Can I deduct expenses for a YouTube channel? Infographic

Can I deduct expenses for a YouTube channel? Infographic

Can I deduct expenses for a YouTube channel?

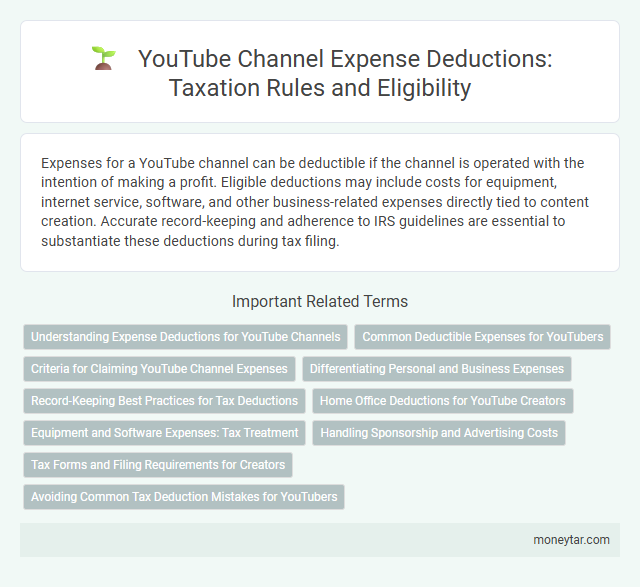

Expenses for a YouTube channel can be deductible if the channel is operated with the intention of making a profit. Eligible deductions may include costs for equipment, internet service, software, and other business-related expenses directly tied to content creation. Accurate record-keeping and adherence to IRS guidelines are essential to substantiate these deductions during tax filing.

Understanding Expense Deductions for YouTube Channels

Expense deductions for a YouTube channel depend on its nature and usage related to income generation. Proper understanding of tax rules ensures valid claims for deductible costs linked to content creation.

- Business vs Hobby Classification - Only expenses for channels operated as a business with intent to earn profit are deductible according to IRS guidelines.

- Qualified Deductible Expenses - Costs such as equipment, software, internet fees, and advertising directly tied to channel operations are eligible for deduction.

- Documentation and Record-Keeping - Maintaining accurate records and receipts is essential for substantiating expense claims during tax filing.

Common Deductible Expenses for YouTubers

Tax deductions for YouTube channel expenses are often available if the channel generates income. Many common expenses qualify as deductible costs when properly documented.

- Equipment Costs - Cameras, microphones, lighting, and computers used for content creation can be deducted.

- Software and Subscriptions - Editing software, royalty-free music, and cloud storage services directly related to the channel qualify as expenses.

- Home Office Expenses - A portion of rent, utilities, and internet bills may be deducted if a dedicated space is used for video production.

Criteria for Claiming YouTube Channel Expenses

Claiming expenses for a YouTube channel depends on meeting specific criteria established by tax authorities. Proper documentation and a clear business purpose are essential to qualify for deductions.

- Business Purpose - Expenses must be directly related to the operation and growth of the YouTube channel as a business activity.

- Ordinary and Necessary - Costs should be common and accepted in the content creation industry to qualify for deduction.

- Record Keeping - Maintaining receipts, invoices, and logs is required to substantiate expense claims during tax filing.

Meeting these criteria helps ensure eligible YouTube channel expenses can be deducted in compliance with tax laws.

Differentiating Personal and Business Expenses

| Expense Type | Description | Tax Deductible? | Examples |

|---|---|---|---|

| Business Expenses | Costs incurred directly for operating a YouTube channel as a source of income or business activity | Yes, fully deductible | Camera equipment, editing software subscriptions, advertising fees, internet costs (proportionate), home office expenses (if exclusively used) |

| Personal Expenses | Costs related to personal use or activities not linked to generating income from the channel | No, not deductible | Personal internet use, leisure filming, unrelated electronic devices |

| Mixed-Use Expenses | Expenses that serve both personal and business purposes | Deductible only for the business-use portion | Internet bills, cell phone plans, electricity bills |

| Record Keeping | Importance of maintaining detailed and accurate records to support deductions | Required for validation by tax authorities | Receipts, invoices, usage logs, mileage records |

| IRS Guidelines | Regulations defining deductible business expenses for self-employed creators | Expenses must be ordinary and necessary | Publication 535, IRS rulings on business deductions |

Record-Keeping Best Practices for Tax Deductions

Maintaining accurate records is essential for maximizing tax deductions related to a YouTube channel. Proper documentation supports all claimed expenses and helps avoid issues during tax audits.

Keep detailed receipts and invoices for equipment, software, and home office costs. Use accounting software or spreadsheets to track income and expenses consistently. Organize records by date and category to ensure easy access when filing taxes or responding to inquiries from tax authorities.

Home Office Deductions for YouTube Creators

YouTube creators can deduct home office expenses if they use a specific area of their home exclusively and regularly for their channel activities. Eligible deductions include a portion of rent, utilities, and internet costs based on the percentage of the home used for the business.

To qualify, the space must be the principal place for editing videos, planning content, or managing the channel's operations. Accurate records and calculations are essential to support the home office deduction claim on the tax return.

Equipment and Software Expenses: Tax Treatment

Expenses for equipment and software used in a YouTube channel are generally deductible as business expenses if the channel operates for profit. Deductible items include cameras, microphones, editing software, and subscriptions directly related to content creation. Proper documentation and a clear business purpose are essential to claim these deductions on your tax return.

Handling Sponsorship and Advertising Costs

Expenses related to sponsorship and advertising for a YouTube channel can often be deducted if they are ordinary and necessary for the business. Costs such as sponsored content production, promotional materials, and paid advertisements directly tied to channel growth qualify as deductible business expenses. Proper documentation and clear separation from personal expenses are essential to ensure these deductions meet tax regulations.

Tax Forms and Filing Requirements for Creators

Expenses related to running a YouTube channel can be deductible if the channel is operated as a business. Common deductible expenses include equipment costs, software, internet fees, and marketing expenses.

Filing requirements for creators often involve Schedule C (Form 1040) to report income and expenses. Keeping detailed records supports accurate reporting and ensures compliance with IRS rules for self-employed individuals.

Avoiding Common Tax Deduction Mistakes for YouTubers

Can expenses for a YouTube channel be deducted on your tax return? Tax authorities allow deduction of ordinary and necessary expenses directly related to content creation and channel management. Common mistakes include failing to properly separate personal from business expenses and neglecting to keep detailed records for all transactions.

Related Important Terms

Creator Deduction

Creators can deduct ordinary and necessary business expenses related to their YouTube channel, including equipment, software, internet costs, and home office expenses, provided the channel generates income or is intended to do so. The IRS requires detailed records and proof that the activity is pursued for profit to qualify for these deductions under Schedule C or as self-employed income.

Content Production Write-Off

Expenses directly related to content production for a YouTube channel, such as camera equipment, editing software, and studio costs, can be deducted as business expenses if the channel is monetized and aimed at generating income. Accurate record-keeping and proof of expense relevance are essential to ensure compliance with IRS regulations for allowable write-offs.

Digital Asset Depreciation

Expenses related to a YouTube channel can be deducted if they are ordinary and necessary for generating income, including costs for equipment and software. Depreciation applies to digital assets such as computers and cameras used for content creation, allowing you to deduct a portion of their cost over their useful life according to IRS guidelines.

Home Studio Deduction

Expenses for a home studio used exclusively and regularly for creating YouTube content can qualify as deductible business expenses under IRS rules. This includes a proportional deduction for rent, utilities, and equipment directly related to the dedicated workspace, maximizing tax savings for content creators.

Equipment Bonus Depreciation

Equipment used for a YouTube channel may qualify for bonus depreciation, allowing creators to immediately deduct a significant portion of the cost in the year the equipment is placed in service. This accelerated tax benefit applies to new or used qualifying tangible property, such as cameras, lighting, and computers, streamlining expense recovery and reducing taxable income.

YouTuber Business Expense

YouTubers can deduct ordinary and necessary business expenses such as equipment, software, internet costs, and home office expenses directly related to content creation. Accurate record-keeping and separating personal from business use are essential for IRS compliance and maximizing allowable deductions.

Influencer Tax Treatment

YouTube influencers can deduct ordinary and necessary expenses directly related to content creation, such as equipment, internet costs, and software subscriptions, under IRS rules for self-employed individuals. Accurate record-keeping of income and expenses is essential to substantiate deductions and comply with tax obligations as a sole proprietor or independent contractor.

Monetization Revenue Reporting

Expenses related to managing and producing content for a monetized YouTube channel, such as equipment, software, and marketing costs, are generally deductible against the revenue reported from the channel. Accurate monetization revenue reporting is essential for aligning deductible expenses with earned income, ensuring compliance with IRS guidelines for self-employment income.

Self-Employed Creative Deduction

Self-employed individuals running a YouTube channel can deduct ordinary and necessary expenses directly related to content production, such as equipment, software, and home office costs, under the self-employed creative deduction. It is essential to maintain accurate records and ensure expenses are exclusively for business activities to qualify for these tax deductions.

Social Media Ad Spend Deductibility

Expenses for social media ad spend on a YouTube channel are generally deductible as business expenses if the channel is operated for profit. The IRS allows deduction of advertising costs, including payments to platforms like YouTube, as long as they are ordinary and necessary for generating income.

moneytar.com

moneytar.com