Tax Implications

Income from homemade soap sales is generally considered hobby income if it lacks a profit motive and regularity. Transitioning from hobby to business occurs when activities demonstrate continuity, profit intent, and organized record-keeping. The IRS requires reporting income once soap sales exhibit these business characteristics, triggering potential tax liabilities and deductible expenses.

Related Important Terms

Hobby Loss Rule

Income from homemade soap sales may be taxable depending on whether the activity is classified as a hobby or a business under the IRS Hobby Loss Rule, which disallows deductions exceeding income if the activity is not engaged in for profit. The IRS evaluates factors like profit history and intent, with hobby income reported on Form 1040 Schedule 1, while expenses exceeding income cannot be deducted.

Self-Employment Tax Threshold

Income from homemade soap sales is taxable if it exceeds the IRS self-employment tax threshold, which is currently $400 in net earnings per year. Hobby income not surpassing this threshold typically does not require payment of self-employment tax but must still be reported as miscellaneous income.

De Minimis Exception

Hobby income from homemade soap sales may be subject to taxation unless it falls under the De Minimis Exception, which allows small, infrequent earnings to be exempt from reporting if they do not exceed a minimal threshold set by the IRS. Taxpayers should verify if their total hobby income qualifies under this exception to avoid unnecessary filing obligations.

Side Hustle Taxation

Hobby income from homemade soap sales is taxable and must be reported on your tax return, although it is treated differently than business income, often limiting deductible expenses. The IRS distinguishes hobby activities from side hustles by evaluating profit motive, frequency of sales, and business-like practices, impacting how income and expenses are reported and taxed.

Occasional Income Reporting

Occasional income from homemade soap sales is generally considered taxable if it exceeds the threshold set by tax authorities and is not classified as a hobby but as a source of income. Taxpayers must report this income on their tax returns under occasional or miscellaneous income to ensure compliance with local tax regulations.

IRS Hobby vs. Business Test

Income from homemade soap sales may be taxable if the activity meets the IRS Hobby vs. Business Test, which evaluates factors such as profit motive, regularity of sales, and time invested. Consistent profits and businesslike record-keeping typically indicate a taxable business rather than a non-taxable hobby.

Schedule C Filing

Income earned from homemade soap sales must be reported on Schedule C if it is regular and profit-oriented, classifying it as self-employment income subject to income and self-employment taxes. The IRS requires detailed record-keeping of expenses and revenues associated with the hobby to determine deductible business costs and accurate net income reporting.

Personal Use Allocation

Income from homemade soap sales is taxable if the activity exceeds personal use and generates a profit, requiring the allocation of expenses between personal use and business use. Accurate record-keeping ensures proper deduction of costs related to the taxable portion, distinguishing hobby income from a business activity for tax purposes.

Basis Reduction for Hobby Expenses

Hobby income from homemade soap sales is taxable, but the IRS limits deductions for related expenses to the amount of income generated, resulting in a basis reduction for hobby expenses. This means you cannot deduct losses beyond your hobby income, preventing expense deductions from exceeding the income, thereby reducing the taxable basis accordingly.

Safe Harbor Provision

Income from homemade soap sales can be considered taxable under the IRS Safe Harbor Provision if it exceeds $600 annually or is conducted with a profit motive. This provision allows hobbyists to report income while potentially deducting related expenses up to the amount of income earned, preventing misclassification as a business.

moneytar.com

moneytar.com