Is money made flipping liquidation pallets taxable? Infographic

Is money made flipping liquidation pallets taxable? Infographic

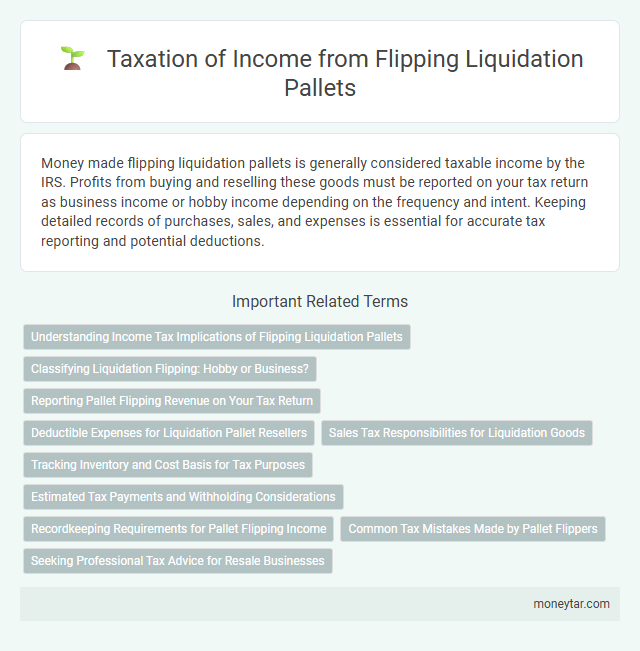

Is money made flipping liquidation pallets taxable?

Money made flipping liquidation pallets is generally considered taxable income by the IRS. Profits from buying and reselling these goods must be reported on your tax return as business income or hobby income depending on the frequency and intent. Keeping detailed records of purchases, sales, and expenses is essential for accurate tax reporting and potential deductions.

Understanding Income Tax Implications of Flipping Liquidation Pallets

Income earned from flipping liquidation pallets is subject to income tax and must be reported to tax authorities. Understanding how this income is classified helps ensure compliance with tax regulations.

- Taxable Income - Profits made from reselling liquidation pallets are considered taxable income by the IRS.

- Record Keeping - Maintaining detailed records of purchases and sales is essential to accurately report income and expenses.

- Self-Employment Tax - If pallet flipping is treated as a business, self-employment tax may apply to your net earnings.

Consulting a tax professional can clarify your specific tax obligations related to flipping liquidation pallets.

Classifying Liquidation Flipping: Hobby or Business?

Profits from flipping liquidation pallets may be taxable depending on how the activity is classified by the IRS. Determining whether flipping liquidation pallets is a hobby or a business is crucial for tax reporting purposes.

The IRS considers factors such as the intent to generate profit, regularity of transactions, and business-like activity to classify the endeavor. If flipping is deemed a business, income must be reported on Schedule C, and expenses may be deductible.

Reporting Pallet Flipping Revenue on Your Tax Return

| Topic | Taxation of Money Made Flipping Liquidation Pallets |

|---|---|

| Definition | Flipping liquidation pallets involves purchasing pallets of returned, surplus, or overstocked goods at a discounted price and reselling the items for profit. |

| Taxability | Income earned from flipping liquidation pallets is considered taxable income by the IRS and must be reported on your tax return. |

| Reporting Revenue | Report all revenue generated from reselling liquidation pallets on Schedule C (Form 1040) as part of your business income if operating as a sole proprietor or single-member LLC. |

| Recordkeeping | Maintain detailed records including purchase receipts, sales invoices, and any related business expenses such as shipping and storage to accurately calculate profit and taxable income. |

| Expenses Deduction | Deduct legitimate business expenses incurred in pallet flipping against your gross income to reduce taxable income, such as transportation costs, supplies, and advertising fees. |

| Self-Employment Tax | Income from flipping liquidation pallets may be subject to self-employment tax if classified as business income rather than hobby income. |

| Reporting Hobby Income | If pallet flipping is not a business and is done sporadically, income is still taxable but reported differently, without business expense deductions on Schedule 1 (Form 1040). |

| Tax Forms | Key forms include Schedule C (Profit or Loss from Business), Schedule SE (Self-Employment Tax), and Form 1040 for individual income reporting. |

| IRS Guidelines | The IRS treats proceeds from liquidations and resales as taxable income consistent with ordinary business activity rules. |

Deductible Expenses for Liquidation Pallet Resellers

Money earned from flipping liquidation pallets is subject to taxation as business income. Understanding which expenses are deductible can help reduce your overall tax liability when reselling liquidation items.

- Cost of Goods Sold (COGS) - The purchase price of liquidation pallets and associated shipping fees can be deducted as business expenses.

- Storage and Warehouse Fees - Expenses related to storing liquidation inventory qualify as deductible operational costs.

- Marketing and Selling Costs - Advertising, listing fees, and other sales-related expenses reduce taxable income from pallet reselling activities.

Sales Tax Responsibilities for Liquidation Goods

Money earned from flipping liquidation pallets is subject to tax regulations, particularly sales tax laws. Understanding your sales tax responsibilities for liquidation goods is essential to remain compliant with state and local tax authorities.

Sales tax applies when you sell tangible goods, including items from liquidation pallets, to customers. You must register for a sales tax permit if your state requires it and collect the appropriate sales tax on all taxable sales.

Tracking Inventory and Cost Basis for Tax Purposes

Income generated from flipping liquidation pallets is taxable and must be reported to the IRS. Accurate tracking of inventory and cost basis is essential to determine the correct taxable profit. Maintaining detailed records of purchase prices, shipping costs, and resale revenue ensures proper tax compliance and minimizes audit risks.

Estimated Tax Payments and Withholding Considerations

Income earned from flipping liquidation pallets is considered taxable and must be reported to the IRS. Estimated tax payments may be required quarterly to cover self-employment tax and income tax liability if sufficient withholding is not in place. Proper withholding considerations and record-keeping are essential to avoid penalties and ensure compliance with tax regulations.

Recordkeeping Requirements for Pallet Flipping Income

Income earned from flipping liquidation pallets is subject to taxation and must be accurately reported to the IRS. Proper recordkeeping is essential for documenting all sales, expenses, and profits associated with pallet flipping activities.

Detailed records should include purchase receipts, sales invoices, and expense logs to substantiate income and deductible costs. Maintaining organized documentation helps simplify tax filing and supports accuracy in income reporting. Failure to keep thorough records may result in penalties or audits by tax authorities.

Common Tax Mistakes Made by Pallet Flippers

Money earned from flipping liquidation pallets is generally considered taxable income by the IRS. Failure to report this income or misunderstanding deductible expenses leads to common tax mistakes among pallet flippers.

- Not reporting all income - Many pallet flippers overlook declaring all proceeds, which can trigger audits or penalties.

- Misclassifying expenses - Incorrectly categorizing costs related to pallets can result in missed deductions or overstated expenses.

- Ignoring self-employment tax - Earnings from flipping pallets may require paying self-employment tax if treated as a business activity.

Seeking Professional Tax Advice for Resale Businesses

Is the income earned from flipping liquidation pallets subject to taxation? Earnings from resale activities, including flipping liquidation pallets, are generally considered taxable income by the IRS. Seeking professional tax advice helps ensure compliance with tax laws and maximizes possible deductions for resale businesses.

Related Important Terms

Hobby Income Taxation

Money earned from flipping liquidation pallets is generally considered taxable as hobby income if the activity is not conducted as a business. The IRS requires reporting all hobby income on Form 1040, Schedule 1, and allows deductions only up to the amount of income earned, disallowing business loss deductions.

Short-Term Capital Gains Tax

Profits from flipping liquidation pallets are generally subject to short-term capital gains tax if the items are sold within a year of purchase, and these gains are taxed at ordinary income rates. It is essential to maintain detailed records of purchase and sale dates to accurately report and calculate any taxable income associated with these transactions.

Self-Employment Tax

Income earned from flipping liquidation pallets is subject to Self-Employment Tax if it is generated through regular and continuous business activities. The IRS treats such profits as self-employment income, requiring payment of both Social Security and Medicare taxes on net earnings.

Cost of Goods Sold (COGS) Deductions

Income earned from flipping liquidation pallets is taxable and must be reported as business income, with expenses directly related to purchasing pallets, such as the Cost of Goods Sold (COGS), deductible to reduce taxable income. Accurate tracking of pallet purchase costs, shipping fees, and other expenses tied to acquiring and reselling inventory ensures compliance and optimizes tax deductions under IRS guidelines.

Inventory Turnover Taxation

Income generated from flipping liquidation pallets is taxable under inventory turnover taxation rules, as such sales are considered business revenue. Accurate record-keeping of purchases and sales is essential to properly report and calculate taxable income from inventory turnovers.

Online Reseller Sales Tax Nexus

Money earned from flipping liquidation pallets is taxable as it constitutes income from resale activities, and online resellers must consider sales tax nexus laws, which vary by state and determine where tax collection is required based on physical presence or economic thresholds. Understanding specific nexus thresholds, such as transaction volume or revenue limits, is essential for compliance with state sales tax obligations in e-commerce liquidation pallet businesses.

Gross Receipts Tax

Revenue earned from flipping liquidation pallets is subject to Gross Receipts Tax (GRT) as it constitutes business income derived from selling goods. Sellers must report the total gross receipts from these transactions to comply with state and local tax regulations governing GRT.

Peer-to-Peer Marketplace Reporting (Form 1099-K)

Income earned from flipping liquidation pallets is taxable and must be reported if transactions exceed $600 or 200 sales through peer-to-peer marketplaces, triggering the issuance of Form 1099-K. The IRS requires platforms to report gross payment transactions, making it essential to track sales data accurately for tax compliance.

Passive Income vs. Active Income Classification

Money made flipping liquidation pallets is generally classified as active income since it involves continuous effort, buying, sorting, and reselling goods rather than passive investment returns. Tax authorities treat profits from these activities as taxable business income, requiring proper reporting and potentially subjecting the seller to self-employment taxes.

Unreported eCommerce Revenue Penalties

Earnings from flipping liquidation pallets are considered taxable income and must be reported to the IRS to avoid penalties. Failure to report eCommerce revenue accurately can result in fines, interest, and potential audits for unreported income violations.

moneytar.com

moneytar.com