How is Airbnb host income taxed if I rent out my guest room occasionally? Infographic

How is Airbnb host income taxed if I rent out my guest room occasionally? Infographic

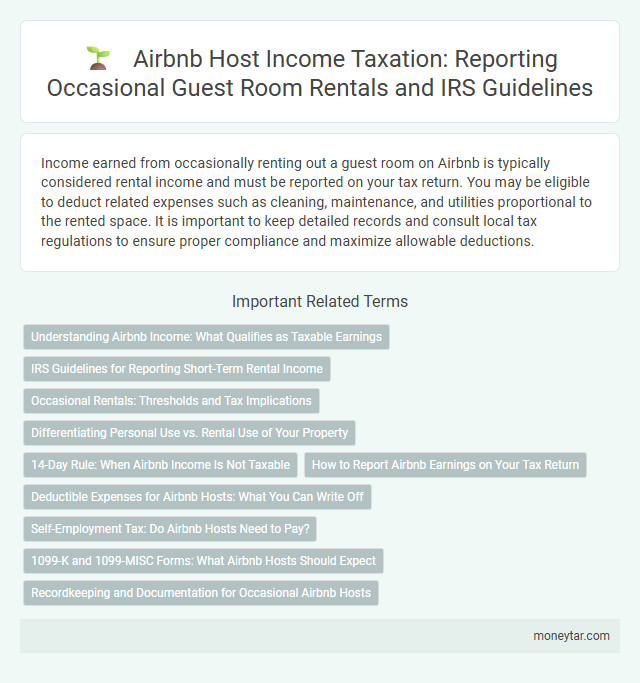

How is Airbnb host income taxed if I rent out my guest room occasionally?

Income earned from occasionally renting out a guest room on Airbnb is typically considered rental income and must be reported on your tax return. You may be eligible to deduct related expenses such as cleaning, maintenance, and utilities proportional to the rented space. It is important to keep detailed records and consult local tax regulations to ensure proper compliance and maximize allowable deductions.

Understanding Airbnb Income: What Qualifies as Taxable Earnings

Understanding Airbnb host income is essential for proper tax reporting. Knowing what qualifies as taxable earnings will help you comply with tax regulations when renting out your guest room occasionally.

- Rental income is taxable - Earnings from renting out a guest room, even occasionally, must be reported as income on your tax return.

- Expenses may be deductible - You can deduct certain expenses related to the rental, such as a portion of utilities and cleaning costs, reducing taxable income.

- Personal use affects reporting - If you rent the room for less than 15 days per year, the income may be tax-exempt, but proper documentation is required.

IRS Guidelines for Reporting Short-Term Rental Income

Airbnb host income from occasional guest room rentals is generally considered taxable by the IRS and must be reported as rental income. Hosts should keep detailed records of all rental income and related expenses to accurately report earnings on Schedule E or Schedule 1, depending on frequency and services provided. The IRS requires reporting of short-term rental income even if the rental period is brief or sporadic, and failure to report can result in penalties.

Occasional Rentals: Thresholds and Tax Implications

Income earned from occasional rentals, such as renting out a guest room on Airbnb, is subject to specific tax rules. Different countries set thresholds to determine when income must be reported and taxed.

In many jurisdictions, occasional rental income below a certain threshold is tax-exempt, allowing hosts to keep earnings without reporting. If your income exceeds these limits, it must be declared as taxable income under rental or miscellaneous income categories. Expenses related to the rental may be deductible, lowering the taxable amount.

Differentiating Personal Use vs. Rental Use of Your Property

| Aspect | Details |

|---|---|

| Personal Use vs. Rental Use | Income tax treatment depends on whether your guest room is rented occasionally as a personal space or primarily used for rental purposes. Personal use refers to renting the space sporadically while maintaining it mainly for your own use. Rental use indicates the property is predominantly available for guests, generating consistent income. |

| Tax Reporting for Personal Use | Income earned from occasional rentals is typically reported as part of miscellaneous income. Expenses directly related to rental periods may be deducted proportionally but must correspond strictly to the rented days. |

| Tax Reporting for Rental Use | If the guest room is rented extensively, it qualifies as rental property income. This requires declaring the full income with allowable deductions such as maintenance, utilities, and depreciation allocated to the rented space. |

| Expense Allocation | Expenses must be divided between personal and rental use. Accurate records of rental days versus personal use days help determine deductible expenses and avoid tax issues. |

| Tax Forms | Occasional rental income may be reported on Form 1040 Schedule 1 or Schedule C if classified as a business. Rental income requires filing Schedule E to report income and expenses from rental property. |

| Key Takeaway | You should maintain detailed records distinguishing rental use from personal use to ensure proper tax treatment and maximize allowable deductions related to renting out your guest room. |

14-Day Rule: When Airbnb Income Is Not Taxable

If you rent out your guest room on Airbnb occasionally, your income might not be taxable under the 14-Day Rule. This rule allows you to exclude rental income if you rent your property for 14 days or less in a year.

- 14-Day Rule Overview - You can rent your guest room for up to 14 days annually without reporting the income as taxable.

- No Income Reporting Required - Income earned under this period does not have to be included on your tax return.

- Limit Applies Per Property - The rule applies individually to each property you rent on Airbnb occasionally.

How to Report Airbnb Earnings on Your Tax Return

How do I report Airbnb earnings from renting out my guest room occasionally on my tax return? You must report all income earned from Airbnb rentals as part of your taxable income. Use IRS Schedule E or Schedule C depending on the extent of your rental activity and the services provided.

Deductible Expenses for Airbnb Hosts: What You Can Write Off

Airbnb host income is considered taxable and must be reported on your tax return even if you rent out your guest room occasionally. The IRS treats earnings from short-term rentals as rental income subject to income tax.

Hosts can deduct various expenses to reduce taxable income, including mortgage interest, property taxes, utilities, and cleaning fees. Expenses directly related to the rental period, such as repairs and depreciation, are also deductible, helping hosts minimize tax liability.

Self-Employment Tax: Do Airbnb Hosts Need to Pay?

Income earned from renting out your guest room on Airbnb is generally subject to federal income tax. The IRS considers this rental income, and you must report it even if you rent out the space occasionally.

Self-employment tax applies if you provide substantial services beyond basic lodging, like cleaning or meals. If your hosting activities are limited to renting, you typically do not pay self-employment tax but may still owe regular income tax on the earnings.

1099-K and 1099-MISC Forms: What Airbnb Hosts Should Expect

Airbnb host income from occasional guest room rentals is subject to federal income tax and requires proper reporting on tax forms. Hosts should understand the implications of 1099-K and 1099-MISC forms issued by Airbnb to comply with IRS regulations.

- 1099-K Form Issuance - Airbnb issues a 1099-K if a host receives over $600 in gross payments starting in tax year 2022, reflecting total payment transactions.

- 1099-MISC Form Use - The 1099-MISC form may be provided for miscellaneous income if Airbnb pays for services outside the usual hosting payments.

- Reporting Host Income - Hosts must include all income reported on 1099 forms on their tax returns, regardless of occasional or full-time hosting.

Accurate record-keeping and understanding IRS reporting requirements help Airbnb hosts avoid penalties and ensure tax compliance.

Recordkeeping and Documentation for Occasional Airbnb Hosts

Occasional Airbnb hosts must keep detailed records of rental income and related expenses to comply with tax regulations. Documentation should include booking receipts, payments received, and any costs incurred for maintenance or cleaning. Proper recordkeeping ensures accurate reporting and helps maximize eligible deductions when filing taxes.

Related Important Terms

Short-Term Rental Occupancy Tax

Income earned from occasionally renting out a guest room on Airbnb is subject to federal income tax and may also be liable for Short-Term Rental Occupancy Tax, which varies by local jurisdiction and typically applies to rentals under 30 days. Hosts must register with local tax authorities, collect the applicable occupancy tax from guests, and remit it according to municipal regulations to ensure compliance.

14-Day Rule Exception

Airbnb host income is not taxed if you rent out your guest room for 14 days or less in a year, as per the IRS 14-Day Rule Exception, which classifies this income as tax-free rental income. Income earned beyond these 14 days must be reported and is subject to standard rental income tax regulations.

Platform Remittance Agreements

Income earned from occasionally renting out a guest room on Airbnb is typically reported as rental income and may be subject to self-employment tax if services are provided. Airbnb often enters into Platform Remittance Agreements with tax authorities, automatically collecting and remitting applicable occupancy taxes on behalf of hosts to ensure compliance with local tax laws.

Mixed-Use Property Allocation

Income from renting out a guest room in a mixed-use property is taxed proportionally based on the area used for rental versus personal use, with only the rental portion's income and expenses considered for tax purposes. Accurate records of square footage and rental duration are essential to correctly allocate income and deductible expenses under IRS guidelines for mixed-use property taxation.

Home-Sharing Host Tax Deduction

Income earned from occasionally renting out a guest room on Airbnb is generally considered rental income and is subject to federal income tax. Home-sharing hosts can claim specific tax deductions, such as a portion of mortgage interest, property taxes, utilities, and depreciation, allocated based on the space and time rented, to reduce their taxable income.

Schedule E Reporting (Airbnb Income)

Income earned from renting out a guest room on Airbnb occasionally is typically reported on Schedule E of IRS Form 1040, which covers supplemental income and loss from rental real estate. Hosts must report gross rental income and can deduct related expenses such as mortgage interest, property taxes, repairs, and depreciation to determine taxable rental income.

City-Level Transient Occupancy Tax (TOT)

City-Level Transient Occupancy Tax (TOT) applies to Airbnb host income when renting out a guest room occasionally, requiring hosts to collect and remit a percentage of rental charges to the local government, often ranging from 5% to 15% depending on the city. Compliance with TOT regulations includes registering with city tax authorities, maintaining accurate records of rental transactions, and submitting regular tax filings to avoid penalties.

De Minimis Use Provision

Income from renting out a guest room occasionally on Airbnb may be excluded from taxable income under the IRS De Minimis Use Provision if the rental period does not exceed 14 days per year. This provision allows hosts to avoid reporting income, but expenses related to the rental cannot be deducted when the rental is below this threshold.

Voluntary Collection Agreement (VCA)

Income earned from occasionally renting out a guest room on Airbnb is generally subject to income tax and must be reported to the Australia Taxation Office (ATO). Hosts can enter into a Voluntary Collection Agreement (VCA) with the ATO, allowing Airbnb to report earnings directly, simplifying tax compliance and ensuring accurate reporting of rental income.

Cleaning Fee Taxability

Cleaning fees charged by Airbnb hosts are typically considered part of rental income and must be reported for tax purposes. The IRS treats cleaning fees as taxable income, requiring hosts to include them alongside the rent received when filing taxes.

moneytar.com

moneytar.com