Must I declare income from reselling sneakers online? Infographic

Must I declare income from reselling sneakers online? Infographic

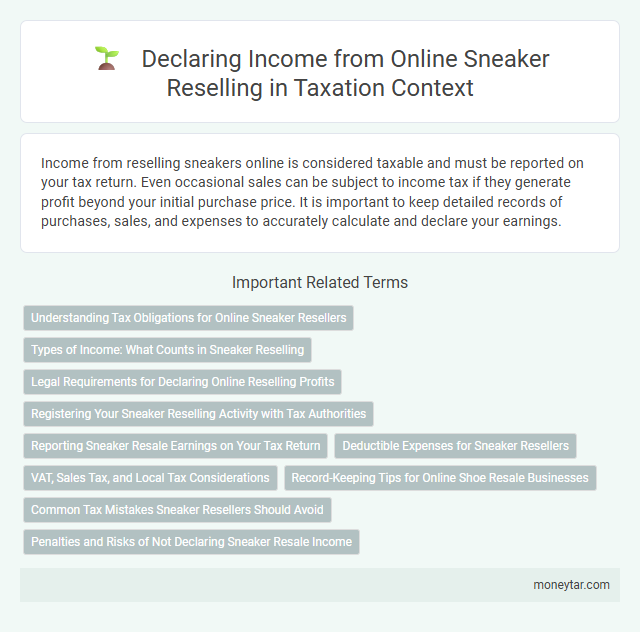

Must I declare income from reselling sneakers online?

Income from reselling sneakers online is considered taxable and must be reported on your tax return. Even occasional sales can be subject to income tax if they generate profit beyond your initial purchase price. It is important to keep detailed records of purchases, sales, and expenses to accurately calculate and declare your earnings.

Understanding Tax Obligations for Online Sneaker Resellers

Income generated from reselling sneakers online is generally subject to taxation and must be declared to the appropriate tax authorities. Earnings from online sales are considered taxable income regardless of whether the activity is occasional or frequent.

Record keeping of all transactions, including purchase prices and sale amounts, is essential for accurate tax reporting. Understanding tax obligations helps avoid penalties and ensures compliance with income tax laws related to e-commerce activities.

Types of Income: What Counts in Sneaker Reselling

Income earned from reselling sneakers online is considered taxable and must be declared to tax authorities. Understanding the types of income involved in sneaker reselling helps clarify tax obligations.

Profits from sneaker reselling are categorized as business income if you engage in frequent or organized sales activities. Occasional sneaker sales may be treated as capital gains, subject to different tax rules. Keeping detailed records of purchase prices, sale prices, and related expenses ensures accurate income reporting and compliance.

Legal Requirements for Declaring Online Reselling Profits

Must I declare income from reselling sneakers online? Income earned from online resale activities, including sneakers, is subject to taxation under most jurisdictions' tax laws. You are required to report any profits as part of your taxable income to comply with legal obligations and avoid penalties.

Registering Your Sneaker Reselling Activity with Tax Authorities

Income generated from reselling sneakers online is subject to taxation and must be reported to tax authorities. Properly registering your sneaker reselling activity ensures compliance with local tax regulations and avoids potential fines.

- Register Your Business - Officially register your sneaker reselling activity as a business entity with the relevant tax office to obtain a tax identification number.

- Maintain Accurate Records - Keep detailed records of all sales, purchases, and expenses related to your sneaker reselling to support your tax declarations.

- Understand Local Tax Laws - Research and follow the specific tax laws applicable to online reselling activities in your jurisdiction for precise reporting requirements.

Failing to register your sneaker reselling activity can result in penalties and legal issues with tax authorities.

Reporting Sneaker Resale Earnings on Your Tax Return

Income earned from reselling sneakers online is considered taxable and must be reported on your tax return. The IRS treats sneaker sales as income if you sell them with the intention of making a profit.

Report sneaker resale earnings as part of your gross income on Schedule C if you operate as a business. Casual sellers may report income as "Other Income" on Form 1040, depending on the frequency and scale of sales.

Deductible Expenses for Sneaker Resellers

| Deductible Expense | Description | Tax Benefit |

|---|---|---|

| Cost of Goods Sold (COGS) | Purchase price of sneakers you resell, including shipping fees paid to suppliers. | Reduces taxable income by the total cost of acquiring inventory. |

| Shipping and Delivery Fees | Costs for shipping sneakers to customers or returns. | Deductible as business expenses, lowering overall income tax. |

| Packaging Materials | Boxes, bubble wrap, and labels used for shipping sneakers. | Considered necessary business expenses, reducing taxable profit. |

| Online Marketplace Fees | Listing fees, transaction fees, and seller commission charged by platforms like eBay or StockX. | Deductible, which decreases the amount of taxable revenue. |

| Home Office Expenses | Portion of rent, utilities, and internet used exclusively for the sneaker reselling business. | Allows a percentage of household expenses to offset income generated from reselling. |

| Advertising and Marketing Costs | Expenses on social media ads, sponsored posts, and promotion materials. | Reduces taxable income by the amount spent on promoting the business. |

| Equipment and Software | Costs for cameras, computers, or inventory management software required to run the business. | May be depreciated or deducted fully depending on cost and usage. |

You must include income from sneaker reselling when filing taxes, but these deductible expenses can significantly reduce your taxable profit.

VAT, Sales Tax, and Local Tax Considerations

Income earned from reselling sneakers online is subject to various tax regulations depending on your location and sales volume. Understanding VAT, sales tax, and local tax obligations ensures compliance and avoids penalties.

- Value Added Tax (VAT) - If your sneaker reselling business surpasses the VAT threshold in your country, you must register for VAT and charge it on your sales.

- Sales Tax - Sales tax requirements vary by state or region, and you may need to collect and remit sales tax when selling sneakers to customers within certain jurisdictions.

- Local Tax Considerations - Some local governments impose specific taxes on online sales or business income that you must report and pay based on local regulations.

Record-Keeping Tips for Online Shoe Resale Businesses

Maintaining accurate records is essential for online shoe resale businesses to ensure proper income declaration and compliance with tax regulations. Keep detailed logs of each transaction, including purchase receipts, sales invoices, and shipping documentation. Organized record-keeping simplifies tax reporting and supports your claims in case of an audit.

Common Tax Mistakes Sneaker Resellers Should Avoid

Income earned from reselling sneakers online is taxable and must be reported to the IRS. Failure to declare these earnings often leads to penalties, underpayment interest, or audits. Common tax mistakes sneaker resellers should avoid include not keeping accurate records, ignoring sales tax obligations, and underreporting income.

Penalties and Risks of Not Declaring Sneaker Resale Income

Income from reselling sneakers online is subject to taxation and must be reported to comply with tax regulations. Failure to declare such income can lead to significant penalties and legal risks.

- Tax Evasion Penalties - Not declaring sneaker resale income may result in fines, interest charges, and potential criminal prosecution for tax evasion.

- Audit Risk - Undisclosed income increases the likelihood of a tax audit, where authorities may scrutinize financial records and sales activity.

- Loss of Tax Benefits - Income omission can disqualify sellers from deductions or credits, increasing overall tax liability and financial burden.

Related Important Terms

Sneaker Resale Tax Compliance

Income generated from reselling sneakers online must be declared as taxable income under IRS guidelines to ensure sneaker resale tax compliance. Failure to report earnings can result in penalties, interest, and increased scrutiny from tax authorities.

Digital Marketplace Income Reporting

Income earned from reselling sneakers online through digital marketplaces must be declared to tax authorities, as these platforms often report sales data directly to the IRS or relevant tax agencies. Failure to report digital marketplace income can result in penalties, making it essential to maintain accurate records of all transactions and include them in your annual tax return.

Hobby vs. Business Classification

Income from reselling sneakers online must be declared if the activity is classified as a business, which is determined by factors like frequency, profit intention, and organization; casual sales as a hobby typically do not require reporting. Tax authorities assess whether the sneaker sales demonstrate a continuous profit-seeking activity or are occasional transactions without business intent.

Threshold for 1099-K Issuance

Income from reselling sneakers online must be declared if the total sales exceed the IRS threshold for 1099-K issuance, currently set at $600 in gross payments regardless of transaction count. The 1099-K form is used to report these payments to the IRS, and failing to report income above this threshold can result in penalties.

Casual Seller Tax Obligations

Income earned from reselling sneakers online, even as a casual seller, must be declared if it exceeds the tax-free threshold set by the IRS or relevant tax authority. Failure to report this income can result in penalties, as the IRS classifies profits from online sales as taxable income subject to ordinary income tax rates.

Inventory Cost Deduction for Resellers

Income from reselling sneakers online must be declared as taxable, while inventory cost deduction allows resellers to subtract the purchase price and related expenses of sneakers held for sale from their gross income. Proper record-keeping of acquisition costs, shipping fees, and packaging expenses is essential to maximize deductible amounts and reduce taxable income accurately.

Untaxed Peer-to-Peer Earnings

Income from reselling sneakers online is considered taxable and must be declared to tax authorities, as untreated peer-to-peer earnings can trigger audits and penalties. The IRS requires reporting all profits from online sales, and failure to report untaxed income from sneaker reselling may result in interest charges and fines.

Platform-Facilitated Tax Withholding

Income from reselling sneakers online is typically subject to declaration, especially when transactions occur through platforms with platform-facilitated tax withholding features, which automatically withhold and report taxes to the IRS once sales exceed a certain threshold, such as $600 annually. Sellers should review their transaction statements and consult tax guidelines to ensure compliance with income reporting requirements and understand withholding obligations.

Artificial Intelligence Audit Triggers

Income from reselling sneakers online must be declared as taxable income to avoid triggering artificial intelligence audit systems designed to detect undeclared revenue. These AI algorithms analyze sales patterns, payment transactions, and income reports to identify discrepancies and potential tax evasion in e-commerce activities.

Short-Term Flip Capital Gains

Income from reselling sneakers online is considered short-term capital gains if the items are sold within one year of purchase and must be reported on your tax return. The IRS requires declaring these gains as ordinary income, subject to your regular income tax rate, regardless of whether the flipping activity is occasional or frequent.

moneytar.com

moneytar.com