Do I need to pay taxes on eBay sales of used clothing? Infographic

Do I need to pay taxes on eBay sales of used clothing? Infographic

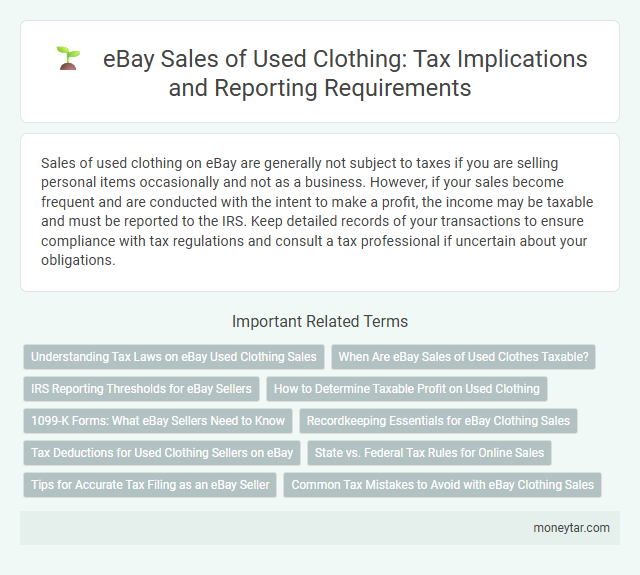

Do I need to pay taxes on eBay sales of used clothing?

Sales of used clothing on eBay are generally not subject to taxes if you are selling personal items occasionally and not as a business. However, if your sales become frequent and are conducted with the intent to make a profit, the income may be taxable and must be reported to the IRS. Keep detailed records of your transactions to ensure compliance with tax regulations and consult a tax professional if uncertain about your obligations.

Understanding Tax Laws on eBay Used Clothing Sales

Selling used clothing on eBay may be subject to taxes depending on your location and sales volume. The IRS generally considers casual sales as non-taxable, but consistent selling activities might be classified as a business, requiring income reporting. Understanding state and federal tax laws helps ensure compliance with eBay sales regulations on used clothing.

When Are eBay Sales of Used Clothes Taxable?

Selling used clothing on eBay typically does not require paying taxes if sales are infrequent and not for profit. The IRS considers occasional sales of personal items as non-taxable.

eBay sales of used clothes become taxable when selling is regular, substantial, or conducted as a business. Income generated from frequent sales must be reported as business income on tax returns. State sales tax may also apply depending on local laws and your seller status.

IRS Reporting Thresholds for eBay Sellers

Selling used clothing on eBay may require tax reporting depending on your sales volume and payment amounts. The IRS has specific thresholds that determine when sellers must report income from online sales.

- IRS 1099-K Reporting Threshold - Sellers who receive over $600 in gross payments through third-party networks like PayPal must receive a Form 1099-K from the payment processor as of the 2023 tax year.

- Gross Payments vs. Profit - The IRS reporting is based on total sales received, not the profit made from selling used clothing on eBay.

- Record Keeping Importance - Maintaining detailed records of all sales and related expenses helps in accurately reporting taxable income and complying with IRS regulations.

How to Determine Taxable Profit on Used Clothing

Determining taxable profit on eBay sales of used clothing involves calculating the difference between your total sales revenue and the cost basis of the items sold. The cost basis typically includes the original purchase price and any related expenses, such as cleaning or repairs.

If you sell items for more than their cost basis, the profit is generally taxable income. Keep accurate records of both purchase costs and sales proceeds to correctly report taxable profit to the IRS.

1099-K Forms: What eBay Sellers Need to Know

Sellers on eBay who receive over $600 in sales through payment platforms may receive a 1099-K form from eBay, reporting their gross sales to the IRS. This form helps the IRS track income that must be reported for tax purposes, including used clothing sales. Understanding the 1099-K requirements ensures sellers comply with tax laws and accurately report income from their eBay transactions.

Recordkeeping Essentials for eBay Clothing Sales

When selling used clothing on eBay, maintaining accurate records is crucial for tax reporting. Keep detailed documentation of all sales transactions, including dates, amounts, and buyer information.

Save receipts and invoices related to the original purchase and any expenses incurred for the items sold. Proper recordkeeping ensures compliance with IRS requirements and simplifies tax filing for your eBay clothing sales.

Tax Deductions for Used Clothing Sellers on eBay

| Aspect | Details |

|---|---|

| Tax Obligation on eBay Sales | Selling used clothing on eBay can be subject to taxation depending on the frequency and profit generated. Occasional sales typically do not require tax payment, but consistent selling for profit may be taxable income. |

| Tax Deductions Available | Sellers may deduct costs related to the used clothing sold, including the original purchase price if documented, shipping fees, eBay listing and selling fees, and costs of repairs or cleaning to improve sale value. |

| Record-Keeping Recommendations | Maintain detailed records of purchase receipts, sales invoices, and all related expenses to substantiate deductions and income reported for tax purposes. |

| Reporting Income | Income from eBay sales should be reported as part of your gross income when filing tax returns if sales are frequent or generate profit beyond personal use thresholds. |

| Consulting a Tax Professional | Tax laws related to online sales vary. Consulting a tax expert ensures compliance and maximizes eligible deductions specific to used clothing sales on eBay. |

State vs. Federal Tax Rules for Online Sales

Do I need to pay taxes on eBay sales of used clothing? Tax obligations for eBay sales depend on both federal and state tax laws, which vary significantly. Federal tax rules generally require reporting income from sales, but states may impose additional sales tax collection requirements based on where you live and where the buyer is located.

Tips for Accurate Tax Filing as an eBay Seller

Selling used clothing on eBay may require tax payments depending on local regulations and sales volume. Accurate tax filing ensures compliance and avoids penalties.

- Keep Detailed Records - Track all sales receipts and expenses related to eBay transactions for accurate reporting.

- Understand Tax Thresholds - Know your state's sales tax thresholds and when tax collection is mandatory for online sales.

- Report Income Correctly - Include all earnings from eBay sales on your tax return, even from selling used clothing.

Common Tax Mistakes to Avoid with eBay Clothing Sales

Selling used clothing on eBay may require you to report income for tax purposes depending on your sales volume and profit. Understanding tax obligations can prevent costly errors and audits.

- Failing to report income - All profits from eBay sales, including used clothing, must be reported as taxable income to the IRS.

- Mistaking casual sales for business activity - Regular or large-scale sales might classify you as a business, subjecting you to self-employment tax.

- Ignoring record-keeping - Proper documentation of purchases, sales, and expenses is essential for accurate tax reporting and potential deductions.

Consulting a tax professional can help clarify your specific obligations and ensure compliance with tax laws on eBay clothing sales.

Related Important Terms

Digital Goods Taxation

Sales of used clothing on eBay typically do not require payment of digital goods taxes, as these items are classified as physical goods rather than digital products. However, sellers should be aware of general sales tax obligations and state-specific rules that may apply to online transactions.

Online Marketplace Facilitator Laws

Online marketplace facilitator laws require platforms like eBay to collect and remit sales taxes on behalf of sellers, including those selling used clothing. Sellers may still need to report income from eBay sales on their tax returns, but tax collection responsibilities mainly fall on the marketplace under these laws.

Form 1099-K Threshold

Sales on eBay involving used clothing may require tax reporting if your transactions exceed the IRS Form 1099-K threshold, which is $600 in gross payments starting from the 2023 tax year. Meeting or surpassing this threshold obligates eBay to issue a Form 1099-K, making your earnings subject to federal income tax reporting and potentially impacting your tax liability.

Peer-to-Peer Sales Tax

Income from peer-to-peer sales on eBay, including used clothing, is generally subject to taxation if it exceeds the IRS threshold for hobby income or business activity, typically $600 in gross sales per year, which triggers a Form 1099-K from eBay. Reporting these sales on your tax return ensures compliance with federal and state tax laws, as the IRS considers profits from such transactions taxable income.

Occasional Seller Exclusion

Occasional sellers of used clothing on eBay typically fall under the Occasional Seller Exclusion, meaning they are not required to pay taxes if sales are infrequent and not part of a business. However, consistent sales or profit-driven activity may trigger tax obligations, including self-employment tax and income reporting to the IRS.

Garage Sale Exception

Sales of used clothing on eBay often qualify for the Garage Sale Exception, which exempts casual or occasional sales from being taxed as business income in many states. To avoid paying taxes, ensure your activity remains infrequent and does not resemble a business operation by documenting individual transactions and showing items sold are personal property rather than inventory.

Cost Basis Documentation

Maintaining accurate cost basis documentation for used clothing sold on eBay helps determine taxable gains or losses by comparing sale proceeds to the original purchase price. Proper records, such as receipts or purchase history, ensure compliance with IRS regulations and support accurate tax reporting on online sales.

Hobby Income Reporting

Income generated from selling used clothing on eBay classified as a hobby must be reported on your tax return, subject to hobby income rules set by the IRS. Expenses directly related to the hobby cannot be deducted to offset this income, resulting in taxable profits being fully included as gross income.

De Minimis Threshold

Sales of used clothing on eBay typically fall below the de minimis threshold, meaning you may not need to pay taxes if your total sales do not exceed the IRS's minimum reporting limits, often set at $600 annually. Monitoring cumulative sales is essential, as surpassing this threshold requires reporting income and potentially paying taxes on the profits.

Secondhand Platform Compliance

Sales of used clothing on eBay may be subject to tax reporting requirements depending on your total annual sales and local tax laws; eBay often issues Form 1099-K to sellers exceeding $600 in sales in the United States. Compliance with secondhand platform regulations requires accurate income reporting and adherence to state sales tax collection policies to avoid penalties.

moneytar.com

moneytar.com