Can I write off equipment purchased for streaming on Twitch? Infographic

Can I write off equipment purchased for streaming on Twitch? Infographic

Can I write off equipment purchased for streaming on Twitch?

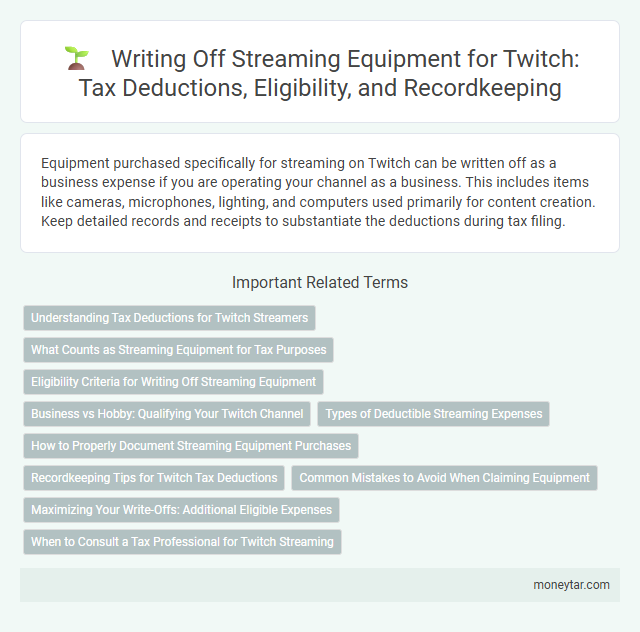

Equipment purchased specifically for streaming on Twitch can be written off as a business expense if you are operating your channel as a business. This includes items like cameras, microphones, lighting, and computers used primarily for content creation. Keep detailed records and receipts to substantiate the deductions during tax filing.

Understanding Tax Deductions for Twitch Streamers

Streaming equipment purchased for Twitch may qualify as a legitimate business expense if used for content creation and income generation. Understanding the specific tax deductions available helps maximize your eligible write-offs and reduce taxable income.

- Equipment as a Business Expense - Streaming gear used exclusively for Twitch content can be classified as a deductible business asset.

- Depreciation Rules Apply - High-cost equipment might need to be depreciated over several years rather than fully deducted in one tax year.

- Keep Detailed Records - Maintaining invoices and usage documentation is essential to substantiate claims during tax filing or audits.

What Counts as Streaming Equipment for Tax Purposes

Streaming equipment includes devices and software essential for creating and broadcasting content on platforms like Twitch. Common examples are cameras, microphones, computers, lighting, and streaming software subscriptions.

For tax purposes, your streaming equipment must be used primarily for your Twitch channel to qualify as a deductible business expense. Equipment that serves personal use may require you to prorate the deduction based on the percentage of business use. Keep detailed records and receipts to support your claims in case of an audit.

Eligibility Criteria for Writing Off Streaming Equipment

| Eligibility Criteria for Writing Off Streaming Equipment | Details |

|---|---|

| Business Use | Equipment must be used primarily for producing income through streaming activities on Twitch. |

| Ordinary and Necessary Expense | Purchases must be ordinary and necessary for your streaming business, including cameras, microphones, lighting, and computers. |

| Documented Purchase | Keep receipts and proof of purchase to validate the deduction during tax filing. |

| Usage Percentage | Calculate the percentage of business use versus personal use to determine the deductible amount if equipment is used for non-streaming purposes. |

| Depreciation Rules | For expensive items, apply IRS depreciation regulations to write off the cost over multiple years. |

| Self-Employment Reporting | Report expenses on Schedule C if self-employed; proper classification ensures eligibility for deductions. |

| Consult Tax Professional | Seek advice to confirm eligibility based on specific circumstances and recent tax code updates. |

Business vs Hobby: Qualifying Your Twitch Channel

Determining whether you can write off equipment purchased for streaming on Twitch depends on whether your channel is classified as a business or a hobby. The IRS scrutinizes the intent, profitability, and operational practices of your Twitch channel to make this distinction.

- Business Classification - Your Twitch channel qualifies as a business if you consistently aim to generate profit and maintain proper accounting records.

- Hobby Classification - If your streaming activities lack a clear profit motive or generate minimal income, the IRS may categorize your channel as a hobby.

- Equipment Write-Off Eligibility - Only when your channel is classified as a business can you deduct streaming equipment expenses as legitimate business costs on your tax return.

Accurately documenting income, expenses, and efforts to grow your Twitch channel helps support a business classification for tax write-offs.

Types of Deductible Streaming Expenses

Can I write off equipment purchased for streaming on Twitch? Streaming equipment such as cameras, microphones, and computers used exclusively for content creation qualify as deductible business expenses. Proper documentation and proof of use are essential to maximize tax benefits.

How to Properly Document Streaming Equipment Purchases

Proper documentation of streaming equipment purchases is crucial for maximizing tax deductions on Twitch income. Accurate records ensure compliance with IRS regulations and simplify the tax filing process.

- Keep Original Receipts - Store detailed purchase receipts that include the date, seller information, and item description to verify the expense.

- Record Business Use Percentage - Document how much the equipment is used exclusively for streaming versus personal use to determine deductible amounts.

- Maintain a Log of Purchases - Create a spreadsheet or digital record listing all equipment bought, purchase dates, costs, and purpose related to your streaming activities.

Recordkeeping Tips for Twitch Tax Deductions

Keeping detailed records of equipment purchased for streaming on Twitch is essential for maximizing your tax deductions. Save all receipts, invoices, and proof of payment to substantiate your claims during tax filing. Accurate documentation helps ensure that streaming-related expenses are correctly reported and eligible for write-offs.

Common Mistakes to Avoid When Claiming Equipment

When claiming equipment purchased for streaming on Twitch, avoid mixing personal and business use costs, as only the business portion is deductible. Failing to keep detailed records and receipts can lead to rejected deductions during an audit. Overstating the value or claiming non-qualifying items such as general household electronics may trigger IRS scrutiny.

Maximizing Your Write-Offs: Additional Eligible Expenses

Equipment purchased for streaming on Twitch, such as cameras, microphones, and lighting, can be written off as business expenses if used primarily for your streaming activities. Keep detailed records and receipts to support these deductions during tax filing.

Maximizing your write-offs includes tracking additional eligible expenses like internet costs, software subscriptions, and home office space. These deductions reduce your taxable income, helping you retain more of your streaming earnings.

When to Consult a Tax Professional for Twitch Streaming

Understanding the tax implications of equipment purchased for Twitch streaming is crucial. Knowing when to consult a tax professional can ensure accurate deductions and compliance with tax laws.

Consult a tax professional if your streaming activities generate significant income or if you purchase high-value equipment. Professional advice helps maximize write-offs while avoiding errors on your tax return.

Related Important Terms

Streamer Equipment Deduction

Streamers can deduct the cost of equipment purchased for Twitch streaming as a business expense on their tax returns, reducing taxable income. Eligible equipment includes cameras, microphones, computers, and lighting, but it must be used primarily for streaming activities to qualify for the streamer equipment deduction.

Content Creator Tax Write-off

Content creators can typically write off equipment purchased for streaming on Twitch as a business expense, reducing taxable income. Eligible items include cameras, microphones, computers, and lighting, provided they are used primarily for producing streaming content.

Virtual Studio Asset Expensing

Equipment purchased for streaming on Twitch can be written off under Virtual Studio Asset Expensing, which allows content creators to deduct the cost of cameras, microphones, lighting, and software used directly in their streaming setup. The IRS permits these capital expenses to be depreciated or fully expensed in the year of purchase under Section 179 or bonus depreciation, reducing taxable income for eligible business-related streaming activities.

Influencer Business Expense

Equipment purchased for streaming on Twitch qualifies as a deductible business expense if used primarily for content creation and monetization purposes. Detailed records of purchases, usage, and income are essential to maximize deductions under IRS guidelines for influencer business expenses.

Digital Broadcast Depreciation

Equipment purchased for streaming on Twitch qualifies as a depreciable asset under IRS Section 179 or MACRS, allowing you to write off the cost over time as digital broadcast depreciation. Properly tracking the purchase date, cost, and business use percentage ensures you maximize deductions on cameras, microphones, and computers used exclusively for content creation.

IRS Schedule C Media Gear

Equipment purchased for streaming on Twitch can be deducted on IRS Schedule C under media gear as a business expense if used primarily for creating content and generating income. Proper documentation, such as receipts and proof of business use, is essential to maximize deductions while complying with IRS guidelines.

Home Office Streaming Allowance

Equipment purchased for streaming on Twitch can be partially written off under the Home Office Streaming Allowance if you use a dedicated space in your home exclusively for content creation. The IRS allows deductions for computers, cameras, microphones, and other streaming gear proportional to their business use, helping reduce taxable income for full-time streamers.

Livestream Hardware Amortization

Livestream hardware purchased for Twitch streaming can be written off as business equipment through amortization, allowing the cost to be deducted over its useful life according to IRS guidelines. Properly categorizing devices such as cameras, microphones, and computers as assets ensures compliance with tax rules while maximizing deductions proportional to their depreciation.

Creator Economy Tax Code

Equipment purchased for streaming on Twitch qualifies as a deductible business expense under the Creator Economy Tax Code, allowing creators to write off costs such as cameras, microphones, and computers used exclusively for content creation. Maintaining detailed records and ensuring the equipment is primarily used for streaming activities support maximizing these tax benefits and complying with IRS guidelines.

Section 179 Twitch Setup

Equipment purchased for streaming on Twitch, including cameras, microphones, and computers, can be written off under Section 179 if used primarily for business purposes. Section 179 allows taxpayers to deduct the full cost of qualifying streaming setup equipment in the year of purchase, reducing taxable income for streamers actively generating revenue.

moneytar.com

moneytar.com