Can credit repair companies legally erase legitimate debts? Infographic

Can credit repair companies legally erase legitimate debts? Infographic

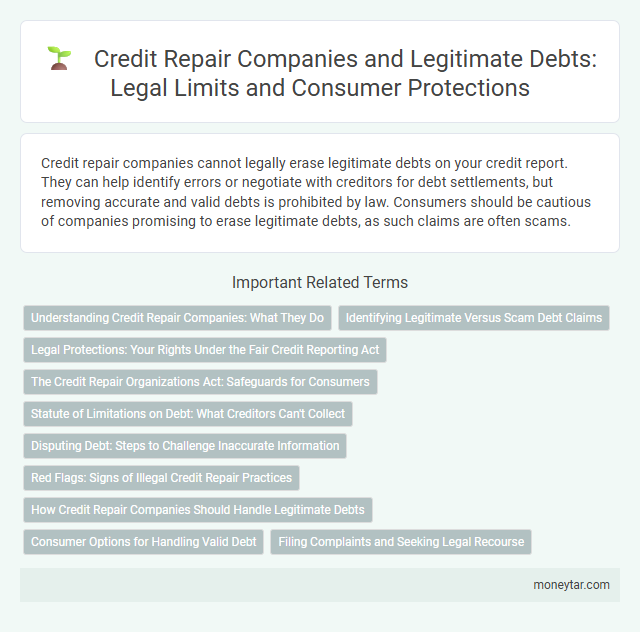

Can credit repair companies legally erase legitimate debts?

Credit repair companies cannot legally erase legitimate debts on your credit report. They can help identify errors or negotiate with creditors for debt settlements, but removing accurate and valid debts is prohibited by law. Consumers should be cautious of companies promising to erase legitimate debts, as such claims are often scams.

Understanding Credit Repair Companies: What They Do

Credit repair companies specialize in helping consumers address inaccuracies and errors on their credit reports. They analyze credit data to identify disputable items that may unjustly lower credit scores.

These companies cannot legally erase legitimate debts that are accurate and verifiable. Their role focuses on improving credit profiles by disputing false information rather than eliminating valid obligations.

Identifying Legitimate Versus Scam Debt Claims

Can credit repair companies legally erase legitimate debts? Credit repair companies cannot legally erase legitimate debts from your credit report. They may help dispute errors, but they cannot remove authentic debts that you owe.

How to identify legitimate versus scam debt claims? Legitimate debt claims are verified by proper documentation and creditor communication. Scam claims often lack validation and use aggressive tactics to pressure you.

What should you watch for to avoid debt repair scams? Be wary of companies promising to erase all your debts quickly or without proof. Legitimate services focus on correcting inaccuracies, not eliminating valid debts.

Legal Protections: Your Rights Under the Fair Credit Reporting Act

Credit repair companies cannot legally erase legitimate debts from your credit report. The Fair Credit Reporting Act (FCRA) provides specific protections to ensure the accuracy of credit information.

- Accurate Reporting - Creditors must report debt information truthfully and accurately; false claims can be disputed under the FCRA.

- Dispute Resolution - Consumers have the right to dispute incorrect or outdated debt entries, and credit bureaus must investigate within 30 days.

- Prohibition of Misrepresentation - Credit repair companies cannot legally remove valid debts by misrepresenting facts or using deceptive practices.

The Credit Repair Organizations Act: Safeguards for Consumers

Credit repair companies cannot legally erase legitimate debts according to federal law. The Credit Repair Organizations Act (CROA) provides essential protections for consumers engaging with these companies.

- Prohibition on False Promises - CROA prohibits credit repair organizations from making false claims about removing accurate negative information from credit reports.

- Mandatory Disclosures - Companies must provide written contracts detailing consumers' rights and the services to be performed before any work begins.

- Consumer Rights - Consumers have the right to cancel credit repair contracts within three business days without penalty under CROA.

Credit repair companies must comply with CROA, ensuring they cannot erase legitimate debts but can only assist in correcting inaccurate credit information.

Statute of Limitations on Debt: What Creditors Can't Collect

| Topic | Details |

|---|---|

| Credit Repair Companies and Legitimate Debts | Credit repair companies cannot legally erase legitimate debts. These companies may negotiate with creditors but cannot remove accurate debt information from credit reports if the debt is valid and verified. |

| Statute of Limitations on Debt | The statute of limitations sets a time limit during which creditors can sue to collect a debt. Once this period has expired, creditors lose the legal right to file a lawsuit to collect that debt. The duration varies by state and type of debt, ranging from 3 to 10 years in most cases. |

| What Creditors Can't Collect After Statute Expiry | Creditors cannot force payment through legal channels after the statute of limitations has expired. They can still attempt to collect the debt, but they cannot use the court system to compel repayment. |

| Your Rights | You have the right to dispute debts that are incorrectly reported and to be informed of the statute of limitations on your debts. Understanding this can prevent unnecessary payments towards outdated obligations. |

Disputing Debt: Steps to Challenge Inaccurate Information

Credit repair companies cannot legally erase legitimate debts from your credit report. They specialize in disputing inaccurate or unverifiable information that negatively impacts your credit score. Consumers should gather evidence, file disputes with credit bureaus, and follow up to ensure incorrect data is corrected or removed.

Red Flags: Signs of Illegal Credit Repair Practices

Credit repair companies cannot legally erase legitimate debts from your credit report. Removing accurate and verifiable debt information is against federal laws like the Fair Credit Reporting Act (FCRA).

Watch for red flags indicating illegal credit repair practices, such as promises to remove all negative information regardless of accuracy. Beware of companies asking for upfront fees before providing services. If a company advises you to dispute true debts or create a new credit identity, these are signs of fraudulent activity.

How Credit Repair Companies Should Handle Legitimate Debts

Credit repair companies cannot legally erase legitimate debts from a consumer's credit report. These companies must focus on disputing inaccurate or unverifiable information rather than removing valid debt entries. Consumers should work with credit repair companies that advise on effective debt management and timely payments to improve credit scores ethically.

Consumer Options for Handling Valid Debt

Credit repair companies cannot legally erase valid debts that you owe. These companies may help you identify errors on your credit report, but legitimate debts must be repaid or negotiated directly with creditors.

You have several consumer options for handling valid debt, including setting up payment plans or seeking debt management programs. Consulting a reputable credit counselor can provide guidance on managing and resolving your debt responsibly.

Filing Complaints and Seeking Legal Recourse

Credit repair companies cannot legally erase legitimate debts, but they can help identify errors on credit reports. Filing complaints and seeking legal recourse are essential steps when disputing inaccuracies or unfair credit practices.

- File Complaints with the CFPB - The Consumer Financial Protection Bureau accepts complaints about credit repair companies and debt collectors violating credit laws.

- Contact State Attorney General - Your state attorney general's office can provide resources and take action against fraudulent credit repair practices.

- Seek Legal Counsel - Consulting a consumer rights attorney ensures protection of your rights and guidance through debt disputes or credit report inaccuracies.

Related Important Terms

Credit Sweeping

Credit sweeping is a controversial practice that involves disputing accurate information on credit reports to remove legitimate debts, which credit repair companies cannot legally erase without proof of error or fraud. The Fair Credit Reporting Act mandates accurate reporting, preventing credit repair companies from legally eliminating valid debts through credit sweeping techniques.

Debt Validation Loophole

Credit repair companies cannot legally erase legitimate debts, but some exploit the Debt Validation Loophole by demanding creditors provide proof of the debt's validity, which if not furnished, can lead to removal of the debt from credit reports. The Fair Debt Collection Practices Act (FDCPA) requires debt collectors to validate debts upon request, creating opportunities for consumers to challenge unverifiable debts.

Artificial Deletion Claims

Credit repair companies cannot legally erase legitimate debts through artificial deletion claims, as the Fair Credit Reporting Act mandates accurate reporting of all valid debts. Attempting to remove accurate debt information fraudulently can lead to severe legal consequences for both the company and the consumer.

Zombie Debt Erasure

Credit repair companies cannot legally erase legitimate debts but may attempt to negotiate or validate claims, while zombie debt erasure targets outdated or invalid debts that creditors can no longer legally collect due to the statute of limitations. Zombie debts often result from old obligations that have been sold multiple times, allowing credit repair services to challenge or remove these from credit reports through dispute processes.

Tradeline Washing

Credit repair companies cannot legally erase legitimate debts outright, as Tradeline Washing involves the unlawful practice of adding unauthorized tradelines to a credit report to artificially boost credit scores. The Federal Trade Commission strictly prohibits Tradeline Washing because it misrepresents credit histories and violates fair credit reporting laws.

FCRA Exploitation

Credit repair companies cannot legally erase legitimate debts as the Fair Credit Reporting Act (FCRA) prohibits the removal of accurate and verifiable information from credit reports. Exploiting the FCRA by disputing valid debts or using deceptive tactics to manipulate credit reports constitutes fraud and can result in legal consequences for both the companies and consumers involved.

Metro 2 Dispute Abuse

Credit repair companies cannot legally erase legitimate debts as Metro 2 Dispute Abuse involves submitting false or misleading information on credit reports, which violates the Fair Credit Reporting Act (FCRA). The Consumer Financial Protection Bureau (CFPB) actively monitors and penalizes practices where credit repair firms exploit Metro 2 formats to fabricate disputes and erase valid debts.

Pay-for-Delete Schemes

Credit repair companies cannot legally erase legitimate debts but may negotiate pay-for-delete schemes where creditors remove negative information in exchange for payment. These arrangements are not guaranteed and can violate credit reporting regulations if misrepresented or improperly executed.

Credit Profile Number (CPN) Fraud

Credit repair companies cannot legally erase legitimate debts, and using a Credit Profile Number (CPN) to bypass accurate debt reporting constitutes fraud under federal law. The use of CPNs often involves falsifying credit information, which can result in severe legal consequences including fines and imprisonment.

Illegitimate Charge-off Removal

Credit repair companies cannot legally erase legitimate debts but may negotiate to dispute illegitimate charge-offs if errors or fraudulent activity are evident. Removing illegitimate charge-offs involves validating account accuracy with credit bureaus, ensuring compliance with the Fair Credit Reporting Act (FCRA).

moneytar.com

moneytar.com