Are digital product sales to customers in the EU subject to VAT? Infographic

Are digital product sales to customers in the EU subject to VAT? Infographic

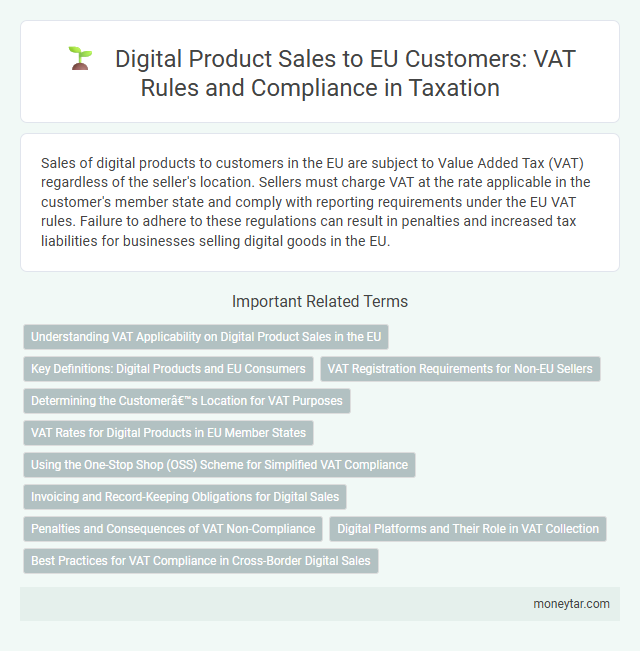

Are digital product sales to customers in the EU subject to VAT?

Sales of digital products to customers in the EU are subject to Value Added Tax (VAT) regardless of the seller's location. Sellers must charge VAT at the rate applicable in the customer's member state and comply with reporting requirements under the EU VAT rules. Failure to adhere to these regulations can result in penalties and increased tax liabilities for businesses selling digital goods in the EU.

Understanding VAT Applicability on Digital Product Sales in the EU

Digital product sales to customers in the European Union are subject to Value Added Tax (VAT) under EU VAT law. The place of consumption regulates VAT applicability, meaning VAT is charged based on the customer's location within the EU. Sellers must register for VAT in the EU or use the One Stop Shop (OSS) system to comply with tax collection and reporting requirements for digital goods.

Key Definitions: Digital Products and EU Consumers

Digital products refer to goods delivered electronically, such as software, e-books, music, and online services. These intangible items are accessed or downloaded by the customer without any physical distribution.

EU consumers are individuals or entities purchasing goods or services within European Union member states. These consumers are subject to specific VAT rules designed to ensure tax compliance across borders within the EU.

Sales of digital products to EU consumers are generally subject to Value Added Tax (VAT) based on the consumer's location, not the seller's. This rule ensures that VAT is paid in the country where the consumption occurs.

You must register for VAT in the relevant EU country or use the One-Stop Shop (OSS) scheme to simplify VAT reporting and payment on your digital product sales. Correct classification of digital products and identification of consumer location are crucial for compliance.

VAT Registration Requirements for Non-EU Sellers

Non-EU sellers supplying digital products to customers in the EU must comply with VAT registration requirements. These sellers are required to register for VAT in an EU member state or use the VAT One Stop Shop (OSS) scheme.

VAT registration is mandatory once a non-EU seller exceeds the EU-wide threshold of EUR10,000 in digital sales to consumers. Registration ensures proper VAT collection and remittance at the applicable rates in each customer's EU country. The OSS scheme simplifies compliance by allowing sellers to file a single VAT return for all EU sales instead of registering in each member state.

Determining the Customer’s Location for VAT Purposes

Determining the customer's location is crucial for applying VAT to digital product sales in the EU. The location dictates whether VAT must be charged and at what rate.

You must identify where the customer resides or uses the digital product, using reliable evidence such as IP addresses, billing details, or bank information. This ensures compliance with EU VAT rules and accurate tax reporting.

VAT Rates for Digital Products in EU Member States

Digital product sales to customers in the EU are subject to Value Added Tax (VAT) under EU VAT rules. VAT rates for digital products vary among EU Member States, typically ranging from 17% to 27%. Businesses must apply the VAT rate of the customer's country for digital goods like e-books, software, and streaming services.

Using the One-Stop Shop (OSS) Scheme for Simplified VAT Compliance

Are digital product sales to customers in the EU subject to VAT under the One-Stop Shop (OSS) scheme? The OSS scheme allows businesses to report and pay VAT for all EU digital sales through a single VAT return, simplifying compliance. You can avoid registering for VAT in each EU country by using the OSS to manage your VAT obligations efficiently.

Invoicing and Record-Keeping Obligations for Digital Sales

Digital product sales to customers in the EU are subject to VAT, requiring strict adherence to invoicing and record-keeping rules. Proper documentation ensures compliance with EU tax authorities and facilitates accurate VAT reporting.

- Invoice Requirements - Each digital sale must include an invoice showing the VAT amount charged, buyer's location, and the VAT rate applied according to EU rules.

- Retention Period - You are obligated to keep all digital sales records and related invoices for at least 10 years as mandated by EU VAT legislation.

- Proof of Customer Location - Documentation supporting the customer's EU country of residence is essential to apply the correct VAT rate and must be stored securely.

Penalties and Consequences of VAT Non-Compliance

Sales of digital products to customers in the EU are subject to Value Added Tax (VAT) regulations, requiring sellers to comply strictly with VAT rules. Failure to comply with VAT obligations can result in significant penalties and legal consequences for businesses.

- Financial Penalties - Non-compliance with VAT rules often leads to hefty fines imposed by tax authorities across EU member states.

- Legal Action - Persistent failure to declare or pay VAT can result in legal proceedings including prosecution and potential business restrictions.

- Reputation Damage - Businesses that violate VAT regulations risk losing customer trust and damaging their reputation in the European market.

Digital Platforms and Their Role in VAT Collection

| Topic | Details |

|---|---|

| Digital Product Sales in the EU | Sales of digital products such as software, e-books, online courses, and streaming services to customers in the European Union are subject to Value Added Tax (VAT). The VAT applies regardless of the seller's location, provided the customer is based in the EU. |

| VAT Rules for Digital Products | EU VAT regulations require sellers to charge VAT based on the customer's member state. The VAT rate corresponds to the rate applicable in the customer's country, ensuring tax compliance and uniformity across the EU. |

| Role of Digital Platforms | Digital platforms that facilitate the sale of digital products act as intermediaries and are often responsible for VAT collection and remittance. These platforms streamline VAT compliance for both sellers and tax authorities. |

| Digital Platforms and VAT Collection Obligations | Under EU rules, marketplaces and digital platforms may be deemed the supplier of the digital product for VAT purposes. This shifts the VAT collection and payment responsibility from the individual seller to the platform, simplifying tax administration. |

| Benefits of Platform VAT Collection | Platforms collecting VAT ensure accurate tax reporting, reduce the risk of VAT evasion, and improve transparency. This also helps small sellers avoid complex VAT registration in multiple EU countries. |

| Summary | Digital product sales to EU customers are subject to VAT based on the customer's location. Digital platforms play a crucial role in collecting and remitting VAT, supporting compliance and reducing administrative burdens for sellers. |

Best Practices for VAT Compliance in Cross-Border Digital Sales

Sales of digital products to customers in the EU are subject to VAT according to the destination principle, where VAT is charged based on the buyer's location. Compliance with VAT rules requires accurate determination of customer location and correct VAT rates application.

- Accurate Customer Location Identification - Use reliable IP geolocation and billing address verification to determine the appropriate VAT rate for each EU customer.

- Registration in Relevant EU Member States - Register for VAT or use the One Stop Shop (OSS) scheme to simplify filing and payment obligations across multiple EU countries.

- Maintain Comprehensive Sales Records - Keep detailed invoices and transaction logs to support VAT reporting and facilitate audits by tax authorities.

Implementing these best practices ensures compliance with EU VAT regulations and minimizes risk in cross-border digital product sales.

Related Important Terms

MOSS (Mini One Stop Shop)

Sales of digital products to customers in the EU are subject to VAT, requiring sellers to charge VAT based on the customer's location. The Mini One Stop Shop (MOSS) scheme simplifies VAT reporting by allowing businesses to declare and pay VAT for all EU member states through a single online portal.

OSS (One Stop Shop)

Sales of digital products to customers in the EU are subject to VAT and can be efficiently managed through the One Stop Shop (OSS) system, which simplifies VAT reporting by allowing businesses to declare and pay VAT for all EU member states in a single return. Using OSS reduces administrative burden and ensures compliance with varying VAT rates across different EU countries.

Place of Supply Rules

Digital product sales to customers in the EU are subject to VAT based on the Place of Supply rules, which determine VAT jurisdiction according to the customer's location rather than the seller's. Under these rules, businesses must charge VAT at the rate applicable in the customer's EU member state, ensuring compliance with local tax regulations.

VAT Reverse Charge Mechanism

Sales of digital products to customers in the EU generally require VAT to be charged based on the customer's location, with the VAT Reverse Charge Mechanism applying primarily to B2B transactions, shifting the VAT payment responsibility from the supplier to the business customer. This mechanism simplifies cross-border VAT compliance by allowing the business buyer to self-account for VAT, eliminating the need for the supplier to register for VAT in each EU member state.

Digital Services VAT Threshold

Sales of digital products to customers in the EU are subject to VAT and must comply with the Digital Services VAT Threshold, which requires businesses to register and charge VAT in each EU member state once their sales exceed EUR10,000 annually. This threshold applies to all cross-border digital services, ensuring that VAT is collected based on the customer's location rather than the seller's.

Electronically Supplied Services (ESS)

Sales of digital products classified as Electronically Supplied Services (ESS) to customers in the EU are subject to VAT based on the customer's location, requiring businesses to charge VAT at the applicable rate in the customer's EU member state. The VAT rules mandate registration and compliance with the EU's Mini One Stop Shop (MOSS) system or its successor, the One Stop Shop (OSS), to facilitate VAT reporting and payment across multiple EU jurisdictions.

VAT Identification Number (VATIN)

Sales of digital products to customers in the EU require sellers to collect VAT based on the customer's location unless the customer provides a valid VAT Identification Number (VATIN) proving business status. Verification of the VATIN enables sellers to apply the reverse charge mechanism, shifting VAT reporting responsibility to the buyer and avoiding double taxation.

Non-Union OSS Scheme

Sales of digital products to customers in EU member states under the Non-Union One-Stop Shop (OSS) scheme are subject to VAT based on the customer's location, requiring sellers outside the EU to register and report VAT through the OSS portal. This system simplifies VAT compliance by allowing non-EU businesses to declare and pay VAT for all applicable EU sales in a single quarterly return.

VAT Intermediary Platform

Sales of digital products to customers in the EU are subject to VAT, with the VAT Intermediary Platform acting as the responsible party for VAT collection and remittance under the EU VAT rules for digital services. This mechanism simplifies compliance by shifting VAT obligations from individual sellers to the platform facilitating the transaction, ensuring proper tax treatment across member states.

EU VAT Package for Digital Goods

Sales of digital products to customers in the EU are subject to VAT under the EU VAT Package for Digital Goods, which requires suppliers to charge VAT based on the customer's location. This framework ensures consistent tax compliance by applying VAT rates corresponding to each EU member state where the digital service is consumed.

moneytar.com

moneytar.com