What budget line items are most often underestimated? Infographic

What budget line items are most often underestimated? Infographic

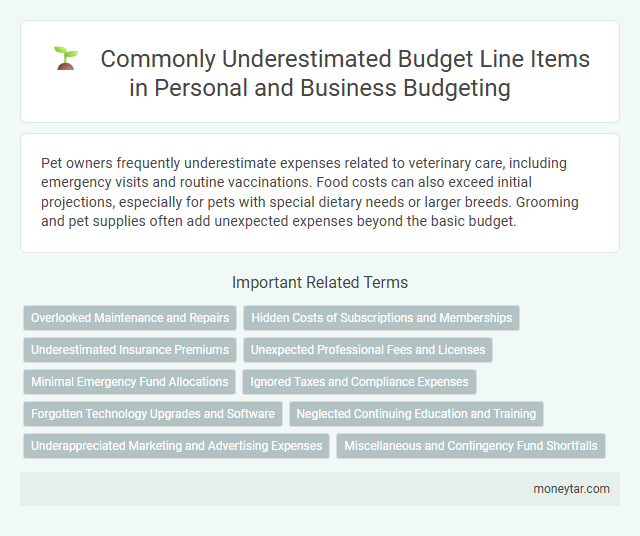

What budget line items are most often underestimated?

Pet owners frequently underestimate expenses related to veterinary care, including emergency visits and routine vaccinations. Food costs can also exceed initial projections, especially for pets with special dietary needs or larger breeds. Grooming and pet supplies often add unexpected expenses beyond the basic budget.

Overlooked Maintenance and Repairs

One of the most frequently underestimated budget line items is maintenance and repairs. Many budgets fail to allocate sufficient funds for unexpected wear and tear or routine upkeep.

Overlooked maintenance can lead to costly emergencies and equipment downtime. You should consider setting aside a dedicated budget line for regular repairs to avoid financial strain.

Hidden Costs of Subscriptions and Memberships

Which budget line items are most often underestimated in personal and business budgeting? Subscription and membership fees frequently incur hidden costs that many overlook. These charges, including automatic renewals and ancillary fees, can silently increase monthly expenses beyond initial estimates.

Underestimated Insurance Premiums

| Budget Line Item | Common Underestimation Reasons | Impact on Overall Budget |

|---|---|---|

| Insurance Premiums | Failing to account for annual increases, additional coverage needs, or policy changes | Leads to unexpected expenses that strain financial plans and reduce available funds |

When budgeting, underestimated insurance premiums often create financial gaps. Your budget should include potential premium hikes and new insurance requirements to avoid surprises.

Unexpected Professional Fees and Licenses

Unexpected professional fees, such as legal consultations or specialist services, are frequently underestimated in budgets. Licenses and permits often incur hidden costs that surpass initial estimates. You should allocate extra funds to these budget line items to avoid financial shortfalls.

Minimal Emergency Fund Allocations

Minimal emergency fund allocations are among the most frequently underestimated budget line items. Many individuals fail to account for unexpected expenses adequately, leading to financial strain during emergencies.

- Unexpected Medical Expenses - Often overlooked, medical emergencies can incur substantial costs beyond typical health insurance coverage.

- Home Repairs and Maintenance - Sudden repairs, such as plumbing or electrical issues, commonly exceed initial budget expectations.

- Job Loss or Income Reduction - Insufficient emergency funds leave individuals vulnerable to income disruptions without a financial buffer.

Accurately estimating minimal emergency fund allocations is crucial for maintaining financial stability and preparedness.

Ignored Taxes and Compliance Expenses

Ignored taxes frequently cause budget overruns due to their complex and varying nature across regions. Compliance expenses are often underestimated because companies overlook the continual costs of adhering to evolving regulations. Both categories require careful analysis to avoid unexpected financial shortfalls.

Forgotten Technology Upgrades and Software

Budgeting frequently overlooks critical expenses related to technology upgrades and software. These underestimated line items can significantly impact overall project costs and timelines.

- Hardware Replacement Costs - Organizations often forget to budget for essential technology upgrades, leading to outdated equipment that hampers productivity.

- Software Licensing Fees - Ongoing and renewal costs for software licenses are commonly underestimated or omitted from budgets.

- Integration and Compatibility Expenses - Costs associated with integrating new software or upgrading existing systems to maintain compatibility are frequently overlooked.

Neglected Continuing Education and Training

One of the most commonly underestimated budget line items is continuing education and training. Organizations frequently overlook the ongoing costs associated with skill development and certification renewal.

Neglecting this expense can lead to skill gaps and reduced employee performance over time. Training programs often require more resources than initially anticipated, including materials, instructor fees, and employee time away from work. Properly accounting for these costs ensures sustained workforce competency and long-term organizational growth.

Underappreciated Marketing and Advertising Expenses

Underestimating marketing and advertising expenses is a common budgeting pitfall that can disrupt overall financial planning. Your budget should realistically account for all related costs to avoid unexpected shortfalls.

- Creative Production Costs - Expenses for designing and producing ads, videos, and graphics often exceed initial estimates.

- Digital Advertising Spend - Costs for pay-per-click campaigns and social media ads frequently rise due to competitive bidding and targeting adjustments.

- Agency and Consultant Fees - Fees charged by marketing agencies or consultants are sometimes overlooked or underestimated in budgets.

Miscellaneous and Contingency Fund Shortfalls

Miscellaneous expenses are frequently underestimated in budgeting due to their unpredictable and varied nature. These small, often overlooked costs can accumulate, causing significant deviations from the original budget.

Contingency fund shortfalls are common when unforeseen events exceed allocated reserves. Inadequate contingency planning can lead to financial strain and disrupt project timelines.

Related Important Terms

Lifestyle Creep Allocations

Lifestyle creep allocations, such as discretionary spending on dining, entertainment, and luxury upgrades, are most often underestimated in budgets, leading to gradual overspending. These incremental increases in lifestyle expenses frequently outpace income growth, causing significant strain on overall financial planning.

Subscription Creep Fees

Subscription creep fees are frequently underestimated in budgeting due to their incremental monthly increases and multiple overlapping services that go unnoticed. Tracking recurring expenses and consolidating subscriptions can prevent unexpected budget overruns caused by these hidden charges.

“One-Time” Expense Buffer

One-time expenses such as equipment repairs, software upgrades, and unexpected consulting fees are frequently underestimated in budgeting, leading to financial shortfalls. Allocating a dedicated one-time expense buffer of at least 10-15% of the total budget provides essential flexibility to absorb these irregular but impactful costs.

Micro-transaction Tracking

Micro-transaction tracking often underestimates budget line items such as transaction fees, currency conversion costs, and platform service charges. Neglecting these expenses leads to inaccurate forecasting and impacts overall financial planning in digital budgeting strategies.

Maintenance Overlook Costs

Maintenance overlook costs are frequently underestimated in budget line items, leading to unexpected expenses that can exceed initial projections by 20-30%. Items such as routine equipment servicing, spare parts replacement, and unscheduled repairs often lack adequate funding, resulting in operational disruptions and inflated maintenance budgets.

Emergency Inflation Cushion

Emergency inflation cushions are frequently underestimated in budgets, often leading to significant shortfalls during periods of unexpected price increases. Commonly overlooked budget line items include fluctuating fuel costs, sudden spikes in utility expenses, and unexpected rises in raw material prices.

Sinking Fund Shortfalls

Sinking fund shortfalls are frequently underestimated due to insufficient allocation for future asset replacements and maintenance costs. Many budgets fail to accurately project inflation and unexpected repairs, leading to funding gaps that impact long-term financial stability.

Tax Season Surprises

Commonly underestimated budget line items during tax season include unexpected tax liabilities, such as self-employment taxes and underpaid estimated quarterly taxes, along with overlooked deductions and credits. Many taxpayers also fail to anticipate additional expenses like penalties, interest on late payments, and increased professional fees for complex tax filing assistance.

Hidden Fee Absorption

Hidden fee absorption is frequently underestimated in budgeting, often causing unexpected costs that impact overall financial planning; common budget line items affected include administrative fees, transaction charges, and third-party service costs. Accurately forecasting these hidden fees requires thorough vendor contract review and contingency allocation to prevent budget overruns.

Recurring Annual Renewals

Recurring annual renewals such as software subscriptions, licensing fees, and maintenance contracts are frequently underestimated in budgets, leading to unexpected financial strain. Failure to accurately forecast these recurring expenses often results in budget shortfalls that disrupt operational continuity.

moneytar.com

moneytar.com