Can I qualify for the QBI deduction with Amazon FBA income? Infographic

Can I qualify for the QBI deduction with Amazon FBA income? Infographic

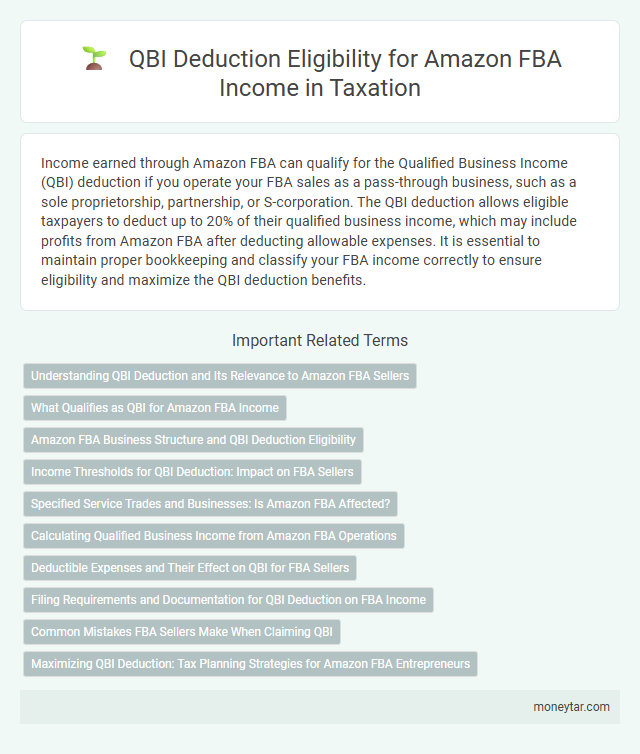

Can I qualify for the QBI deduction with Amazon FBA income?

Income earned through Amazon FBA can qualify for the Qualified Business Income (QBI) deduction if you operate your FBA sales as a pass-through business, such as a sole proprietorship, partnership, or S-corporation. The QBI deduction allows eligible taxpayers to deduct up to 20% of their qualified business income, which may include profits from Amazon FBA after deducting allowable expenses. It is essential to maintain proper bookkeeping and classify your FBA income correctly to ensure eligibility and maximize the QBI deduction benefits.

Understanding QBI Deduction and Its Relevance to Amazon FBA Sellers

The Qualified Business Income (QBI) deduction allows eligible taxpayers to deduct up to 20% of their qualified business income from a qualified trade or business. This deduction aims to reduce the tax burden on income generated by pass-through entities such as sole proprietorships, partnerships, and S-corporations.

Amazon FBA sellers who report their income on Schedule C may qualify for the QBI deduction if their business meets the IRS requirements. Your Amazon FBA income must come from an active trade or business rather than passive income to be eligible for this valuable tax benefit.

What Qualifies as QBI for Amazon FBA Income

Qualifying for the Qualified Business Income (QBI) deduction with Amazon FBA income depends on the nature of the income and how your business is structured. Understanding what constitutes QBI for Amazon FBA income is crucial for maximizing your tax benefits.

- Active Business Income - Income from selling products through Amazon FBA counts as QBI if it stems from a trade or business that you actively operate.

- Business Structure Impact - Income reported on Schedule C or through pass-through entities like an LLC or S Corporation is generally eligible for the QBI deduction.

- Exclusions Apply - Investment income or passive earnings from Amazon FBA do not qualify as QBI under IRS rules.

Amazon FBA Business Structure and QBI Deduction Eligibility

Amazon FBA income typically qualifies for the Qualified Business Income (QBI) deduction if your business structure is a sole proprietorship, partnership, S corporation, or LLC treated as a pass-through entity. The IRS considers income from selling products via Amazon FBA as qualified business income, subject to certain limitations.

Your eligibility depends on the nature of your Amazon FBA business, including factors like net taxable income and the type of business entity. Proper classification and accurate reporting of your Amazon FBA income on tax returns are essential to maximize QBI deduction benefits.

Income Thresholds for QBI Deduction: Impact on FBA Sellers

Income thresholds for the Qualified Business Income (QBI) deduction play a crucial role in determining eligibility for Amazon FBA sellers. For 2024, single filers with taxable income below $182,100 and married filing jointly below $364,200 can generally claim the full 20% QBI deduction on FBA income. Exceeding these limits may trigger phase-outs or additional limitations based on the type of service and wages paid, impacting the deduction amount for your Amazon FBA business.

Specified Service Trades and Businesses: Is Amazon FBA Affected?

Amazon FBA income generally qualifies for the Qualified Business Income (QBI) deduction as it is considered a trade or business. Specified Service Trades or Businesses (SSTBs) have limitations, but Amazon FBA typically does not fall under SSTB restrictions.

- Specified Service Trades and Businesses Defined - SSTBs include fields like law, health, consulting, and other services but usually exclude retail and e-commerce operations.

- Amazon FBA Classification - Selling products through Amazon FBA is typically seen as a retail business, allowing eligibility for the QBI deduction.

- Impact of SSTB Rules - SSTB rules restrict QBI deductions for high-income earners in service trades, but this usually does not affect Amazon FBA sellers.

You can often claim the QBI deduction on Amazon FBA income unless other specific criteria adversely apply.

Calculating Qualified Business Income from Amazon FBA Operations

| Topic | Calculating Qualified Business Income (QBI) from Amazon FBA Operations |

|---|---|

| Definition of QBI | Qualified Business Income refers to the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business, including Amazon FBA activities. |

| Eligibility for QBI Deduction with Amazon FBA | Income generated from Amazon FBA qualifies as business income when it arises from a trade or business operated as a sole proprietorship, partnership, S corporation, or LLC. |

| Components of Amazon FBA Income Considered | Revenue after subtracting returns, allowances, cost of goods sold (COGS), and ordinary and necessary business expenses related to the FBA business. |

| Exclusions from QBI | Items such as capital gains, capital losses, dividends, interest income not properly allocable to the business, and wage income do not count towards QBI. |

| Calculation Process |

|

| Recordkeeping Requirements | Maintain detailed documentation of sales, expenses, inventory costs, and fees to accurately calculate the QBI deduction. |

| Tax Form Reporting | Report QBI from Amazon FBA on IRS Form 1040, Schedule C if operating as a sole proprietorship. Partnerships, S corporations, or LLCs use the appropriate tax forms with respective K-1 schedules. |

| Conclusion | You can qualify for the QBI deduction with Amazon FBA income by carefully calculating net business income following IRS guidelines for qualified trades or businesses. |

Deductible Expenses and Their Effect on QBI for FBA Sellers

Can I qualify for the QBI deduction with Amazon FBA income? Amazon FBA income can qualify for the Qualified Business Income (QBI) deduction if it is reported on a Schedule C or similar business income form. Deductible expenses related to your FBA business, such as shipping costs, inventory, platform fees, and advertising, directly reduce your taxable income and increase your potential QBI deduction.

How do deductible expenses affect the QBI deduction for FBA sellers? Deductible expenses lower your net business income, which is the basis for calculating the QBI deduction. Properly tracking and claiming these deductible expenses ensures an accurate QBI amount, maximizing your tax benefit while complying with IRS guidelines.

Filing Requirements and Documentation for QBI Deduction on FBA Income

To qualify for the Qualified Business Income (QBI) deduction with Amazon FBA income, you must meet specific filing requirements set by the IRS. This includes reporting your income on Schedule C, as part of your Form 1040 tax return.

Accurate documentation is essential to substantiate your QBI deduction claim. Keep detailed records of all income, expenses, and cost of goods sold related to your Amazon FBA business. Proper bookkeeping ensures compliance and supports your eligibility for the deduction during an IRS review or audit.

Common Mistakes FBA Sellers Make When Claiming QBI

Many Amazon FBA sellers mistakenly assume all their income qualifies for the Qualified Business Income (QBI) deduction, but only income from a qualified trade or business is eligible. Failure to properly separate personal expenses from business income often leads to inaccurate QBI calculations and potential IRS scrutiny. Understanding these common errors helps ensure your Amazon FBA income is correctly reported to maximize the QBI deduction benefits.

Maximizing QBI Deduction: Tax Planning Strategies for Amazon FBA Entrepreneurs

Qualifying for the QBI deduction with Amazon FBA income depends on whether your business activities meet the IRS criteria for a qualified trade or business. Proper tax planning can help maximize deductions and reduce taxable income effectively.

- Evaluate Your Business Structure - Amazon FBA sellers structured as sole proprietors, partnerships, or S corporations may qualify for the QBI deduction based on net income from qualified business activities.

- Separate Business and Personal Expenses - Maintaining clear records of Amazon FBA income and expenses ensures accurate calculation of qualified business income for the deduction.

- Monitor Income Thresholds - Staying within IRS wage and income limits helps optimize the QBI deduction amount available for Amazon FBA earnings under Section 199A.

Related Important Terms

QBI (Qualified Business Income) Amazon Seller rules

Amazon FBA income can qualify for the Qualified Business Income (QBI) deduction if the seller operates as a pass-through entity like an LLC, S-corporation, or sole proprietorship and meets the IRS eligibility criteria, including income thresholds and active business participation. Key factors include ensuring the Amazon FBA business is a qualified trade or business, proper reporting on Schedule C or relevant tax forms, and adherence to specified limitations related to service businesses and specified service trades or businesses (SSTBs).

Section 199A pass-through deduction eligibility

Amazon FBA income can qualify for the Section 199A qualified business income (QBI) deduction if it is reported on a Schedule C and is generated from a qualified trade or business under IRS guidelines. Eligibility depends on factors such as taxable income thresholds, the nature of the business activity, and whether the income is effectively connected with a U.S. trade or business.

E-commerce Schedule C treatment

Amazon FBA income reported on Schedule C as part of an e-commerce business typically qualifies for the Qualified Business Income (QBI) deduction under Section 199A, provided the business meets the IRS criteria for a trade or business. Properly documenting expenses and ensuring the net income falls within the QBI deduction threshold are essential for maximizing this tax benefit.

Specified Service Trade or Business (SSTB) Amazon FBA

Amazon FBA income may qualify for the Qualified Business Income (QBI) deduction if the business is not classified as a Specified Service Trade or Business (SSTB), as SSTB designations like health, law, or consulting typically exclude eligibility. Sellers engaged in Amazon FBA generally operate a trade or business that is distinct from SSTB categories, allowing them to potentially claim the QBI deduction subject to income thresholds and other IRS requirements.

Aggregation election for multiple FBA accounts

Amazon FBA sellers with multiple accounts can qualify for the Qualified Business Income (QBI) deduction by making an aggregation election, which allows combining income from various FBA businesses to meet the deduction thresholds and maximize tax benefits. Proper aggregation requires meeting specific IRS requirements, such as common ownership and similar products or services, ensuring the collective income qualifies under Section 199A for the deduction.

Taxable income threshold for QBI deduction

To qualify for the Qualified Business Income (QBI) deduction with Amazon FBA income, your taxable income must fall below $182,100 for single filers or $364,200 for married filing jointly in 2024. Exceeding these thresholds triggers limitations based on service type and wage or property factors related to your business.

Self-employment tax overlap with QBI

Amazon FBA income qualifies for the Qualified Business Income (QBI) deduction if it is reported as self-employment income on Schedule C, subject to meeting IRS criteria. Self-employment tax paid does not reduce QBI but affects taxable income, influencing the overall benefit of the QBI deduction for FBA sellers.

Amazon FBA business vs. hobby classification

Amazon FBA income may qualify for the Qualified Business Income (QBI) deduction if the activity is classified as a bona fide business rather than a hobby, which depends on factors such as profit motive, regularity, and scalability of operations. The IRS evaluates Amazon FBA sellers based on consistent profits, business-like practices, and intent to generate income, distinguishing taxable business income eligible for QBI from hobby income that is not deductible.

QBI deduction phase-out limits for e-commerce entrepreneurs

E-commerce entrepreneurs with Amazon FBA income may qualify for the Qualified Business Income (QBI) deduction if their taxable income falls below the IRS phase-out thresholds, which for 2024 are $182,100 for single filers and $364,200 for joint filers. Income exceeding these limits faces a gradual reduction of the QBI deduction, influenced by the type of business and W-2 wages paid, potentially diminishing the tax benefits for high-earning Amazon sellers.

Inventory-based trade exclusion for QBI purposes

Amazon FBA income may qualify for the Qualified Business Income (QBI) deduction unless it falls under the Inventory-based trade or business exclusion under IRS guidelines, which typically disqualifies businesses primarily involved in buying inventory for resale. Determining eligibility requires analyzing whether the FBA activity is considered a qualified trade or business under Section 199A, focusing on the nature of inventory management and sales operations.

moneytar.com

moneytar.com