Do you report rental income from lending out your RV? Infographic

Do you report rental income from lending out your RV? Infographic

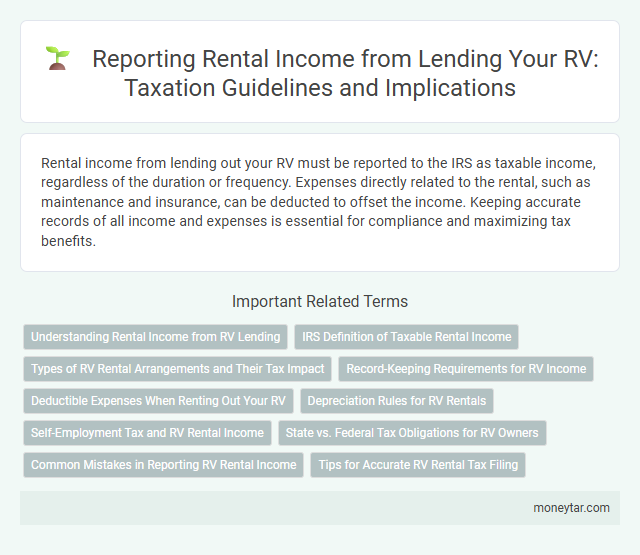

Do you report rental income from lending out your RV?

Rental income from lending out your RV must be reported to the IRS as taxable income, regardless of the duration or frequency. Expenses directly related to the rental, such as maintenance and insurance, can be deducted to offset the income. Keeping accurate records of all income and expenses is essential for compliance and maximizing tax benefits.

Understanding Rental Income from RV Lending

Rental income from lending out your RV is considered taxable and must be reported to the IRS. It includes any payments made by renters for the use of your recreational vehicle. Keeping detailed records of rental income and related expenses helps ensure accurate tax reporting and potential deductions.

IRS Definition of Taxable Rental Income

The IRS defines taxable rental income as all payments received for the use or occupation of property, including an RV. When you lend out your RV, the rental income you collect is generally considered taxable.

You must report this income on your federal tax return, regardless of how long the RV is rented. Deductions for expenses like maintenance, depreciation, and insurance related to the RV rental may be claimed. Failure to report rental income can lead to penalties and interest imposed by the IRS.

Types of RV Rental Arrangements and Their Tax Impact

Rental income from lending out your RV must be reported on your tax return, with the tax implications varying based on the type of rental arrangement. Short-term rentals, similar to hotel stays, are treated as personal property rentals, while long-term leases may classify the RV as a business asset. Understanding whether the rental is considered occasional or commercial use helps determine deductible expenses and the appropriate tax forms to file.

Record-Keeping Requirements for RV Income

Rental income from lending out your RV must be accurately recorded for tax purposes. Maintaining detailed records ensures compliance with IRS requirements and supports accurate income reporting.

Keep documentation of rental agreements, payment receipts, and any expenses related to the RV. Proper record-keeping helps you deduct eligible costs and reduces the risk of errors during tax filing.

Deductible Expenses When Renting Out Your RV

Rental income from lending out your RV must be reported as part of your taxable income. Properly tracking deductible expenses can reduce your overall tax liability related to the rental activity.

Deductible expenses include maintenance, repairs, insurance, and depreciation costs directly associated with the RV rental. Expenses like cleaning fees, advertising for renters, and mileage used for rental purposes are also eligible deductions.

Depreciation Rules for RV Rentals

Rental income from lending out your RV must be reported on your tax return. Depreciation rules apply to the RV as a business asset used for rental purposes.

- Depreciation allows recovery of RV cost - You can deduct a portion of the RV's purchase price each year to account for wear and tear related to rental use.

- Use IRS MACRS system - The Modified Accelerated Cost Recovery System (MACRS) typically applies for calculating depreciation of rental property including RVs.

- Allocation between personal and rental use - Depreciation expense must be prorated if the RV is used for both personal and rental activities based on mileage or time method.

Self-Employment Tax and RV Rental Income

Do you need to report rental income from lending out your RV for tax purposes?

Rental income from your RV must be reported on your tax return, but it is typically not subject to self-employment tax if it's considered passive rental income. However, if you provide substantial services with the RV rental, such as guided tours or regular cleaning, the income may be treated as self-employment income and subject to self-employment tax.

State vs. Federal Tax Obligations for RV Owners

Rental income from lending out your RV must be reported to both federal and state tax authorities, but specific obligations vary by jurisdiction. Understanding the differences between federal and state tax rules is crucial for accurate reporting and compliance.

- Federal Tax Reporting - Rental income is considered taxable income and must be reported on your federal tax return using Schedule E or Schedule C, depending on the rental activity.

- State Income Tax - Most states require reporting of rental income, and state tax rates may differ from federal rates, impacting your overall tax liability.

- Local Tax Requirements - Some local jurisdictions impose additional taxes or require permits for RV rentals, which you must comply with to avoid penalties.

Common Mistakes in Reporting RV Rental Income

| Common Mistakes in Reporting RV Rental Income |

|---|

| Failing to report rental income from lending out your RV is a frequent error that can trigger IRS audits and penalties. All income, including payments for RV rentals, must be declared on your tax return. |

| Confusing personal use and rental use of the RV can lead to incorrect income and expense reporting. Accurate records of rental days versus personal use days are essential to properly allocate income and deductible expenses. |

| Neglecting to track and deduct allowable expenses related to RV rental, such as maintenance, repairs, insurance, and depreciation, can reduce potential tax benefits. |

| Reporting rental income without considering applicable tax forms, such as Schedule E for rental income or Schedule C if the rental activity qualifies as a business, is a common mistake affecting tax liability. |

| Overlooking local tax regulations and lodging taxes associated with RV rentals can lead to additional state or local tax obligations beyond federal reporting requirements. |

| Mixing personal expenses with rental expenses reduces clarity and can cause audits. Keeping separate financial records for the RV rental activity helps ensure compliance and accurate tax reporting. |

Tips for Accurate RV Rental Tax Filing

Reporting rental income from lending out your RV requires careful attention to tax regulations. Accurate record-keeping helps ensure compliance and maximizes deductions.

- Keep detailed mileage and rental logs - Document each rental period and any expenses related to the RV to support your income claims.

- Separate personal use from rental use - Allocate expenses based on the percentage of days the RV was rented versus personal use.

- Claim eligible expenses - Deduct costs like maintenance, insurance, and depreciation related to the rental activity.

Proper documentation and clear differentiation between personal and rental usage simplify tax filing for RV rental income.

Related Important Terms

RV Sharing Economy Taxation

Rental income earned from lending out your RV through sharing economy platforms must be reported as taxable income to the IRS and may be subject to both federal and state income taxes. Expenses directly related to the rental activity, such as maintenance, insurance, and depreciation, can be deducted to reduce your overall tax liability on RV sharing income.

Peer-to-Peer RV Rental Income Reporting

Rental income earned from peer-to-peer RV sharing platforms must be reported on your tax return, typically using Schedule E (Form 1040) for supplemental income or Schedule C if the activity is considered a business. Accurate record-keeping of rental days, expenses, and platform fees is essential to properly calculate taxable income and eligible deductions.

IRS Form 1099-K for RV Platforms

Rental income from lending out your RV through platforms may require reporting on IRS Form 1099-K if the gross payments exceed $600, following the IRS threshold changes for third-party payment networks. RV owners should track all transactions on these platforms, as the 1099-K form is used to report payment card and third-party network transactions for accurate income reporting on tax returns.

Short-Term RV Rental Deductions

Short-term RV rental income must be reported as taxable income, and you can deduct expenses such as maintenance, insurance, and depreciation proportional to the rental period. The IRS allows deductions for costs directly related to the rental activity, maximizing tax benefits while ensuring compliance.

Depreciation Schedule for RV Rentals

When reporting rental income from lending out your RV, it is essential to use a depreciation schedule to allocate the vehicle's cost over its useful life, typically 5 to 7 years under the Modified Accelerated Cost Recovery System (MACRS). Properly applying the depreciation schedule helps reduce taxable rental income by accounting for the RV's wear and tear during the rental period.

Passive vs. Active RV Income Classification

Rental income from lending out your RV is typically classified as passive income if you do not materially participate in managing the rentals, whereas active income classification applies when you are actively involved in the rental activities such as handling bookings and maintenance. The IRS distinguishes between passive and active income for tax purposes, affecting how income is reported and the eligibility for deductions and credits.

Section 280A “Vacation Home Rules”

Rental income from lending out your RV must be reported under IRS Section 280A, which treats the RV as a "vacation home" if used personally for more than 14 days or 10% of the total days rented. Expenses deductible against rental income are limited and prorated based on the RV's personal versus rental use under these vacation home rules.

Transient Occupancy Tax for RVs

Rental income from lending out your RV is generally subject to Transient Occupancy Tax (TOT), which applies to short-term rentals of vehicles used for lodging. RV owners must report income earned from renting their units and remit applicable TOT based on local jurisdiction rates, often varying between 6% and 15%.

Platform Withholding Tax on RV Earnings

Reports of rental income from lending out your RV must include Platform Withholding Tax, which requires platforms to withhold a percentage of earnings for tax purposes before disbursing payments to owners. This withholding tax ensures compliance with tax regulations and simplifies reporting obligations for RV owners by pre-collecting tax on their rental income.

Local Jurisdictional Excise Taxes on Mobile Rentals

Rental income from lending out your RV is subject to local jurisdictional excise taxes, which vary by municipality and state regulations governing mobile rentals. Compliance requires reporting this income on your tax return, including applicable transient occupancy taxes, sales taxes, and any special mobile vehicle rental levies imposed locally.

moneytar.com

moneytar.com