Is pet-sitting income subject to self-employment taxes? Infographic

Is pet-sitting income subject to self-employment taxes? Infographic

Is pet-sitting income subject to self-employment taxes?

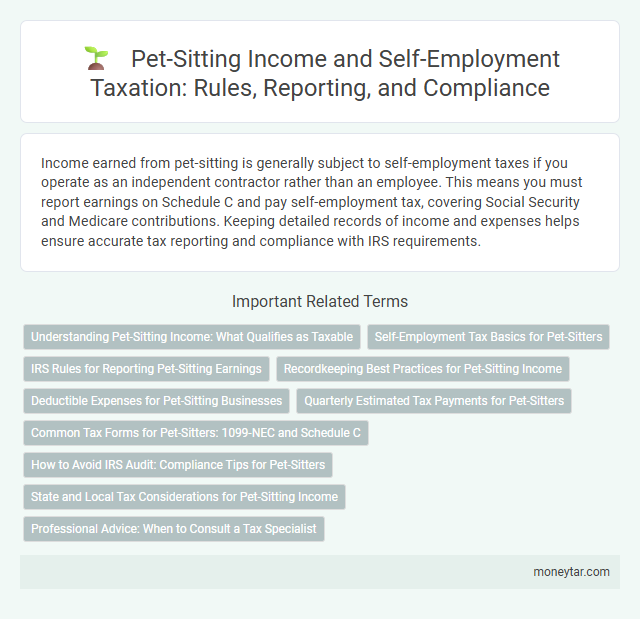

Income earned from pet-sitting is generally subject to self-employment taxes if you operate as an independent contractor rather than an employee. This means you must report earnings on Schedule C and pay self-employment tax, covering Social Security and Medicare contributions. Keeping detailed records of income and expenses helps ensure accurate tax reporting and compliance with IRS requirements.

Understanding Pet-Sitting Income: What Qualifies as Taxable

Is pet-sitting income subject to self-employment taxes? Earnings from pet-sitting are generally considered taxable income by the IRS. If you provide pet-sitting services as an independent contractor, this income is subject to self-employment taxes.

Self-Employment Tax Basics for Pet-Sitters

| Topic | Details |

|---|---|

| Self-Employment Tax Overview | Self-employment tax covers Social Security and Medicare taxes for individuals who work for themselves. Pet-sitting income often qualifies as self-employment income if earned independently. |

| Pet-Sitting Income | Income earned from providing pet-sitting services is generally subject to self-employment taxes if operated as a business or sole proprietorship. |

| Threshold for Taxation | If net income from pet-sitting exceeds $400 in a tax year, self-employment tax filing is required. |

| Tax Rates | Self-employment tax rate is currently 15.3%, which includes 12.4% for Social Security and 2.9% for Medicare taxes. |

| Deductions and Expenses | Expenses directly related to pet-sitting such as supplies, advertising, and transportation can be deducted, reducing taxable income. |

| Filing Requirements | You must report pet-sitting income and expenses on Schedule C (Form 1040) and calculate self-employment tax on Schedule SE. |

IRS Rules for Reporting Pet-Sitting Earnings

Pet-sitting income is generally subject to self-employment taxes if the activity is carried out as a business. The IRS considers earnings from pet-sitting as taxable income that must be reported on Schedule C of Form 1040.

According to IRS rules, individuals providing pet-sitting services must report all earned income regardless of the amount. If net earnings exceed $400, self-employment tax applies, covering Social Security and Medicare contributions. It is important to keep detailed records and receipts to accurately report income and expenses related to pet-sitting activities.

Recordkeeping Best Practices for Pet-Sitting Income

Pet-sitting income is generally subject to self-employment taxes if you operate as an independent service provider. Accurate recordkeeping is essential to ensure proper tax reporting and compliance with IRS regulations.

- Separate Business and Personal Finances - Maintain a dedicated bank account for all pet-sitting income and expenses to simplify tracking and reporting.

- Document All Income Sources - Record every payment received, including cash and electronic transactions, to ensure complete income reporting.

- Keep Detailed Expense Records - Save receipts and logs for supplies, travel, and advertising to maximize deductible expenses accurately.

Consistent and organized records support effective tax preparation and minimize the risk of underreporting pet-sitting income subject to self-employment taxes.

Deductible Expenses for Pet-Sitting Businesses

Income from pet-sitting is subject to self-employment taxes if it qualifies as a business activity. Identifying deductible expenses helps reduce the overall taxable income for pet-sitting businesses.

- Home Office Deduction - Expenses related to a dedicated space used exclusively for pet-sitting operations can be deducted.

- Supplies and Equipment - Costs for pet food, toys, grooming tools, and cleaning supplies are deductible business expenses.

- Transportation Costs - Mileage and travel expenses incurred while visiting clients or purchasing supplies can be claimed as deductions.

Quarterly Estimated Tax Payments for Pet-Sitters

Pet-sitting income is generally subject to self-employment taxes if earned as an independent contractor. Quarterly estimated tax payments help manage these taxes by covering your expected tax liability throughout the year.

- Self-Employment Tax Obligation - Pet-sitting income counts as self-employment income and requires paying Social Security and Medicare taxes.

- Quarterly Estimated Payments Requirement - You must make quarterly estimated tax payments if you expect to owe $1,000 or more in taxes when filing your return.

- Payment Deadlines and Penalties - Estimated tax payments are due in April, June, September, and January to avoid penalties for underpayment.

Common Tax Forms for Pet-Sitters: 1099-NEC and Schedule C

Pet-sitting income is generally subject to self-employment taxes if you operate as an independent contractor. Reporting this income correctly involves using specific tax forms.

Common tax forms for pet-sitters include Form 1099-NEC, which reports nonemployee compensation. Schedule C is used to report income and expenses from your pet-sitting business, calculating net profit subject to self-employment tax.

How to Avoid IRS Audit: Compliance Tips for Pet-Sitters

Pet-sitting income is generally subject to self-employment taxes if earned through regular, profit-driven activities. Accurate record-keeping of all pet-sitting revenue and related expenses helps demonstrate compliance with IRS regulations. Filing Schedule SE with Form 1040 and reporting income transparently reduces the risk of an IRS audit for pet-sitters.

State and Local Tax Considerations for Pet-Sitting Income

State and local tax laws vary regarding pet-sitting income and its classification for tax purposes. You may be required to pay self-employment taxes on pet-sitting earnings depending on your state's guidelines.

Some states impose additional business or occupational taxes on pet-sitting services. Understanding local regulations helps ensure compliance and accurate reporting of income to state tax authorities.

Professional Advice: When to Consult a Tax Specialist

Pet-sitting income is generally subject to self-employment taxes if you earn more than $400 annually from the activity. Determining your specific tax obligations can be complex, especially with varying local regulations and deductible expenses. Consulting a tax specialist ensures accurate reporting and maximizes potential deductions related to your pet-sitting business.

Related Important Terms

Gig Economy Taxation

Pet-sitting income earned through gig economy platforms is subject to self-employment taxes if the activity is performed as a business rather than a hobby. The IRS requires gig workers to report all earnings and pay self-employment taxes, covering Social Security and Medicare contributions on net income exceeding $400 annually.

Self-Employment Pet Services

Income earned from pet-sitting services is generally subject to self-employment taxes if the activity is carried out as a business rather than a hobby. The IRS requires individuals providing self-employment pet services to report their earnings on Schedule C and pay both the employer and employee portions of Social Security and Medicare taxes.

Schedule C Reporting

Pet-sitting income is typically subject to self-employment taxes and must be reported on Schedule C as part of the individual's tax return. Accurate reporting of all income and related expenses on Schedule C ensures compliance with IRS regulations and proper calculation of self-employment tax obligations.

Hobby vs Business Income

Pet-sitting income is subject to self-employment taxes if it is earned through a business operated with the intention of making a profit, meeting IRS criteria such as regularity and profit motive. Income from occasional pet-sitting done as a hobby without profit intent is reported as hobby income and generally not subject to self-employment taxes but may still be taxable.

1099-NEC for Pet-Sitters

Pet-sitting income reported on Form 1099-NEC is generally subject to self-employment taxes if the activity is conducted as a business. The IRS considers pet-sitting income self-employment income, requiring reporting on Schedule C and payment of both Social Security and Medicare taxes via Schedule SE.

Taxable Side Hustles

Pet-sitting income is subject to self-employment taxes if earned through independent contracting, as the IRS classifies it as a taxable side hustle requiring reporting on Schedule C and payment of both Social Security and Medicare taxes. Accurate record-keeping of earnings and expenses is essential to comply with tax obligations and maximize deductible business costs.

Home-Based Business Deductions

Pet-sitting income earned through a home-based business is subject to self-employment taxes and qualifies for various home office deductions, such as a portion of rent, utilities, and supplies directly related to the business. Accurate record-keeping and IRS Schedule C filing are essential to maximize deductions and comply with tax regulations on pet-sitting income.

Qualified Business Income Deduction (QBI) for Pet Care

Pet-sitting income is generally subject to self-employment taxes unless the individual is considered an employee rather than an independent contractor. Eligible pet care businesses may qualify for the Qualified Business Income Deduction (QBI), allowing them to deduct up to 20% of their qualified income, subject to IRS limitations based on income thresholds and business structure.

Independent Contractor Compliance

Pet-sitting income earned as an independent contractor is generally subject to self-employment taxes, requiring accurate reporting on Schedule C to the IRS. Compliance with independent contractor tax obligations includes maintaining detailed records of income and expenses to ensure proper calculation of Social Security and Medicare tax liabilities.

Digital Payment Platform Tax Reporting (i.e., Venmo/PayPal for Sitters)

Income earned from pet-sitting through digital payment platforms like Venmo and PayPal is generally subject to self-employment taxes if it meets the IRS threshold of $600 or more annually, triggering the issuance of Form 1099-K or 1099-NEC for tax reporting. Sitters must accurately report this income on Schedule C to ensure compliance with federal tax regulations governing self-employment earnings.

moneytar.com

moneytar.com