Do micro-task gigs like Amazon Mechanical Turk require tax reporting? Infographic

Do micro-task gigs like Amazon Mechanical Turk require tax reporting? Infographic

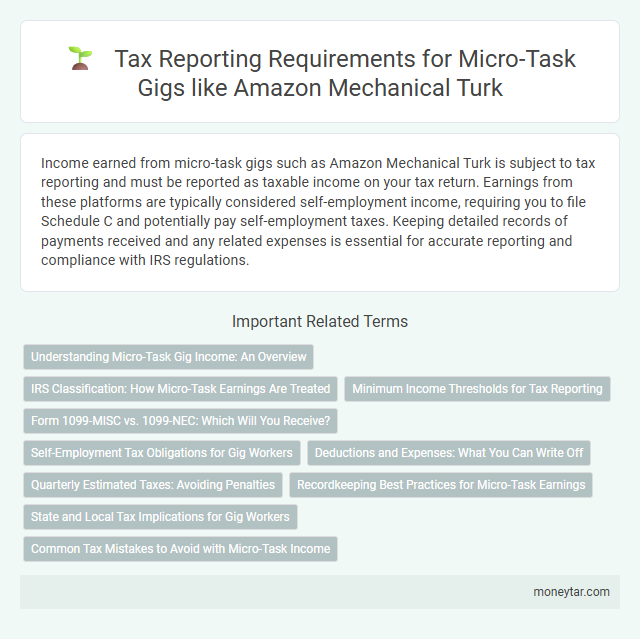

Do micro-task gigs like Amazon Mechanical Turk require tax reporting?

Income earned from micro-task gigs such as Amazon Mechanical Turk is subject to tax reporting and must be reported as taxable income on your tax return. Earnings from these platforms are typically considered self-employment income, requiring you to file Schedule C and potentially pay self-employment taxes. Keeping detailed records of payments received and any related expenses is essential for accurate reporting and compliance with IRS regulations.

Understanding Micro-Task Gig Income: An Overview

Income earned from micro-task gigs, such as Amazon Mechanical Turk, typically requires proper tax reporting. Understanding the nature of this income helps in complying with IRS regulations and avoiding potential penalties.

Tax reporting depends on the total earnings and whether the platform issues a 1099 form.

- Micro-task gig income is taxable - Earnings from platforms like Amazon Mechanical Turk are considered self-employment income by the IRS.

- Thresholds for reporting vary - If your income exceeds $600 in a year, the platform may issue a 1099-NEC form for reporting purposes.

- Self-employment taxes apply - Income earned may be subject to both income tax and self-employment tax, which covers Social Security and Medicare contributions.

IRS Classification: How Micro-Task Earnings Are Treated

Micro-task gigs such as Amazon Mechanical Turk are considered self-employment by the IRS, meaning earnings must be reported as business income. These earnings typically require filing Schedule C along with your tax return, detailing income and expenses related to the gig work. Failure to report micro-task income can result in penalties or audits by the IRS.

Minimum Income Thresholds for Tax Reporting

Micro-task gigs like Amazon Mechanical Turk may require tax reporting depending on your earnings. The IRS mandates reporting if your income from these platforms exceeds minimum thresholds.

For 2024, you must report income if you earn $600 or more from a single payer, such as Amazon Mechanical Turk. Earnings below this threshold generally do not require tax reporting but should still be tracked for accuracy.

Form 1099-MISC vs. 1099-NEC: Which Will You Receive?

| Topic | Details |

|---|---|

| Micro-task Gigs Tax Reporting | Income earned from micro-task platforms such as Amazon Mechanical Turk is subject to tax reporting requirements. Earnings must be reported to the IRS even if the total amount is below $600. |

| Form 1099-MISC | This form is used to report miscellaneous income. Some platforms may issue Form 1099-MISC for payments related to prizes, awards, or other income types distinct from nonemployee compensation. |

| Form 1099-NEC | Form 1099-NEC is specifically used to report nonemployee compensation, which includes payments to independent contractors and gig workers. Most micro-task earnings will be reported here if they reach the IRS threshold. |

| Which Form Will You Receive? | Your micro-task platform may issue either Form 1099-NEC or 1099-MISC based on the nature of your income. Typically, nonemployee compensation is reported on 1099-NEC. Reviewing the form received ensures accurate tax reporting. |

Self-Employment Tax Obligations for Gig Workers

Micro-task gigs like Amazon Mechanical Turk generally require tax reporting if earnings exceed the IRS threshold of $600 per year. Gig workers are considered self-employed and must report income on Schedule C when filing taxes. Self-employment tax obligations include both Social Security and Medicare taxes, calculated on net earnings from these gigs.

Deductions and Expenses: What You Can Write Off

Micro-task gigs like Amazon Mechanical Turk typically require tax reporting as income earned must be reported to the IRS. The platform often provides a Form 1099 if earnings exceed the reporting threshold.

You can write off various deductions and expenses related to micro-task work, including internet costs, computer equipment, and home office expenses. Tracking these deductions can reduce taxable income and lower overall tax liability.

Quarterly Estimated Taxes: Avoiding Penalties

Income earned through micro-task gigs such as Amazon Mechanical Turk is subject to tax reporting requirements. Workers must understand the importance of quarterly estimated tax payments to avoid penalties.

- Estimated Tax Payments - Individuals earning income from micro-task platforms often need to make quarterly estimated tax payments to cover federal and state tax liabilities.

- Penalties for Underpayment - Failure to pay sufficient quarterly taxes can result in penalties and interest charges from the IRS or state tax agencies.

- Form 1099-K or 1099-MISC - Platforms may issue tax forms reporting earnings which must be included in tax filings to ensure compliance.

Consistently submitting quarterly estimated taxes helps micro-task workers avoid costly penalties and maintain good standing with tax authorities.

Recordkeeping Best Practices for Micro-Task Earnings

Do micro-task gigs like Amazon Mechanical Turk require tax reporting? Income earned from these platforms is considered taxable and must be reported to the IRS. Maintaining accurate records of your earnings and expenses will streamline tax filing and ensure compliance.

State and Local Tax Implications for Gig Workers

Micro-task gigs like Amazon Mechanical Turk often generate income that requires proper tax reporting. State and local tax regulations vary and can impact how this income is reported and taxed.

Your earnings from micro-task platforms are generally subject to state income tax and may also influence local tax obligations depending on where you reside. Many states treat gig income as taxable and expect workers to report it on their state tax returns. Understanding your state's specific rules helps ensure compliance and avoid penalties related to unreported gig earnings.

Common Tax Mistakes to Avoid with Micro-Task Income

Micro-task gigs like Amazon Mechanical Turk generate taxable income that must be reported to the IRS. Understanding common tax mistakes can help you avoid penalties and ensure compliance.

- Failing to Report All Income - Every dollar earned through micro-task platforms is taxable and must be reported, even if you do not receive a 1099 form.

- Neglecting to Track Expenses - Keeping detailed records of deductible expenses such as internet costs or equipment can reduce taxable income but is often overlooked.

- Ignoring Self-Employment Tax - Micro-task earnings are subject to self-employment tax, which many workers forget to calculate and pay quarterly estimated taxes on.

Related Important Terms

Gig Economy Income Reporting

Income earned from micro-task gigs like Amazon Mechanical Turk is considered taxable and must be reported on your tax return. The IRS requires reporting of all gig economy income, typically documented on Form 1099-NEC or Form 1099-K depending on earnings thresholds.

1099-K Threshold Changes

Micro-task gigs like Amazon Mechanical Turk now require tax reporting if earnings exceed the updated 1099-K thresholds set by the IRS, which mandate reporting for individuals earning over $600 annually from third-party networks. These threshold changes increase transparency and ensure gig workers report income accurately for tax compliance.

Digital Platform Worker Taxation

Micro-task gigs on platforms like Amazon Mechanical Turk are subject to tax reporting requirements, with income typically reported on IRS Form 1099-NEC if earnings exceed $600 annually. Digital platform workers must track all earnings and expenses accurately to comply with self-employment tax obligations and avoid penalties.

Crowdsourced Earnings Declaration

Crowdsourced earnings from micro-task platforms like Amazon Mechanical Turk are considered taxable income and must be reported on tax returns despite often lacking a traditional W-2 form. The IRS requires individuals to declare all earnings from crowdsourced gigs, including payments not documented by platforms, to ensure accurate income reporting and tax compliance.

Microtask Tax Compliance

Micro-task gigs performed on platforms like Amazon Mechanical Turk typically generate taxable income that must be reported to the IRS using Form 1099-NEC if earnings exceed $600 annually. Workers should maintain accurate records of all payments received to ensure proper microtask tax compliance and avoid penalties for underreporting income.

Form 1040 Schedule C for Gig Workers

Micro-task gigs like Amazon Mechanical Turk require tax reporting if you earn income above the IRS threshold, typically reported on Form 1040 Schedule C as self-employment income. Gig workers must track earnings and related expenses to accurately complete Schedule C, ensuring compliance with IRS requirements for taxable income and deductible business costs.

Self-Employment Tax Liability

Income earned from micro-task platforms like Amazon Mechanical Turk is subject to self-employment tax if the net earnings exceed $400 annually. Workers must report this income on Schedule C and calculate self-employment tax using Schedule SE to comply with IRS regulations.

Third-Party Settlement Organization (TPSO)

Micro-task gigs on platforms like Amazon Mechanical Turk are subject to tax reporting if the platform qualifies as a Third-Party Settlement Organization (TPSO), which mandates issuing Form 1099-K when gross payments exceed $600 annually. IRS regulations require TPSOs to report earnings to ensure gig workers accurately report income from micro-task gigs for tax compliance.

On-demand Labor Tax Guidelines

Micro-task gigs such as Amazon Mechanical Turk require tax reporting when income exceeds the IRS threshold, typically $600 annually, mandating Form 1099-K or 1099-MISC issuance by the platform. On-demand labor tax guidelines classify earnings as self-employment income, subject to federal income tax and self-employment tax, necessitating accurate record-keeping and quarterly estimated tax payments.

Platform-Facilitated Work Tax Implications

Income earned from micro-task gigs on platforms like Amazon Mechanical Turk is considered taxable and must be reported to the IRS, with the platform typically issuing a Form 1099-MISC or 1099-NEC if earnings exceed $600 annually. Workers are responsible for self-reporting this income and may owe both income tax and self-employment tax under platform-facilitated work tax regulations.

moneytar.com

moneytar.com