What are the tax implications of flipping items on Facebook Marketplace? Infographic

What are the tax implications of flipping items on Facebook Marketplace? Infographic

What are the tax implications of flipping items on Facebook Marketplace?

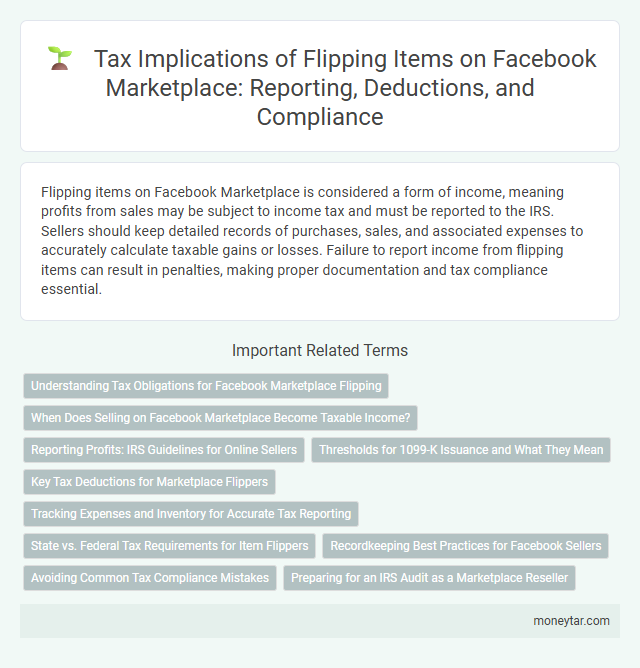

Flipping items on Facebook Marketplace is considered a form of income, meaning profits from sales may be subject to income tax and must be reported to the IRS. Sellers should keep detailed records of purchases, sales, and associated expenses to accurately calculate taxable gains or losses. Failure to report income from flipping items can result in penalties, making proper documentation and tax compliance essential.

Understanding Tax Obligations for Facebook Marketplace Flipping

Flipping items on Facebook Marketplace can generate taxable income that must be reported to the IRS. Understanding your tax obligations is essential to avoid penalties and ensure compliance.

Income earned from selling items, even if it's from buying and reselling, is generally considered taxable. You may need to keep detailed records of your purchases, sales, and related expenses to accurately report your profits. If you consistently flip items, the IRS may classify your activities as a business, requiring you to pay self-employment taxes and possibly collect sales tax depending on your state.

When Does Selling on Facebook Marketplace Become Taxable Income?

Selling items on Facebook Marketplace may generate taxable income if transactions result in a profit. The IRS requires reporting income from sales that exceed the original purchase price or include items acquired for resale.

Casual sales of personal items at a loss generally do not trigger tax liabilities. However, frequent sales or flipping items for profit can classify the earnings as business income, subject to taxation and reporting obligations.

Reporting Profits: IRS Guidelines for Online Sellers

| Aspect | Details |

|---|---|

| Taxable Income | Profits from flipping items on Facebook Marketplace are considered taxable income by the IRS and must be reported on your tax return. |

| Reporting Requirements | The IRS requires all income sources to be reported, including sales through online platforms like Facebook Marketplace, regardless of whether you receive a Form 1099-K. |

| Form 1099-K Threshold | Starting tax year 2023, platforms must issue Form 1099-K if gross payments exceed $600; this form reports income to both the seller and IRS. |

| Record Keeping | Maintain detailed records of purchase prices, sale prices, and related expenses to accurately calculate taxable profit on flipped items. |

| Business vs Hobby | Frequent and profitable selling may classify your activity as a business, subjecting you to additional tax rules such as self-employment tax. |

| Reporting on Tax Forms | Profits are typically reported on Schedule C (Form 1040) if treated as a business, or included as miscellaneous income if classified as occasional sales. |

Thresholds for 1099-K Issuance and What They Mean

Flipping items on Facebook Marketplace can have tax implications depending on your sales volume. Understanding thresholds for 1099-K issuance is crucial to ensure compliance with IRS regulations.

- 1099-K Thresholds - The IRS requires payment platforms to issue a 1099-K if gross payments exceed $600 in a calendar year starting 2023.

- Reporting Requirements - You must report income from sales regardless of receiving a 1099-K to avoid underreporting taxable income.

- Taxable Income - Profits earned from flipping are considered taxable income and should be declared on your tax return.

Key Tax Deductions for Marketplace Flippers

What are the tax implications of flipping items on Facebook Marketplace? Income earned from selling items on Facebook Marketplace is generally taxable and must be reported to the IRS. Failure to report this income can lead to penalties and interest.

What key tax deductions can marketplace flippers claim? Marketplace flippers can deduct expenses such as the cost of goods sold, shipping fees, and platform fees. Keeping detailed records of these expenses helps reduce taxable income and ensures accurate tax filings.

How does the cost of goods sold affect taxes for Facebook Marketplace sellers? The cost of goods sold (COGS) includes the purchase price of items resold, and it directly reduces gross income. Properly tracking COGS is essential for minimizing taxable profit on flipped items.

Are shipping and packaging costs deductible for Facebook Marketplace flippers? Yes, shipping and packaging expenses used to deliver sold items are tax-deductible business expenses. These costs should be documented to support deductions during tax filing.

Can Facebook Marketplace sellers deduct fees charged by the platform? Fees charged by Facebook Marketplace or associated payment processors qualify as deductible business expenses. These deductions lower net income and overall tax liability.

Tracking Expenses and Inventory for Accurate Tax Reporting

Flipping items on Facebook Marketplace generates taxable income that must be reported to the IRS. Tracking expenses such as purchase costs, shipping fees, and listing charges is essential for accurately determining net profit. Maintaining detailed inventory records helps ensure proper tax reporting and minimizes the risk of audits or penalties.

State vs. Federal Tax Requirements for Item Flippers

Flipping items on Facebook Marketplace generates income that may be subject to both federal and state tax requirements. At the federal level, the IRS considers profits from sales as taxable income, requiring you to report earnings and possibly pay self-employment taxes if flipping is frequent. State tax obligations vary, with some states imposing sales tax, income tax, or both, making it essential to understand your specific state's regulations when reporting marketplace profits.

Recordkeeping Best Practices for Facebook Sellers

Flipping items on Facebook Marketplace can generate taxable income that must be reported to the IRS. Proper recordkeeping is essential for accurately tracking profits and deductible expenses.

Maintaining detailed records helps ensure compliance with tax laws and simplifies the filing process for sellers.

- Track Purchase and Sale Dates - Record the exact dates of acquiring and selling items to determine holding periods and calculate capital gains or losses.

- Document Purchase Prices and Sale Amounts - Keep receipts, invoices, or screenshots showing original purchase costs and sale prices to accurately report taxable income.

- Maintain Expense Records - Save receipts for related expenses such as shipping, listing fees, and repairs to maximize deductible costs.

Avoiding Common Tax Compliance Mistakes

Flipping items on Facebook Marketplace can lead to taxable income that must be reported to the IRS. Understanding the tax implications helps sellers avoid costly mistakes and comply with tax regulations.

- Keep Accurate Records - Document all purchases, sales, and expenses to support income reporting and deductions.

- Report All Income - Declare all profits from sales, regardless of amount, to avoid penalties and audits.

- Understand Hobby vs Business - Differentiate between occasional selling and a business to determine applicable tax rules and potential deductions.

Proper tax compliance protects against IRS issues and ensures legal operation when flipping items online.

Preparing for an IRS Audit as a Marketplace Reseller

Flipping items on Facebook Marketplace generates taxable income that must be reported to the IRS. Sellers should maintain detailed records of all transactions, including purchase prices, sale amounts, and related expenses to accurately report profits.

Preparing for an IRS audit involves organizing receipts, bank statements, and communication with buyers to substantiate reported income. Proper documentation minimizes audit risks and ensures compliance with tax regulations for marketplace resellers.

Related Important Terms

Hobby Income Taxation

Income earned from flipping items on Facebook Marketplace is considered hobby income by the IRS and must be reported on your tax return, although hobby-related expenses are not deductible. The net profit from these sales is subject to ordinary income tax rates and could potentially increase your overall tax liability.

Digital Platform Seller Reporting

Selling items on Facebook Marketplace is subject to tax reporting requirements under the IRS Digital Platform Seller Reporting rules, which mandate platforms to issue Form 1099-K if sales exceed $600 annually. Sellers must report all income from transactions, as failure to do so can lead to penalties and audits by the IRS.

1099-K Threshold Changes

Selling items on Facebook Marketplace may trigger tax reporting requirements if total transactions exceed the IRS 1099-K threshold, which was lowered to $600 starting in 2022, regardless of the number of sales. Sellers reaching this threshold must report income from sales on their tax returns, as the IRS receives copies of 1099-K forms to track potential taxable revenue.

Basis Documentation Requirement

The IRS requires sellers flipping items on Facebook Marketplace to maintain accurate basis documentation, including purchase price receipts and records of improvements, to correctly calculate capital gains or losses. Failure to provide proper documentation can result in higher taxable income due to the inability to deduct the original purchase cost from the sale proceeds.

Short-Term Capital Gains Tax

Profits from flipping items on Facebook Marketplace are typically subject to Short-Term Capital Gains Tax, which applies when assets are sold within one year of purchase and are taxed at ordinary income tax rates. Sellers must report these gains as taxable income on their tax returns, potentially increasing their overall tax liability depending on their income bracket.

Inventory Cost Allocation

When flipping items on Facebook Marketplace, tax implications require careful inventory cost allocation to accurately determine taxable profit. Sellers must track the original purchase price, shipping, and any refurbishment expenses to calculate the cost of goods sold (COGS), ensuring correct reporting of income and minimizing potential tax liabilities.

Cash App Payment Disclosure

Flipping items on Facebook Marketplace requires reporting all income to the IRS, including payments received via Cash App, which may be disclosed to tax authorities under the IRS information reporting requirements. Sellers must maintain detailed records of transactions and report gains as taxable income to avoid penalties for underreporting.

Marketplace Facilitation Law

Profits from flipping items on Facebook Marketplace are considered taxable income and must be reported to the IRS, with Marketplace Facilitation Laws requiring Facebook to collect and remit sales tax on behalf of sellers in certain states. Sellers should track income and expenses carefully to comply with federal and state tax regulations, including potential self-employment tax liabilities.

Peer-to-Peer Sales Audit

Flipping items on Facebook Marketplace may trigger peer-to-peer sales tax audits if profits are substantial and transactions are frequent, as the IRS scrutinizes income from informal online sales. Sellers must accurately report taxable income and maintain detailed records to avoid penalties and ensure compliance with federal and state tax regulations.

Social Commerce Tax Compliance

Profits from flipping items on Facebook Marketplace are considered taxable income by the IRS and must be reported on your tax return, with specific attention to self-employment tax if sales are frequent or substantial. Maintaining detailed records of purchases, sales, and related expenses is essential for accurate Social Commerce Tax Compliance and avoiding penalties.

moneytar.com

moneytar.com