Is flipping used books a business or a hobby in the eyes of the IRS? Infographic

Is flipping used books a business or a hobby in the eyes of the IRS? Infographic

Is flipping used books a business or a hobby in the eyes of the IRS?

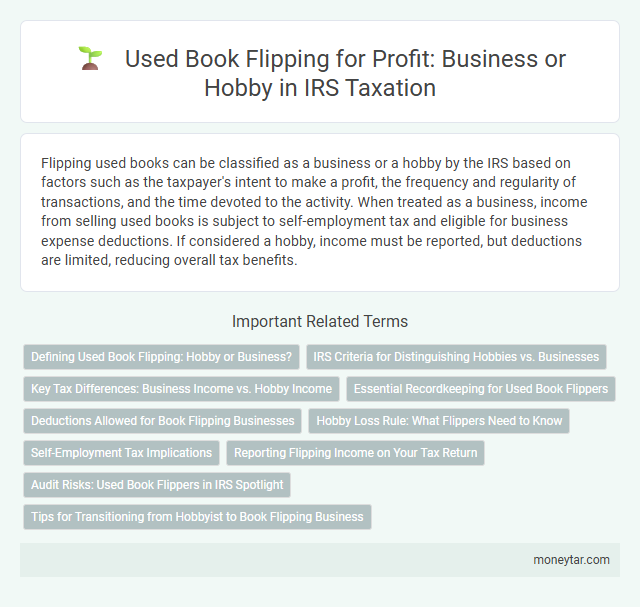

Flipping used books can be classified as a business or a hobby by the IRS based on factors such as the taxpayer's intent to make a profit, the frequency and regularity of transactions, and the time devoted to the activity. When treated as a business, income from selling used books is subject to self-employment tax and eligible for business expense deductions. If considered a hobby, income must be reported, but deductions are limited, reducing overall tax benefits.

Defining Used Book Flipping: Hobby or Business?

Flipping used books involves buying and reselling them for profit, but the IRS distinguishes between a business and a hobby based on intent and activity. Understanding this distinction affects how You report income and expenses for tax purposes.

- Profit Motive - The IRS evaluates whether You engage in used book flipping with the genuine intention to make a profit.

- Regularity of Activity - Frequent, organized buying and selling suggests a business rather than a casual hobby.

- Record Keeping - Maintaining detailed financial records signals a business operation under IRS guidelines.

IRS Criteria for Distinguishing Hobbies vs. Businesses

The IRS distinguishes between a business and a hobby based on the intent to make a profit and the regularity of activities. Flipping used books can be classified as a business if it meets specific IRS criteria indicating profit-driven operations.

- Profit Motive - The IRS evaluates if the activity is engaged in primarily for generating profit rather than personal pleasure.

- Consistency and Frequency - Regular and continuous book flipping activities suggest a business rather than a hobby.

- Record Keeping and Business Practices - Maintaining detailed records, advertising, and other business-like practices support classification as a business.

Key Tax Differences: Business Income vs. Hobby Income

| Aspect | Business Income | Hobby Income |

|---|---|---|

| Definition | Buying and reselling used books with the intent to make a profit regularly. | Occasional selling of used books without consistent profit motive. |

| Profit Motive | Demonstrated by consistent profits over multiple years and business-like activities. | Profit is not the main objective; losses may be frequent without efforts to improve profitability. |

| Income Reporting | Report as business income on Schedule C (Form 1040). | Report as miscellaneous income on Form 1040, but deductions are limited. |

| Deductions | Deduct all ordinary and necessary expenses related to the book flipping activity, including inventory costs. | Deductions for expenses are only allowed up to the amount of income reported from the hobby; no losses can be claimed. |

| Self-Employment Tax | You must pay self-employment tax on net profit. | No self-employment tax applies to hobby income. |

| Recordkeeping Requirements | Maintain detailed records of purchases, sales, expenses, and profits. | Recordkeeping is less stringent, but it is advisable to track income and expenses. |

| IRS Evaluation Factors | Includes time and effort invested, expectation of profit, and businesslike manner. | Less time invested, lack of business plan, and inconsistent profits. |

| Audit Risk | Higher scrutiny if claiming losses or inconsistent reporting. | May trigger IRS interest, especially if large expenses are claimed without profit. |

Essential Recordkeeping for Used Book Flippers

The IRS distinguishes between a business and a hobby based on factors such as profit motive and regularity of activities when flipping used books. Essential recordkeeping includes maintaining detailed logs of purchases, sales, expenses, and receipts to substantiate income and deductions. You should keep accurate records to support the legitimacy of your book flipping as a business for tax purposes.

Deductions Allowed for Book Flipping Businesses

The IRS considers whether flipping used books is a business or a hobby based on factors such as profit motive, consistency, and record-keeping. Book flippers classified as businesses can deduct ordinary and necessary expenses related to their activity.

Allowed deductions include costs of purchasing books, shipping fees, and supplies like envelopes and labels. Other deductible expenses may cover home office costs, internet service, and mileage incurred for sourcing inventory.

Hobby Loss Rule: What Flippers Need to Know

The IRS distinguishes between flipping used books as a business or a hobby based on profit motive and regularity of transactions. Under the Hobby Loss Rule, if the activity is not engaged in for profit, losses cannot be deducted against other income. Flippers must demonstrate consistent profits and proper record-keeping to classify their flipping as a business for tax purposes.

Self-Employment Tax Implications

Is flipping used books considered a business or a hobby by the IRS for tax purposes? The IRS examines factors such as profit motive, frequency of sales, and record-keeping to distinguish between a business and a hobby. If classified as a business, income from used book flipping is subject to self-employment tax, requiring you to report earnings on Schedule C and pay Social Security and Medicare taxes.

Reporting Flipping Income on Your Tax Return

The IRS evaluates whether flipping used books is a business or a hobby based on factors such as profit motive, activity regularity, and record-keeping. Reporting flipping income accurately on your tax return is essential to comply with IRS regulations.

Income from flipping used books must be reported on Schedule C if considered a business, allowing deductions for related expenses. Hobby income, however, is reported as "Other Income" on Form 1040, without business expense deductions.

Audit Risks: Used Book Flippers in IRS Spotlight

The IRS scrutinizes individuals who flip used books to determine if the activity qualifies as a business or a hobby. Proper classification affects tax reporting requirements and potential deductions.

- Frequency of Sales - Consistent and frequent book sales indicate a business intent rather than a hobby.

- Profit Motive - Demonstrating a clear profit goal through record-keeping and pricing strategies supports business classification.

- Audit Risk - Used book flippers face increased IRS audit risk when income is reported but expenses are limited or inconsistent.

Clear documentation and adherence to IRS guidelines reduce audit risks for those flipping used books.

Tips for Transitioning from Hobbyist to Book Flipping Business

The IRS distinguishes between a hobby and a business based on intent to make a profit and regularity of activity. Flipping used books can be considered a business if it demonstrates consistent profit motivation and operational structure.

Transitioning from hobbyist to a recognized book flipping business requires maintaining detailed records of purchases, sales, and expenses. Registering the business and obtaining an Employer Identification Number (EIN) establishes legitimacy. Consistently treating the activity as a business, including proper bookkeeping and marketing efforts, enhances the potential for IRS recognition.

Related Important Terms

Hobby Loss Rule

The IRS applies the Hobby Loss Rule to determine if flipping used books is a business or a hobby, examining factors like profit motive, frequency of transactions, and record-keeping practices. If the activity does not show a consistent profit over three out of five years, it is classified as a hobby, limiting deductions to income only.

Schedule C Filing

The IRS considers flipping used books a business if material participation, profit motive, and regularity of transactions demonstrate an intent to generate income, necessitating Schedule C filing for reporting income and expenses. Hobby activities lack consistent profit and personal involvement, thus do not qualify for Schedule C deductions or business loss claims.

Ordinary Course of Trade

The IRS evaluates whether flipping used books constitutes a business or a hobby based on the ordinary course of trade, emphasizing regularity, profit motive, and active participation. Consistent buying and selling of used books with the intent to generate profit typically qualifies as a business rather than a hobby.

Section 183 Activity

The IRS considers flipping used books under Section 183, which differentiates between a business and a hobby based on the intent to make a profit and the consistency of income from the activity. If the activity is primarily for profit and demonstrates regularity, it qualifies as a business, allowing deduction of related expenses; otherwise, it may be treated as a hobby with limited tax benefits.

Profit Motive Test

The IRS applies the Profit Motive Test to determine if flipping used books qualifies as a business, requiring consistent profit-seeking activity and evidence of regularity and intent to make a profit. Hobby losses are disallowed unless taxpayers demonstrate a genuine profit motive, such as maintaining detailed records, income exceeding expenses over time, and marketing efforts.

Material Participation

The IRS determines whether flipping used books is a business or a hobby based on the taxpayer's material participation, which involves regular, continuous, and substantial involvement in the activity. Meeting the material participation criteria allows income from book flipping to be treated as business income, eligible for deductions and potential loss offset.

Self-Employment Tax Exposure

Flipping used books may be considered a business by the IRS if activities are conducted with regularity, profit intent, and record-keeping, potentially subjecting income to self-employment tax. Hobby income is reported differently and typically avoids self-employment tax, but consistent profit generation and business-like behavior increase self-employment tax exposure under IRS guidelines.

Hobby Income Reporting

Flipping used books is considered a hobby by the IRS if it lacks profit motive and regularity, meaning income must be reported on Form 1040 Schedule 1 as "Other Income" without business deductions. Consistent profits, businesslike record-keeping, and investment in inventory typically signal a business, altering tax obligations and allowing expense deductions.

Inventory Accounting Basis

The IRS considers flipping used books a business if the activity is carried out with continuity and profit motive, requiring the use of an inventory accounting basis to track purchases and sales accurately. Proper inventory accounting separates business income from hobby income, influencing tax deductions and reporting obligations under IRS guidelines.

Consignment Sales Taxation

The IRS generally considers flipping used books a business if the activity is conducted with continuity, profit motive, and proper record-keeping, which subjects consignment sales to self-employment tax and income reporting requirements. Consignment sales income must be reported as business income, and expenses related to the acquisition and sale of used books are deductible to accurately determine taxable profit.

moneytar.com

moneytar.com