How is income from flipping thrift store finds taxed? Infographic

How is income from flipping thrift store finds taxed? Infographic

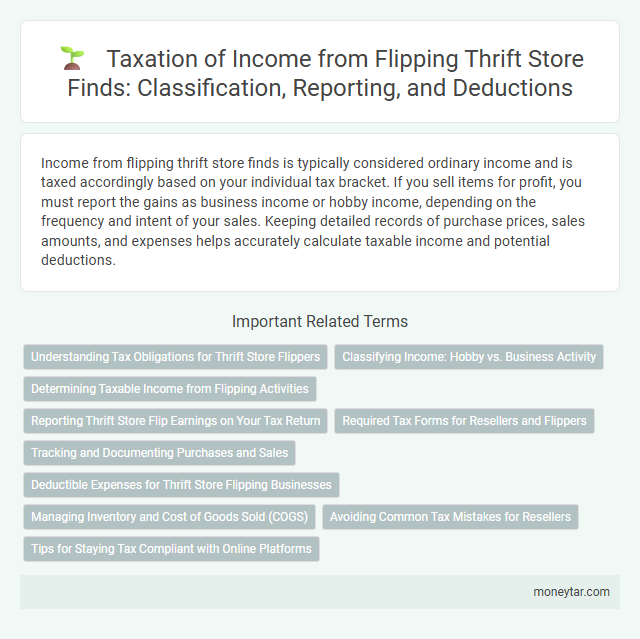

How is income from flipping thrift store finds taxed?

Income from flipping thrift store finds is typically considered ordinary income and is taxed accordingly based on your individual tax bracket. If you sell items for profit, you must report the gains as business income or hobby income, depending on the frequency and intent of your sales. Keeping detailed records of purchase prices, sales amounts, and expenses helps accurately calculate taxable income and potential deductions.

Understanding Tax Obligations for Thrift Store Flippers

Income from flipping thrift store finds is generally considered taxable and must be reported to the IRS. Understanding your tax obligations can help avoid penalties and ensure compliance when selling these items for profit.

- Taxable Income Classification - Profits from resale activities are typically categorized as ordinary income subject to income tax.

- Record Keeping Requirement - Keeping detailed records of purchases, sales, and related expenses is essential for accurate reporting and potential deductions.

- Self-Employment Tax Impact - Frequent flipping may classify you as self-employed, requiring payment of self-employment taxes in addition to income tax.

Classifying Income: Hobby vs. Business Activity

| Aspect | Description |

|---|---|

| Activity Type | Income from flipping thrift store finds can be classified as either hobby income or business income. The classification impacts tax treatment and reporting requirements. |

| Hobby Income | If flipping is occasional and not intended to generate a profit consistently, the income is considered hobby income. Hobby income must be reported on your tax return but expenses related to the hobby cannot be deducted. |

| Business Income | If the activity is carried out with regularity and the intent to make a profit, it is classified as a business. Business income requires reporting on Schedule C. You can deduct related expenses, such as purchase cost, shipping, and advertising. |

| IRS Criteria | The IRS evaluates factors such as frequency of sales, profit motive, time and effort invested, and whether you depend on the income. These factors help determine whether flipping thrift store finds is a hobby or a business. |

| Tax Implications | Business activity income is subject to self-employment tax while hobby income is not. Proper classification ensures compliance and optimizes your tax position. |

Determining Taxable Income from Flipping Activities

Income from flipping thrift store finds is generally considered taxable and must be reported on your tax return. The amount taxable depends on the profit made from buying and reselling items.

Determining taxable income from flipping activities involves calculating the difference between the sales price and the original purchase cost, minus any related expenses such as shipping or restoration. Profits are usually treated as business income if flipping is frequent, subject to self-employment tax. If considered occasional sales, profits may be taxed as capital gains, depending on the holding period and local tax regulations.

Reporting Thrift Store Flip Earnings on Your Tax Return

How is income from flipping thrift store finds reported on your tax return? Income earned from flipping thrift store items is considered taxable and must be reported as part of your gross income. Proper documentation of purchases and sales helps ensure accurate tax reporting.

Where do you report thrift store flip earnings on your tax return? If flipping is a business, report earnings on Schedule C (Form 1040) under business income. For occasional sales, use Schedule D to report capital gains or losses.

What records are necessary for reporting thrift store flip income? Keep detailed records including purchase receipts, sale prices, and dates of transactions for tax purposes. These documents support income reporting and help calculate any deductible expenses.

Required Tax Forms for Resellers and Flippers

Income from flipping thrift store finds is generally considered taxable as business income. Resellers and flippers must report this income on Schedule C (Form 1040) to detail profits and expenses. Additionally, if gross sales exceed $600, Form 1099-K may be issued by payment platforms, which must be reconciled with reported income.

Tracking and Documenting Purchases and Sales

Income from flipping thrift store finds is considered taxable and must be reported as part of your gross income. Properly tracking and documenting all purchases and sales is essential for accurate tax reporting and maximizing deductions.

- Maintain Detailed Records - Keep receipts and logs of each thrift store purchase, including date, price, and item description.

- Track Sales Transactions - Document the sale date, amount received, and platform used to sell the item.

- Separate Personal and Business Expenses - Clearly distinguish between items bought for resale and personal use to avoid tax complications.

Organized records support income reporting and help substantiate expenses during tax filing.

Deductible Expenses for Thrift Store Flipping Businesses

Income from flipping thrift store finds is considered taxable business income by the IRS. Entrepreneurs must report all profits earned from selling these items as part of their gross income on tax returns.

Deductible expenses for thrift store flipping businesses include the cost of purchased items, shipping fees, and supplies used for refurbishment. Other allowable deductions can cover marketing expenses, online platform fees, and home office costs related to the flipping business.

Managing Inventory and Cost of Goods Sold (COGS)

Income from flipping thrift store finds is considered taxable business income by the IRS when conducted regularly and with the intent to profit. Properly managing inventory and accurately calculating the Cost of Goods Sold (COGS) is essential for reporting net income correctly.

Inventory management involves tracking each item's purchase price, condition, and sale price to determine profit margins. COGS includes all expenses directly related to acquiring the items, such as purchase cost, shipping, and any repair or refurbishment expenses.

Avoiding Common Tax Mistakes for Resellers

Income from flipping thrift store finds is generally considered taxable business income by the IRS. Proper record-keeping and understanding your tax obligations help avoid common tax mistakes for resellers.

- Report All Income - Failure to report resale income can trigger audits and penalties, so document all sales accurately.

- Separate Personal and Business Expenses - Mixing expenses complicates deductions and risks disallowed costs during tax review.

- Keep Detailed Records - Maintain receipts, purchase dates, sale prices, and related costs to substantiate income and deductible expenses.

Tips for Staying Tax Compliant with Online Platforms

Income from flipping thrift store finds is considered taxable and must be reported as part of your gross income. The IRS requires accurate records of all sales and expenses related to your flipping activities, especially when using online platforms. Maintaining detailed documentation and understanding platform-specific tax reporting tools help you stay compliant and avoid penalties.

Related Important Terms

Hobby Income Taxation

Income earned from flipping thrift store finds is classified as hobby income by the IRS when activities lack profit motive, subjecting it to taxation without deductible business expenses. Hobby income must be reported as other income on Form 1040, with expenses only deductible up to the amount of income generated, following IRS Publication 535 guidelines.

Self-Employment Tax

Income from flipping thrift store finds is typically subject to self-employment tax if the activity is conducted as a business, reflecting earnings from self-employment rather than occasional selling. The self-employment tax rate is 15.3%, covering Social Security and Medicare, and applies to net earnings of $400 or more from these transactions.

IRS Form 1099-K Thresholds

Income from flipping thrift store finds is taxed as self-employment income and must be reported to the IRS, with earnings tracked on Form 1099-K if payment processing exceeds $600 in gross payments starting in tax year 2023. The IRS lowered the Form 1099-K reporting threshold to $600 regardless of transaction volume, increasing scrutiny on small-scale sellers and requiring careful record-keeping of purchase costs and sales revenue.

Online Marketplace Sales Tax

Income from flipping thrift store finds is taxed as ordinary income and must be reported on your tax return, with profits subject to federal and state income tax rates. Online marketplace sales tax typically applies to buyers, but sellers using platforms like eBay or Etsy should be aware of marketplace facilitator laws requiring these platforms to collect and remit sales tax on their behalf.

Short-Term Capital Gains

Income from flipping thrift store finds is taxed as short-term capital gains if the items are sold within one year of purchase, meaning the profits are added to your ordinary income and taxed at your regular federal income tax rate. The IRS treats these sales as business income or self-employment income if you frequently engage in flipping, requiring you to report earnings on Schedule C and possibly pay self-employment tax.

Schedule C Reporting

Income from flipping thrift store finds is reported on Schedule C as business income, subject to ordinary income tax rates and self-employment tax. Expenses related to purchasing, refurbishing, and selling the items can be deducted to reduce taxable income on the Schedule C form.

Basis Determination for Used Goods

Income from flipping thrift store finds is taxed based on the difference between the selling price and the adjusted basis of the used goods, which is typically the purchase price plus any costs for improvements or repairs. Accurately determining the basis is essential for calculating capital gains or ordinary income, depending on whether the item is considered a hobby or business inventory under IRS rules.

Inventory Cost Deduction

Income from flipping thrift store finds is taxed as ordinary business income, requiring sellers who flip items regularly to report profits and deduct inventory costs. Inventory cost deductions include the purchase price of items and any expenses directly related to acquiring and preparing them for sale, reducing taxable income.

De Minimis Tax Rule

Income from flipping thrift store finds is generally subject to ordinary income tax rates, but the De Minimis Tax Rule allows small, infrequent gains to be excluded from taxable income if they fall below a specific IRS threshold, typically around $600 per year. Hobby income rules may also apply, requiring report of all income from sales, yet small-scale flipping that meets the De Minimis limit often avoids triggering significant tax liabilities.

Peer-to-Peer Resale Tax Compliance

Income from flipping thrift store finds is generally considered self-employment income and must be reported on Schedule C of the IRS Form 1040, subject to both income tax and self-employment tax. Peer-to-peer resale platforms may issue 1099-K forms if sales exceed $600, requiring sellers to maintain detailed records of purchase costs and sales proceeds to ensure accurate tax compliance.

moneytar.com

moneytar.com