Can I get taxed for renting my car out on Turo? Infographic

Can I get taxed for renting my car out on Turo? Infographic

Can I get taxed for renting my car out on Turo?

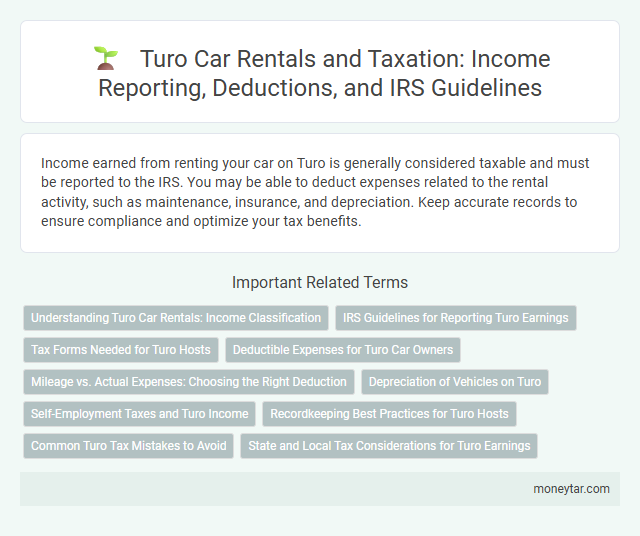

Income earned from renting your car on Turo is generally considered taxable and must be reported to the IRS. You may be able to deduct expenses related to the rental activity, such as maintenance, insurance, and depreciation. Keep accurate records to ensure compliance and optimize your tax benefits.

Understanding Turo Car Rentals: Income Classification

Can I get taxed for renting my car out on Turo? Renting your car on Turo generates income that the IRS classifies as taxable. This income must be reported on your federal tax return, affecting your overall tax liability.

IRS Guidelines for Reporting Turo Earnings

The IRS requires you to report all income earned from renting your car on Turo. Earnings from Turo rentals are considered taxable income and must be included on your tax return.

Turo provides a Form 1099-K if your earnings exceed IRS thresholds, helping you report accurately. Keeping detailed records of rental income and expenses ensures compliance with IRS guidelines.

Tax Forms Needed for Turo Hosts

Renting your car on Turo generates taxable income that must be reported to the IRS. Turo typically provides a Form 1099-K if your earnings exceed $600 in a calendar year. Hosts should use this form along with Schedule C (Form 1040) to report rental income and any related expenses properly.

Deductible Expenses for Turo Car Owners

Renting out your car on Turo is considered a taxable activity by the IRS. Turo car owners can deduct certain expenses to reduce their taxable income.

- Vehicle Depreciation - Owners can deduct the depreciation of the vehicle used for rentals over its useful life.

- Maintenance and Repairs - Costs related to oil changes, tire replacements, and general repairs are deductible.

- Insurance Expenses - Premiums for car insurance related to Turo rentals can be deducted as a business expense.

Keeping detailed records of all expenses will help maximize deductible amounts when filing taxes.

Mileage vs. Actual Expenses: Choosing the Right Deduction

Renting your car on Turo can trigger tax obligations, making it essential to understand deductible options. Choosing between mileage and actual expenses affects your tax benefits and record-keeping requirements.

- Mileage Deduction - Simplifies tracking by applying a standard rate per mile driven during car rentals on Turo.

- Actual Expenses Deduction - Allows deduction of specific costs like gas, maintenance, and depreciation associated with your Turo rentals.

- Choosing the Right Method - Evaluate your rental usage carefully to maximize deductions and comply with IRS rules.

Depreciation of Vehicles on Turo

Renting your car on Turo can affect your taxes, especially through vehicle depreciation. Understanding how depreciation works is essential for accurate tax reporting.

- Depreciation Deduction - Taxpayers can deduct vehicle depreciation to offset rental income from Turo.

- IRS Guidelines - The IRS requires using the Modified Accelerated Cost Recovery System (MACRS) to calculate depreciation on rental vehicles.

- Allocation of Use - Depreciation must be prorated based on the percentage of time the car is rented versus personal use.

Self-Employment Taxes and Turo Income

Income earned from renting your car on Turo is subject to taxation and must be reported on your tax return. Self-employment taxes apply if you provide significant services beyond just renting the vehicle, classifying the income as self-employment income. Keeping detailed records of all Turo earnings and expenses is essential for accurate tax reporting and compliance with IRS regulations.

Recordkeeping Best Practices for Turo Hosts

Renting out your car on Turo generates rental income that must be reported on your tax return. Maintaining accurate records is essential for tracking income and deductible expenses.

Best practices include keeping detailed logs of rental dates, mileage, and maintenance costs. Save all receipts and invoices related to car expenses to support your tax deductions and ensure compliance with IRS requirements.

Common Turo Tax Mistakes to Avoid

Renting your car on Turo can generate taxable income that must be reported to the IRS. Many car owners overlook specific tax rules, leading to common mistakes in their filings.

Failing to track rental expenses accurately is a frequent error, reducing potential deductions. Some renters mistakenly assume personal use offsets all rental income, which is not always the case. Not reporting income received from Turo rentals can result in penalties and interest charges from tax authorities.

State and Local Tax Considerations for Turo Earnings

| State | Tax Type | Description | Implications for Turo Earnings |

|---|---|---|---|

| California | State Income Tax | California requires residents to report all income, including earnings from car rentals through Turo. | Turo income is subject to state income tax and must be reported on your California tax return. |

| New York | Sales and Use Tax | New York imposes sales tax on short-term vehicle rentals. | Rental income from Turo may be subject to collection and remittance of sales tax, which you are responsible for managing. |

| Texas | State and Local Tax | Texas does not levy a state income tax but applies local taxes on certain vehicle rentals. | You must review local jurisdiction rules where the vehicle is rented to determine applicable taxes on Turo earnings. |

| Florida | Transient Rental Tax | Florida imposes a transient rental tax on short-term vehicle rentals. | Turo earnings from Florida-based rentals may be subject to this tax, requiring registration and remittance. |

| Illinois | Use Tax and Income Tax | Illinois requires reporting of all income and charges use tax on certain vehicle rentals. | Your Turo income is taxable income, and you must also consider use tax obligations depending on local ordinances. |

State and local tax rules vary widely for car owners renting vehicles through Turo. Your responsibility includes understanding applicable income taxes, sales taxes, transient rental taxes, and any local levies where the car is located or rented. Proper compliance ensures that Turo earnings are accurately reported and taxed in accordance with state and local regulations.

Related Important Terms

Peer-to-peer car sharing income tax

Income earned from renting your car on Turo is considered taxable under peer-to-peer car sharing regulations and must be reported on your tax return. The IRS treats this income as self-employment or rental income, requiring you to account for related expenses and potentially pay both federal and state taxes.

Turo host self-employment tax

Income earned from renting your car out on Turo is subject to self-employment tax if you are considered a Turo host engaging in a business activity. The IRS treats this income as self-employment income, requiring you to report it on Schedule C and pay both the employer and employee portions of Social Security and Medicare taxes.

Digital platform reporting (Form 1099-K)

Renting your car on Turo generates income that the IRS requires you to report, and Turo may issue a Form 1099-K if your earnings exceed $600, reflecting payments processed through the digital platform. This form facilitates tax reporting by documenting gross rental income, which must be included in your federal tax return under self-employment or rental income.

Passive rental income classification

Income earned from renting your car on Turo is typically classified as passive rental income by tax authorities and must be reported on your tax return. This income may be subject to federal and state income taxes, and you may also be able to deduct related expenses such as maintenance, insurance, and depreciation to offset taxable income.

Schedule C or Schedule E reporting (Turo rentals)

Income earned from renting your car on Turo is typically reported on Schedule C if you provide substantial services or operate as a business, while passive rentals without significant services are reported on Schedule E; proper classification impacts deductible expenses and self-employment tax liability. Accurate record-keeping of rental income and expenses is essential to comply with IRS requirements and optimize tax outcomes for peer-to-peer car rentals.

Short-term rental excise tax

Short-term rental excise tax may apply to income earned from renting your car out on Turo, depending on state and local regulations. Tax authorities often classify Turo rentals as short-term vehicle rentals, subjecting them to specific excise taxes designed for transient property usage.

Depreciation deduction for Turo vehicles

When renting out your car on Turo, you may qualify for depreciation deductions on your vehicle, allowing you to recover the cost of wear and tear caused by rental activity. The IRS permits you to deduct depreciation expenses based on the business use percentage of the vehicle, which must be carefully documented to maximize tax benefits.

Local car sharing occupancy tax

Local car sharing occupancy taxes may apply when renting your car out on Turo, varying significantly by city and state regulations. Hosts are often required to collect and remit these taxes, which can include transient occupancy or rental vehicle surcharges specific to short-term car sharing platforms.

Platform-facilitated tax remittance

Income earned from renting your car on Turo is subject to taxation, with the platform often facilitating tax remittance by collecting and submitting applicable sales and occupancy taxes directly to authorities. Turo's automated tax collection ensures compliance with local and state tax regulations, minimizing the burden on hosts to manually report or remit taxes derived from their rental income.

Section 280A (Mixed-use property rules)

Renting your car on Turo may be subject to taxation under Section 280A, which governs mixed-use property rules that can apply to personal assets used for income generation. This section limits deductions when a property, including vehicles, is used for both personal and business purposes, potentially impacting your taxable income from car rentals.

moneytar.com

moneytar.com