Can you make money by borrowing collectibles for temporary exhibitions? Infographic

Can you make money by borrowing collectibles for temporary exhibitions? Infographic

Can you make money by borrowing collectibles for temporary exhibitions?

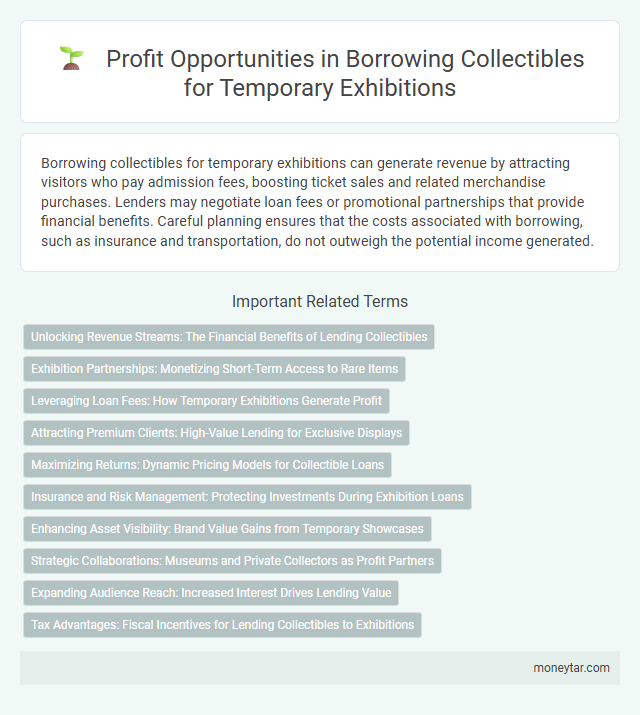

Borrowing collectibles for temporary exhibitions can generate revenue by attracting visitors who pay admission fees, boosting ticket sales and related merchandise purchases. Lenders may negotiate loan fees or promotional partnerships that provide financial benefits. Careful planning ensures that the costs associated with borrowing, such as insurance and transportation, do not outweigh the potential income generated.

Unlocking Revenue Streams: The Financial Benefits of Lending Collectibles

Can you make money by borrowing collectibles for temporary exhibitions? Borrowing collectibles allows institutions and collectors to diversify their offerings without the cost of permanent acquisition. Unlocking revenue streams through lending fees and increased visitor engagement showcases the financial benefits of this strategy.

Exhibition Partnerships: Monetizing Short-Term Access to Rare Items

Exhibition partnerships offer a unique way to monetize short-term access to rare collectibles by borrowing items for temporary displays. Museums and galleries often collaborate with collectors to create exclusive exhibitions that attract paying visitors and generate revenue. Your ability to leverage these partnerships can turn borrowed collectibles into profitable opportunities through ticket sales, sponsorships, and merchandise.

Leveraging Loan Fees: How Temporary Exhibitions Generate Profit

Borrowing collectibles for temporary exhibitions can be a lucrative strategy through leveraging loan fees. Museums and galleries often generate profit by charging fees associated with the loan of valuable items.

- Loan Fees as Revenue - Institutions charge borrowing fees to cover insurance, transportation, and curator expenses.

- Enhanced Audience Attraction - High-profile borrowed collectibles draw larger crowds, increasing ticket sales and merchandise revenue.

- Partnership Opportunities - Collaborations with collectors and lenders may lead to sponsored events and additional financial support.

Effective management of loan fees enables temporary exhibitions to become profitable ventures for hosting institutions.

Attracting Premium Clients: High-Value Lending for Exclusive Displays

Borrowing collectibles for temporary exhibitions can generate significant revenue by attracting premium clients willing to pay for exclusive access to high-value items. Institutions and private lenders benefit from lending rare pieces, leveraging their unique appeal to enhance event prestige.

High-value lending services offer tailored contracts and insurance options that reassure premium clients about the security and authenticity of the exhibits. This approach maximizes financial returns while positioning lenders as trusted providers of luxury cultural experiences.

Maximizing Returns: Dynamic Pricing Models for Collectible Loans

Maximizing returns on borrowed collectibles for temporary exhibitions involves applying dynamic pricing models tailored to demand fluctuations and collector interest. This approach leverages real-time market data to adjust loan fees, ensuring optimal revenue from high-demand periods. You can increase profitability by continuously analyzing trends and setting prices that reflect the unique value and rarity of each collectible.

Insurance and Risk Management: Protecting Investments During Exhibition Loans

| Insurance and Risk Management: Protecting Investments During Exhibition Loans | |

|---|---|

| Context | Temporary exhibition loans of collectibles involve lending valuable items for a limited period to increase visibility, attract audiences, and generate income. |

| Financial Opportunity | Making money by borrowing collectibles depends on effectively managing risks to protect the value of the items while leveraging them for exhibition revenue or sponsorship. |

| Insurance Importance | Obtaining comprehensive insurance coverage is essential to safeguard collectibles against damage, theft, or loss during transit and display. Insurance policies typically cover appraisal value, transport, and exhibition periods. |

| Risk Mitigation Strategies | Implement strict handling protocols, environmental controls, and security measures to minimize risks. Collaborate with trusted logistics and security services specialized in art and collectibles. |

| Your Role | You must ensure that loan agreements clearly specify responsibilities, coverage limits, and liability clauses to avoid unexpected financial exposure. |

| Conclusion | Effective insurance and risk management are critical to making your investment in borrowing collectibles profitable by reducing potential losses and enhancing confidence among lenders and exhibitors. |

Enhancing Asset Visibility: Brand Value Gains from Temporary Showcases

Borrowing collectibles for temporary exhibitions can significantly enhance asset visibility, driving increased brand recognition and value. These temporary showcases offer unique opportunities to position assets in high-profile settings, attracting diverse audiences and potential investors.

- Brand Exposure Amplification - Temporary exhibitions place collectibles in prominent venues, increasing public and media attention to the asset and its owner.

- Market Value Appreciation - Enhanced visibility through curated displays often leads to higher appraisal values and stronger resale potential.

- Networking and Partnership Opportunities - Exhibitions create platforms for establishing connections with collectors, museums, and sponsors, broadening the asset's influence.

Strategic Collaborations: Museums and Private Collectors as Profit Partners

Borrowing collectibles for temporary exhibitions can create profitable opportunities through strategic collaborations. These partnerships bridge museums and private collectors, unlocking new revenue streams.

- Expanded Audience Reach - Temporary exhibits attract diverse visitors eager to see unique collections, increasing ticket sales and museum visibility.

- Shared Marketing Resources - Museums and collectors combine promotional efforts, maximizing publicity and boosting attendance for special exhibitions.

- Revenue Sharing Models - Profit agreements between institutions and collectors allow both parties to benefit financially from loaned artifacts.

Expanding Audience Reach: Increased Interest Drives Lending Value

Borrowing collectibles for temporary exhibitions can significantly expand audience reach. Increased visitor interest elevates the perceived value of the loaned items.

When collectors lend items to exhibitions, their pieces gain exposure to diverse and larger audiences. This heightened visibility can enhance the reputation of both the lender and the collectibles. Museums and galleries benefit from increased attendance, which often translates into greater media attention and sponsorship opportunities, driving lending value higher.

Tax Advantages: Fiscal Incentives for Lending Collectibles to Exhibitions

Borrowing collectibles for temporary exhibitions offers unique tax advantages that can enhance your financial strategy. Fiscal incentives are often available to lenders, reducing taxable income through deductions and credits related to the loaned items.

Your participation in lending valuable collectibles can qualify for depreciation benefits and potential exemptions on capital gains during the exhibition period. These tax advantages make lending not only a cultural contribution but also a financially savvy decision.

Related Important Terms

Exhibition Lending Arbitrage

Exhibition lending arbitrage enables museums and galleries to profit by borrowing high-demand collectibles at minimal or no cost and subsequently generating revenue through ticket sales, sponsorships, or exclusive event access. This strategy leverages the value discrepancy between temporary exhibition rights and permanent ownership, maximizing financial gains from borrowed artifacts.

Temporary Asset Monetization

Temporary asset monetization through borrowing collectibles for exhibitions enables owners to generate income by lending rare items to museums, galleries, or events. This practice leverages the high demand for exclusive exhibits, transforming dormant assets into profitable opportunities without selling ownership.

Collectible Rental Yield

Collectible rental yield can generate significant income by lending valuable items to temporary exhibitions, with average returns ranging from 5% to 12% annually depending on the rarity and demand of the pieces. Investors maximize profits by strategically selecting high-profile events and leveraging appraisal values to set competitive rental rates.

Exhibit-Driven Revenue Sharing

Exhibit-driven revenue sharing allows collectors to earn income by lending valuable collectibles for temporary exhibitions, where profits generated from ticket sales or merchandising are shared between the lender and the exhibition organizer. This model leverages the appeal of rare items to enhance visitor experiences while providing collectors with a passive revenue stream tied directly to exhibition success.

Short-Term Collectibles Leasing

Short-term collectibles leasing allows museums and galleries to generate revenue by borrowing valuable items for temporary exhibitions, creating unique visitor experiences that increase ticket sales and sponsorship opportunities. This practice leverages the high demand for exclusive displays while minimizing ownership costs and risks associated with permanent acquisitions.

Museum Loan Profitization

Museums can generate revenue by borrowing collectibles for temporary exhibitions through loan fees, sponsorship deals, and increased ticket sales driven by exclusive displays. Strategic museum loan profitization leverages high-profile artifacts to attract visitors and partnerships that monetize the borrowing process efficiently.

Artifacts Liquidity Loan Model

The Artifacts Liquidity Loan Model enables collectors to generate income by temporarily lending valuable collectibles to exhibitions while retaining ownership, leveraging the demand for rare artifacts to produce steady cash flow without permanent sale. This model maximizes asset liquidity and market exposure, attracting institutions willing to pay premiums for exclusive, time-limited display rights.

Cultural Asset Revenue Stream

Borrowing collectibles for temporary exhibitions can generate significant revenue through ticket sales, sponsorships, and increased visitor engagement that boosts merchandise and concession income. Leveraging high-profile cultural assets attracts diverse audiences, enhances institutional reputation, and opens opportunities for exclusive partnerships and grants.

Pop-Up Exhibition Partnerships

Pop-up exhibition partnerships enable collectors to monetize their collectibles by lending them to temporary shows, generating income through exhibition fees and increased visibility. These partnerships leverage exclusive items to attract audiences, enhancing both the borrowing party's event appeal and the lender's financial benefits.

Collection Time-Sharing Economics

Borrowing collectibles for temporary exhibitions enables institutions to monetize underutilized assets by employing collection time-sharing economics, optimizing asset visibility while sharing maintenance costs. This model enhances revenue streams through strategic loan agreements and increased visitor engagement without permanent ownership.

moneytar.com

moneytar.com