Can I deduct meal expenses while delivering for DoorDash? Infographic

Can I deduct meal expenses while delivering for DoorDash? Infographic

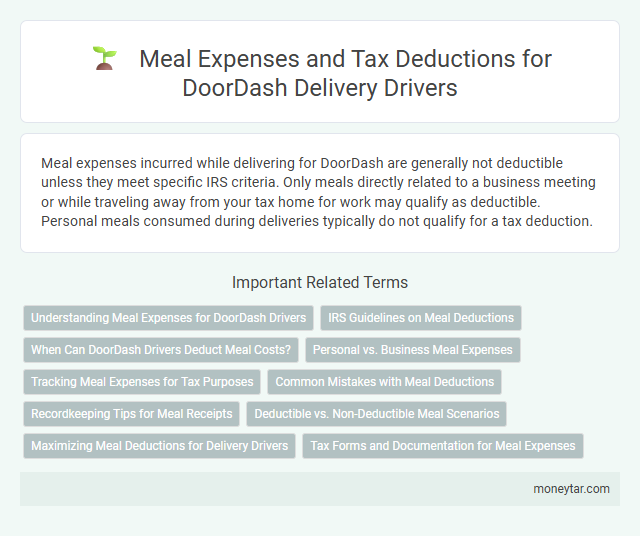

Can I deduct meal expenses while delivering for DoorDash?

Meal expenses incurred while delivering for DoorDash are generally not deductible unless they meet specific IRS criteria. Only meals directly related to a business meeting or while traveling away from your tax home for work may qualify as deductible. Personal meals consumed during deliveries typically do not qualify for a tax deduction.

Understanding Meal Expenses for DoorDash Drivers

| Topic | Details |

|---|---|

| Meal Expense Deduction Eligibility | Meal expenses are generally deductible only if they qualify as business-related and meet IRS criteria. DoorDash drivers can deduct meal expenses when the meals are necessary for conducting deliveries away from their tax home. |

| IRS Guidelines for Meals | The IRS requires that meal expenses must be ordinary, necessary, and directly related to business activities. For DoorDash drivers, meals consumed during a workday away from home may qualify if they maintain a temporary work location. |

| Temporary Work Location Definition | A temporary work location means a place where the driver works away from their main tax home and for a limited time. Meals purchased while delivering at such locations can be partially deductible. |

| Meal Expense Deduction Limits | Typically, only 50% of the meal expenses that meet IRS criteria can be deducted. Drivers must keep accurate records, including receipts and documentation of the business purpose. |

| Non-Deductible Meal Expenses | Meals that are considered personal or routine daily expenses, such as regular groceries or meals at home, are not deductible for DoorDash drivers. |

| Record-Keeping Recommendations | Maintain detailed records of all meal expenses, including date, cost, location, and relevance to delivery work. Use mileage and delivery logs to support the business purpose of meals. |

| Summary | DoorDash drivers can deduct meal expenses if the meals are directly tied to business and occur away from their tax home. Compliance with IRS documentation and deduction limits is essential for claiming meal expenses. |

IRS Guidelines on Meal Deductions

The IRS allows meal expense deductions for individuals delivering for DoorDash only if the meals are incurred during business travel or while away from your tax home. Meals must be ordinary, necessary, and directly related to the business activity to qualify for deductions. Keeping detailed records and receipts is essential to substantiate these meal expenses under IRS guidelines.

When Can DoorDash Drivers Deduct Meal Costs?

Meal expenses can be deductible for DoorDash drivers only under specific circumstances related to work. Understanding when these costs qualify helps maximize your tax deductions accurately.

- Meals must be incurred during business travel - Meals are deductible when you are traveling away from your tax home for work purposes and need to stop for sustenance.

- Meals during extended work hours - If work hours significantly exceed your normal schedule, the cost of meals may be deductible as necessary expenses.

- Personal meals are not deductible - Regular meals consumed during short breaks or at home do not qualify for deductions according to IRS guidelines.

Personal vs. Business Meal Expenses

Meal expenses incurred while delivering for DoorDash can be deductible if they qualify as business expenses. Personal meal costs, however, are generally not deductible unless directly related to business activities.

The IRS allows deductions for meals when traveling or working away from home under specific conditions. It is important to separate personal meal expenses from those necessary for performing DoorDash delivery services to ensure compliance.

Tracking Meal Expenses for Tax Purposes

DoorDash delivery drivers can deduct meal expenses if they are directly related to their delivery work and meet IRS guidelines for business meals. It is essential to keep detailed records, including receipts, dates, and the business purpose of each meal. Using a mileage and expense tracking app can simplify documenting meal expenses to maximize tax deductions.

Common Mistakes with Meal Deductions

Meal expenses for DoorDash deliveries can be deducted under specific IRS guidelines. Understanding common mistakes helps ensure accurate tax reporting and maximized deductions.

- Claiming meals not related to work - Only meals consumed during delivery hours qualify for deductions, not personal or unrelated meals.

- Forgetting to keep detailed records - Without receipts or mileage logs, meal expense deductions may be disallowed by the IRS.

- Misinterpreting the 50% deduction limit - Meal expenses are typically deductible up to 50%, not 100%, unless the IRS states otherwise for special cases.

Properly tracking meal expenses and understanding IRS rules can prevent deductible errors while delivering for DoorDash.

Recordkeeping Tips for Meal Receipts

Can I deduct meal expenses while delivering for DoorDash? Meal expenses during DoorDash deliveries can be deductible if they meet IRS criteria for business expenses. Keeping detailed records and receipts is crucial to support your deduction claims.

How should I keep records for meal receipts? Organize all meal receipts by date and categorize them under delivery-related expenses. Use a digital app or physical folder to store receipts and note the purpose of each expense to ensure accuracy during tax filing.

Deductible vs. Non-Deductible Meal Scenarios

Meal expenses during DoorDash deliveries may be partially deductible depending on the situation. Understanding deductible versus non-deductible meal scenarios is essential for accurate tax reporting.

- Deductible Meal Expenses - Meals purchased during overnight travel for deliveries may be deductible if they meet IRS meal allowance guidelines.

- Non-Deductible Personal Meals - Meals consumed during regular working hours that are not required for travel typically cannot be deducted.

- Record Keeping - Keeping detailed receipts and notes about the purpose of each meal helps distinguish deductible from non-deductible expenses.

Maximizing Meal Deductions for Delivery Drivers

Delivery drivers for DoorDash can deduct meal expenses under specific IRS guidelines, primarily when the meal is directly related to business activities. To maximize these deductions, drivers must ensure the expenses are reasonable and incurred during delivery hours.

Keeping detailed records of all meal purchases, including receipts and times, strengthens the validity of these deductions. Utilizing apps or expense tracking tools helps document and categorize meals as business expenses efficiently.

Tax Forms and Documentation for Meal Expenses

Meal expenses incurred while delivering for DoorDash may be deductible if they meet IRS guidelines. Proper documentation is essential to substantiate these deductions on your tax return.

Keep detailed records of each meal expense, including the date, amount, and business purpose. Use IRS Form 1040 Schedule C to report your income and deductible expenses from DoorDash delivery. Retain receipts and mileage logs to support your meal expense claims in case of an audit.

Related Important Terms

Gig economy meal deduction

Meal expenses incurred during DoorDash deliveries qualify as deductible business expenses when they are necessary and directly related to the delivery service, typically limited to meals consumed during working hours away from home. Proper documentation, including receipts and records of delivery dates and locations, is essential to maximize deductions while complying with IRS guidelines for gig economy workers.

DoorDash delivery tax write-off

Meal expenses incurred while delivering for DoorDash are generally deductible only if they meet the IRS criteria for business meals, which requires the meal to be directly related to the delivery work and not lavish or extravagant. Drivers should keep detailed records and receipts to substantiate any meal expense deductions on their tax returns to maximize DoorDash delivery tax write-offs.

On-shift food expense allowance

Meal expenses incurred during DoorDash deliveries are generally deductible as on-shift food expenses if they meet IRS criteria for business-related costs, such as being necessary and directly related to your delivery work. To qualify, keep detailed records of each meal expense and demonstrate that these costs were incurred during active delivery hours for accurate tax deductions.

IRS Schedule C food expense

Meal expenses incurred while delivering for DoorDash can be partially deducted on IRS Schedule C as business expenses, but only 50% of the cost is generally allowed. To qualify, expenses must be directly related to your delivery service, properly documented with receipts, and recorded in your business records.

Self-employed meal reimbursement

Self-employed DoorDash drivers can deduct 50% of meal expenses incurred while delivering, provided the meals are ordinary and necessary for business purposes. Maintaining detailed receipts and records of delivery times and locations is essential to substantiate these meal deductions during tax filing.

50% meal deduction rule (gig drivers)

Meal expenses incurred while delivering for DoorDash are subject to the IRS's 50% meal deduction rule, allowing gig drivers to deduct only half of their eligible meal costs. To qualify, meals must be directly related to the delivery work, and drivers should keep detailed records including receipts and timestamps to substantiate their deductions.

Delivery driver sustenance deduction

Delivery drivers for DoorDash can deduct meal expenses only if the meals are directly related to their work hours and incurred while on delivery routes, following IRS rules for business meal deductions. Keeping detailed records and receipts is essential to substantiate the sustenance deduction under IRS Publication 463 guidelines.

DoorDash operational expense (meals)

Meal expenses incurred during active delivery shifts for DoorDash are generally considered non-deductible personal expenses by the IRS, as they are viewed as personal meals rather than business expenses. DoorDash drivers can only deduct meal costs if they meet the criteria of being directly related to business activities, such as meals during overnight travel or while attending business meetings.

Tax home definition for dashers

For DoorDash drivers, the IRS defines a tax home as the general area or city where the driver regularly conducts their delivery activities; meal expenses are deductible only if incurred while away from this tax home for an extended period. Expenses incurred during routine local deliveries within the tax home are generally considered personal and non-deductible under IRS guidelines.

Temporary work location meal deduction

Meal expenses incurred while delivering for DoorDash can be partially deductible if the driver's temporary work location qualifies as a temporary work assignment under IRS rules, typically lasting less than one year. Deductible meals must be directly related to the delivery work performed away from the taxpayer's tax home, ensuring adherence to the 50% limit on business meal expense deductions.

moneytar.com

moneytar.com