Are proceeds from digital yard sales (Facebook Marketplace, etc.) taxable? Infographic

Are proceeds from digital yard sales (Facebook Marketplace, etc.) taxable? Infographic

Are proceeds from digital yard sales (Facebook Marketplace, etc.) taxable?

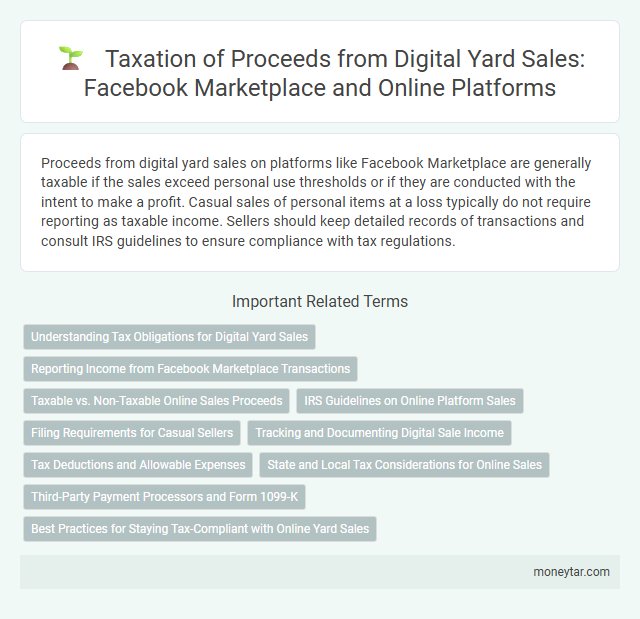

Proceeds from digital yard sales on platforms like Facebook Marketplace are generally taxable if the sales exceed personal use thresholds or if they are conducted with the intent to make a profit. Casual sales of personal items at a loss typically do not require reporting as taxable income. Sellers should keep detailed records of transactions and consult IRS guidelines to ensure compliance with tax regulations.

Understanding Tax Obligations for Digital Yard Sales

| Topic | Details |

|---|---|

| Definition of Digital Yard Sales | Sales of personal items through online platforms such as Facebook Marketplace, eBay, and similar digital marketplaces. |

| Taxability of Proceeds | Proceeds from casual sales of personal items are generally not taxable income if sold for less than the original purchase price. |

| When Proceeds Become Taxable | If items are sold for more than the original cost, the difference may be considered taxable capital gains income. Consistent selling as a business may require reporting all income. |

| IRS Reporting Requirements | Occasional sellers typically do not need to report income from digital yard sales. Frequent sellers or those operating as businesses must report income using Schedule C and may receive Form 1099-K from payment platforms. |

| Business vs Personal Sales | Regular sales, inventory purchase for resale, and profit motive indicate a business activity, which is subject to income tax and self-employment tax obligations. |

| Record Keeping | Maintaining detailed records of purchases, sales prices, and expenses related to online sales is essential for accurate tax filing and substantiating reported income or losses. |

| State Tax Considerations | Some states impose sales tax collection responsibilities on online sellers. Verify local regulations on sales tax reporting and remittance for digital yard sale proceeds. |

| Summary | Proceeds from digital yard sales are typically non-taxable if selling personal used goods at a loss or break-even. Taxation applies when selling above purchase price or operating as a business, requiring income reporting and possible sales tax collection. |

Reporting Income from Facebook Marketplace Transactions

Proceeds from digital yard sales on platforms like Facebook Marketplace may be taxable income depending on the nature of the transactions. It is important to understand reporting requirements to comply with tax regulations.

- Taxable Income Thresholds - Income from sales that exceed personal use exemptions must be reported to tax authorities.

- Record Keeping - Maintaining detailed records of each transaction ensures accurate reporting and supports tax filings.

- IRS Reporting Requirements - The IRS may require reporting of gross receipts from sales made through third-party networks such as Facebook Marketplace.

You should review IRS guidelines to determine how to report income from digital yard sales properly.

Taxable vs. Non-Taxable Online Sales Proceeds

Proceeds from digital yard sales on platforms like Facebook Marketplace are generally non-taxable if you sell personal items at a loss or break even. If you sell items for more than the original purchase price or engage in frequent sales as a business, those proceeds become taxable income. Understanding the distinction between casual sales and business activity is crucial for proper tax reporting.

IRS Guidelines on Online Platform Sales

The IRS treats income from digital yard sales on platforms like Facebook Marketplace as taxable if the activity is frequent or for profit. Casual sales of personal items typically do not require reporting unless sold above original purchase price.

- Taxable Income Reporting - Income from online sales must be reported if transactions are part of a business or profit-driven activity.

- Form 1099-K Thresholds - Platforms report sellers to the IRS using Form 1099-K when sales exceed $600 in aggregate per year starting 2023.

- Personal Use Exemptions - Selling used personal property at a loss generally is not taxable and does not require IRS reporting.

Filing Requirements for Casual Sellers

Proceeds from digital yard sales on platforms like Facebook Marketplace may be subject to taxation depending on the total amount sold and the frequency of sales. Casual sellers are generally required to report income if sales exceed the IRS threshold for payment transactions.

Your filing requirements depend on whether you received a Form 1099-K from the platform and if your total sales surpass $600 in a calendar year. Even without a 1099-K, all income from casual sales must be reported on your tax return to remain compliant.

Tracking and Documenting Digital Sale Income

Proceeds from digital yard sales on platforms like Facebook Marketplace are considered taxable income by the IRS. It is essential to keep detailed records of all transactions, including sale amounts, dates, and item descriptions. Proper documentation ensures accurate reporting on tax returns and facilitates compliance with tax regulations.

Tax Deductions and Allowable Expenses

Proceeds from digital yard sales on platforms like Facebook Marketplace are generally considered taxable income if you regularly sell items for profit. You must report these earnings on your tax return even if the transactions appear informal.

Relevant tax deductions may include the original purchase price of items sold, shipping costs, and platform fees. Keeping detailed records of these allowable expenses helps reduce your taxable income effectively.

State and Local Tax Considerations for Online Sales

Proceeds from digital yard sales, such as those conducted on Facebook Marketplace, may be subject to state and local tax laws depending on the jurisdiction. Sellers should be aware of the specific tax regulations that apply to online sales in their state or locality to ensure compliance.

- State Sales Tax Obligations - Many states require sellers to collect and remit sales tax on online transactions, including digital yard sale proceeds, if sales exceed a certain threshold.

- Local Tax Requirements - Local governments may impose additional taxes or registration requirements on online sales, impacting digital yard sale sellers within those jurisdictions.

- Reporting and Recordkeeping - Sellers must maintain detailed records of digital yard sale transactions to properly report income and comply with state and local tax regulations.

Third-Party Payment Processors and Form 1099-K

Are proceeds from digital yard sales on platforms like Facebook Marketplace taxable? Sales made through third-party payment processors such as PayPal or Venmo may generate Form 1099-K if transactions exceed IRS thresholds. Sellers should report income accurately to avoid potential tax liabilities related to these digital sales.

Best Practices for Staying Tax-Compliant with Online Yard Sales

Proceeds from digital yard sales on platforms like Facebook Marketplace may be taxable depending on your total income and frequency of sales. Reporting these earnings ensures compliance with tax laws and helps avoid penalties.

Keep detailed records of all transactions, including dates, items sold, and amounts received. Understand the difference between occasional personal sales and business activity, as tax obligations vary. Consult IRS guidelines or a tax professional to stay informed about thresholds and reporting requirements for online sales.

Related Important Terms

Digital Garage Sale Income

Proceeds from digital garage sales on platforms like Facebook Marketplace are generally considered taxable income by the IRS, as they may be classified under casual sales or business income depending on volume and intent. Sellers must report income exceeding their cost basis and keep detailed records of transactions to ensure accurate tax filing and compliance.

Online Marketplace Taxation

Proceeds from digital yard sales on platforms like Facebook Marketplace are generally taxable if the activity constitutes a business or generates significant profit, requiring reporting as income to the IRS. Casual sales of personal items at a loss typically do not trigger tax liability, but consistent sales or profit-making ventures may fall under online marketplace taxation regulations.

Hobbyist Resale Gains

Proceeds from digital yard sales on platforms like Facebook Marketplace are generally not taxable if conducted as hobbyist resale gains, since the IRS does not consider occasional personal sales as taxable income unless the activity is pursued with an intent to make a profit. However, frequent or substantial sales may classify the activity as a business, requiring reporting of income and expenses on tax returns.

Occasional Seller Rule

Proceeds from digital yard sales on platforms like Facebook Marketplace are generally not taxable under the IRS Occasional Seller Rule, which exempts casual sellers from reporting income if sales are infrequent and items sold are personal use property. However, consistent or profit-driven selling activities may classify the seller as a business, triggering tax reporting and liability for income and self-employment taxes.

Peer-to-Peer Sale Reporting

Proceeds from digital yard sales conducted through platforms like Facebook Marketplace are generally considered taxable income and must be reported under peer-to-peer sale reporting requirements established by the IRS. Sellers receiving payments via third-party networks may also receive Form 1099-K if thresholds of $600 or more in gross payments are met, necessitating accurate income declaration for compliance.

1099-K Threshold Updates

Proceeds from digital yard sales on platforms like Facebook Marketplace may be taxable if they exceed the updated 1099-K reporting threshold of $600 in gross payments, effective from the 2023 tax year. Sellers meeting or surpassing this threshold receive a Form 1099-K, which the IRS uses to track income and ensure accurate tax reporting.

Platform Payment Tracking

Proceeds from digital yard sales on platforms like Facebook Marketplace may be taxable if payments are tracked through platform payment systems such as Facebook Pay, which report transactions to the IRS using Form 1099-K when thresholds are met. Sellers should monitor transaction amounts and reporting requirements to ensure compliance with tax regulations related to platform payment tracking.

Cost Basis Documentation

Proceeds from digital yard sales on platforms like Facebook Marketplace are taxable when items sold exceed their cost basis, requiring accurate cost basis documentation to determine taxable gains. Maintaining receipts, purchase records, and proof of value is essential for calculating the difference between the original purchase price and the sale price for proper tax reporting.

Personal Item Depreciation

Proceeds from digital yard sales on platforms like Facebook Marketplace are generally not taxable if items are sold for less than their original purchase price due to personal item depreciation. Selling used personal property at a loss typically does not trigger taxable income, as the IRS considers such transactions non-income events.

Casual Seller Safe Harbor

Proceeds from digital yard sales on platforms like Facebook Marketplace are generally not taxable under the IRS Casual Seller Safe Harbor if the items sold were used personal belongings and sales do not exceed $600 in a year. This exemption excludes gains from transactions conducted as a business or those involving new inventory purchased primarily for resale.

moneytar.com

moneytar.com