Do I pay tax on money earned from cashback and reward apps? Infographic

Do I pay tax on money earned from cashback and reward apps? Infographic

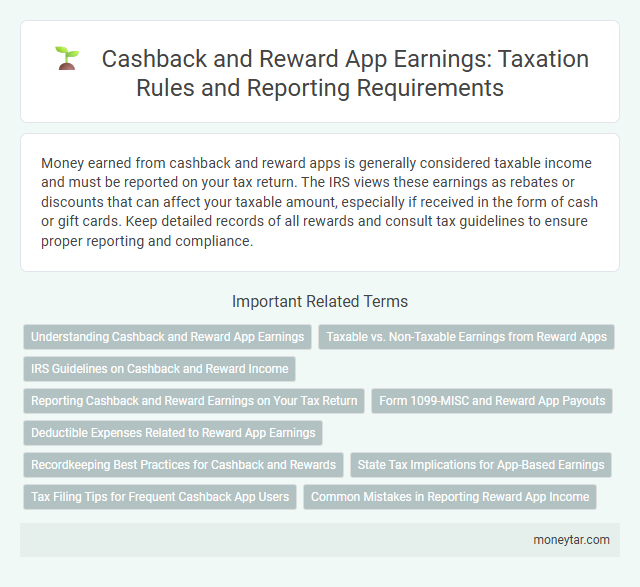

Do I pay tax on money earned from cashback and reward apps?

Money earned from cashback and reward apps is generally considered taxable income and must be reported on your tax return. The IRS views these earnings as rebates or discounts that can affect your taxable amount, especially if received in the form of cash or gift cards. Keep detailed records of all rewards and consult tax guidelines to ensure proper reporting and compliance.

Understanding Cashback and Reward App Earnings

Cashback and reward apps provide users with financial incentives by offering a percentage of money back or points redeemable for purchases. These earnings are typically considered a form of rebate or discount rather than direct income.

The IRS generally does not tax rewards earned from cashback apps unless the amount is substantial or linked to a business activity. Understanding the distinction helps determine if your cashback rewards need to be reported as taxable income.

Taxable vs. Non-Taxable Earnings from Reward Apps

Tax treatment of money earned from cashback and reward apps depends on the source and nature of the earnings. Understanding whether these earnings are taxable or non-taxable is essential for accurate tax reporting.

- Cashback from Purchases - Typically, cashback earned as a discount or rebate on purchases is not considered taxable income since it reduces the cost of goods or services.

- Reward Points Converted to Cash - If reward points or bonuses are redeemed as cash or gift cards, the value may be taxable and should be reported as income.

- Referral Bonuses and Promotional Earnings - Earnings received from referral programs or promotional sign-ups are usually considered taxable income and must be declared to tax authorities.

IRS Guidelines on Cashback and Reward Income

Money earned from cashback and reward apps may be subject to taxation based on IRS guidelines. Understanding how the IRS treats this income helps ensure proper reporting on your tax return.

- Taxable Income - The IRS generally considers cashback rewards and rebates as discounts and not taxable income unless received as part of a business activity.

- Reward Points and Gift Cards - Rewards like gift cards or points converted to cash are taxable if received from promotional activities or business transactions.

- Reporting Requirements - Individuals must report any cashback or rewards income exceeding $600, especially if issued via Form 1099-K or Form 1099-MISC by the app provider.

Reporting Cashback and Reward Earnings on Your Tax Return

Cashback and reward earnings from apps are considered taxable income by the IRS. Reporting these amounts on your tax return is necessary to remain compliant with tax regulations.

Track all cashback and rewards received throughout the year, including gift cards and points converted to cash. Report the total amount as income on your tax form, typically on Schedule 1 (Form 1040).

Form 1099-MISC and Reward App Payouts

Money earned from cashback and reward apps may be subject to taxation depending on the amount and type of income. Form 1099-MISC is often used by companies to report payments made to individuals from these reward app payouts.

- Form 1099-MISC Reporting - Companies issue Form 1099-MISC to report non-employee compensation, including cashback rewards over $600.

- Taxable Income from Reward Apps - Earnings received from reward apps are considered taxable income and must be reported on your tax return.

- Threshold for Reporting - If your total cashback or reward payouts exceed $600 in a year, the app provider will likely send you a Form 1099-MISC for tax purposes.

Always consult IRS guidelines or a tax professional to ensure accurate reporting of reward app income.

Deductible Expenses Related to Reward App Earnings

Expenses directly related to earning cashback and rewards through apps may be deductible when calculating taxable income. Keep detailed records of any fees or purchases necessary to qualify for these rewards to support your deductions. Consult tax guidelines to determine which expenses qualify as deductible and reduce your taxable amount effectively.

Recordkeeping Best Practices for Cashback and Rewards

| Recordkeeping Best Practices for Cashback and Rewards |

|---|

| Keep detailed records of all cashback and rewards earned through apps, including dates, amounts, and the source of each transaction. Maintain digital or printed statements from the apps to verify income received. |

| Separate rewards and cashback earnings from other income in financial documents. This practice simplifies tracking and reporting during tax filing. |

| Use personal finance software or spreadsheets to categorize and total rewards and cashback income throughout the year. Accurate tracking helps ensure compliance with tax regulations and improves record accuracy. |

| Retain documentation supporting your cashback and reward earnings for at least three years in case of audit by tax authorities. Receipts, app transaction histories, and bank statements serve as critical evidence. |

| Consult official tax guidelines to determine whether cashback or reward app income is taxable based on the type and amount of rewards. Proper recordkeeping ensures You have accurate data to report if necessary. |

State Tax Implications for App-Based Earnings

Money earned from cashback and reward apps is considered taxable income by most state tax authorities. These earnings must be reported on your state tax return as they contribute to your total taxable income.

State tax implications vary depending on where you reside, with some states requiring full reporting of app-based earnings while others have specific thresholds or exemptions. It is crucial to maintain accurate records of all cashback and rewards received throughout the year. Failure to report these earnings may result in penalties or additional state tax assessments.

Tax Filing Tips for Frequent Cashback App Users

Do I pay tax on money earned from cashback and reward apps? Income from cashback and reward apps is generally considered taxable by the IRS and must be reported on your tax return. Keeping detailed records of all earnings helps ensure accurate tax filing and compliance.

Common Mistakes in Reporting Reward App Income

Many taxpayers mistakenly believe cashback and reward app earnings are tax-free, leading to underreporting income. The IRS treats these earnings as taxable, similar to other forms of income, requiring accurate reporting. Failure to report can trigger audits or penalties, emphasizing the importance of including all reward app income on your tax return.

Related Important Terms

Cashback Taxation

Money earned from cashback and reward apps is generally considered taxable income and must be reported on your tax return. The IRS treats cashback rebates as a form of income or gift depending on the app's terms, so keeping detailed records and consulting tax guidelines for thresholds and reporting requirements is essential to ensure compliance.

Reward App Income Reporting

Income earned from cashback and reward apps is generally considered taxable and must be reported as miscellaneous income on your tax return. The IRS requires disclosure of all income sources, including app-based rewards, which may be issued on Form 1099-MISC if thresholds are met.

Micro-Earnings Tax Compliance

Income earned from cashback and reward apps is generally considered taxable by the IRS and must be reported as miscellaneous income on your tax return, especially if the total exceeds $600 annually, triggering a Form 1099-K or 1099-MISC from the app provider. Maintaining detailed records of micro-earnings ensures accurate tax compliance and helps avoid penalties associated with unreported income from these digital platforms.

Digital Earnings Disclosure

Money earned from cashback and reward apps is generally considered taxable income and must be reported on your tax return under digital earnings disclosure requirements. Failing to disclose these digital earnings can lead to penalties and interest charges from tax authorities.

Gift Card Tax Treatment

Money earned from cashback and reward apps in the form of gift cards is considered taxable income by the IRS and must be reported on your tax return. The fair market value of gift cards received is subject to income tax and may require inclusion as ordinary income or miscellaneous income, depending on the specific tax situation.

Referral Bonus Taxability

Referral bonuses earned through cashback and reward apps are generally considered taxable income by the IRS and must be reported on your tax return. The value of these bonuses is subject to federal income tax and may also be subject to state and local taxes depending on your jurisdiction.

Promo Reward Income

Income earned from cashback and reward apps is considered taxable under Promo Reward Income by the IRS and must be reported on your tax return. Even small amounts accumulated through promotions, bonuses, or points converted into cash are subject to federal income tax and may require issuing Form 1099-MISC or 1099-K if thresholds are met.

Passive App Earnings Tax

Money earned from cashback and reward apps is considered taxable income and must be reported on your tax return. The IRS treats these passive app earnings as miscellaneous income, subject to income tax and possibly self-employment tax if reported on a 1099-MISC or 1099-K form.

Third-Party Payout Taxation

Money earned from cashback and reward apps is generally considered taxable income by the IRS and third-party payment processors like PayPal or Venmo may issue a Form 1099-K if your earnings exceed $600 annually. It's essential to report these third-party payouts on your tax return to comply with tax regulations and avoid penalties.

Loyalty Program Tax Rules

Cashback and reward earnings from loyalty programs are considered taxable income by the IRS when the value received is converted to cash or equivalent, requiring reporting on your tax return. The fair market value of rewards, points, or cashback credited to your account must be included as income, as specified in IRS guidelines for loyalty program tax rules.

moneytar.com

moneytar.com