Can I deduct home office expenses if I run a dropshipping business on Etsy? Infographic

Can I deduct home office expenses if I run a dropshipping business on Etsy? Infographic

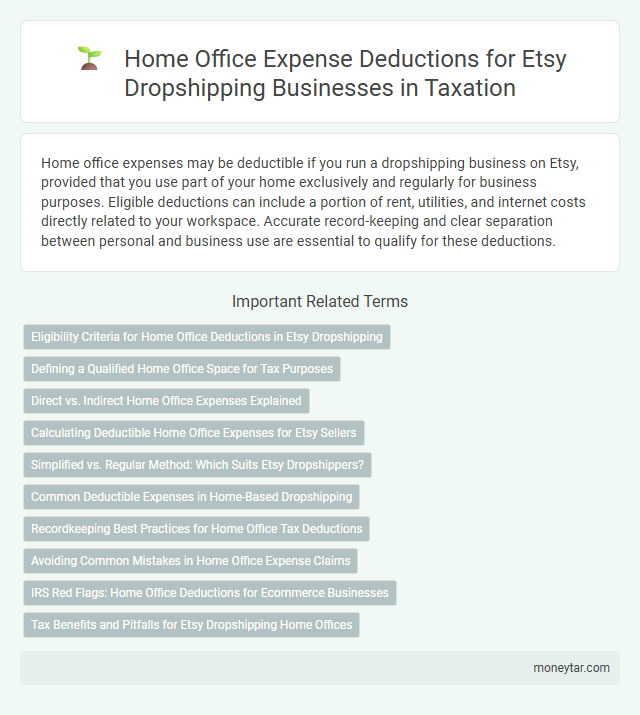

Can I deduct home office expenses if I run a dropshipping business on Etsy?

Home office expenses may be deductible if you run a dropshipping business on Etsy, provided that you use part of your home exclusively and regularly for business purposes. Eligible deductions can include a portion of rent, utilities, and internet costs directly related to your workspace. Accurate record-keeping and clear separation between personal and business use are essential to qualify for these deductions.

Eligibility Criteria for Home Office Deductions in Etsy Dropshipping

If you run a dropshipping business on Etsy, you may qualify for home office deductions if specific eligibility criteria are met. The IRS requires that the home office space be used regularly and exclusively for business purposes.

- Regular and Exclusive Use - The area must be used solely for your Etsy dropshipping business on a consistent basis.

- Principal Place of Business - Your home office must be the primary location where you conduct significant administrative or management tasks for your Etsy store.

- Qualifying Expenses - Deductible costs include a portion of rent, utilities, and maintenance directly related to the home office space.

Defining a Qualified Home Office Space for Tax Purposes

Defining a qualified home office space is essential for deducting expenses related to running a dropshipping business on Etsy. The space must be used exclusively and regularly for business activities to meet IRS requirements.

The area should serve as the principal place of business, where administrative and management tasks are conducted. Personal use of the space disqualifies it from being considered a home office for tax deductions.

Direct vs. Indirect Home Office Expenses Explained

Direct home office expenses are costs that apply exclusively to the space used for your dropshipping business on Etsy, such as repairs or utilities for that specific area. Indirect home office expenses cover a portion of your entire home's expenses, like mortgage interest, rent, or general maintenance.

You can deduct direct expenses in full since they relate solely to your business workspace. Indirect expenses require allocation based on the percentage of your home used for business purposes. Keeping detailed records helps ensure accurate deductions and compliance with tax regulations.

Calculating Deductible Home Office Expenses for Etsy Sellers

Calculating deductible home office expenses for Etsy sellers involves determining the portion of your home used exclusively and regularly for your dropshipping business. You can deduct expenses such as rent, utilities, and internet based on the percentage of your home dedicated to the office space. Maintaining accurate records and using either the simplified or regular method ensures compliance with IRS guidelines for home office deductions.

Simplified vs. Regular Method: Which Suits Etsy Dropshippers?

If you run a dropshipping business on Etsy, you may be eligible to deduct home office expenses. Choosing between the Simplified and Regular Methods depends on your specific business situation and record-keeping preferences.

- Simplified Method - Offers a standard deduction of $5 per square foot of your home office, up to 300 square feet, requiring less paperwork.

- Regular Method - Allows you to deduct actual expenses such as mortgage interest, utilities, and repairs, requiring detailed records and calculations.

- Best Choice for Etsy Dropshippers - If your home office is small and expenses are minimal, the Simplified Method likely suits you better, but larger or more complex expenses favor the Regular Method.

Common Deductible Expenses in Home-Based Dropshipping

Can you deduct home office expenses if you run a dropshipping business on Etsy? Home-based dropshipping businesses often qualify for specific tax deductions related to the workspace. Common deductible expenses include a portion of rent or mortgage interest, utilities, and internet costs directly associated with the home office.

Recordkeeping Best Practices for Home Office Tax Deductions

Maintaining accurate and detailed records is essential for claiming home office expenses when running a dropshipping business on Etsy. Keep receipts, invoices, and a log of all home office-related costs such as utilities, internet, and office supplies. Proper documentation supports your deduction claims and ensures compliance with IRS requirements for home office tax deductions.

Avoiding Common Mistakes in Home Office Expense Claims

Running a dropshipping business on Etsy may qualify you to deduct home office expenses, but accuracy is crucial to avoid issues. Understanding tax rules ensures claims are legitimate and compliant with IRS guidelines.

- Accurate Space Measurement - Deduct only the portion of your home exclusively used for business activities.

- Proper Expense Categorization - Separate personal and business expenses to prevent claim rejections.

- Maintain Detailed Records - Keep receipts and documentation to substantiate your home office deductions during audits.

Following these steps helps ensure your home office expense claims for your Etsy dropshipping business are valid and defensible.

IRS Red Flags: Home Office Deductions for Ecommerce Businesses

| Topic | Details |

|---|---|

| Home Office Deduction Eligibility | You can deduct expenses related to a home office if the space is used exclusively and regularly for your dropshipping business on Etsy. The IRS requires that the area be the principal place of business or a place to meet clients or customers. |

| Common IRS Red Flags |

|

| Recommended Documentation | Keep detailed records of receipts, utility bills, rent or mortgage payments, and calculations of the portion of the home dedicated to business. Maintaining logs of time spent working within the home office strengthens the deduction's validity. |

| Risks of Improper Claims | Incorrect or exaggerated home office deductions can trigger IRS audits, resulting in penalties or repayment of owed taxes. Ecommerce entrepreneurs should exercise caution to ensure deductions meet IRS guidelines to avoid triggering red flags. |

| Tax Advice | Consulting a tax professional familiar with ecommerce taxation helps optimize deductions while adhering to IRS rules. Proper classification of expenses and accurate reporting reduces risk with home office deductions for your dropshipping business on Etsy. |

Tax Benefits and Pitfalls for Etsy Dropshipping Home Offices

Home office expenses can be deductible if you run a dropshipping business on Etsy and use a specific area of your home exclusively for business activities. This deduction may include a portion of rent, utilities, internet, and office supplies directly related to your dropshipping operations.

To qualify, the IRS requires the home office to be used regularly and exclusively for business purposes, which can be challenging for shared or informal spaces. Incorrectly claiming expenses or failing to maintain proper records can trigger audits and result in disallowed deductions.

Related Important Terms

Hybrid Workspace Deduction

You can deduct home office expenses for your Etsy dropshipping business if your workspace qualifies as a hybrid workspace used regularly and exclusively for business activities. The IRS allows a hybrid workspace deduction when a portion of your home is dedicated to managing orders, inventory, and customer service, ensuring accurate record-keeping of expenses like utilities, rent, and internet.

E-commerce Home Office Allocation

Home office expenses can be deducted for an Etsy dropshipping business if the space is used regularly and exclusively for business purposes, with costs allocated based on the percentage of your home dedicated to e-commerce operations. Precise record-keeping of direct and indirect expenses, such as rent, utilities, and internet, is essential to accurately calculate the deductible portion for tax purposes.

Platform-Specific Expense Tracking

Etsy sellers operating a dropshipping business can deduct home office expenses by maintaining meticulous records specific to platform-related activities, such as workspace utilities and internet costs directly tied to managing their Etsy store. Accurate platform-specific expense tracking ensures compliance with tax regulations and maximizes eligible deductions for home office use.

Dropshipping Space Apportionment

Home office expenses can be deductible for a dropshipping business on Etsy if the space is exclusively and regularly used for business activities, with apportionment based on the percentage of the home dedicated to the dropshipping operations. Accurate calculation requires measuring the square footage of the dropshipping workspace relative to the total home area to determine the allowable portion of expenses such as rent, utilities, and maintenance.

Etsy Seller Workspace Deductibility

Home office expenses can be deducted for an Etsy dropshipping business if the workspace is used exclusively and regularly for managing orders, customer communications, and inventory tracking related to the business. The IRS requires clear documentation of the dedicated area in the home used specifically for Etsy seller activities to qualify for home office deductions.

Digital Inventory Storage Write-Off

Home office expenses related to digital inventory storage, such as cloud services or software subscriptions for managing dropshipping products on Etsy, can be deducted if the space is exclusively used for business purposes. The IRS allows deductions for costs directly associated with running a home office, including digital tools used to maintain and organize inventory records.

Virtual Marketplace Tax Perks

Home office expenses may be deductible for your Etsy dropshipping business if you use a specific area exclusively for business purposes, aligning with IRS guidelines on home office deductions. Leveraging virtual marketplace tax perks, such as simplified expense tracking and possible sales tax exemptions, can optimize your overall tax benefits.

Multi-Use Area Percentage Rule

Home office expenses for a dropshipping business on Etsy can be deducted using the Multi-Use Area Percentage Rule, which requires calculating the portion of your home used exclusively and regularly for business activities. Only the percentage of the space dedicated to managing orders, inventory storage, or other Etsy-related tasks qualifies for tax deductions under IRS guidelines.

Remote Retailer Workspace Provision

Home office expenses related to a remote retailer workspace for a dropshipping business on Etsy can be deducted if the space is used exclusively and regularly for business purposes; eligible expenses include a portion of rent, utilities, and internet fees. Accurate records and adherence to IRS guidelines on home office deductions ensure compliance and maximize tax benefits.

Home-Based E-commerce Expense Segregation

Home-based e-commerce businesses, including dropshipping on Etsy, can deduct home office expenses by accurately segregating costs related to business use from personal use, such as utilities, rent, and internet services proportional to the dedicated workspace. Maintaining detailed records and calculations that reflect exclusive and regular use of the home office area ensures compliance with IRS rules for home office deductions.

moneytar.com

moneytar.com