Do Amazon Mechanical Turk workers need to file self-employment taxes? Infographic

Do Amazon Mechanical Turk workers need to file self-employment taxes? Infographic

Do Amazon Mechanical Turk workers need to file self-employment taxes?

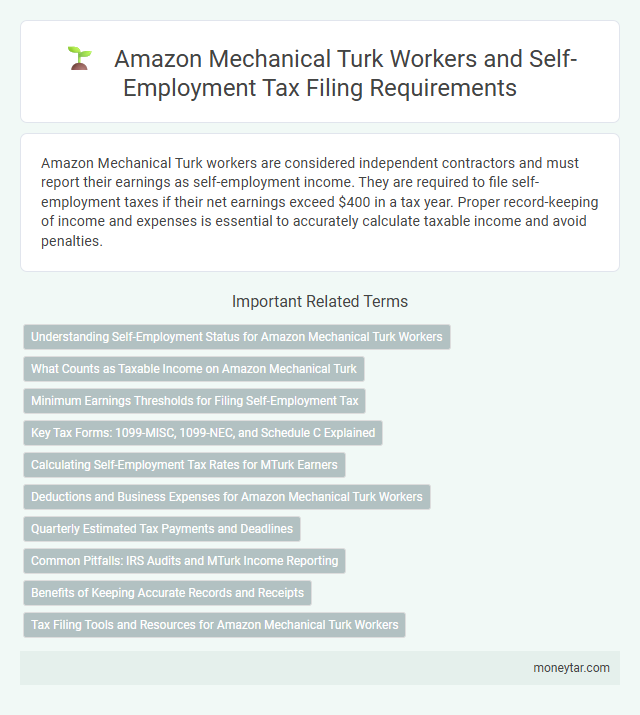

Amazon Mechanical Turk workers are considered independent contractors and must report their earnings as self-employment income. They are required to file self-employment taxes if their net earnings exceed $400 in a tax year. Proper record-keeping of income and expenses is essential to accurately calculate taxable income and avoid penalties.

Understanding Self-Employment Status for Amazon Mechanical Turk Workers

Amazon Mechanical Turk workers are typically considered independent contractors rather than employees. This classification impacts their tax obligations, including the need to file self-employment taxes.

- Self-Employment Tax Responsibility - Workers on Amazon Mechanical Turk must file self-employment taxes if their net earnings exceed $400 annually.

- 1099-MISC and 1099-NEC Forms - Amazon Mechanical Turk may issue these forms to workers who earn over certain thresholds, reporting income to the IRS.

- Tax Deductions and Reporting - Mechanical Turk workers can deduct business expenses related to their work, reducing taxable income on their Schedule C filings.

What Counts as Taxable Income on Amazon Mechanical Turk

Income earned from Amazon Mechanical Turk is considered taxable and must be reported on your tax return. Workers are responsible for filing self-employment taxes if their earnings meet IRS thresholds.

- Payments for completed Human Intelligence Tasks (HITs) - Earnings from completing tasks on Mechanical Turk count as taxable income and must be reported.

- Bonuses and incentives - Any extra compensation received alongside payments for HITs is treated as taxable income.

- Threshold for self-employment tax - If you earn $400 or more from Mechanical Turk in a year, you are required to file self-employment taxes.

Minimum Earnings Thresholds for Filing Self-Employment Tax

Amazon Mechanical Turk workers must understand the minimum earnings thresholds for filing self-employment taxes. The IRS requires self-employed individuals to file if net earnings from self-employment reach $400 or more within a tax year.

Workers earning below the $400 threshold are generally not required to file self-employment taxes. However, they may still need to report income for other tax purposes depending on overall tax circumstances.

Key Tax Forms: 1099-MISC, 1099-NEC, and Schedule C Explained

Amazon Mechanical Turk workers are considered independent contractors and must evaluate their tax obligations carefully. Filing self-employment taxes is often required when earnings exceed the IRS threshold for reporting income.

Key tax forms include the 1099-MISC and 1099-NEC, which report payments made to workers. The 1099-NEC is used for nonemployee compensation if earnings reach $600 or more. Workers file Schedule C to report income and expenses related to their Mechanical Turk activities, determining taxable profit.

Calculating Self-Employment Tax Rates for MTurk Earners

Do Amazon Mechanical Turk workers need to calculate self-employment tax rates on their earnings? Workers on Amazon Mechanical Turk are considered self-employed and must report their income accordingly. The self-employment tax rate is 15.3%, covering Social Security and Medicare contributions.

Deductions and Business Expenses for Amazon Mechanical Turk Workers

Amazon Mechanical Turk workers are considered self-employed and must report their earnings on Schedule C of their tax return. They are responsible for paying self-employment taxes, which cover Social Security and Medicare contributions.

Eligible deductions include home office expenses, internet costs, and fees paid to Amazon Mechanical Turk. Keeping detailed records of business expenses can reduce taxable income and help lower overall tax liability.

Quarterly Estimated Tax Payments and Deadlines

| Topic | Details |

|---|---|

| Self-Employment Tax Filing | Amazon Mechanical Turk workers are classified as independent contractors. Earnings from this platform must be reported as self-employment income on Schedule C of IRS Form 1040. |

| Quarterly Estimated Tax Payments | Workers may be required to make quarterly estimated tax payments to cover federal income tax and self-employment tax if earnings exceed $400. These payments help avoid penalties for underpayment of taxes throughout the year. |

| Estimated Tax Payment Deadlines | Estimated taxes are generally due on April 15, June 15, September 15, and January 15 of the following year. Missing these deadlines can result in interest and penalties. It is important to track income and pay on time. |

| Tax Calculation Considerations | Calculate your estimated tax based on your expected earnings and deductions. Keeping accurate records of Mechanical Turk income and expenses facilitates accurate quarterly tax payments. |

| IRS Forms Involved | IRS Form 1040-ES is used to calculate and submit quarterly estimated tax payments. Schedule SE calculates self-employment tax owed on Mechanical Turk earnings. |

Common Pitfalls: IRS Audits and MTurk Income Reporting

Amazon Mechanical Turk workers must report their earnings as self-employment income on IRS Form Schedule C. Failure to accurately report income can trigger IRS audits, especially if earnings are substantial and tax payments are not made. Common pitfalls include underreporting income and neglecting to pay self-employment taxes, which can result in penalties and interest charges.

Benefits of Keeping Accurate Records and Receipts

Amazon Mechanical Turk workers who earn income through the platform are considered self-employed and must file self-employment taxes. Keeping accurate records and receipts is essential for managing tax obligations efficiently.

- Improves Expense Tracking - Detailed records help identify deductible expenses, reducing taxable income.

- Simplifies Tax Filing - Organized receipts make reporting income and expenses easier and more accurate.

- Supports Audit Defense - Comprehensive documentation provides evidence in case of IRS audits.

Maintaining accurate financial records ensures compliance with tax laws and maximizes potential tax benefits for Amazon Mechanical Turk workers.

Tax Filing Tools and Resources for Amazon Mechanical Turk Workers

Amazon Mechanical Turk workers are considered self-employed and must report their earnings on Schedule C when filing taxes. Tax filing tools like TurboTax and H&R Block offer specialized support to help accurately report income from Mechanical Turk activities. Resources such as the IRS website and online tax preparation platforms provide essential guidance for managing self-employment taxes efficiently.

Related Important Terms

Gig Economy Tax Filing

Amazon Mechanical Turk workers must file self-employment taxes if they earn $400 or more annually, as the IRS classifies their income under gig economy earnings subject to self-employment tax. Reporting income using Schedule C and Schedule SE is essential for accurately calculating Social Security and Medicare contributions based on Mechanical Turk earnings.

Amazon Mechanical Turk (MTurk) 1099 Reporting

Amazon Mechanical Turk (MTurk) workers receiving $600 or more in a calendar year typically receive a 1099-NEC form, which must be reported as self-employment income on their tax returns. Earnings from MTurk are subject to self-employment taxes, including Social Security and Medicare, requiring workers to file Schedule C and Schedule SE with the IRS.

Self-Employment Tax Threshold

Amazon Mechanical Turk workers must file self-employment taxes if their net earnings exceed $400 in a year, meeting the IRS threshold for self-employment tax liability. Earnings below this threshold do not require filing, but all income should be accurately reported for tax purposes.

MTurk Independent Contractor Status

Amazon Mechanical Turk workers classified as independent contractors must file self-employment taxes if their earnings exceed the IRS threshold of $400 annually. This classification requires reporting income using Schedule C and paying both income and self-employment taxes to comply with IRS regulations.

Digital Labor Tax Compliance

Amazon Mechanical Turk workers classified as independent contractors must file self-employment taxes to report income earned from digital labor. The IRS mandates this tax compliance to ensure accurate reporting of earnings for social security and Medicare contributions.

Microworker Self-Employment Income

Amazon Mechanical Turk workers, classified as independent contractors, must report their earnings as self-employment income and file Schedule C with their tax returns. IRS guidelines require Microworker self-employment income to be reported for accurate tax liability calculation, including payment of self-employment taxes covering Social Security and Medicare contributions.

Form 1040 Schedule C for MTurk

Amazon Mechanical Turk workers must file self-employment taxes using Form 1040 Schedule C to report income and expenses from their MTurk activities. Accurately completing Schedule C ensures compliance with IRS requirements and proper calculation of net earnings subject to self-employment tax.

On-Demand Labor Tax Obligations

Amazon Mechanical Turk workers classified as independent contractors must file self-employment taxes if their net earnings exceed $400 annually, reporting income on Schedule SE of Form 1040. The IRS treats earnings from on-demand labor platforms like Mechanical Turk as taxable income, requiring accurate record-keeping and timely tax submissions to comply with federal tax obligations.

Unreported Earned Income Penalties

Amazon Mechanical Turk workers must report their earnings as self-employment income and file taxes accordingly to avoid unreported earned income penalties imposed by the IRS. Failure to report income from Mechanical Turk tasks can lead to significant fines and interest charges for underpayment of taxes.

Crowdsourcing Platform Tax Deductions

Amazon Mechanical Turk workers must file self-employment taxes if their earnings exceed $400 annually, as the IRS classifies these workers as independent contractors on crowdsourcing platforms. Properly tracking income and deducting eligible expenses such as internet costs and computer equipment can reduce taxable income and optimize tax liabilities.

moneytar.com

moneytar.com